Written By – PKC Desk, Edited By – Vijay, Reviewed By – Aakash

- Tax implications on Various Provident Funds :

- Types of PF’s :

- Recognised PF (RPF) :

- This scheme is applicable to an organization which employs 20 or more employees.

- All RPF schemes must be approved by the CIT (Commissioner of Income Tax).

- Companies can either opt for government approved schemes or the employer and employees can together start a PF scheme by forming a Trust.

- The Trust so created shall invest funds in specified manner. The income of the trust shall also be exempt from income taxes.

- Un recognised PF (URPF) :

- These are the Schemes that are started by employer and employees in an establishment, but are not approved by the CIT

- Since they are not recognized, URPF schemes have a different tax treatment as compared to RPFs.

- Statutory PF (SPF) :

- This Fund is mainly meant for Government/University/Educational Institutes (affiliated to university) employees.

- Public PF (PPF) :

- This is a scheme under Public Provident Fund Act 1968

- In this scheme even self-employed persons can make a contribution

- The minimum contribution is Rs. 500 per annum and the maximum contribution is Rs. 150,000 per annum

- The contribution made along with interest earned is repayable after 15 years, unless extended.

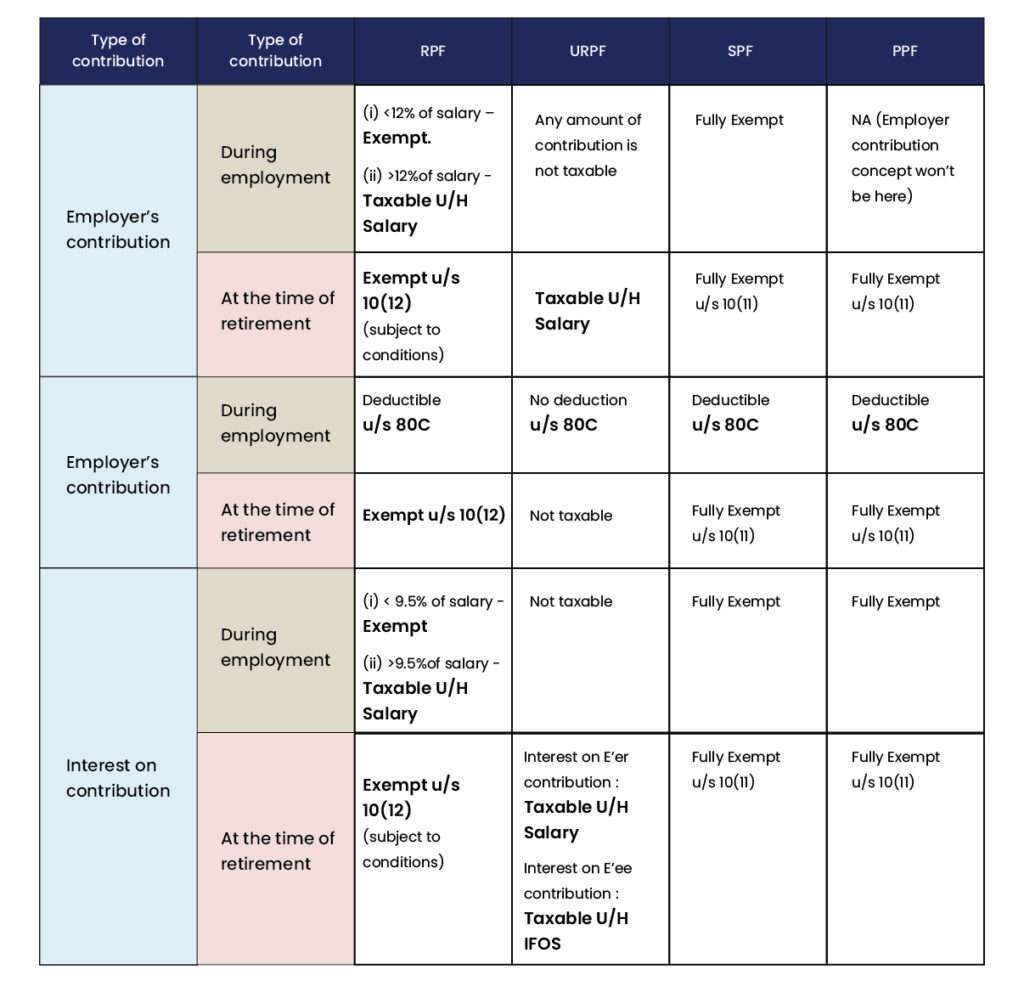

- Taxability of PF :

