- Input Tax Credit is the tax paid by the buyer on purchase of goods and service. Such tax which is paid at the purchase when reduced from output tax liability payable is known as Input Tax Credit.

- There are some specific cases where registered person is not eligible to claim to ITC

- Motor vehicles

- Sale of membership of in a club, health, fitness center

- Services of general insurance , servicing, repairs and maintenance

- Food, beverages, club membership, beauty treatment, etc.

- Travel

- No ITC for Non-resident

- No ITC in fraud cases

- Free samples and destroyed goods etc.

- Composition scheme

- No ITC for personal use

- Rent-a-cab, life insurance, health insurance

- Works contract for Construction of Immovable property

- Motor vehicle

- ITC is not available for motor vehicles used to transport persons, having a seating capacity of less than or equal to 13 persons (including the driver).ITC is not available on vessels and aircraft.

- ITC is available in following cases:

- ITC will be allowed on motor vehicles (and other conveyances) used to transport goods from one place to another. (motor vehicle used for transportation of goods, dumpers, tippers etc

- Sale of membership of in a club, health, fitness center

- No ITC is available on any fees paid to gyms, clubs, fitness centers etc.

- Such services provided by an employer to its employees under statutory obligation Is eligible for ITC

- When such goods and/or services are provided by an employer to its employers without any obligation, ITC is blocked.

- Services of general insurance , servicing, repairs and maintenance

- No ITC is allowed on services of general insurance, servicing, repairs and maintenance

- But ITC is allowed in following cases:

- Such services relating to ineligible vehicles, vessels, or aircraft when used for eligible purposes

- Such services when received by

- Manufacturer of ineligible motor vehicles, vessels, aircraft.

- Supplier of general insurance services in respect of ineligible motor vehicles, vessels and aircraft.

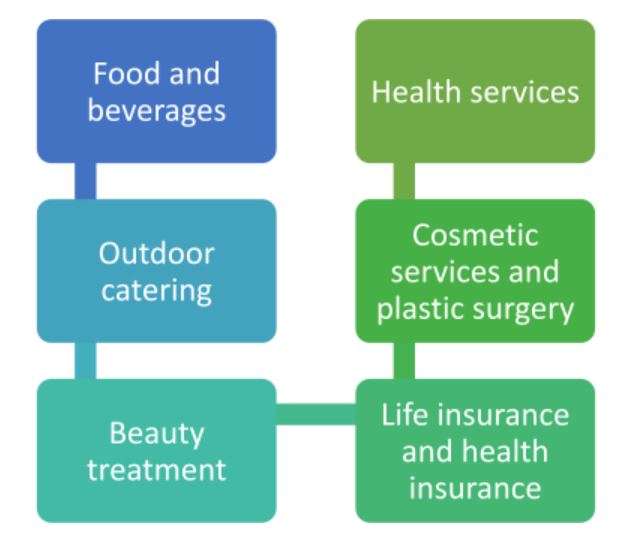

- Food, beverages, club membership, beauty treatment, etc.

- ITC is ineligible in following cases:

- ITC is eligible in following cases:

- When such services are used for furtherance of business

- As a part of taxable composite or mixed supply

- Where it is obligatory for an employer to provide such supplies to its employees.

- Travel

- ITC is blocked on travel benefits given to employees on vacation such as leave or home travel concession.

- ITC is not ineligible, if it is provided by the employer to its employees under any statutory obligations.

- No ITC for Non –Residents

- No ITC will be allowed on goods and/or services received by non-resident.

- ITC is available on any goods imported by him.

