- Why E-will Bill?

e-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding 50,000 or 1,00,000, as the case may be.

- Threshold limit for generation of E-way Bill?

| State | Intra | Inter |

| Tamil Nadu, Jharkhand , Maharashtra , Punjab, Bihar, west Bengal | 1,00,000 | 50,000 |

| Remaining states | 50,000 | 50,000 |

- Registration in e-way portal

All the registered persons under GST need to register on the e-way bill portal using his GSTIN, the system enables him to generate his/her username and password for the e-way bill system.

- Who can generate e-way bills?

- A registered person.

- If a supply is made by an unregistered person to a registered person, the recipient of goods is responsible to generate E-way bills.

- A transporter is responsible to generate E-way bills if the same has not been generated by a supplier.

- In case of unregistered transporters, they will be provided with a Transporter ID on registering on the E-way bill portal.

- How does an unregistered transporter get his transporter Id?

The transporter is required to provide the essential information for enrolment on the EWB portal. The transporter id is created by the EWB system. They need to enroll on the e-way bill portal to get 15digit Unique Transporter Id.

- What are modes of e-way bill generation?

- Using Web based system

- Using SMS based facility

- Using Android App

- Bulk generation facility

- Using Site-to-Site integration

- Using GSP (Goods and Services Tax Suvidha Provider)

- What is Part A in e-way bill?

Part A request for the details such as recipient GSTIN, place of delivery, invoice/challan number and date, HSN code, goods value, transport document number (Goods Receipt Number in the case of road transport) and reasons for transportation.

- What is Part B in e-way bill?

Part B comprises transporter details (Vehicle number and transporter ID). The part B containing transport detail is used to generate the e-way bill.

- Who can file Part A in e-way bill?

- Registered person who is causing movement of the goods

- Transporter if so authorized

- E-commerce operator/courier agency, where the goods are supplied through them.

- Who can file Part B in e-way bills?

- Person who is transporting the goods

- Documents required to generate e-way bills?

- Invoice/Delivery Challan/Bill of Supply

- . For transportation by road – Vehicle number/Transporter ID

- For transportation by rail, air, or ship – Transporter ID, Transport document number, and date on the document.

- Can the e-way bill be modified or edited?

- The e-way bill once generated cannot be edited or modified. Only Part-B can be updated. However, if an e-way bill is generated with wrong information, it can be cancelled and generated afresh. The cancellation is required to be done within twenty-four hours from the time of generation.

- What is the Validity of e-way bills?

| Distance within country | Validity |

| Upto 20 km | One day in case of over dimensional cargo or multimodal shipment in which at least one leg involves transport by ship. |

| For every 20 km or part thereof thereafter | One additional day in case of over dimensional cargo or multimodal shipment in which at least one leg involves transport by ship. |

| Upto 100km | One day in other cases |

| For every 100 km or part thereof thereafter | One additional day in other cases |

- What if validity expired?

- If the validity of the e-way bill expires, the goods are not supposed to be moved. However, under circumstances of natural calamity, law and order issues, trans-shipment delay, accident etc. The transporter may extend the validity period after updating the reason for the extension and the details in PART-B of FORM GST EWB-01.

- Whether e-way bills can be cancelled?

- Yes, e-way bills can be cancelled if either goods are not transported or are not transported as per the details furnished in the e-way bill. The e-way bill can be cancelled within 24 hours from the time of generation.

- What is a consolidated e-way bill?

- Consolidated e-way bill is a document containing the multiple e-way bills for multiple consignments being carried in one goods vehicle.

- A transporter can generate the consolidated e-way bills for movement of multiple consignments in one vehicle.

- What is the impact on businesses due to e-way bill integration with e-invoicing?

- The objective behind the integration of the e-invoicing system with the e-way bill system is to make the entire process easy and automated. The e-way bill generation will be blocked for the taxpayers who have two or more consecutive GST returns pending to be filed. These integrations will have the following benefits for the businesses:

- Easy compliance for the taxpayers.

- Ensuring accuracy by automating the process.

- How to generate e-way bill?

Invoice /documents for movement like delivery challan to be generated

Login to e-way bill system enter username, password, and captcha code, click on login

Click on “generate new” under e-way bill option appearing on the left hand side of the dashboard

Enter details on the screen that appears

click on submit. The system will validates data entered and throws up an error if any

Steps to generate a New e-Way Bill:

1. Logging into e-Way Bill System

To open or login to the e-Way Bill system, users should have registered in the e-Way Bill system.

The user has to open the e-Way Bill portal and enter their username and password along with the displayed captcha. On successful authentication, the system enters the main menu of the e-Way Bill System.

The main menu lists the options available to a user to operate on the e-Way Bill.

In the middle, the system shows the dashboard for the last 3 days for EWB activities pertaining to the user.

Below the dashboard, the system displays the latest updates done in the EWB system along with the link of previous updates.

On the left hand side, the system shows the main menu options.

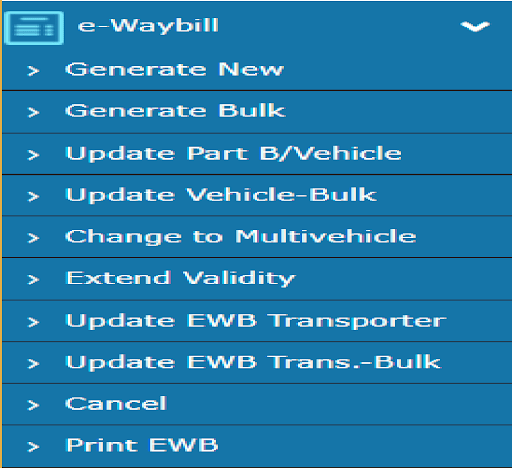

2. Options under e-Way Bill

- Generate New

This option is used to generate the new e-Way Bill.