Tax treatment of Provident Fund can be discussed under two scenarios:

- During the Employment period :

- At the time of retirement

- During the Employment period :

- At the time of retirement :

- Recognised PF/Public PF/Statutory PF :

- The payments received by an assessee from PPF/SPF are fully exempt u/s 10(11)

- In case of RPF, Exemption will be provided u/s 10(12) to Employee subject to following conditions (see flow below)

- If RPF is taxable , then

- The amount not taxed earlier shall be taxed in the same manner as URPF, given below

- Any tax concession (e.g. 80C) availed by assesses for contribution to RPF shall now be withdrawn.

- If , after termination of his employment with one employer, the employee obtains employment under another employer, then

- the accumulated balance in his PF account which is transferred to his individual account in a RPF fund maintained by the new employer will be exempt

- In such a case, for exemption of payment of accumulated balance by the new employer , the period of service with the former employer shall also be taken into account for computing the period of 5 years of service.

- Un-recognised PF :

Amount received on the maturity of URPF

- Employee’s contribution is not taxable

- Interest on Employee contribution is Taxable under IFOS

- Employer’s Contribution is taxed as Salary

- Interest on Employer contribution is Taxable under Salary.

Summary of EPF taxability:

Tax implications on NPS :

- What is NPS?

- National pension scheme is a Scheme approved by the Government for Indian citizens (including NRI) aged 18-65 years.

- Unlike EPF (Employees Provident Fund), contributions towards NPS are not mandatory and are voluntary in nature

- Subscriber to NPS account contributes some amount in their account.

- If the subscriber is an employee, then Employer may also contribute to the employee’s account.

- Employer’s contribution would be taxed as Salary in the hands of the employee.

However, while computing total income of employees for relevant PY, a deduction will be allowed u/s 80CCD (2) in respect of employer contribution (see points below).

- Types of NPS

- (i) Tier 1 :

- This has a fixed lock-in period until the subscriber reaches the age of 60 years

- Only partial withdrawal is allowed, with certain conditions.

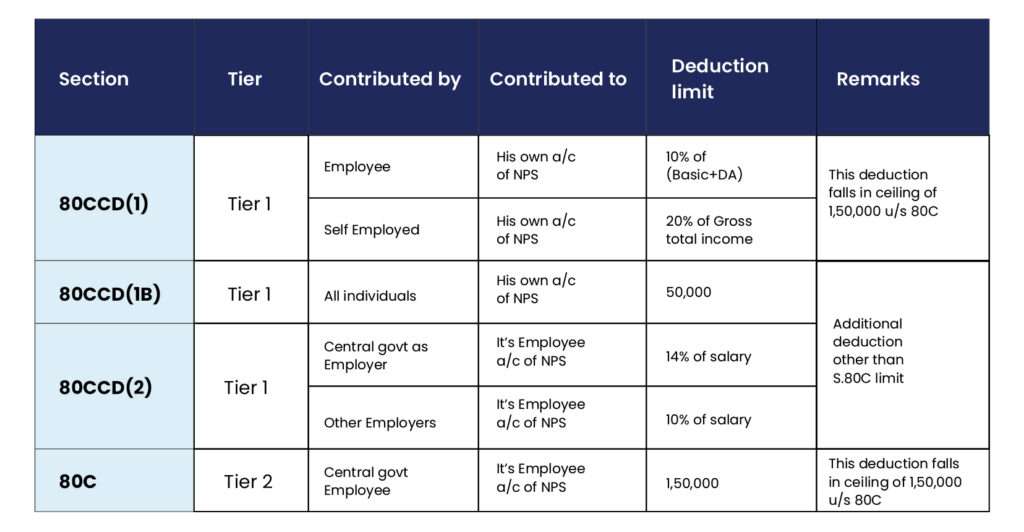

- Contributions made by subscriber towards Tier 1 are qualify for deductions under Section 80CCD(1) and Section 80CCD(1B)

- Deduction can be claimed upto 10% of salary for employees (or) 20% of GTI for non- employees under Sec 80CCD(1) and additional deduction of Rs. 50,000 under Section 80CCD(1B). This means subscriber can invest up to Rs. 2 lakh in an NPS Tier 1 account

