Written By – PKC Desk, Edited By – Krithika Mohan, Reviewed By – Vignesh

Internal audit for retail industry is a critical process that helps businesses stay profitable, compliant, and fraud-free.

Learn with us exactly why audits matter, how they work in the Indian retail sector, and how to do them right.

Importance of Internal Audits in the Indian Retail Sector

Internal audits are a must-have for retail businesses in India. Here’s why they matter so much:

- Catching Errors & Fraud: Audits regularly check financial records to spot mistakes or theft early. This prevents money loss and keeps the business working well.

- Regulatory Compliance: Indian retail faces complex rules like GST, labour laws, and licensing. Audits ensure the store follows these rules, avoiding hefty fines and legal trouble.

- Protecting Inventory: Audits track stock levels to find missing items (shrinkage) due to theft, damage, or errors. Knowing this helps plug leaks and manage stock better.

- Saving Money & Improving Efficiency: Audits review how things are done, like buying stock or running stores. Finding wasteful or slow processes helps cut costs and make operations smoother.

- Better Decision Making: Audits provide accurate and reliable information on sales, stock, and finances. Owners and managers can trust this data to make smarter business plans.

- Controlling Risks: Audits identify potential problems like fraud, supplier issues, or safety hazards before they become big disasters. This allows the business to put safeguards in place.

- Managing Vendors: Audits check if payments to suppliers match deliveries and agreed prices. This prevents overpaying and ensures you get what you paid for.

- Ensuring Transaction Accuracy: Audits verify that sales at the counter (cash and digital) match recorded amounts. This catches till errors or fraud and ensures all money is collected.

- Boost Operational Efficiency: When you audit your store operations, you’ll find issues like over-ordering, delayed vendor payments, and staff inefficiency. This can help businesses fix them faster.

- Prepare for External Audits: If your business is growing, external audits become mandatory. Internal audits help you fix problems proactively and reduce the risk of audit-related penalties

