Secretarial audit vs statutory audit, while both are mandatory under certain conditions, their purpose, scope, and governing laws are not the same.

Understand here the difference between secretarial audit and statutory audit in India so you know exactly which applies to your business.

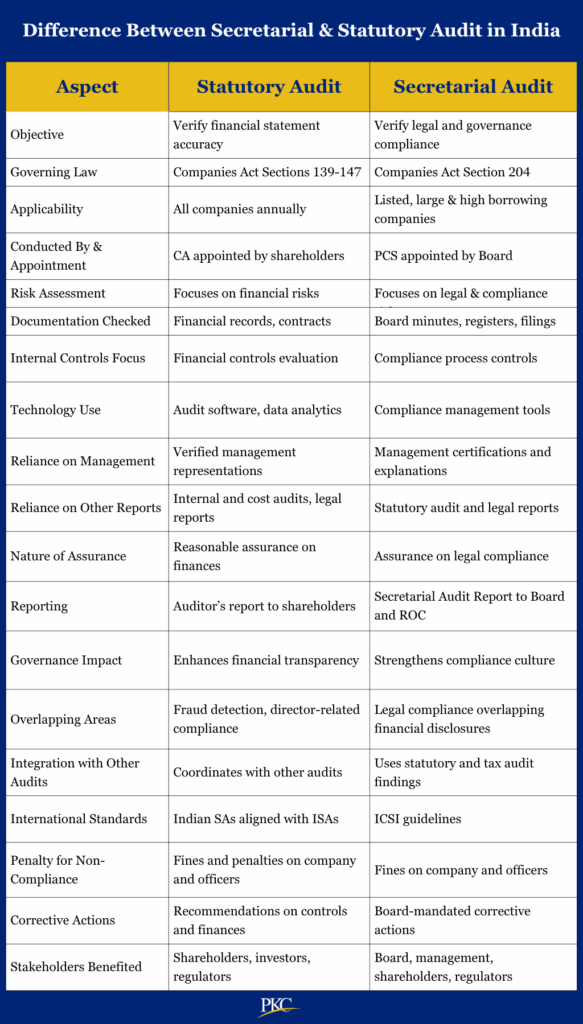

Difference Between Secretarial and Statutory Audit in India

Let’s understand how the two audits differ based on the metrics below:

Objective

Secretarial Audit focuses on evaluating whether a company is complying with all applicable corporate laws, regulations, and internal governance standards.

It verifies statutory filings, board processes, maintenance of registers, and other legal frameworks.

Example: If your company missed filing the MGT-7 Annual Return or held board meetings without proper documentation, it would be flagged during a secretarial audit.

Statutory Audit, on the other hand, aims at examining the financial statements to determine if they present a true and fair view of the company’s financial position.

It detects errors, fraud, and irregularities in financial reporting.

Example: Overstated revenues, misclassified expenses, or undeclared liabilities would be caught in a statutory audit.

Governing Law

Secretarial Audit is governed by

- Section 204(2) of the Companies Act, 2013

- Rule 9 of Companies Rules, 2014

- Secretarial Standards (SS-1 and SS-2) issued by ICSI

- SEBI (Listing Obligations and Disclosure Requirements), 2015 for listed companies

Statutory Audit is governed by:

- Sections 139 to 147 of the Companies Act, 2013

- Income Tax Act, 1961 (for tax audits)

- Accounting Standards (Ind AS/AS) and Standards on Auditing (SA) by ICAI

Applicability

Secretarial Audit is more selective in applicability, focusing on corporate governance risks. It is mandatory for:

- All listed companies

- Public companies with Paid-up capital ≥ ₹50 crore, or Turnover ≥ ₹250 crore

- Private companies with borrowings ≥ ₹100 crore from banks or financial institutions

Statutory Audit has broader financial oversight and is compulsory for almost all operational businesses. It is a legal requirement for:

- All companies, whether private, public, or listed

- Also applicable to LLPs if turnover > ₹40 lakh or contribution> ₹25 lakh

- Some small and One Person Companies (OPCs) may have exemptions, but still must comply with tax audit requirements under certain conditions

Primary Responsibility

Secretarial Audit ensures the Board of Directors and Company Secretary are adhering to laws and governance norms.

