Written By – PKC Desk, Edited By Karunakaran, Reviewed By – Aakash

Wondering how to save tax in business in India? We got you covered. Explore with us the best tips for saving taxes for businesses in India.

By implementing these tips you will be able to not only save taxes but also keep the most of your earnings for your business growth. We’ll cater to all kinds of businesses, small or medium and even growing and large.

How to Save Tax in Business Income in India?

Here are some of the best ways to save taxes for businesses in India:

1.

Identify & Claim Deductions on Business Expenses

To reduce taxable income, identify and claim deductions for legitimate business expenses such as rent, utilities, salaries, office supplies, and marketing costs.

These expenses, when properly documented, can significantly lower your tax liability.

2.

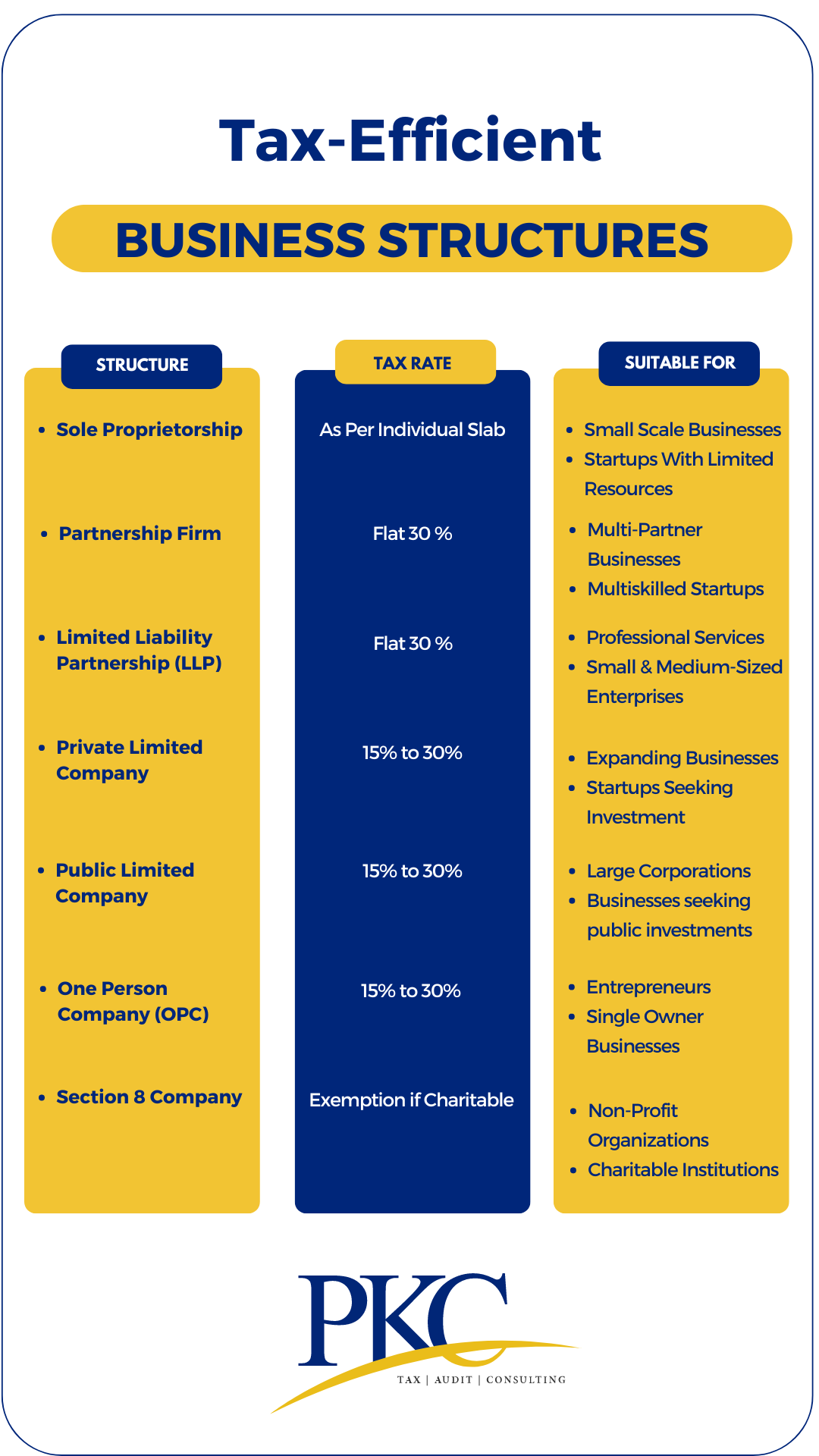

Opt for Tax-Efficient Business Structures

Different business structures have different tax liabilities. Choose a business structure such as sole proprietorship, partnership, LLP, company that aligns with your business and tax goals.

