If you’re planning to sell your business, knowing the top valuation techniques for business sale in India, should be the first step.

Learn with us the best business valuation methods in India, along with how to choose the best one and the mistakes to avoid.

What Is Business Valuation?

Business valuation is the formal process of determining the economic worth of a company. It involves not only checking revenue figures but also looking into profits, assets, size and market conditions.

Additionally, it considers intangible assets like brand reputation, customer loyalty, and future profit potential to determine a businesses’ true worth for the buyer and the seller.

Business valuation forms the basis of many key strategic decisions including raising capital, restructuring, planning an exit, or preparing for mergers and acquisitions.

Importance of Valuation for Business Sale in India

Determines a Fair and Defensible Asking Price

Ensures you price your business accurately, not too high to discourage buyers, and not too low to suffer losses. It reflects true market value, backed by financial and operational data.

Builds Negotiation Strength

Strengthens your position during negotiations. It gives you confidence and factual data to justify your price, minimizing the risk of being undercut.

Attracts Serious Investors and Buyers

Private equity firms, venture capitalists, and corporate acquirers typically require a valuation report before committing to a deal. A transparent valuation builds trust and streamlines their due diligence process.

Ensures Regulatory and Legal Compliance

In India, business sales, especially involving share transfers or foreign investors, must comply with regulations from:

- Companies Act, 2013

- Income Tax Act, 1961

- Securities and Exchange Board of India (SEBI)

- Reserve Bank of India (RBI)

Valuations by a Registered Valuer are mandatory in many such cases, including under IBC (Insolvency and Bankruptcy Code) scenarios.

Facilitates Internal Stakeholder Clarity

For family-owned or partnership businesses, an independent valuation ensures a fair division of assets and smooth resolution of any exit or succession-related conflicts.

Top 7 Valuation Techniques for Business Sale in India

When preparing business for sale in India, accurate valuation is essential. Here are the top 7 valuation techniques used in India:

1. Discounted Cash Flow (DCF) Method

This method values a business by estimating its future cash flows and then “discounting” them back to today’s value using a discount rate (usually Weighted Average Cost of Capital or WACC).

Best for:

- Stable, profitable businesses with predictable cash flows (e.g., FMCG, established manufacturing)

- Private equity firms and for M&A due to its focus on intrinsic value

| PROS | CONS |

|

|

Example:

A software firm in Bengaluru projects ₹10 crore in free cash flow for the next 5 years.

Assuming a WACC 12%, the DCF model calculates the present value of these future earnings, providing an intrinsic value for the business.

2. Comparable Company Analysis (CCA)

Also called “trading multiples,” CCA compares the company’s valuation with publicly listed peers in the same industry. It uses multiples like P/E, EV/EBITDA, or EV/Sales.

Best for:

- Businesses in industries with active public market comparables

- During pre-IPO valuations, equity fundraises

| PROS | CONS |

|

|

Example:

A mid-sized e-commerce startup in Noida has an EBITDA of ₹20 crore.

If listed peers have an average EV/EBITDA of 15x, the implied valuation could be ₹300 crore.

3. Precedent Transaction Analysis (PTA)

Also called Deal Multiples analysis, this business valuation technique looks at past M&A deals in India for similar companies, and applies the multiples from those deals.

Best for:

- M&A scenarios or strategic exits

- Where comparable deal data is available

| PROS | CONS |

|

|

Example:

In 2018, Walmart acquired Flipkart at a valuation of $21 billion, setting a benchmark for Indian e-commerce deals.

A smaller e-commerce startup could use similar transaction multiples as a reference for valuation.

4. Asset-Based Valuation

This method values a company based on the fair market value of its net assets (Assets − Liabilities).

Best for:

- Asset-heavy industries like manufacturing, real estate, and logistics firms

- For liquidation or financial restructuring

| PROS | CONS |

|

|

Example:

A textile company in Surat owns land worth ₹500 Cr. Its machinery is worth ₹50 Cr, while the liabilities are ₹100 Cr.

Net Asset Value (NAV) = (₹500 Cr + ₹50 Cr) – ₹100 Cr = ₹450 Crore.

This is a starting point for its valuation.

5. Revenue Multiple Method

Its simplified valuation method that multiplies annual revenue by an industry-relevant multiple. Common in high-growth or early-stage businesses.

