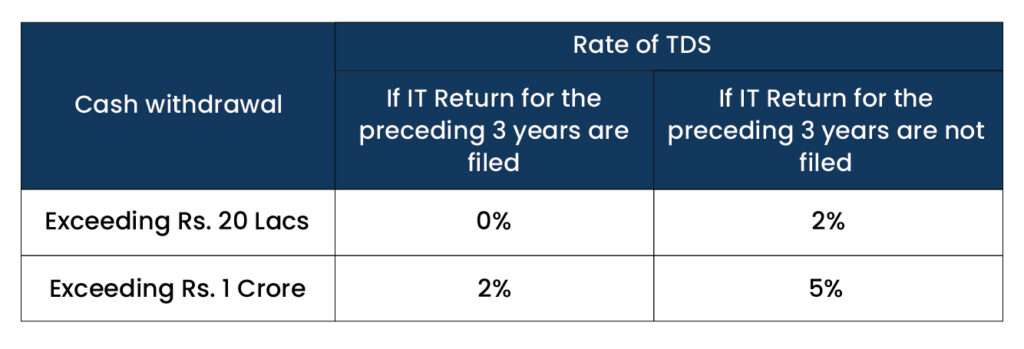

Before 01.07.2020

If any person withdraws cash more than Rs.1 Crore (Single or multiple transactions) from any bank during the Financial year, then TDS @ 2% will be deducted.

Eg- 1: Ashok wants to withdraw Rs.70 lacs from SBI A/c I and Rs.80 lacs from SBI A/c II. Now TDS @ 2% will be deducted on Rs.50 lacs (i.e., Rs.1.5 Crore – Rs.1 Crore).

After 01.07.2020

Any person wants to withdraw cash from any bank after 01.07.2020, then;

Eg-2: In the Eg-1, Let’s consider Ashok has filed preceding 3 years ITR’s. Hence, TDS @ 2% will be deducted on Rs.50 lacs (i.e., Rs.1.5 Crore – Rs.1 Crore).

Eg-3: In the Eg-1, Let’s consider Ashok has not filed preceding 3 years ITR’s. Hence, TDS @ 2% will be deducted on Rs.80 lacs (i.e., Rs.1 Crore – Rs.20 lacs) and TDS @ 5% will be deducted on Rs. 50 lacs (i.e., Rs.1.5 Crore – Rs.1 Crore).

Points to be considered:

- The 3 preceding years for this purpose shall be the 3 years in respect of which the due date for Filing ITR have expired.

Eg -4: As on 01-07-2020, the 3 years to be considered shall be AY 2019-20, 2018-19 & 2017-18. As the due date for filing return for the AY 2020-21 has not expired.

- The limit of Rs. 1cr is the overall limit for all accounts (like saving A/c, current A/c etc.) maintained by a person with one bank in all the branches. The limit is per bank rather than per account/person.

- Lower TDS certificate cannot be submitted.

- Withdrawals include ATM, Branch cash withdrawal, Bearer cheque withdrawal etc.

- Deducted TDS can be claimed as tax credit while filing ITR.

- If PAN is not available, then TDS will be deducted at the penal rate of 20%.

- The above provision is not applicable to Government, Banking companies, cooperative societies engaged in banking business, post office, White label ATM operator, licensed money changer, FEMA dealer, and Commission agent of agriculture produce market.

Motive behind the amendment

The amendment has enhanced the Rate of TDS for the persons who have not filed the IT Return for the preceding 3 Years. Hence, the motive of the Amendment is to encourage people to file their return of income and to discourage cash transactions in the country and promote the digital economy.