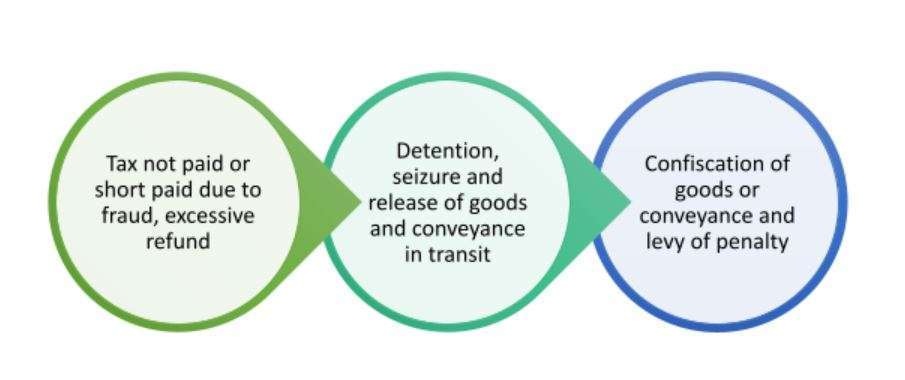

- No ITC in fraud cases

- ITC is not available in following cases

- Tax not paid or short paid due to fraud, excessive refund

- Detention, seizure and release of goods and conveyance in transit

- Confiscation of goods or conveyance and levy of penalty

- ITC is not available in following cases

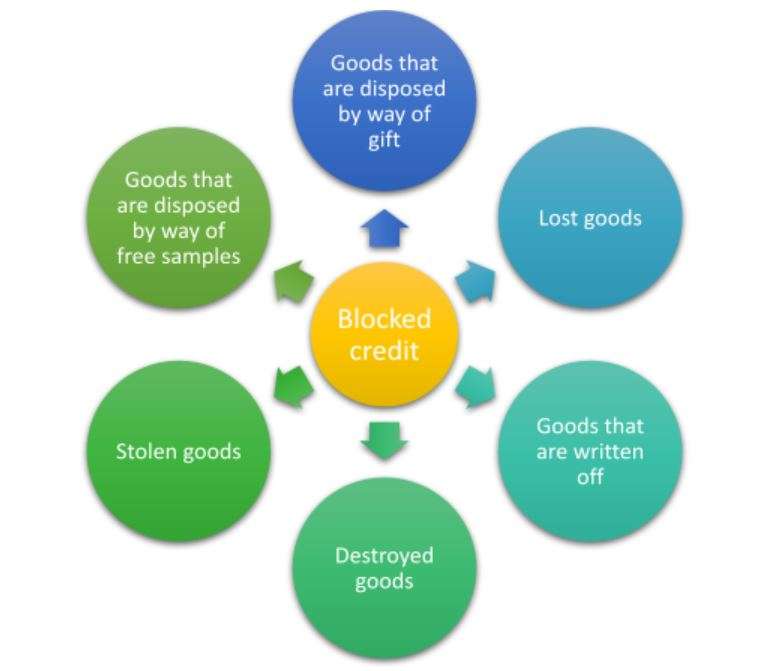

- Free samples and destroyed goods etc.

- In following cases ITC is ineligible:

- Composition scheme

- A composition dealer is not allowed to collect tax from buyers.

- The small traders should fill up GST CMP-01 form to accept the scheme.

- A business registered under the composition scheme is not eligible to avail ITC.

- No ITC for personal use

- One of the most important conditions for availing ITC on goods and/or services is such good and/or services should be used in the course or furtherance of business.

- Where goods and/or services are used partly for business purpose and partly for personal purpose, ITC is restricted to credit attributable to business purpose

- Rent-a-cab, life insurance, health insurance

- ITC is not available on Rent-a-cab ,life insurance, health insurance

- However, ITC is available for

- Any services which are made obligatory for an employer to provide its employee

- When such services are used for furtherance of business

- As a part of taxable composite or mixed supply

- Works contract for Construction of Immovable property

- ITC on work contract services for construction of an immovable property is blocked except when :

- It is an input services for further supply of work contract service

- Immovable property is plant and machinery

- When the value of works contract service is not capitalized

- ITC on work contract services for construction of an immovable property is blocked except when :

Note:

- Construction includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalization, to the said immovable property

- Plant and machinery means apparatus, equipment, and machinery fixed to earth by foundation or structural supports that are used for foundation or structural support but excludes:

- Land

- Building

- Other civil structures

- Telecommunication towers

- Pipelines laid outside the factory premises

Post Author

Babu Prasanth