Best for:

- SaaS, fintech, e-commerce, or D2C startups

- When profits are low or negative

| PROS | CONS |

|

|

Example:

A D2C skincare brand with ₹30 crore in revenue. If similar brands are valued at 6x revenue, the business could be worth ₹180 crore.

Sector-Specific Multiples often used in India:

- SaaS: 8–12x

- Fintech: 5–10x

- Consumer Tech: 4–8x

- Manufacturing: 0.5–2x

6. Earnings Multiple Method

This method applies a multiple (like P/E or EV/EBITDA) to the company’s normalized earnings to arrive at a valuation..

Best for:

- Mature and profitable SMEs and mid-market companies

- For companies with stable and growing profits

| PROS | CONS |

|

|

Example:

A manufacturing company in Pune with normalized EBITDA of ₹15 crore. If similar firms trade at 10x, the valuation is ₹150 crore.

India-Specific EBITDA Multiples:

- FMCG: 15–25x

- Pharma: 12–20x

- IT Services: 10–18x

- Traditional Manufacturing: 6–12x

7. Sum-of-the-Parts (SOTP) Valuation

Ideal for diversified companies, this method values each business unit independently and then sums the values to arrive at the total enterprise value.

Best for:

- Conglomerates where divisions operate in different sectors with varied risk profiles

| PROS | CONS |

|

|

Example:

A conglomerate owns:

- Retail arm: ₹5,000 crore (CCA)

- Real estate: ₹1,500 crore (NAV)

- Logistics: ₹1,200 crore (EBITDA multiple)

- Investments: ₹800 crore

Total SOTP valuation: ₹8,500 crore (less net debt = equity value)

