Written By – PKC Desk, Edited By – Uma Maheswari, Reviewed By – Vignesh

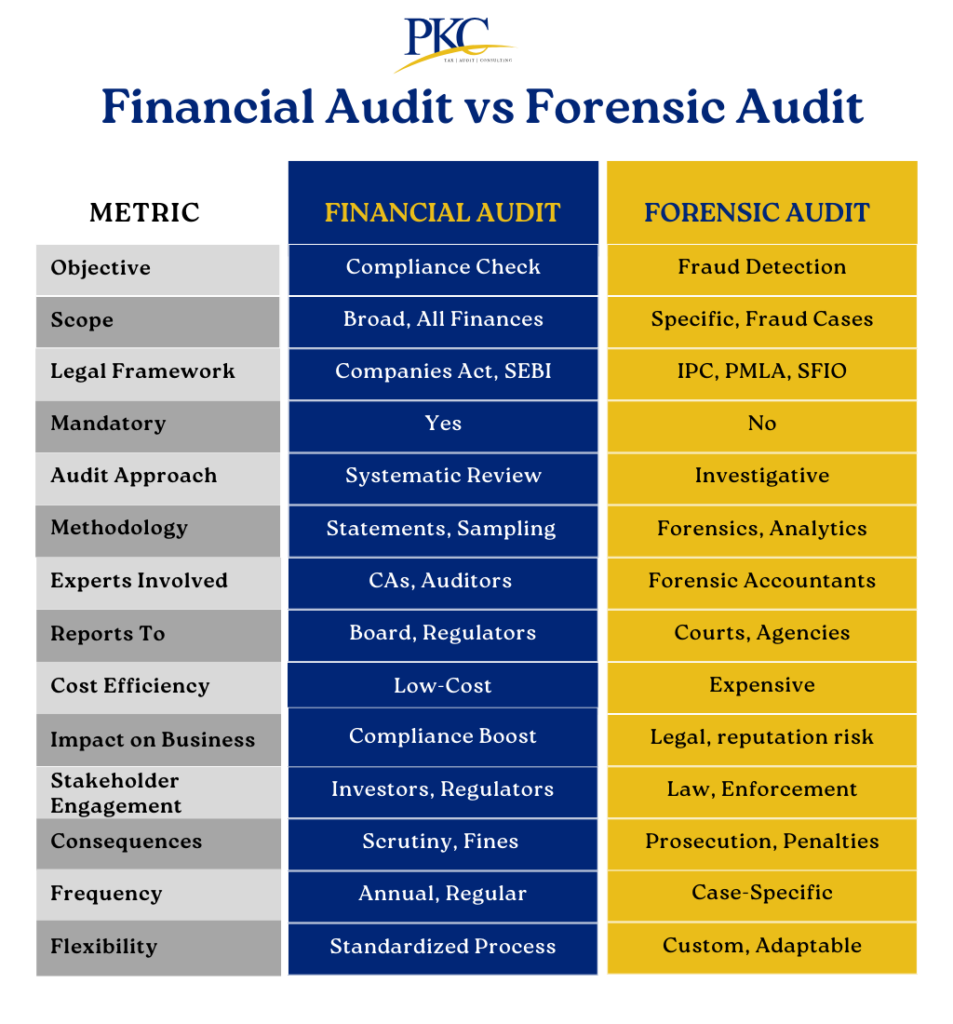

Understanding the difference between Financial Audit vs Forensic Audit is essential for protecting your organization from financial misstatements and fraud.

Explore with us the difference between forensic audit and financial audit where we highlight their distinct purposes and scopes.

Financial Audit vs Forensic Audit: 14 Differences Explained!

Objective

The primary goal of a financial audit is to assess whether a company’s financial statements present a true and fair view of its financial position.

They ensure compliance with accounting standards, taxation, and regulatory requirements focusing on identifying errors, misstatements, and non-compliance.

A forensic audit is more investigative by nature. Its main purpose is to detect fraudulent activities – misconduct, embezzlement, and corruption.

The forensic auditor will gather evidence that can be used in legal proceedings or internal investigations.

Scope

The scope of financial audit is broad. It covers the entire set of financial statements, internal controls, accounting policies, and risk management practices.

These audits ensure the company’s financial reports align with Generally Accepted Accounting Principles (GAAP) , Indian Accounting Standards (Ind AS) or Accounting Standards (AS)

Forensic audits in comparison have a narrow but deep scope. They dig deep into specific suspicions of fraud, misconduct, or financial misrepresentation.

