If you’re selling or buying a business, understanding slump sale tax treatment in India is crucial.

This guide breaks it down with an example, so you know exactly what to expect when transferring a business as a lump sum deal.

What is a Slump Sale?

A Slump Sale refers to the transfer of an entire business undertaking “as a whole” for a lump sum payment, without assigning individual values to its assets and liabilities.

Key Features:

“As a Whole” Transfer

The entire business unit (e.g., a division, plant, or product line) is sold in one go. Buyers acquire all assets including land, machinery, inventory, IP and liabilities – debts, obligations – tied to that unit.

No Asset-Wise Valuation

Unlike an “asset sale,” individual assets/liabilities are not separately valued or priced. The buyer pays a single lump sum for the entire business unit.

Legal Compliance

Requires adherence to:

- Income Tax Act (Section 50B).

- Companies Act, 2013 (shareholder approval, creditor notices).

- GST implications (transfer as a “going concern” may be exempt).

Tax Treatment of Slump Sale in India:

The tax treatment of a Slump Sale in India is governed by Section 50B of the Income Tax Act, 1961.

Here are the tax implications of a slump sale for the seller:

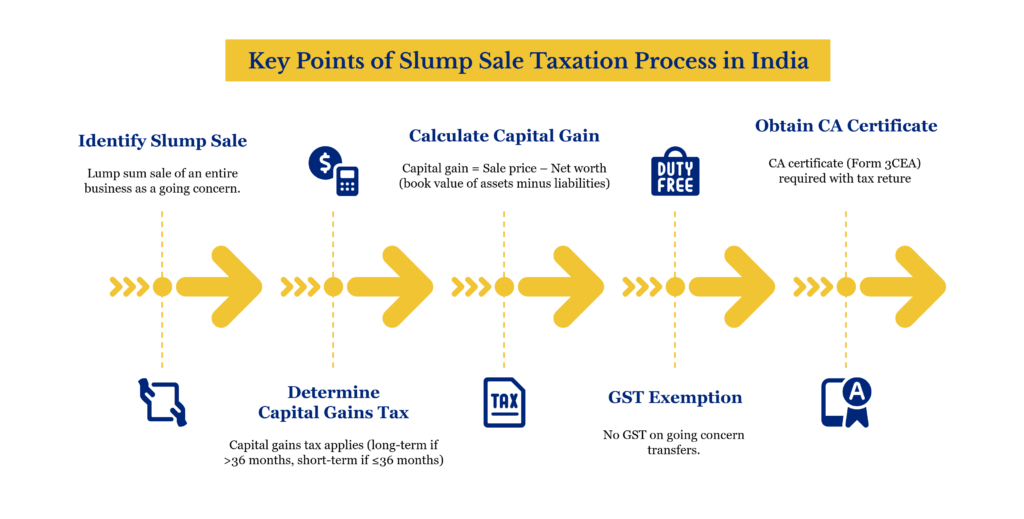

Capital Gains in Slump Sale Transactions

Profits from a slump sale are treated as capital gains (not business income), regardless of the nature of the seller’s business.

Holding Period Determines LTCG/STCG

The entire transaction is treated as a transfer of a capital asset, and the gain or loss is taxed as either short-term or long-term capital gain depending on the period of holding of the undertaking

- Long-Term Capital Gains (LTCG): If the undertaking was held for more than 36 months before the sale, the gain is long-term and taxed at 12.5% (with no indexation benefit).

- Short-Term Capital Gains (STCG): If held for 36 months or less, the gain is short-term and taxed as per the seller’s applicable income tax slab rates

Calculation of Capital Gains

- Capital Gains = Full value of consideration (FVC) – Net worth of the undertaking – Transfer expenses

- Net Worth = Book Value of All Assets (including intangibles like goodwill) − Total Liabilities (as per the books of accounts).

- Full Value of Consideration (FVC): As per the Finance Act 2021, FVC is considered to be the higher of the actual sale price or the fair market value (FMV) determined under Rule 11UAE of the Income-tax Rules.

Essential Tax Components

- Cost of Acquisition = Net Worth: The purchase price paid by the buyer is irrelevant. Tax is computed based on the book value of assets minus liabilities of the undertaking.

- No Separate Asset Valuation: Individual assets (e.g., machinery, land) are not revalued for tax purposes. Only aggregate book values matter.

- Depreciation Recapture: Unlike asset sales, no separate depreciation recapture (Section 50) applies. All gains are covered under Section 50B.

- Goodwill & Intangibles: Self-generated goodwill and intangibles form part of the undertaking’s assets. Their book value is included in net worth.

Tax Calculation Example

XYZ Ltd. sells its garment division (held for 5 years) to MNC Ltd. for ₹100 Crore.

Net Worth of the division (per books):

Assets = ₹70 Crore, Liabilities = ₹20 Crore → Net Worth = ₹50 Crore.

Capital Gains = ₹100 Crore − ₹50 Crore = ₹50 Crore (all LTCG).

Tax Payable = 12.5% of ₹50 Crore (after indexation) ≈ ₹6.25 Crore (before surcharge/cess).