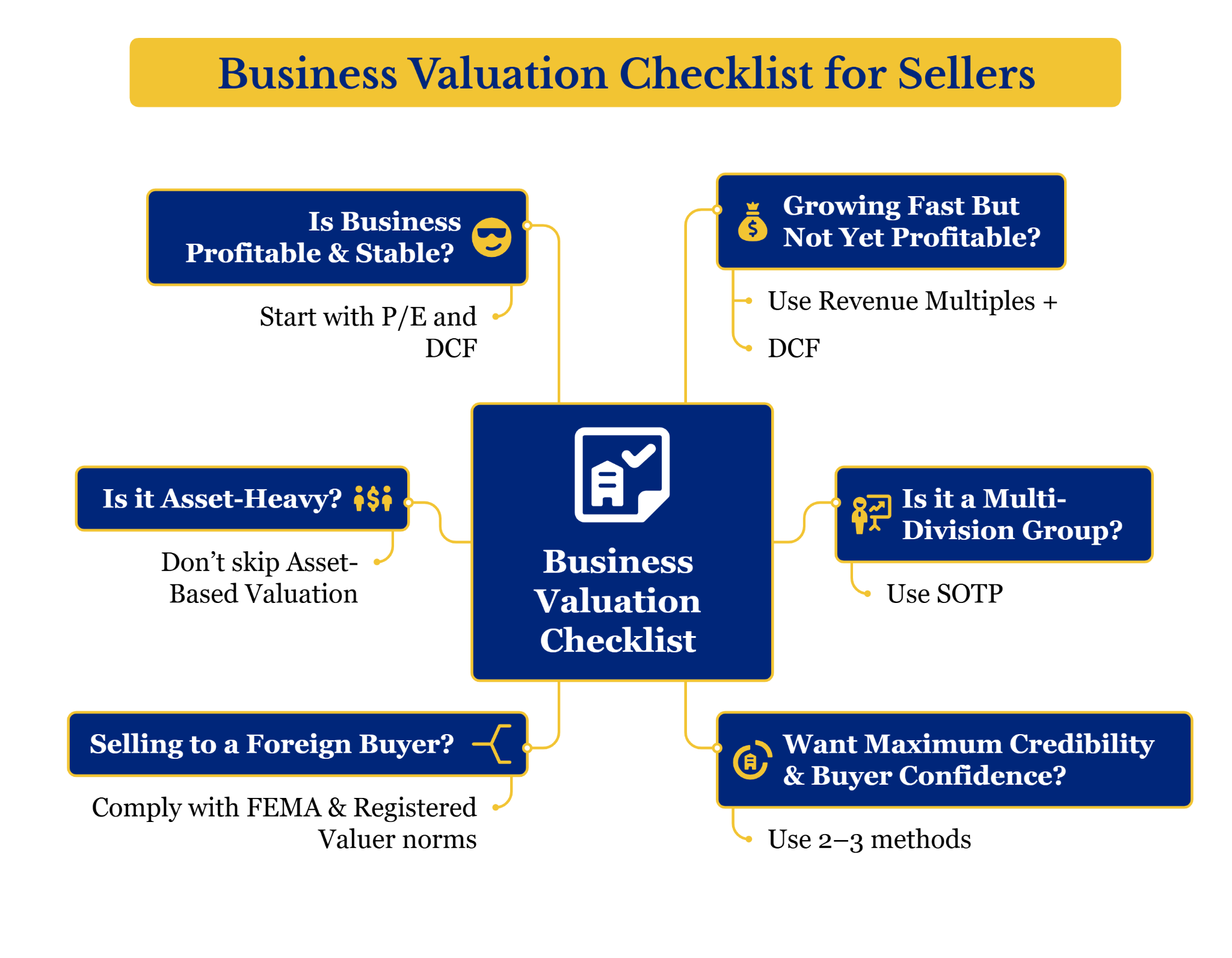

How to Choose the Right Valuation Technique for Selling Your Indian Business?

Choosing the right technique for business valuation in India is tricky given the industry diversity, buyer profiles, and regulatory frameworks.

Here’s a simple framework to help you pick the right method:

1. Assess Business Type and Industry Standards:

The nature of your business and your industry plays a foundational role in selecting the right valuation method.

| Business & Industry Type | Best Valuation Method(s) |

| Profitable SMEs (Manufacturing, IT, FMCG) | P/E Ratio, DCF |

| Tech Startups / High Growth (SaaS, D2C, Fintech) | Revenue Multiple, DCF, Precedent Transactions |

| Asset-Heavy Businesses (Textiles, Hotels, Logistics) | Asset-Based, P/E Ratio |

| Diversified Groups / Conglomerates | Sum-of-the-Parts (SOTP) |

| Distress Sale / Liquidation | Liquidation Value, Asset-Based |

| Niche IP / Service Businesses | DCF, Precedent Transactions |

2. Evaluate Financial Profile:

Analyze your historical and projected financials to choose a method that reflects your company’s value accurately.

- Stable Profits & Cash Flow: Use Earnings Multiples (P/E, EV/EBITDA) or DCF for long-term value based on profitability.

- Early-Stage or Loss-Making: Use Revenue Multiples or Comparable Company Analysis, as earnings-based models aren’t applicable.

- Volatile Earnings: Use DCF with cautious assumptions or Precedent Transactions to reflect real-world deals.

If your projections are speculative or uncertain, avoid relying solely on DCF.

3. Consider Deal Context and Sale Purpose:

Your reason for selling and the kind of buyer involved will also determine the valuation method:

- M&A sale to a competitor or acquirer: Use Precedent Transactions or SOTP (if multiple divisions)

- Financial Buyer (VC/PE): Focus on Return on Investment (ROI) via Revenue or Earnings Multiples, and validate with DCF.

- Distress or Exit/Liquidation: Rely on Asset-Based Valuation or Liquidation Value for a realistic sale price.

- Small businesses with unique strengths: Revenue and earnings multiples

- Compliance-driven Sale (e.g., to foreign buyer): Must follow FEMA, Income Tax, and Companies Act guidelines which usually requires DCF or NAV by a Registered Valuer.

4. Analyze Asset Mix:

If your business has significant tangible assets (plant, property, equipment) asset-based or book value approaches can set a value floor.

For service-led businesses or startups with High intangible assets (IP, software, user base, goodwill), focus on cash flow or market approaches.

5. Review Market and Economic Trends:

Valuations fluctuate with broader market conditions:

- Bullish Market / Booming Sector: Higher multiples (e.g., P/E of 12–15x in IT, vs. 6–8x in manufacturing)

- Bear Market / Recession / Low Sentiment: Conservative methods prevail, like NAV or Book Value.

Always benchmark your valuation against recent transactions and listed comparables in India.

6. Use a Blended Approach

The most accurate valuations come from using multiple business valuation methods. This protects against biased projections, buyer pushback, or missed value from goodwill, IP, or synergy potential.

