Written By – PKC Desk, Edited By – Abhinand, Reviewed By – Aakash

Introduction to New tax regime

From when it is applicable?

The Government introduced S.115 BAC w.e.f FY 2020-21 in the Finance budget , 2020. The reason for the introduction of the new regime is to simplify the Income tax laws and to provide relief for the individuals who do not have any investment.

When and Who should opt for the new scheme?

An Individual / HUF can opt for the new regime. This scheme can be opted by the person who does not make any specified investments or one who requires higher disposable income. Such decisions can be made within the due dates for filing of the returns.

Can we change the regime once opted?

The regime once selected for a particular year can be changed only once for persons having PGBP income . However the government provides an option for the assessee having other than PGBP income to change it every year.

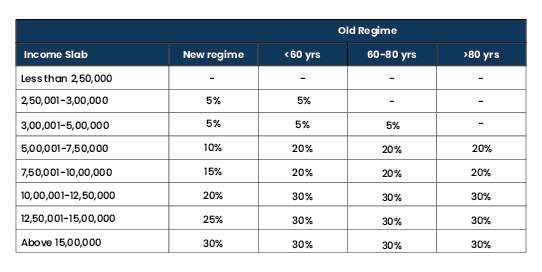

Income Tax rates under both Old tax regime and New tax regime

i. Health and Education cess – 4% of income is leviable on both Old and New Tax Regime.

ii., If resident Individual has Total Income (After deductions and Exemptions) Up to Rs.5,00,000, then No Income tax shall be levied for such person (u/s 87a)

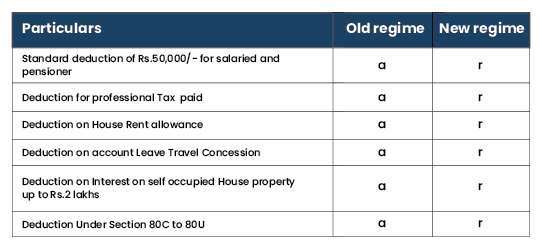

Differences in deduction allowed between Old & New Scheme

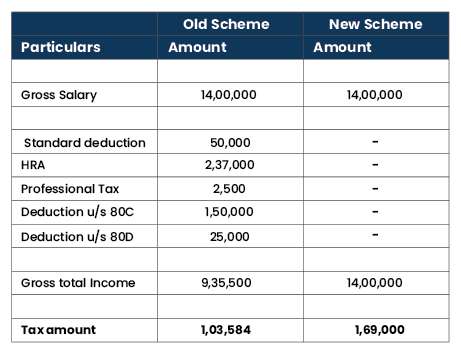

Income Tax computation under both Old tax regime and New tax regime

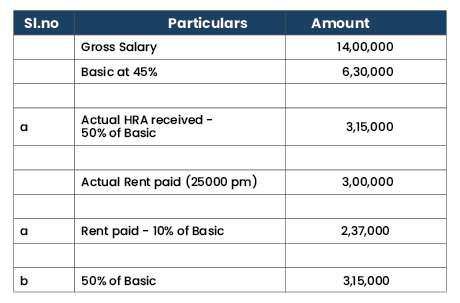

Computation of House rent allowance exemption

Exemption for HRA will be lower of a,b,c i.e Rs 2,37,000/-

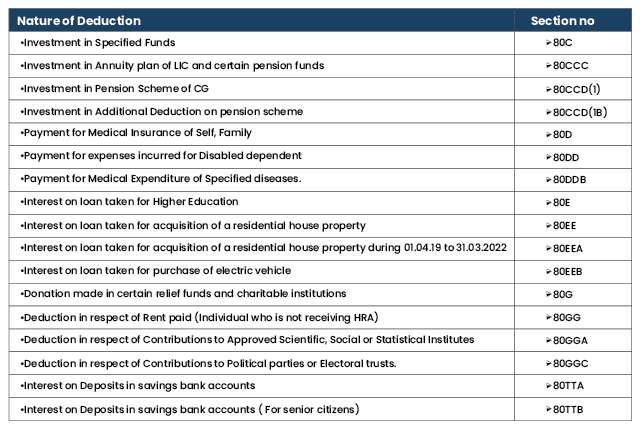

In order to reduce the tax amount Investments can be made as specified under Chapter VI A of Income Tax act, 1961