GST Implications

Slump sale is treated as a supply under GST. However, if the transfer is a going concern, it is exempt from GST. i.e. No tax on the lump sum consideration

If only specific assets are transferred (not as a going concern), GST may apply on those assets.

Conditions for Exemption:

- Buyer must continue the business (not liquidate assets).

- All assets/liabilities necessary for operations must be transferred.

- Employees should generally be retained.

Input Tax Credit (ITC) Reversal:

Seller must reverse ITC on:

- Stock transfers (e.g., raw materials, capital goods).

- Services attributable to the undertaking.

TDS and Other Provisions

No tax is required to be deducted at source (TDS) under Section 194-IA for slump sale transactions.

Section 56(2)(x), which deals with tax on inadequate consideration for immovable property, does not apply to slump sales.

Slump Sale Tax Implications for the Buyer

For the buyer in a slump sale, the tax implications are as follows:

No Capital Gains Tax for Buyer:

The buyer doesn’t have to pay capital gains tax, it’s the seller’s responsibility under Section 50B.

Section 56(2)(x) Not Applicable:

If the buyer pays less than fair market value for the business, there’s no tax under Section 56(2)(x), since it’s a sale of a whole business, not individual assets.

Accounting Treatment:

The buyer must record assets and liabilities at values certified by a registered valuer.

- If the purchase price is higher than the net asset value → record the excess as goodwill.

- If lower → record the difference as capital reserve.

Depreciation:

The buyer can claim depreciation on acquired depreciable assets, based on their allocated values, as per Income Tax rules.

No TDS Deduction Required:

The buyer doesn’t need to deduct tax at source (TDS) under Section 194-IA or any other section for the slump sale payment.

GST Treatment:

If the business is transferred as a going concern, it’s exempt from GST.

The buyer should ensure GST compliance, including transfer of unutilized input tax credit (ITC) using Form GST ITC-02, if needed.

How Can PKC Help With Slump Sale Taxation?

✅37 years proven track record in complex taxation matters

✅Expert Section 50B computation for accurate capital gains

✅Certified CA reports for mandatory net worth certifications

✅Tax-savvy restructuring plans to minimize slump sale liabilities

✅Written-down value precision for depreciable asset calculations

✅Appeal & scrutiny support for slump sale tax disputes

✅Same-day CA certification for urgent slump sale transactions

✅Digital transformation tools streamlining slump sale documentation processes

✅End-to-end M&A support from valuation to tax filing

Compliance & Reporting Requirements of Slump Sale Taxation

While filing for returns, you have to follow specific compliance and reporting rules after a slump sale:

Form 3CEA: Key Compliance for Slump Sale Taxation

Form 3CEA is a Chartered Accountant-certified report required under Section 50B of the Income-tax Act. It confirms:

- Net worth of the undertaking being sold

- Capital gains are computed as per slump sale provisions

- Transaction qualifies as a slump sale

When to File?

- Report must be filed at least one month before the due date for filing the IT returns

- Must be attached with your ITR (typically ITR-6 for companies)

Non-filing may result in scrutiny, penalties, or denial of slump sale treatment.

Documents Required for Form 3CEA

Before the CA can issue the certificate, you’ll need to provide:

- Audited balance sheet of the undertaking

- Profit & Loss account statements

- Slump sale agreement

- Details of assets and liabilities transferred

- Proof of sale consideration received

Other Compliance Requirements

- If treated as ‘Going Concern’ there is no GST charge. File Form GST ITC-02. It should be filed “as soon as possible” after the transfer, and the transferee must accept it on the GST portal

- Obtain board and shareholder approvals as required under Section 180 of the Companies Act, 2013, if the sale involves “the whole or substantially the whole of the undertaking”

- Maintain detailed documentation of the slump sale, including the sale agreement, valuation reports, and a Deed of Conveyance.

Frequently Asked Questions

Yes, a slump sale is taxable in India under Section 50B of the Income Tax Act, 1961. The seller must pay capital gains tax based on the difference between the sale consideration and the net worth of the business undertaking transferred.

Capital gain is calculated by subtracting the net worth of the undertaking from the sale consideration. This is done as per Section 50B of the Income Tax Act.

No, indexation is not allowed. Section 50B clearly states that the net worth is deemed to be the cost of acquisition, so indexation is not applicable.

No, GST is not applicable if the slump sale qualifies as a “transfer of a going concern.”

Yes, sellers must file Form 3CEA certified by a Chartered Accountant. It confirms that the capital gains are calculated correctly under Section 50B.

No, Section 194Q (which requires the buyer to deduct TDS on the purchase of goods above ₹50 lakhs) is not applicable to slump sale transactions. This is because a slump sale is not treated as a purchase of goods, but rather as the transfer of a business as a going concern.

The seller must comply with Section 50B by:

- Filing Form 3CEA, certified by a Chartered Accountant

- Maintaining documentation for net worth calculation

- Reporting the capital gains correctly in the Income Tax Return (ITR)

- Ensuring the slump sale agreement specifies the transfer is on a going concern

Expert verified

Expert verified