Suggested Framework:

- Start with an Earnings or Revenue Multiple: Apply industry-standard P/E or EV/EBITDA ratios

- Cross-check with DCF: Validate long-term potential using projected cash flows

- Set a Value Floor with Asset-Based Valuation: Establish the minimum defensible value

- Benchmark with Comparable Deals: Ensure pricing is in line with market activity

7. Professional Guidance and Due Diligence:

Indian laws and buyer expectations make professional input essential.

Engage experienced valuers, chartered accountants, or financial advisors from trusted firms like PKC Management Consulting.

Their technical skills and sector experience can help implement best valuation models, ensure regulatory compliance, and prepare for buyer due diligence.

Valuation for Startups vs Traditional Businesses in India

Business valuation varies significantly between startups and traditional businesses owing to differences in maturity, revenue models, asset base, and risk.

Startups

Typically early-stage and pre-profit, startups are valued on future potential. Common business valuation techniques for selling include:

- Venture Capital Method: Based on projected exit value and investor ROI

- Revenue Multiple: Valuation = Revenue × Sector multiple (e.g., SaaS, e-commerce)

- Discounted Cash Flow (DCF): Used for late-stage startups with predictable cash flows

- Berkus Method / Scorecard Method: Early-stage valuation based on qualitative factors (idea, team, product readiness, etc.)

- Comparable Company Analysis (CCA): Benchmarking against recent deals in the same domain

Key metrics used for evaluation include Monthly Active Users (MAUs), Customer Acquisition Cost (CAC), Lifetime Value (LTV), Gross Margin and Market Size (TAM/SAM/SOM)

Traditional Businesses

Established and profit-generating, these are valued on historical performance and tangible assets using:

- Earnings Multiple (P/E or EV/EBITDA): Based on sustainable profits

- Asset-Based Valuation: Especially for manufacturing, real estate, etc.

- Discounted Cash Flow (DCF): Reliable for businesses with stable cash flows

- Comparable Company / Transaction Analysis: Uses industry-specific benchmarks

Key Differences in Startup vs Traditional Business Valuation

| Feature | Startups | Traditional Businesses |

| Core Focus | Future growth & scalability | Stability & past performance |

| Valuation Basis | Projections, market potential | Earnings, assets |

| Common Methods | VC, DCF, Revenue Multiples | P/E, EV/EBITDA, Asset-based |

| Financial History | Limited | Audited and stable |

| Investor Type | VCs, Angels | Strategic buyers, family offices |

| Risk Profile | High | Moderate to low |

| Regulatory Concerns | Angel Tax, FEMA norms | Companies Act, Stamp Duty |

Why Choose PKC As Your Business Valuation Experts in India?

✅ 37 years proven track record in financial advisory

✅ 200+ expert professionals including certified chartered accountants

✅ 48-hour rapid query resolution for time-sensitive valuations

✅ Expert board includes certified valuers and CFOs

✅ Technology-enabled valuation processes ensuring future-ready accuracy

✅ Comprehensive valuation for M&A, funding, and compliance

✅ Deep expertise across startups to large corporations

✅ End-to-end support from valuation to implementation strategy

Regulatory Framework That Affects Valuation in India

Business valuation is governed by several laws across fundraising, M&A, share transfers, insolvency, and regulatory filings.

1. Companies Act, 2013 (Section 247)

Valuation is mandatory for mergers, private placements, buybacks, ESOPs, asset transfers, and non-cash director transactions.

Only a Registered Valuer (RV) registered with IBBI can perform valuation/

2. SEBI Regulations (Listed Companies)

Valuation needed for IPOs, share allotments, open offers, delisting, and buybacks.

Valuation is done by SEBI-registered Merchant Bankers using methods like DCF, Comparable Analysis, and Asset-based valuation.

3. FEMA & RBI Guidelines

Applicable for FDI, share transfers with non-residents, and cross-border M&As.

Valuation report can be issued by SEBI-registered Merchant Banker or experienced CAs with valuation experience.

4. Income Tax Act, 1961

Valuation is required for triggers including share issuance at premiums, gift or unlisted share transfers, related-party transactions, and ESOPs.

Rules define how to compute Fair Market Value (FMV) for unlisted equity and preference shares

Accepted valuation methods include Net Asset Value (NAV) Method and Discounted Cash Flow (DCF) Method

5. Insolvency and Bankruptcy Code (IBC), 2016

Valuation is required in corporate insolvency resolution process (CIRP) and liquidation process

Two registered valuers (RVs) must be appointed by the Insolvency Professional (IP) for valuation

Valuation types required include Fair Value and Liquidation Value.

