sec 135: Corporate Social Responsibility

- It implies a concept whereby companies decide to voluntarily contribute to a better society and a cleaner environment.

- It is a concept whereby the companies integrate social and other useful concerns in their business operations for the betterment of “its stakeholders and society in general in a voluntary way.

- Applicability of corporate social responsibility

- Applicability of corporate social responsibility.

- Every Company including its holding or subsidiary, and a foreign Company having

- Net worth of Rs. 500 crore or more, or

- Turnover of Rs. 1000 crore or more or

- A net profit of Rs. 5 crore or more during any financial year shall constitute a Corporate Social Responsibility Committee of the Board.

- Every Company including its holding or subsidiary, and a foreign Company having

What Is Net Worth And Net Profit For The Purpose Of Corporate Social Responsibility .

- Net worth” = Aggregate Value Of Paid Up Capital + Reserves Created Out Of Profits And Securities Premium Account – Aggregate Value Of Accumulated Losses –Deferred Expenditure – Miscellaneous Expenditure

- But does not include reserves created out of revaluation of assets, write-back of depreciation and amalgamation.

- “Net profit” shall not include

- Any profit arising from any overseas branches of the Company (whether operated as a separate Company or and

- Any dividend received from other companies in India (which are covered under and complying with the provisions of 135 of the Act).

Exclusion of Companies from Corporate Social Responsibility

- Every Company Which Ceases To Be A Company Covered Section 135(1) Of The Act For 3 Consecutive Financial Years

- Shall Not Be Required To Constitute A CSR Committee, And

- Is Not Required To Comply With The Provisions As Per Section 135

WHAT IS THE AMOUNT THAT SHOULD BE CONTRIBUTED TOWARDS CSR POLICY?

- How Much Amount Need To Be Contributed: – 2% Avg Net Profits Made During The Last 3 Immediately Preceding FY.

- Where The Amount Needs To Be Spent: Company Shall Give Preference To The Local Area Around It.

- What happen if the company fail to spend the amount : board shall specify the reasons for not spending the amount

WHAT HAPPEN IF THE COMPANY FAIL TO SPEND THE AMOUNT MENTIONED

- Not Relating To On-going Project:

- In case of failure to spend the same, will require carry forward of the same to a Fund specified in Schedule VII, within 6 months of close of the financial year, in addition to disclosure of reasons for not spending in Board Report.

- So amount remaining unspent (other than ongoing project) for the financial year 2020-21 shall be transferred to funds specified in schedule VlI.

- Relating To Ongoing Project :

- Amount needs to be transferred within a period of 30 days from the end of the financial year to a special account called Unspent Corporate Social Responsibility Account (UCSRA).

- So the amount remaining unspent (ongoing project) for the financial year 2020–‐21 shall be transferred to UCSRA latest by April 30, 2021.

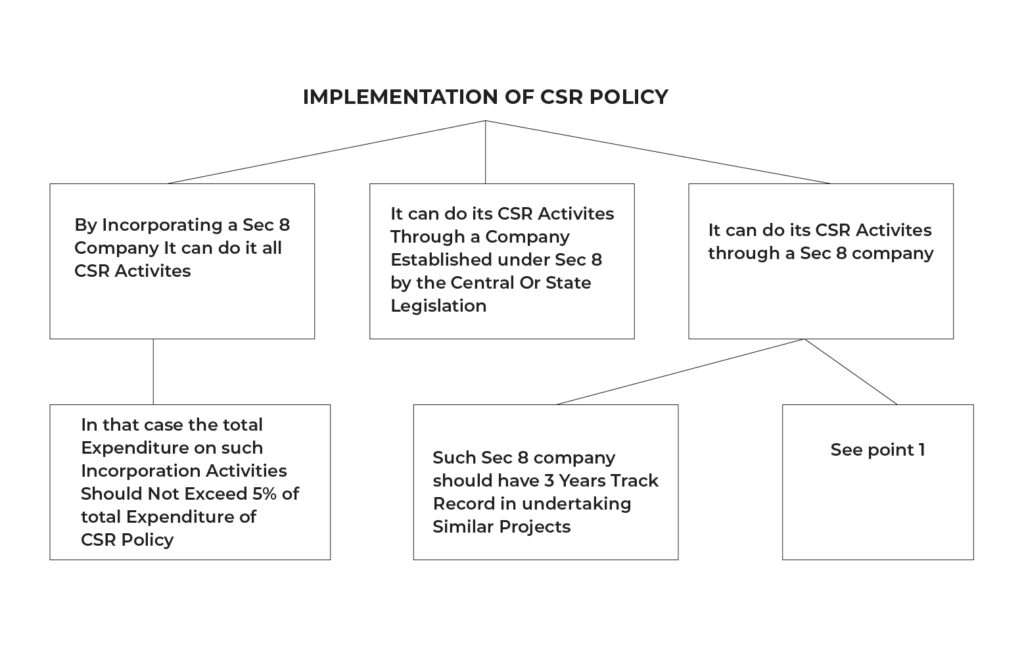

IMPLEMENTATION OF CSR POLICY

Point 1 . The Company Has Specified The Projects Or Programs To Be Undertaken,, The Modalities Of Utilization Of Funds Of Such Projects And Programs And The Monitoring And Reporting Mechanism”.