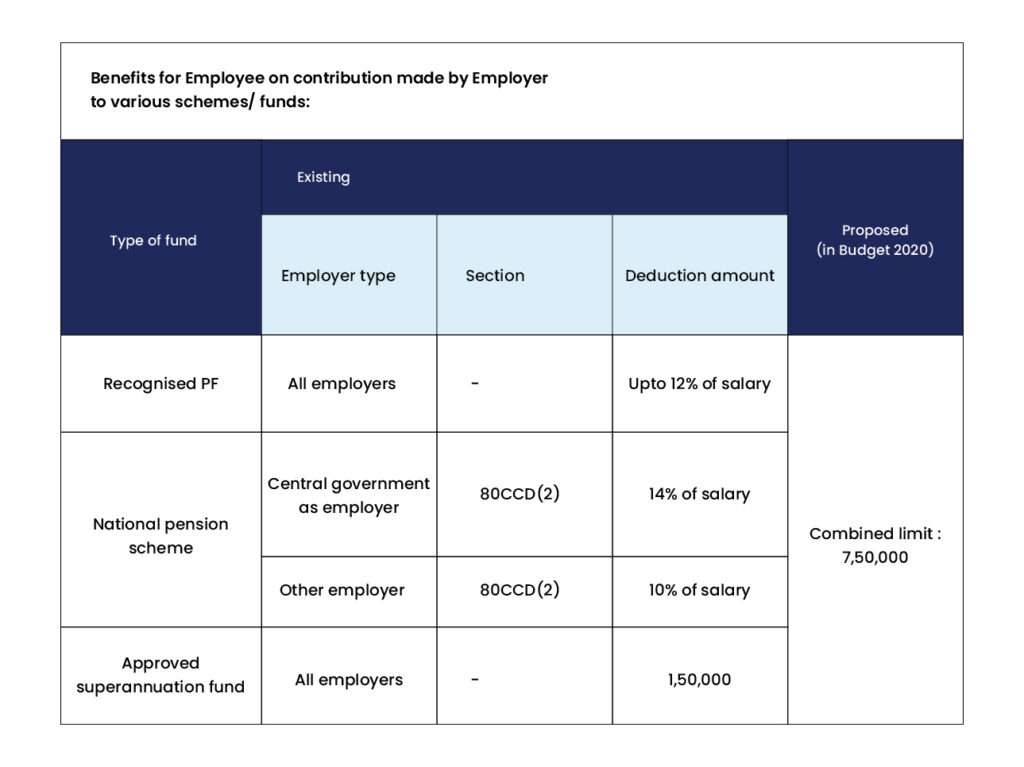

- Similarly, Contributions made by the Employer (in case if subscriber is employee) are eligible for deduction under Section 80CCD(2).

- 80CCD (1) : Falls in ceiling of 1,50,000/-.

80CCD (1B) : Additional deduction upto Rs.50000/- in excess of 1,50,000/-.

80CCD (2) : Additional deduction upto some % of Salary as discussed below in excess of 1,50,000/-

- Ceiling of deduction :

- (ii) Tier 2 :

- This is necessarily a voluntary savings account which allows the subscribers (both government & non-government employees also) to make withdrawals as and when they like.

- NRI cannot open Tier 2 accounts.

- To open a Tier 2 account, subscriber should possess a Tier 1 account first

- Transfer of funds can be done from Tier 2 to Tier 1 account

- Contribution made to a Tier 2 account is not eligible for tax deduction for subscribers other than government employees

- Government employees can get deduction upto 1.5 lakhs u/s 80C only if it has Lock in for 3years

Brief of Tier 1 and Tier 2 as follows :

Summary of ceiling of Tier 1 and Tier 2 as follows:

- Routes of withdrawal :

- Upon superannuation (after retirement)

- Upon Death of Subscriber

- Premature (before retirement)

- Tax implications at the time of lump sum withdrawal (after retirement) :

- Tier 1 :

- Funds from Tier 1 cannot be withdrawn until he achieves 60 years of age

- The amount accumulated in the pension account on which already deduction is claimed at the time of investment will be taxed as the income in the year in which such amounts are received by assessee or his nominee on

- Closure of the account or

- On opting out of the scheme or

- Receipt of pension from the annuity plan purchased or taken on such closure or opting out from the scheme

- Tax liability on closure or opting out of the scheme:

- So, by above provision we can understand that amount received from NPS is chargeable to tax on account of closure or opting out of pension scheme but subject to some conditions in various circumstances as follows :

- Circumstance 1 :

If the above amount received by the nominee on the death of subscriber is exempted

Note: If assessee purchased annuity out of such amount, it should be deemed as if nominee didn’t receive any amount in that year.