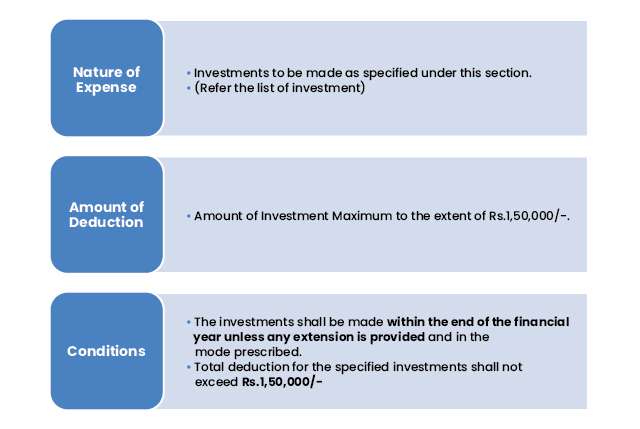

Section 80C – Deduction w.r.t to Specified investments

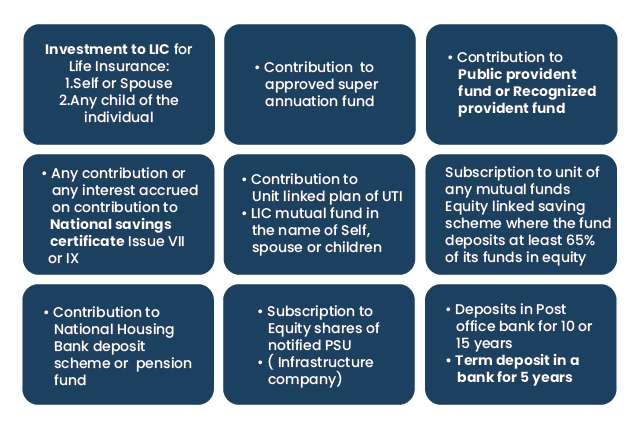

Investment linked deduction u/s 80C:

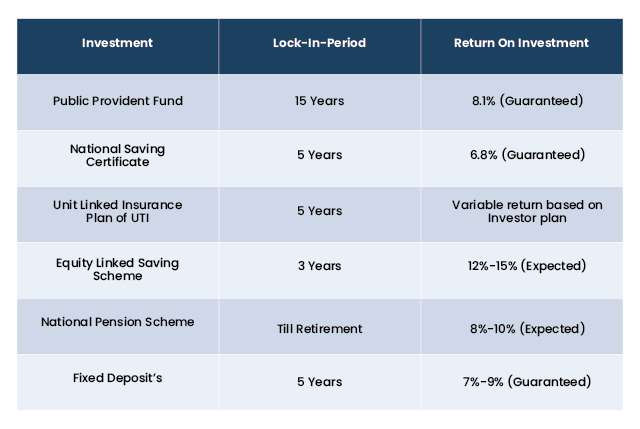

Comparison on Tax-saving Investments:

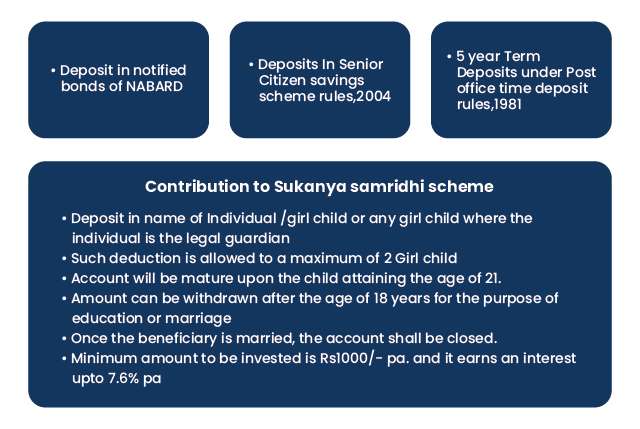

Investment linked deduction u/s 80C:

Expenses linked deduction u/s 80C:

Deduction w.r.t to Payment for Housing loan

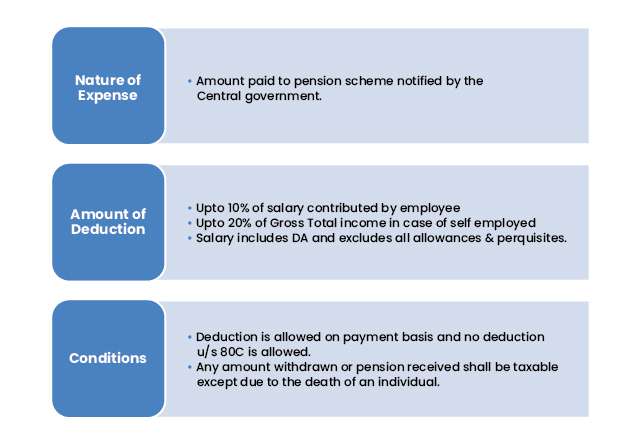

Section 80 CCD – Deduction for contribution to the National pension Scheme of the Central Government.

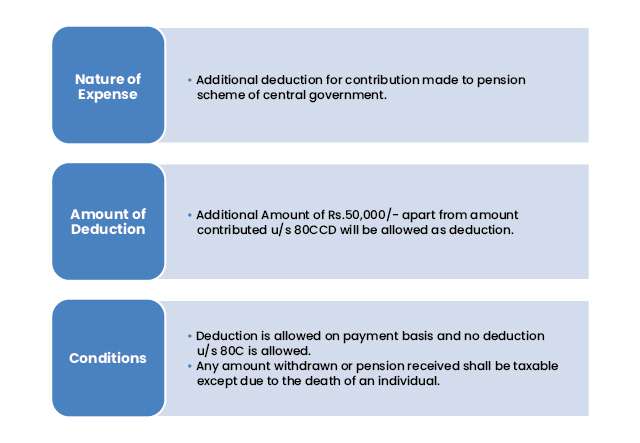

Section 80 CCD (1B) – Deduction for contribution to the National pension Scheme of the Central Government.

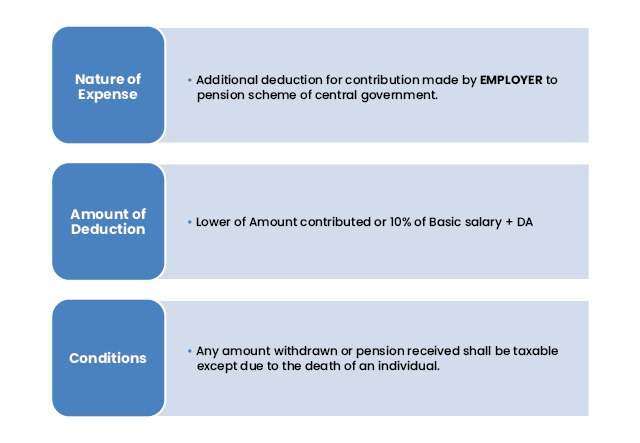

Section 80 CCD (2) – Deduction for contribution by employer to the National pension Scheme of the Central Government.

