Written By – PKC Desk, Edited By Karunakaran, Reviewed By – Aakash

Car ownership comes with significant financial implications. One of the biggest factors is taxes. We have your back as we guide you through how to save tax when buying a car.

Explore the different strategies you can use to reduce the tax on your vehicle purchase, be it private or business use.

Cut Down the Taxes on Your Next Car Purchase: Best Tips

Buying a car is a significant investment. However, if you plan carefully, you can potentially save on taxes. Here are some strategies:

1.

Claim Input Tax Credit (ITC)

If you are purchasing a car for business use, you can claim the GST (Goods and Services Tax) paid on the car as Input Tax Credit.

This is applicable if the car is used for commercial purposes, like taxis, logistics, or transport services.

| IMPORTANT |

| Not available for personal use cars |

| Available only for vehicles with a seating capacity of 13 or more Or Used for specific commercial purposes like transportation services |

2.

Opt for an Electric Vehicle

Under Section 80EEB, you can claim a deduction of up to Rs 1.5 lakh on the interest paid on an EV loan.

| 80EEB deduction is available only for individuals and can be claimed once per person when purchasing an EV for the first time. |

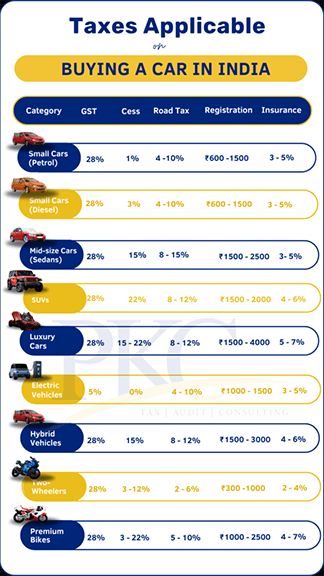

They also attract a lower GST rate of 5%, compared to 28% on petrol and diesel cars. This can result in substantial tax savings upfront.

3.

Take Advantage of Interest Deduction

If you are self-employed and use the vehicle for business purposes, you can claim the interest paid on a car loan as a business expense.

This deduction reduces your taxable income. However, salaried individuals cannot claim this unless the vehicle is primarily used for business activities.

4.

Claiming Expenses for Business Use

If the car is used for business purposes, you can claim the expenses related to the car—such as fuel, maintenance, repairs, and driver salary—as business deductions.

This reduces your taxable income. This benefit is not available if the car is for personal use.

Keep detailed records of these expenses is essential to substantiate claims during tax assessments.

5.

Buy a Car in a State with Lower Road Tax

Road tax varies significantly across Indian states. Some states offer lower rates for specific vehicle types or electric cars.

By buying a car in a state with lower road tax, you can save on this cost.

Compare road tax rates across states before making a purchase.

6.

Claim Depreciation for Business Use

If the car is purchased for business use, you can claim depreciation as an expense under Section 32 of the Income Tax Act.

Depreciation rates are usually 15% for regular vehicles and 30% for electric vehicles.

This reduces your taxable income over the years.

Also Check: Save Tax On Sale Of Commercial Property

7.

Check for State-Specific Incentives

Some states in India offer additional incentives or rebates for purchasing electric vehicles or vehicles that meet certain emission standards.

Research state-specific schemes to take advantage of any available benefits.

8.

Don’t Forget the Tax Collected at Source (TCS)

If you are buying a car valued over Rs 10 lakh, or make cash payments exceeding Rs 2 lakh, the dealer is required to collect 1% TCS (Tax Collected at Source).

You can claim this amount as a tax credit when filing your income tax return, reducing your overall tax liability.

9.

Time Your Purchase Wisely

During certain times, like financial year end or festive seasons, dealers and states may offer temporary reductions or exemptions on road taxes, registration fees, or other charges.

By timing your purchase during these periods, you can reduce costs.

10.

Reimburse Through Salary Structure

This is applicable for salaried employees whose employer offers a car lease program or provides car allowance.

You can get reimbursed for expenses like fuel, maintenance, or loan interest. This can help reduce your taxable salary, as these reimbursements are not taxed.

11.

Opt for Pre-Owned Cars

Used cars attract a lower tax rate compared to new cars. The GST on used cars is generally lower—between 12% to 18%, depending on the car type.

Additionally, some states may offer lower road tax for second-hand vehicles.

12.

Purchase Car for Specific Commercial Use

If you buy a car for commercial purposes, such as for a taxi service, logistics, or business operations, you can claim tax benefits like Input Tax Credit (ITC) on GST, depreciation, and business expenses related to the car.

This helps in reducing the overall tax liability of your business.

13.

Tax Benefits on Car Insurance

This again is applicable for business use vehicles. If the car is used for business purposes, the premium paid for car insurance can be claimed as a business expense.

This reduces your taxable income, leading to tax savings.

14.

Take Advantage of Lower Registration Fees

Buying a car in India and registering it in a state with lower registration fees can lead to significant tax savings.

For instance, Uttar Pradesh recently waived registration fees on strong hybrid vehicles, allowing buyers to save up to Rs. 3.5 lakhs.

15.

Choose a Car with a Lower Engine Capacity

Cars with lower engine capacity (especially under 1500 cc) are often subject to lower road tax and GST rates compared to luxury or high-engine capacity vehicles.

Choosing a car with a smaller engine can help reduce your tax burden both at the time of purchase and during ownership.

Have additional tax questions?

Frequently Asked Questions

Yes, you can save tax when buying a car, primarily if it is used for business purposes, as you can claim deductions on loan interest and depreciation under the Income Tax Act.

You can save GST on a car purchase by claiming Input Tax Credit (ITC) if the vehicle is bought for business use and you are registered under GST.

To claim tax benefits on a car purchase, ensure the vehicle is used for business, include loan interest as a business expense, and maintain documentation to support your claims during tax filing.

Buying a car without GST is not possible, but you may explore options like purchasing from a private seller or opting for certain exemptions available for specific vehicle types like EVs.

Salaried employees usually cannot claim tax benefits on car loans unless the vehicle is an electric vehicle (EV), which allows for a deduction on interest payments under Section 80EEB.

Expert verified

Expert verified