- Circumstance 2 :

In any other case, 60% of the amount received by assessee is tax free in the hands of the assessee.

But remaining 40% of amount should be compulsorily used to buy annuity

Note :

However in case if total accumulated pension is less than or equal to Rs. 2,00,000, Subscriber can opt for 100% lump sum withdrawal.

- Receipt of pension from the annuity plan purchased or taken on such closure or opting out from the scheme :

- Receipts from the annuity is Taxable at the time of receipt

- Tier 2 :

- Funds from Tier 2 can be withdrawn as and when required (unless government employee is claiming deduction u/s 80C which subject to lock in of 3 years)

- Since no deduction is claimed at the time of investment, liability to pay tax will not arise at the time of withdrawal.

- Tax implications at the time of partial withdrawal (before retirement) :

- NPS will not allow you to exit before your age of 60.

- However, in some special circumstances, you can withdraw 25% in total of your own contribution in NPS. This is called Partial withdrawal

- At the Partial withdrawal , assessee should comply with terms and conditions specified under Pension Fund regulatory and Development authority act, 2013.

- This you can do only after 3 years of investment and just 3 times in the entire tenure of NPS.

- The special circumstances are –

- Children’s wedding.

- Building/buying a residential house

- Critical illness of self/family

- Higher education of children.

- In this case, the amount received by assessee on partial withdrawal is Exempt u/s 10(12B)

- Tax implications at the time of Exit out of the scheme (before retirement) :

- After 3 years of NPS investment, if assessee don’t want to contribute anymore, then he can opt for a premature exit from NPS

- Then, Assessee will receive 20% of corpus as a lump sum

- Balance 80% will be mandatorily used for an annuity fund that would provide monthly pension.

Note :

If the total corpus < 1,00,000, Subscriber can opt for 100% lump sum withdrawal

- Assessee can choose pension payment mode like monthly, half-yearly or yearly.

- In this case, both the lump sum and pension received by the assessee will be Taxable as per income tax slab.

- Brief of NPS:

For details, please view https://npscra.nsdl.co.in/all-faq-withdrawal.php

Tax implications on Superannuation fund :

- What is superannuation fund ?

- It is an organizational pension program created by a company for the benefit of its employees

- It is a kind of retirement benefit that is offered by employer to employee

- Employer makes a contribution every year on employee behalf towards the group superannuation policy held by the employer

- It is called as company pension plan

- How does the superannuation fund work ?

- The employer contributes to a superannuation benefit on behalf of employees towards group superannuation policy held by him.

- Organisations either manage superannuation fund by their own trusts or open a superannuation benefit fund with any of the approved insurance companies or buy the product from insurance companies like LIC’s New Group Superannuation Cash Accumulation Plan or ICICI’s Endowment superannuation plans etc.

- The employer contributes a fixed percentage (up to a maximum of 15%) of employees’ basic pay + DA and the same percentage of contribution needs to be made for a particular category of employees.

- At the time of retirement, the employee can withdraw up to 1/3rd of the accumulated benefit and convert the balance into a regular pension, which is in turn kept in the annuity fund for receiving annuity returns at chosen intervals.

- In case the employee changes his job, he has an option to transfer the superannuation amount to a new employer.

- In case the new employer does not have a superannuation scheme, the employee may either choose to withdraw the amount or retain the amount in the fund till retirement or withdraw as discussed above.

- Types of Superannuation benefits :

- Defined Benefit plan

- Defined Contributions plan

- Defined Benefit plan:

- In this plan, the benefit derived is already fixed irrespective of contribution to the plan

- The predetermined benefit is based on various factors such as a number of years of service in the organisation, salary, age at which employee starts reaping the benefit

- Upon retirement, an eligible employee receives a fixed amount which is determined by the pre-existing formula, at regular intervals.

- Defined Contributions plan:

- This superannuation benefit is opposite to defined benefit plan

- Defined contribution plan has a fixed contribution and benefit is directly correlated with the contribution and market forces.

- This type of benefit is better to manage and the risk is with the employee as he does not know how much he will receive at retirement.