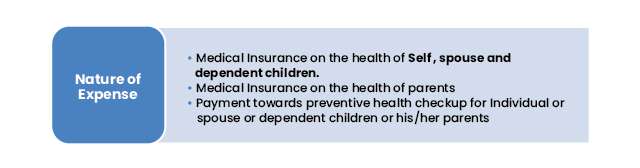

Section 80D – Deduction for payment of Medical Insurance

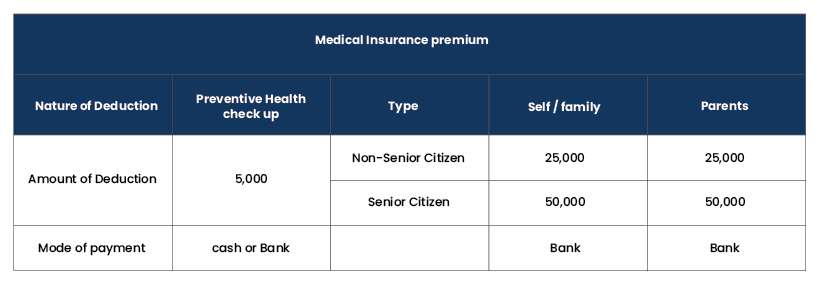

Section 80EEA – Deduction w.r.t Interest paid on Housing loan

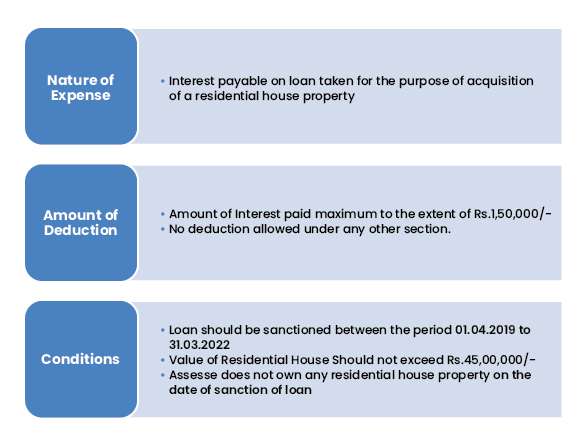

Section 24b – Deduction w.r.t Interest paid on Housing loan

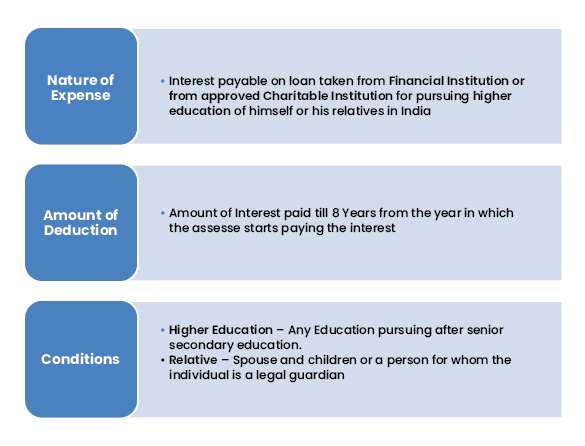

Section 80E – Deduction w.r.t Interest paid on Education loan

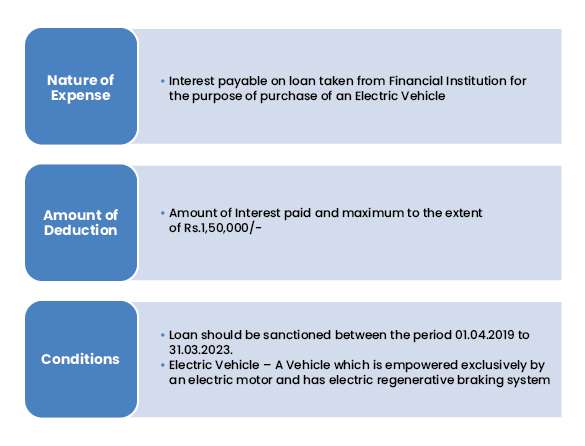

Section 80EEB– Deduction w.r.t Interest paid on E-vehicle loan

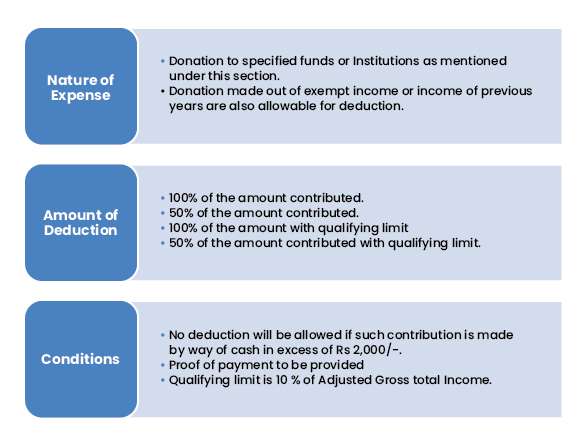

Section 80G – Deduction for contributions to certain funds, Charitable Institutions:

Category I – Donations eligible for 100% deduction

Category II – Donations eligible for 50% deduction:

Category III – Donations eligible for 100% deduction with qualifying limit :

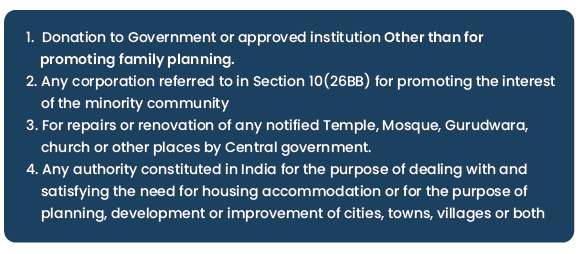

Category IV – Donations eligible for 50% deduction with qualifying limit :

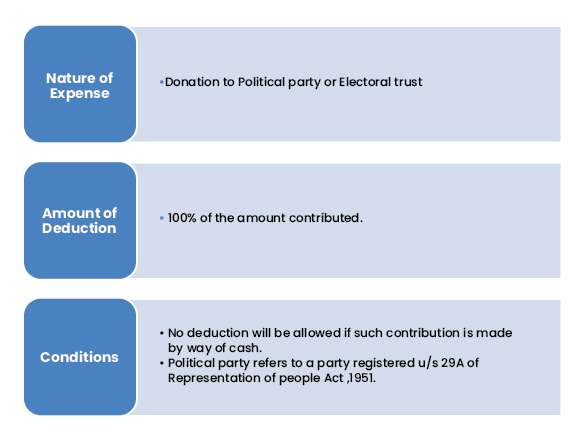

Section 80 GGC – Deduction for contributions to Political parties/ Electoral Trust:

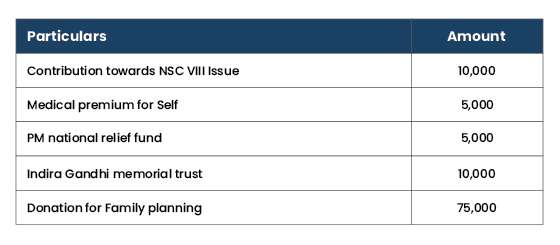

Example for 80G:

Mr.X Whose Gross Total Income is Rs.7,70,000 inclusive of Long- Term Capital Gain of Rs.80,000 /-

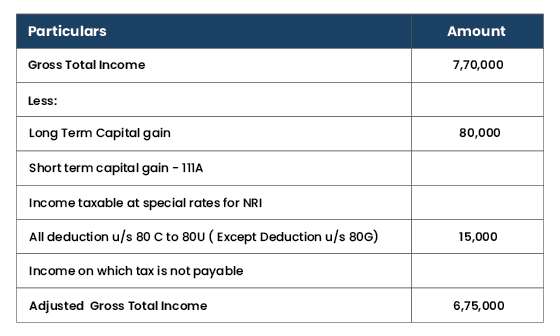

Adjusted Gross Total Income:

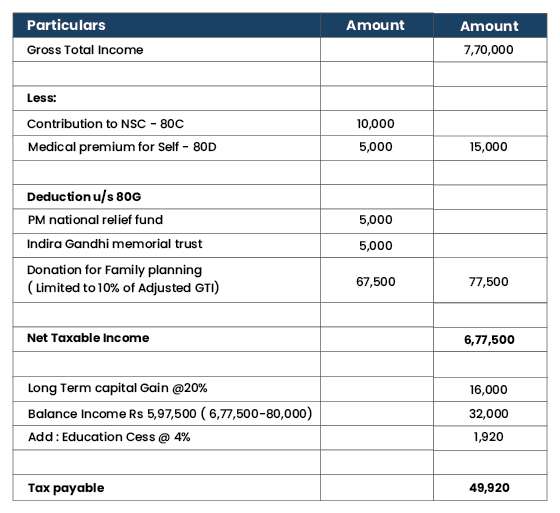

Solution:

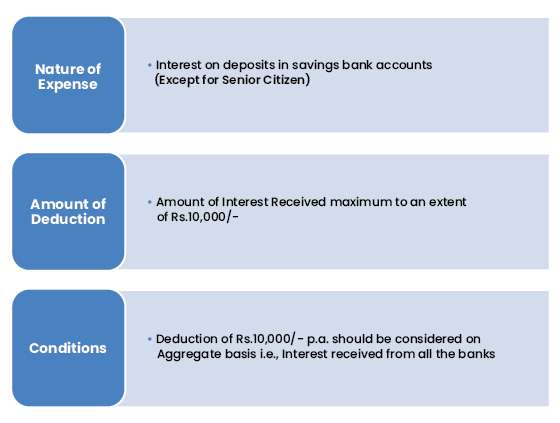

Section 80TTA- Deduction on interest received in savings bank account

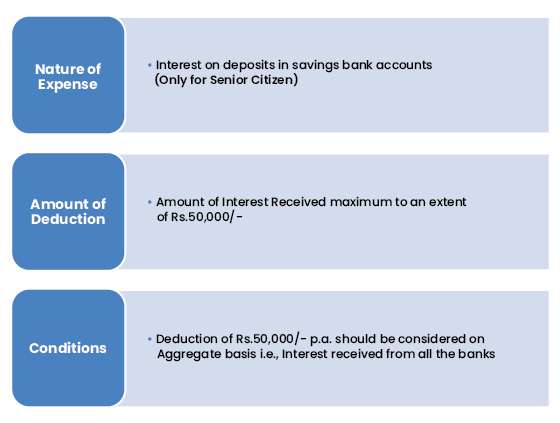

Section 80TTB – Deduction on interest received in savings bank account for Senior citizens