6. Indian Accounting Standards (Ind AS)

Relevant for fair value measurement, impairments, M&A, and ESOPs.

7. Stamp Duty Acts

Valuation impacts duty during restructurings like mergers.

Factors That Influence Business Valuation in India

- Financial Performance: Consistent revenue growth, strong EBITDA and net margins, healthy cash flows, and low debt levels enhance valuation by indicating stability and efficiency.

- Business Assets: Both tangible (land, buildings, machinery, inventory) and intangible assets (brand, IP, software, goodwill) add value.

- Market & Industry Dynamics: Companies in high-growth sectors (SaaS, fintech, renewables) with strong market positioning, a unique offering, and a diversified customer base attract premium valuations.

- Operational Maturity: Scalable systems, documented processes, capable leadership teams, and low reliance on a few customers or suppliers indicate resilience and readiness for growth.

- Legal & Regulatory Compliance: Full adherence to Indian laws (Companies Act, FEMA, GST) and minimal pending litigations reduce legal and financial risks.

- Macroeconomic & Policy Factors: Interest rates, inflation, FDI openness, regulatory clarity, and government incentives (e.g., PLI schemes) significantly impact investor sentiment and valuation.

- Nature of Sale: Buyers pay more when a sale is part of a strategic plan for growth, but pay less when the sale is due to financial trouble or liquidation

Common Mistakes & Practice in Applying Business Valuation Techniques for Sale

1. Overestimating Growth Potential

Business owners, especially startups, often use overly optimistic projections (e.g., 100% YoY growth) to inflate valuation, usually in DCF models.

🗸 Best Practice: Use conservative, data-backed forecasts. Benchmark projections against industry averages, past performance, and comparable Indian companies. Investors value realism over hype.

2. Ignoring Market Conditions

Valuing a business in isolation without considering macroeconomic factors, market cycles, or sector trends.

🗸 Best Practice: Adjust valuation for real-time market dynamics including inflation, liquidity, funding sentiment, and recent M&A/IPO activity in India. Stay contextually relevant.

3. Using a Single Valuation Method

Relying solely on one method (like revenue multiple or book value) without cross-verification.

🗸 Best Practice: Apply a triangulation approach, typically DCF + Comparable Company + Asset-based, to establish a credible and defensible value range.

4. Failing to Normalize Financials

Valuation based on raw profit without adjusting for personal expenses, one-offs, or related-party transactions.

🗸 Best Practice: Normalize financials to reflect Maintainable Profit. Add back non-operating and discretionary expenses to present the business’s true earning power.

5. Using Irrelevant Comparable Data

Using US or global peers for benchmarking, or comparing a private firm to a large listed company.

🗸 Best Practice: Use India-specific comparables, same size, sector, and maturity level. Apply appropriate discounts for illiquidity and control premiums if needed.

6. Ignoring Purpose-Based Valuation Differences

Using the same valuation logic for different use-cases, e.g., selling the business vs issuing new shares vs bank loans.

🗸 Best Practice: Tailor the valuation method to the purpose, strategic sale, legal compliance, buyout, or fundraising, each requires different considerations and methods.

7. DIY Valuation Without Expertise

Relying on internal accountants or Excel templates to value the business without understanding valuation theory.

🗸 Best Practice: Hire professionals like IBBI Registered Valuers, CAs, or M&A advisors with experience in business sales. A well-done valuation boosts credibility and smoothens deal closure.

Frequently Asked Questions

The five most common business valuation methods are Discounted Cash Flow (DCF), Comparable Company Analysis, Precedent Transactions, Asset-Based Valuation, and Earnings/Revenue Multiples. Each method suits different industries and stages of business.

The best method depends on the type of business, but Earnings Multiples and DCF are most widely used in India. Many experts use a mix of methods to ensure fairness.

The fastest way is to apply a revenue multiple or earnings multiple based on industry benchmarks. While quick, this method is less detailed than a full DCF or professional valuation.

Multiply the company’s annual revenue by the industry-standard revenue multiple (e.g., 3x, 5x, or 10x). For example, a SaaS firm with ₹10 crore revenue at 6x multiple would be valued at ₹60 crore.

Valuation ensures both buyers and sellers agree on a fair price. It also helps with legal compliance, taxation, and investor negotiations.

Expert verified

Expert verified