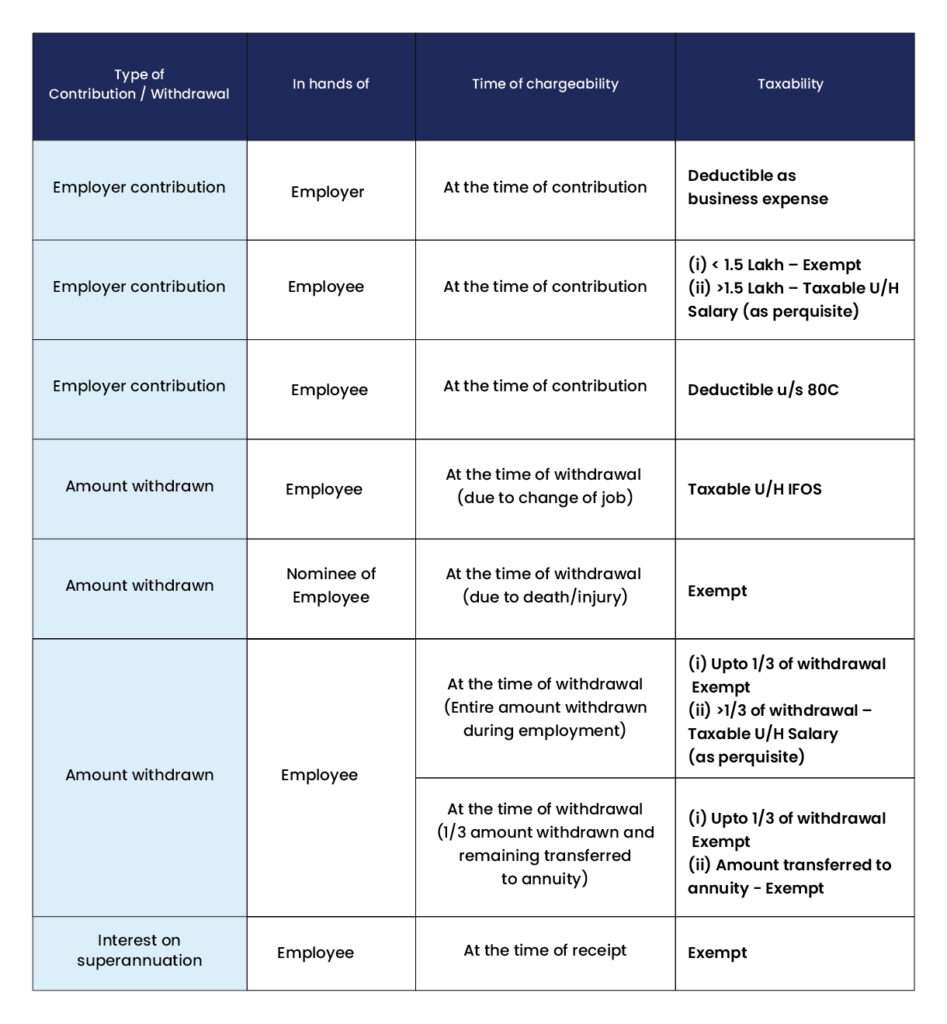

- Tax implications on Superannuation fund :

- Like any other retirement benefit, superannuation benefit also provides income tax benefits to both employer and employee.

- However, such benefits are restricted to an approved superannuation fund.

- This approval is required to be obtained from the CIT in accordance with the rules set out in Part B of the Fourth Schedule of the IT Act.

- Tax implications on Employer contribution :

- Contribution to approved superannuation fund (by income tax department) is deductible business expense and

- Any income received by self-managed trusts of an approved superannuation fund is also exempt.

- Tax implications on Employee contribution :

- Employee’s contribution to the approved superannuation fund is deductible under Section 80C subject to overall limit of Rs 150,000.

- Amount withdrawn if any by the employee at the time of change of job is taxable under the head “IFOS”

- Any benefit received from superannuation fund on death or injury are tax free

- Interest from a superannuation fund is tax free

- On retirement, 1/3 of the commuted fund is fully exempt from tax and the remaining amount if transferred to an annuity is tax-free and if the amount is withdrawn, it is taxable in the hands of the employee.

- Employer’s contribution of up to Rs 1.5 lakh in respect of an employee is exempt.

- However, if the contribution exceeds Rs 1.5 lakh, the amount in excess will be taxable in the hands of the employee as a perquisite.

Summary of Taxability of Superannuation fund:

Budget 2020 Proposals :

Expert verified

Expert verified