So, instead of analysing all financial data, forensic auditors check specific transactions, unusual patterns, and discrepancies that indicate fraudulent activities.

Also Useful:

Internal Audit Vs Financial Audit

Legal Framework

Financial audits in India are governed by The Companies Act, 2013, Securities and Exchange Board of India (SEBI) regulations, and Accounting & Auditing Standards issued by ICAI.

Forensic audits operate under multiple laws – Indian Penal Code (IPC), Prevention of Corruption Act, Prevention of Money Laundering Act (PMLA), and other fraud-related legislations.

Forensic audits are often commissioned by regulatory authorities like the Serious Fraud Investigation Office (SFIO), Enforcement Directorate (ED), Central Bureau of Investigation (CBI), or Reserve Bank of India (RBI).

Mandatory

A financial audit is mandatory for all registered companies under the Companies Act, 2013.

Public companies, listed entities, and large businesses need to get their financials audited annually to ensure compliance with tax laws, SEBI and other regulations.

A forensic audit is not mandatory unless there is a specific suspicion of fraud, financial irregularities, or legal disputes.

It is conducted when stakeholders, regulators, or law enforcement agencies suspect misconduct and demand an investigation.

Audit Approach

Financial audits follow a standardized approach. They focus on verification, sampling, risk assessment, and internal control evaluations.

Auditors make sure that the financial statements are accurate, complete, and compliant with applicable accounting standards.

Forensic audits follow an investigative approach. Here the auditors scrutinize specific transactions, digital trails, email communications, and asset movements.

These audits are more focused on identifying irregularities, financial fraud, and potential legal violations.

Methodology

Financial auditors conduct document verification, reconciliations, ledger reviews, and risk-based sampling to validate financial data.

They check whether financial reports reflect the company’s true financial position and follow proper accounting procedures.

The methodology of forensic audits is more advanced and investigative.

It uses techniques like digital forensics, data analytics, interview techniques, background checks, and tracing suspicious financial transactions.

Experts Involved

Financial audits are conducted primarily by Chartered Accountants (CAs) and certified auditors who specialize in financial reporting, compliance, and internal controls.

Forensic audits are done by forensic accountants, fraud examiners, cyber-forensic specialists, legal experts, and investigative professionals.

Impact on Business

A clean financial audit report enhances a company’s credibility, investor confidence, and regulatory compliance.

Forensic audit can have a serious impact, including legal action, reputational damage, financial penalties, and loss of stakeholder trust.

However, it can also help businesses improve risk management and prevent future fraud.

Stakeholder Engagement

Financial audits involve company management, investors, government agencies, and external auditors. It ensures transparency and accountability in financial reporting.

Forensic audit engages law enforcement agencies, regulatory bodies, legal professionals, forensic specialists, and internal investigators to track and resolve financial fraud.

Consequences

A qualified or adverse financial audit report may result in regulatory actions, increased scrutiny, or investor concerns, but it does not necessarily indicate criminal activity.

Forensic audit can lead to criminal prosecution, legal proceedings, fines, asset seizures, or business closures if fraud or financial misconduct is confirmed.

Frequency

Financial audit is conducted annually for all registered companies. Public companies may additionally have quarterly audits as part of regulatory requirements.

Forensic audit is conducted only when required. It is usually triggered by fraud allegations, whistleblower complaints, or regulatory mandates.

Flexibility

Financial audits are highly structured with standard procedures and regulatory compliance requirements.

Forensic audits are more flexible and customized, adapting to the specific case, investigation needs, and legal framework involved.

Frequently Asked Questions

1. What is the main difference between Financial Audit and Forensic Audit?

A Financial Audit is a routine examination of financial statements to ensure accuracy, compliance, and transparency. Forensic Audit, is an investigative audit conducted when fraud, embezzlement, or financial misconduct is suspected.

2. Who conducts a Financial Audit and a Forensic Audit?

Financial audit is conducted by CAs and external auditors registered with regulatory authorities like ICAI . Forensic audit is conducted by forensic accountants, fraud examiners, cyber-forensic specialists, and legal professionals.

3. What is the cost difference between a Financial Audit and a Forensic Audit?

Financial audit is more cost-effective as it is a routine compliance requirement. Forensic audit is more expensive due to specialized investigations, legal involvement, and forensic technology usage.

4. Who benefits from a Financial Audit and a Forensic Audit?

Financial audit is beneficial for shareholders, investors, regulatory authorities, and company management to ensure transparency in financials. Forensic audit benefits law enforcement agencies, courts, businesses, and regulators in uncovering financial crimes.