CSR COMMITTEE

- The CSR Committee Shall Be Consisting Of 3 Or More Directors, Out Of Which At Least One Director Shall Be An Independent Director.

- An Unlisted Public Company Or Private Company Which Is Not Required To Appoint An Independent Director Shall Have Its CSR Committee Without Such Director.

- A Private Company Having Only 2 Directors On Its Board Shall Constitute Its CSR Committee With 2 Such Directors.

- With Respect To A Foreign Company Covered As Above, The CSR Committee Shall Comprise Of At Least Two Persons Of Which:

- One Person Shall Be As Specified Under Section 380(1)(D) Of The Act And

- Another Person Shall Be Nominated By The Foreign Company.

- The Board’s Report Under Sub-Section (3) Of Section 134 Shall Disclose The Composition Of The CSR Committee.

- ACTIVITIES COMES UNDER CSR POLICY

Click The Below Link To Get The CSR Activities

- AN ACTIVITY NOT COMES UNDER CSR POLICY.

- Any Expenditure Incurred For The Benefit Of Employees.

- Any Contribution either Directly or Indirectly To A Political Party.

- Any Expenditure Incurred For Fulfillment Of Any Act Or Regulation.

- CSR Activities Should Be Undertaken By The Companies In Project Or Program Mode. One Off Event Such As Marathon Or Award Or Sponsorship Of TV Program, Etc., Would Not Be Qualified As CSR Expenditure.

- The Project or Programs or Activities Undertaken Outside India.

Reporting responsibilities IN CSR ACTIVITIES

- The Board’s Report Pertaining To Any FY Commencing On Or After 01/04/2014 Shall Include An Annual Report On The CSR Activities Of The Company

- In The Format Prescribed In The CSR Rules Setting Out:

- A Brief Outline Of The CSR Policy,

- The Composition Of The CSR Committee,

- The Average Net Profit For The Last Three Financial Years And

- The Prescribed CSR Expenditure.

- If The Company Has Been Unable To Spend The Minimum Required On Its CSR Initiatives, The Reasons For Not Doing So Are To Be Specified In The Board Report.

- In Case Of A Foreign Company, The Balance Sheet Filed U/S 381 Shall Contain An Annexure Regarding Report On CSR.

PENAL PROVISIONS

The Companies Act Requires That –

🡪 The Board’s Report Shall Disclose The Composition Of The Corporate Social Responsibility Committee.

🡪 If The Company Fails To Spend Such Amount (I.E. At Least 2% Of The Average Net Profit), The Board Shall Disclose And Specify The Reasons For Not Spending The Amount In Its Report.

| Who is liable | Punishment |

COMPANY | Penalty : Min – 50000 Max – 25 lakhs |

| Every officer of the Company who is in default | Imprisonment for a term which may extend to 3 years or Fine: Minimum Rs. 50,000; Maximum Rs 5 lakhs or Both. |

CSR IMPLICATIONS ON INCOME TAX

- If Any Assesse Has Any Legal Or Contractual Obligations To Incur Any Expenditure, Then Such Expenditure Will Taken As Expenditure Incurred Wholly And Exclusively For The Purpose Of Business. Therefore It Can Be Allowed As Deduction Under Sec 30 To 36 Of Income Tax Act 1961.

- If It Is Not Allowed Under Above Sections Then It Can Be Allowed Under Sec 37(1).

- Therefore Before Amendment Csr Expenditure Also Treated As Expenditure Incurred For The Business Purpose. Hence It Can Be Allowed As Deduction.

DISALLOWANCE OF CSR EXPENDITURE.

- Expenditure Incurred By An Assessee On The CSR Activities As Per Section 135 Of The Companies Act, 2013 Shall Not Be Deemed To Be An Expenditure Incurred By The Assessee For The Purposes Of The Business Or Profession.

- The Contention Behind Such A Disallowance For Deduction Of CSR Expenditure Was That Csr Expenditure Is An Application Of Income And Thus Is Not Incurred Wholly And Exclusively For The Purposes Of Carrying On The Business.

- The Government Wants Some Companies Who Cross The Limit Should Contribute A Certain Percentage For The Welfare Of The Society. It Try To Reduce Its Burden By Transferring To Prescribed Companies.

- So If Government Gives Allowence Of Expenditure Then There Is No Use Of Transferring Burden.

Whether any CSR expenditure is wholly and fully disallowed as a deduction under the Income Tax Act, 1961 ?

- The answer is no. because CSR expenditure incurred under sec 30 to 36 can be allowed as deduction provided assessee has to comply with the conditions prescribed

- If any CSR expenditure fails to satisfy any of the conditions for availing business deduction under sections 30 to 36, then such expenditure cannot be allowed under section 37 due to specific restrictions on the allowability of CSR expenditures.

- The scope of the restriction imposed in section 37 does not extend to Chapter VI-A of the Act which is independent of section 37.

- Hence, it can be safely concluded that CSR expenditure is eligible for deduction under section 80G of the Income Tax Act, 1961 even if the expenditure was disallowed under section 37(1) by virtue of Explanation 2.

Expert verified

Expert verified