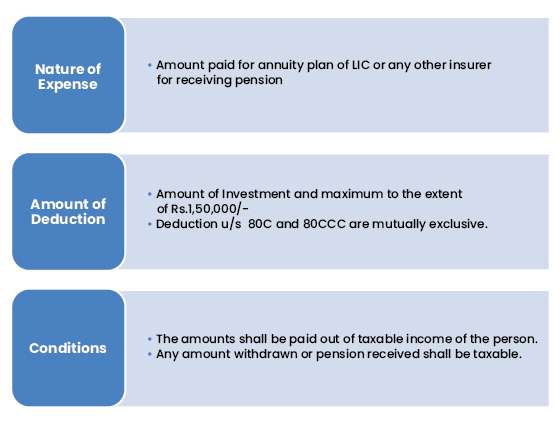

Section 80CCC – Deduction for contribution to certain pension funds

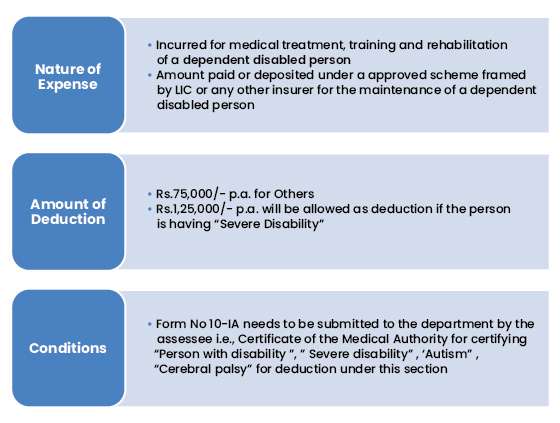

Section 80DD – Deduction for medical expenses of Disabled dependent

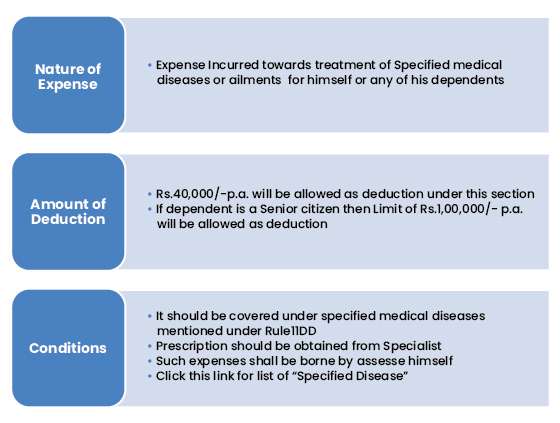

Section 80DDB – Deduction for Medical Expenses

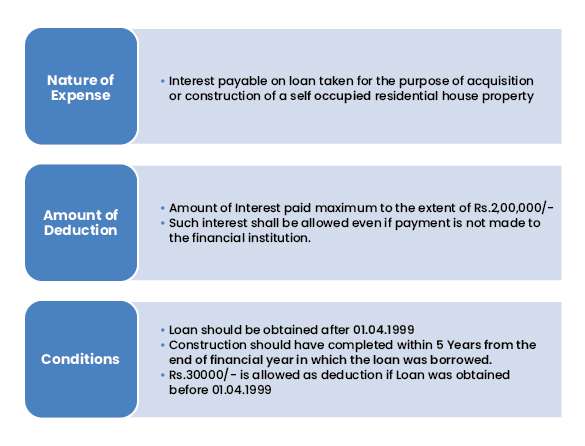

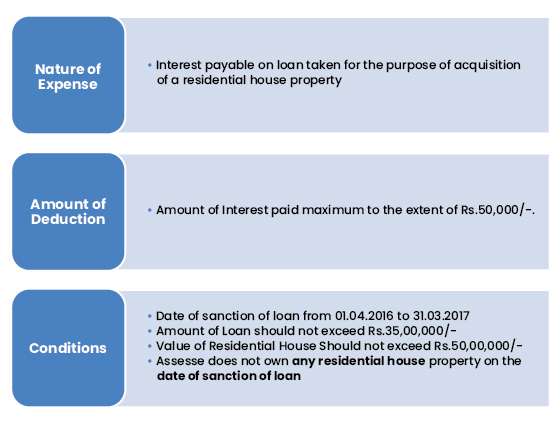

Section 80EE – Deduction w.r.t Interest paid on Housing loan

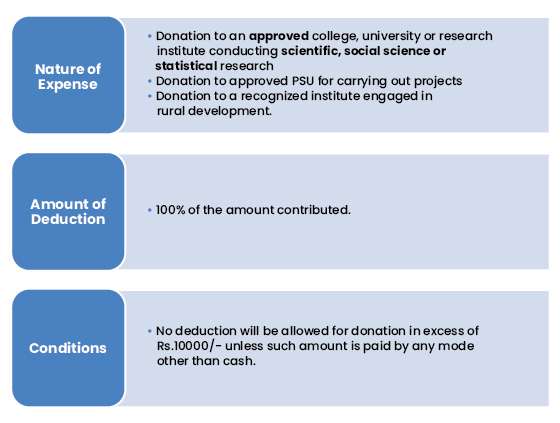

Section 80GGA – Deduction for contribution to Scientific Research or Rural Development:

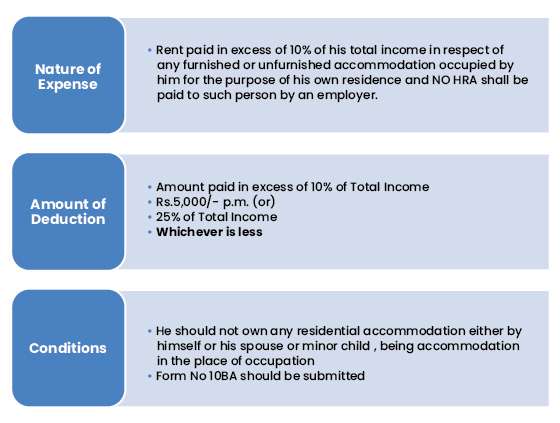

Section 80GG – Deduction w.r.t Rent paid in case of no HRA

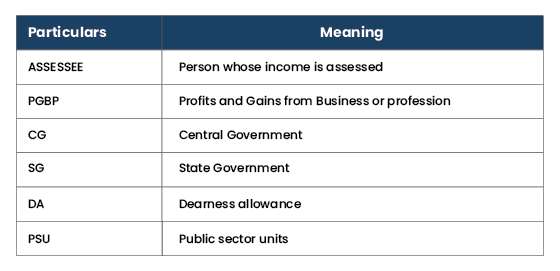

Meanings of the Key terminologies used:

Expert verified

Expert verified