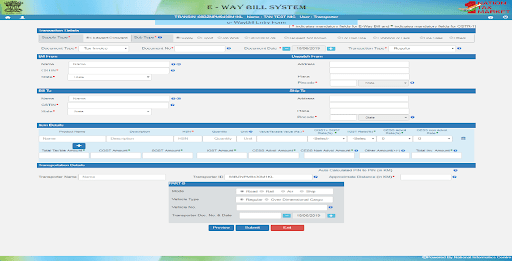

When the user clicks the ‘Generate New’ sub-option under ‘e-waybill’ option, the following EWB Entry Form will be displayed, allowing the user to enter the e-way bill generation details.

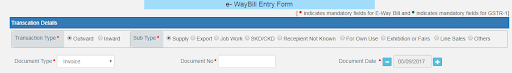

- Transaction Type: Select ‘Outward’ if you are a supplier of consignment Select ‘Inward’ if you are a recipient of consignment.

- Sub-type: Select the relevant sub-type applicable to you: If transaction type selected is Outward, following subtypes appear:

- Document type: Select either of Invoice / Bill/ challan/ credit note/ Bill of entry or others if not listed.

- Document No.: Enter the document/invoice number

- Document Date: Select the date of Invoice or challan or Document.

Note: The system will not allow the user to enter the future date.

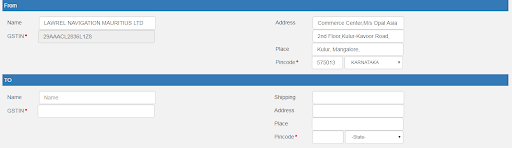

- Supplier and Recipient Address: Depending on whether you are a supplier or a recipient, enter the relevant address details.

Note: If the supplier/client is unregistered, then mention ‘URP’ in the field GSTIN, indicating that the supplier/client is an ‘Unregistered Person’

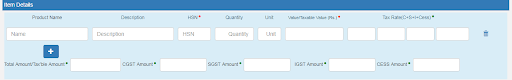

- Item Details: Add the details of the consignment (HSN code-wise) in this section:

- Product name

- Description

- HSN Code

- Quantity,

- Unit,

- Value/Taxable value

- Tax rates of CGST and SGST or IGST (in %)

- Tax rate of Cess, if any charged (in %)

Note: The user can add multiple products by clicking on button.

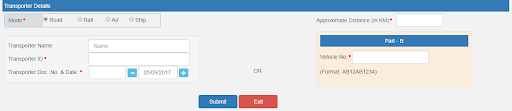

- Transporter details: The mode of transport(Road/rail/ship/air) and the approximate distance covered (in KM) needs to be compulsorily mentioned in this part.

Apart from above, either of the details have to be mentioned:

- Transporter name, transporter ID, transporter Doc. No. & Date.

(OR)

- Vehicle number in which consignment is being transported.

Note: The e-waybill system will Auto – calculate and display the estimated motorable distance between the supplier and recipient addresses as per the PIN codes entered in “Bill From & Bill To” Section.

Users are also allowed to enter the actual distance as per the movement of goods. However, it will be limited to 10% more than the auto calculated distance displayed.

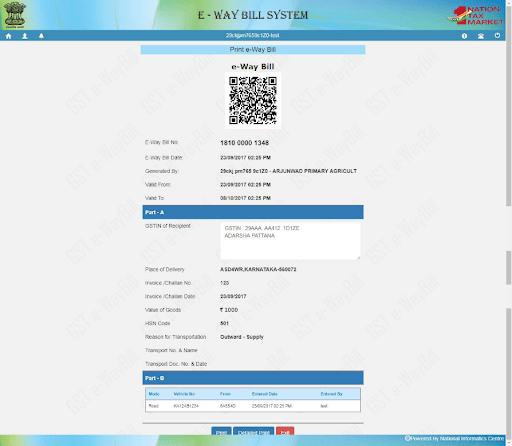

- Submitting the e-Way Bill

- Click on ‘Submit’. The system validates data entered and throws up an error if any. Otherwise, your request is processed and the e-way bill in Form EWB-01 form with a unique 12-digit number is generated. The e-way bill generated looks like this:

Steps to generate bulk e-Way Bills:

Bulk e-Way bill is used when a user needs to generate multiple e-Way Bills at one shot.

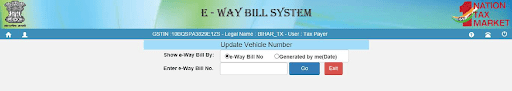

Steps to update Part B for an e-Way Bill:

This option is used to update the vehicle number of the e-Way Bill, if

- It has not been entered while generating e-Way Bill

(OR)

- Vehicles have been changed for moved goods because of various reasons like transit movement, vehicle breakdown etc.

- Update Part B/Vehicle

When the user selects the ‘Update Part B/Vehicle’ sub-option under ‘e-Waybill’ option, the following screen will be displayed.

In this form the user needs to select one option –

- e-Way Bill No

(OR)

- Generated Date

- Select the corresponding e-Way Bill:

The system will show the list of related E-way bills for those parameters.

Here, the user should select the corresponding e-way bill for the vehicle update.

Post Authors