This is applicable for businesses who are just starting out or who are considering changing its legal form.

Also Read:

Tax saving tips for small business owners

3.

Claim Tax Relief for Depreciation

You can reduce your taxable income by claiming depreciation on assets such as machinery, vehicles, equipment, and buildings.

By systematically writing off the cost of assets over their useful life, you can reduce your taxable income and defer tax payments. Manufacturing businesses can claim additional depreciation under Section 35AD.

4.

Record Preliminary Expenses

This tip is suitable for businesses in their early stages. Keep track of all the money you spend before your business officially starts, like registration or legal fees, marketing costs, etc.

You can spread out these expenses on your balance sheets over a few years to reduce your taxes in the early stages.

5.

Invest in Tax- Saving Instruments

Invest in government-approved tax-saving instruments like Public Provident Fund (PPF), National Savings Certificate (NSC), or Equity Linked Savings Schemes (ELSS) under Section 80C.

You can use these investment opportunities to reduce business taxable income and avail deductions up to Rs 1.5 lakhs.

6.

Deduct TDS Where Applicable

Make sure you correctly deduct and pay the required Tax Deducted at Source (TDS) on salaries, contractor payments, and other specified expenses.

This not only keeps you compliant with tax laws but also reduces your taxable income.

7.

Save Business Taxes on Capital Gains

Capital gains are taxed differently based on the holding period. Reinvest capital gains from the sale of business assets into specified instruments like bonds or residential property under Sections 54EC and 54F.

Businesses can also reduce long-term capital gains tax liability by claiming indexation benefits. This is done by adjusting the purchase price of long-term assets like property or securities for inflation when calculating capital gains.

8.

Consider Engaging Professionals for Business Tax Planning

Consult an experienced chartered accountant or CA firm like PKC Management Consulting for expert tax advice and assistance.

With their expertise you can optimize your tax strategy and save money in the long run.

9.

Claim Expenses for Marketing and Advertising

All expenses related to marketing and advertising can be deducted from taxable income. This includes costs for:

- Digital marketing campaigns

- Print and online advertising

- Attending trade shows and conferences

- Promotional materials like brochures and flyers

- Hiring marketing professionals

By claiming these expenses, you can reduce your taxable income and lower your overall tax liability.

10.

Utilize Employee Benefits to Save Business Tax

Provide tax-exempt employee benefits like medical insurance, transport allowance, and housing allowance.

This will enhance employee satisfaction and retention. You reduce the taxable income of employees, thereby lowering the overall tax liability for the business.

11.

Save GST in Your Business

Businesses in India can legally save GST by planning strategically and ensuring compliance. Best ways to save GST for businesses is

- Maximizing Input Tax Credit (ITC): You can claim GST paid on business expenses like rent, advertising, software, and professional services, provided suppliers are GST-compliant and invoices are valid.

- Choose the right GST Scheme: For example small businesses can opt for the Composition Scheme with lower tax rates and simpler filing, though ITC isn’t available.

-

Correct Classification of Goods and Services: Under proper HSN/SAC codes prevents overpayment and penalties.

-

Plan your Supply Chain: Reduce interstate IGST, and claim ITC on capital goods like machinery or computers.

12.

Capitalize on Loss Carry Forward

If your business incurs losses, you can carry them forward to offset against future profits for up to 8 years.

Understand the set-off rules for loss carry forward to maximize tax benefits. This strategy helps in reducing tax liability in the profitable years.

Get the expert guidance your business deserves

13.

Presumptive Taxation Scheme

Businesses with a turnover up to Rs 2 crores can opt for presumptive taxation under Section 44AD.