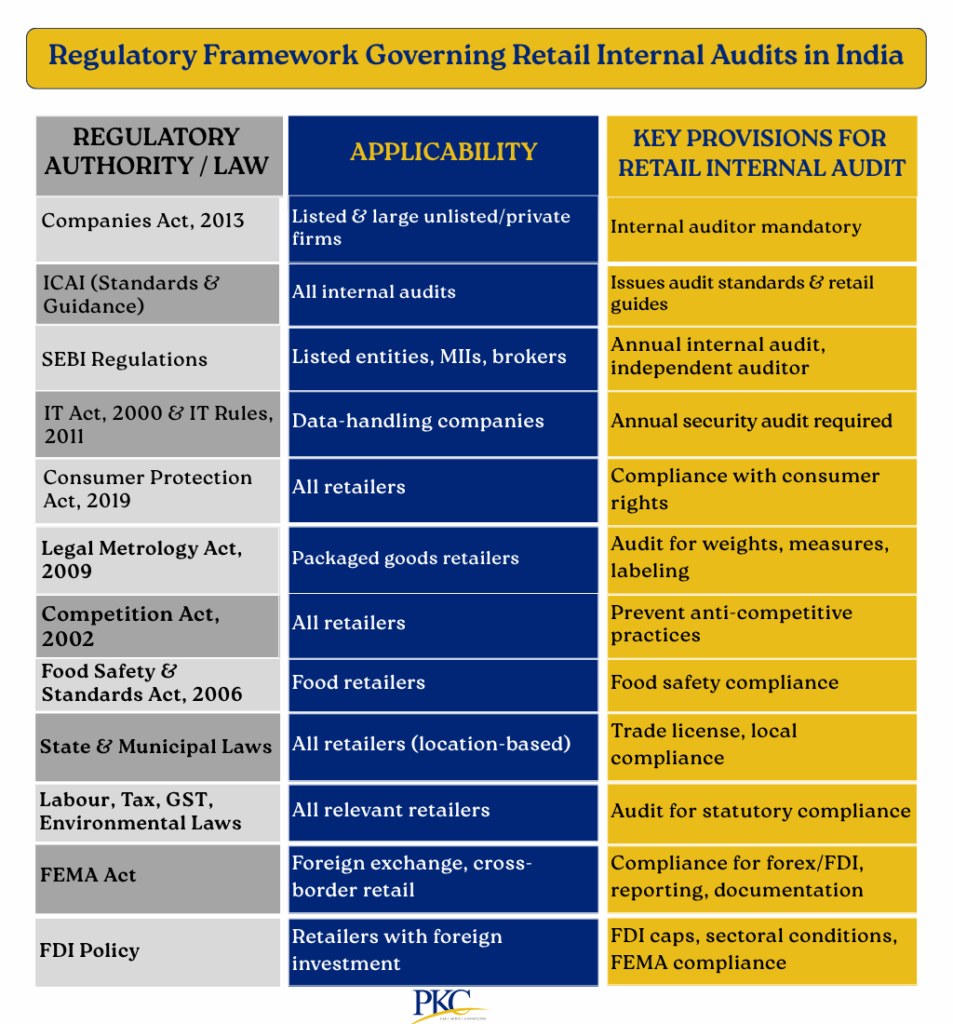

Regulatory Framework Governing Retail Internal Audits in India

Internal audits for retailers are governed by many laws and regulations.

Here’s a quick break down of the main regulations and legal bodies that control internal audits in India’s retail sector:

Key Areas Covered During Internal Audit of Retail Companies

An internal audit in the retail industry covers the following main areas:

1. Inventory Management and Stock Control

Objective: Ensure stock is accurate, updated, and well-managed.

Audits will check:

- Stock levels (physical vs recorded)

- Shrinkage or missing items

- Damaged or expired goods

- Overstocking or understocking problems

- Barcode system and POS integration

2. Point of Sale (POS) System and Billing Checks

Objective: Identify revenue leaks, fake sales, and staff manipulation

Auditors check:

- Fake returns or cancelled bills

- Manual price changes or discounts

- Cash vs card payment matching

- Daily closing balance accuracy

- Coupon, loyalty points, and reward misuse.

3. Vendor Management and Procurement

Objective: Stop fraud and ensure fair, documented vendor handling.

Audit checks include:

- Vendor selection process

- Purchase order system

- Goods received vs invoices

- Payment terms and delays

- Unauthorized vendor deals or commissions

4. Sales and Revenue Reporting

Objective: Ensure revenue is correctly recorded and no money is going missing.

Internal audits review:

- Sales reports vs actual cash/bank credits

- Returns and refund policy compliance

- Cross-verification with bank statements

- Discounts and promotional expenses

- Cash handling at store level

5. Human Resource and Payroll Audit

Objective: Identify payroll fraud, ghost workers, and HR compliance gaps.

Auditors check:

- Employee attendance and roster

- Overtime and leave records

- Payroll system vs bank transfers

- PF, ESI, gratuity compliance

- Bonuses and incentives

6. Legal and Regulatory Compliance

Objective: Avoid fines, penalties, or legal trouble.

Audit areas include:

- GST filings and input credit

- Labor laws, EPF, and ESI contributions

- FSSAI license (for food retail)

- Environmental, health, and safety laws

- State-specific retail licensing

7. Cash Handling and Bank Reconciliation

Objective: Find cash mismanagement or employee theft.

Internal audit looks at:

- Daily cash collection logs

- Petty cash misuse

- Cash theft or shortage

- Bank reconciliation reports

- Deposits and withdrawals timing

8. Store Operations and SOP Adherence

Objective: Ensure consistency and professionalism across all stores.

Audit checks for:

- SOP (Standard Operating Procedures) usage

- Opening/closing protocols

- Cleanliness and layout standards

- Safety and customer service policies

- CCTV usage and security logs

9. IT Systems and Data Security

Objective: Protect your systems from fraud or cyber attacks.

Audit reviews:

- Access controls for POS and ERP systems

- Backup procedures

- Cybersecurity policies

- Unauthorized system changes

- Customer data privacy

10. Marketing and Promotional Spend

Objective: Make sure your marketing money isn’t being wasted or misused.

Audits cover:

- Campaign effectiveness

- Promotion code abuse

- Social media and influencer costs

- ROI (return on investment) reports

- Misuse of ad budgets

11. Fixed Assets and Expenses

Objective: Prevent asset theft, misuse, and fake expenses.

Auditors assess:

- Ghost assets (assets on paper but not in store)

- Asset tagging and physical verification

- Expense vouchers and approvals

- Capex vs Opex (capital vs operational spending)

12. Fraud Protection

Objective: Reduce fraud risk by improving internal processes.

