What are Set Off Rules?

GST has 4 components – Integrated Tax, Central Tax, State/UT Tax & Cess.

Taxes paid on interstate purchases & sales are Integrated Tax. Taxes paid on intrastate purchases & sales are Central & State/UT Tax.

Amount collected through central tax is for the central government & state tax is for the state government. The Integrated Tax is shared by the state & central government.

Set off rules determine how we adjust the output tax (for each component) with the input tax to determine the tax liability & the component towards which it needs to be paid.

Rules of utilization

Rule 1: IGST Liability & IGST ITC should become zero.

If IGST Liability is more than IGST ITC, then use CGST & SGST ITC also (in any proportion)

If IGST Liability is more than IGST ITC, then use CGST & SGST ITC also (in any proportion)

IGST Related:

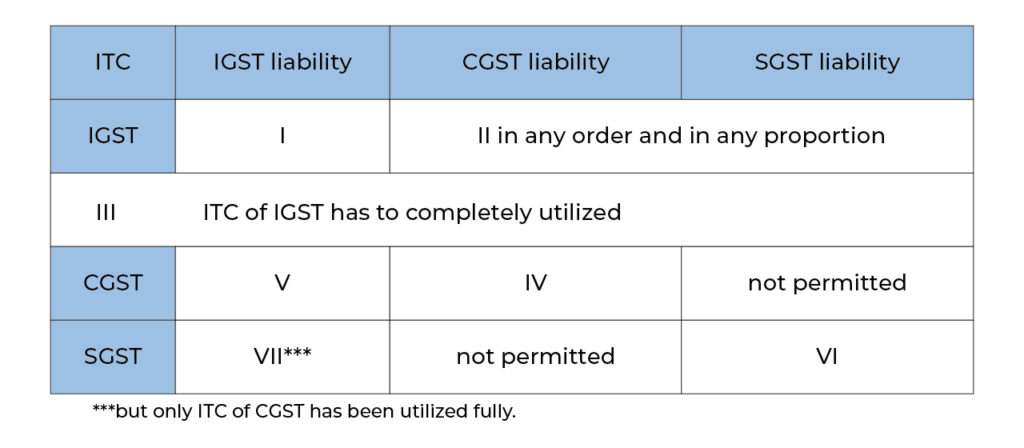

- Rule: IGST Credit & Liability should become zero before proceeding to CGST/SGST

- IGST credit should first be utilized towards payment of IGST.

- Remaining IGST credit, if any, can be utilized towards Payment of CGST and SGST/UGST in any order and in any proportion.

- Entire Output IGST must be

- Entire ITC of IGST should be utilized before utilizing the ITC of CGST and SGST/UTGST.

- ITC of CGST should be utilized for payment of IGST (if any) and CGST in that order. ITC of CGST cannot be utilized for payment of SGST/UGST

- ITC of SGST/UTGST should be utilized for payment of IGST (if any) & SGST/UTGST in that order.

- However ITC of SGST/UTGST should be utilized for payment of IGST, only after ITC of CGST has been utilized fully.

***but only ITC of CGST has been utilized fully.

Example:

1.

| Head | Output tax liability | ITC |

| IGST | 1500 | 1200 |

| CGST | 1200 | 1050 |

| SGST/UTGST | 1200 | 1050 |

| Total | 3900 | 3300 |

Solution:

| ITC of | IGST liability | CGST liability | SGST liability | Balance |

| IGST | 1200 | 200 | 100 | 0 |

| ITC of IGST has been utilized fully | ||||

| CGST | 0 | 1000 | 0 | 50 |

| SGST | 0 | 0 | 1050 | 0 |

SGST liability of 50 has to be paid through cash ledger.

Author

Babu Prasanth

Expert verified

Expert verified