This scheme simplifies tax calculations by allowing you to declare a fixed percentage of your turnover as taxable income, making it easier.

Explore More Tax Saving Tips for Small Businesses

14.

Don’t Let Go of Tax Credits

Ensure that you utilize all available tax credits, such as those for taxes paid in foreign countries. These can offset your Indian tax liability.

You can often use those payments to reduce the taxes you owe in India, helping you save money.

15.

Stick to Digital Transactions

Contribute to the government’s initiative of a cashless economy. Encourage your customers to pay digitally.

Doing this may help you qualify for a lower tax rate, plus it makes your business easier to manage.

16.

Tax Exemptions for Startups

If your business qualifies as a startup, you may be eligible for various tax exemptions and incentives under government schemes like Startup India.

You can claim incentives such as a 3-year tax holiday under Section 80IAC.

17.

Use Research & Development Deductions

If your business is involved in innovation, claim deductions on expenses related to research and development under Section 35(2AB).

This can lower your taxable income while promoting innovation within your business. You can deduct specific R&D expenses, including salaries, equipment, and materials used for research.

18.

Utilize Tax Deductions on Interest Paid

If your business has taken out loans, the interest paid on those loans is tax-deductible. This includes interest on business loans, equipment financing, commercial property mortgages, credit cards used for business expenses.

Be sure to keep detailed records of the interest paid to claim this deduction.

19.

Family Employment

Employing family members in the business can be a strategic move. Salaries paid to them can be deducted as business expenses, reducing overall taxable income.

This can also provide financial support to family members while keeping the business operations within trusted hands.

20.

Claim Benefits on Export Income

If your business exports goods or services, you can claim tax benefits like GST on your export income. This includes:

- Deduction of 50% of profits from export turnover under Section 10AA

- Deduction of 100% of profits for the first 5 years and 50% for the next 5 years under Section 10B

Remember, these benefits are subject to certain conditions and limits.

21.

Conduct Regular Audits

Regularly audit your financial records (even when not mandatory) to ensure that you are compliant and identify potential tax-saving opportunities.

A well-audited business is protected from penalties and benefits better from tax planning.

22.

Explore Other Tax Benefits for Business Owners

Apart from the points covered above, business owners can save tax by utilising special corporate tax rates to promote domestic manufacturing and reduce compliance costs.

- Section 115BAA: Domestic companies can opt for a 22% flat corporate tax rate

- Section 115BAB: Newly set-up manufacturing companies registered after October 2019 can enjoy a 15% concessional tax rate if conditions are met.

- MSMEs benefit from multiple tax-saving opportunities like relaxed TDS/TCS rules and lower compliance burden under 2025 updates.

Certain perquisites and allowances (travel and conveyance) are tax-exempt for employees and owners if used exclusively for business purposes.

Frequently Asked Questions About Tax Saving for Businesses in India

Businesses can claim deductions for various expenses such as rent, utilities, salaries, office supplies, and marketing costs. Depreciation on assets, interest on business loans, and contributions to employee welfare funds are also commonly deducted.

Yes, premiums paid for insuring business assets like machinery, buildings, or stock can be claimed as deductions. This reduces taxable income while ensuring the business is protected against unforeseen events.

Some of the main laws include Income Tax Act, Goods and Services Tax (GST), Customs Act, Central Excise Act.

Yes, startups in India may be eligible for tax exemptions under the Startup India initiative. These can significantly reduce their tax burden during the initial years

Yes, you can deduct 100% of legitimate business expenses that are wholly and exclusively incurred for business purposes. These can include office rent, staff salaries, marketing, professional fees, and utilities. Depreciation can be claimed on capital assets instead of full deduction.

To save corporate tax, companies can claim deductions under Sections 35, 80-IA, 80-IAC, and 80JJAA, investing in R&D, and utilising startup tax holidays. Opting for the 15% concessional tax rate under Section 115BAB and depreciation on assets also reduces taxable income.

To reduce taxable profits:

- Claim deductions on salaries, rent, and marketing expenses

- Invest in infrastructure, R&D, or new equipment

- Carrying forward business losses

- Donating to approved charitable institutions

- Setting up operations in SEZs for tax holidays

Expert verified

Expert verified