Auditor evaluates:

- Segregation of duties (who approves vs who executes)

- Fraud-prone areas (cash, discounts, inventory)

- Whistleblower mechanisms

- Unusual or duplicate transactions

- Internal control gaps (like missing approval levels)

Checklist for Conducting Internal Audit in a Retail Store in India

Here’s a Sample checklist for retail internal audit:

Challenges of Conducting Internal Audits in Indian Retail

Here are some of the common challenges faced during internal audits of retailers in India:

Diverse & Fragmented Operations:

Indian retail ranges from huge chains to tiny local shops, also known as kiranas, making standardized audits hard.

Also, audits slow down busy store operations like sales or restocking.

Management may resist audits during peak seasons (festivals, sales) when scrutiny is most needed but disruption is costly.

High Employee Turnover:

Staff often change jobs quickly in retail, especially floor staff.

This means internal auditors constantly train new people on controls, and key witnesses for past transactions may be gone.

Technological Limitations:

Many smaller retailers still rely on manual records or basic software. This makes data hard to access and verify.

Even larger chains might use disconnected systems (POS, inventory, finance) that don’t share data easily.

Sheer Volume of Transactions:

Stores handle thousands of daily sales (cash & digital), returns, and stock movements.

Auditing this massive volume quickly and accurately is extremely difficult and time-consuming.

Inventory Management Issues:

Physical stock checks are tough due to large, fast-moving inventories spread across stores and warehouses. Discrepancies (shrinkage – theft/spoilage/damage) are common and hard to pinpoint during audits.

Vendor Management Complexity:

Dealing with numerous suppliers involves many invoices, discounts, and returns.

Ensuring payments match deliveries and agreed terms is messy due to inconsistent documentation from vendors.

Data Quality & Availability:

Relying on store-level staff for accurate record-keeping leads to errors or missing data.

Poor quality input data makes the audit findings unreliable.

Perception as Cost, Not Value:

And in many cases, store managers often see audits only as fault-finding exercises that add cost.

Getting buy-in for implementing audit recommendations can be hard if the benefits aren’t clearly understood.

Benefits of Outsourcing Internal Audit for Retailers

✅ Access to Expert Auditors

You get a skilled team that understands retail audits, GST, Indian laws, and industry standards, without hiring full-time staff.

✅ Unbiased & Independent Review

External auditors provide neutral feedback, spot red flags, and give honest suggestions without internal pressure or conflict of interest.

✅ Helps Maintain Legal Compliance

Outsourced auditors stay updated with GST rules, Companies Act, labor laws, and FSSAI guidelines — ensuring your business is always compliant.

✅ Better Fraud Detection and Risk Management

Professionals can identify theft, POS manipulation, payroll fraud, or fake expenses faster and more efficiently.

✅ Enhanced Reporting for Investors and Banks

Professional reports build trust with investors, banks, and stakeholders — increasing chances of funding and partnerships.

✅ Access to Tools & Tech

Many outsourced audit firms use advanced software for inventory checks, data analysis, and compliance tracking — tools that may be too expensive in-house.

✅ Consistency Across Multiple Store Locations

They ensure the same audit quality across branches, improving your overall business standard and decision-making.

✅ Quick Implementation of Recommendations

With their experience, outsourced teams can provide actionable advice and even help implement better internal controls.

Why is PKC a Great Fit for Retailer Audits?

- Deep niche in retail-specific audit challenges

- End-to-end services: SOP audits, inventory checks, GST compliance, fraud detection

- Proven track record with Indian and global retail brands

- Trusted by businesses that want clarity, control, and compliance

Frequently Asked Questions

- What is an internal audit in retail?

An internal audit for the retail industry is a process to review your store’s operations, stock, cash flow, and compliance to find risks and fix them.

- How often should internal audits be done for the retail industry?

Most retail chains in India do audits quarterly or monthly depending on store size and risk level.

- What laws apply to retail internal audits in India?

Key laws that drive retail internal audits include the Companies Act, GST Law, FSSAI (for food retail), and labor laws like EPF and ESI.

- How do I choose the right internal audit partner for my retail company?

Pick a firm with retail-specific experience, multi-location audit ability, and a deep understanding of Indian laws — like PKC Management Consulting.

- What are the risks of skipping internal audits for retail companies?

Not conducting retail audits could lead retailers to face legal penalties, GST issues, stock loss, or fraud – and investors will lose trust.

Expert verified

Expert verified