The responsibility for maintaining legal records and compliance documentation lies with the company’s internal management.

Statutory Audit makes sure that the Board and Financial Management maintain correct books.

The auditor expresses an independent opinion on financial statements but the accuracy of those statements is the responsibility of the company’s management.

Conducted By & Appointment Process

Secretarial Audit is conducted by a Practicing Company Secretary (PCS) registered with ICSI. Appointed by the Board of Directors through a resolution in a Board Meeting

Statutory Audit is conducted by a Chartered Accountant (CA) or CA firm like PKC Management Consulting registered with ICAI.

The auditor is appointed by the shareholders at the Annual General Meeting (AGM) In case of a new company, the first auditor is appointed by the Board within 30 days of incorporation

Frequency

Secretarial Audit conducted annually, for every financial year. The report (Form MR-3) is submitted along with the Board’s Report in the Annual Return.

Statutory Audit conducted annually, though listed companies and large entities often undergo quarterly reviews and internal audits as well.

Cost Incurred

Secretarial Audit is generally less expensive. The costs depend on size, compliance level, and complexity of company operations

Statutory Audit involves higher costs due to extensive testing, documentation, financial validation, and audit team efforts

For regulated sectors (banking, insurance, NBFCs), audit complexity and cost can increase significantly.

Scope & Focus Area

Secretarial Audit checks compliance with:

- Companies Act, 2013

- SEBI Regulations, LODR, FEMA, and RBI Guidelines

- Board meetings, AGMs, filings (ROC/MCA)

- Registers like Share Register, Director Register

- Disclosures, Related Party Transactions, Share Issuance, etc.

Statutory Audit covers:

- Financial Statements (Balance Sheet, P&L, Cash Flow, etc.)

- Books of Accounts

- Internal Controls and Risk Assessment

- Accounting Standards Compliance

- Physical Verification of Assets

- Revenue Recognition, Expense Classification, etc.

Nature of Work

Secretarial Audit is process-driven, qualitative, and document-based. It focuses on verifying whether corporate processes are followed correctly.

It is usually less dependent on numbers, more on procedures, filings, and documentation

Statutory Audit is data-driven, quantitative, and analytical in its approach. It iInvolves sampling, cross-verification, vouching, reconciliation

It detects misstatements, frauds, tax discrepancies, and accounting irregularities

Industry-Specific Coverage

Secretarial Audit applies across all industries that meet thresholds. It is more crucial for regulated sectors like:

- Banking (regulated by RBI)

- Capital Markets (regulated by SEBI)

- Manufacturing, Pharma, NBFCs, etc.

Statutory Audit is universally applicable. It requires industry-specific expertise, especially in:

- Real Estate (Revenue recognition)

- E-commerce (Inventory and GST reconciliations)

- Manufacturing (Cost and inventory control)

- Financial services (Risk provisioning, RBI norms)

Risk Assessment Approach

Secretarial Audit adopts a compliance risk-based methodology. It focuses on legal and regulatory breaches, such as non-compliance with the Companies Act, SEBI regulations, or procedural lapses in board governance.

The approach is largely rule-based and checklist-oriented, designed to identify high-risk areas like related party transactions, board processes, or delays in disclosures.

Statutory Audit follows a risk-based financial approach using the audit risk model. It identifies and evaluates audit risks, including inherent, control, and detection risk, to determine where material misstatements in financial statements are most likely.

High-risk areas such as revenue recognition, provisions, and estimates are scrutinized using professional judgment and materiality thresholds.

Documentation Checked

Secretarial Auditors examine legal and procedural records, including:

- Board and committee meeting minutes

- Statutory registers

- Compliance certificates

- Policies like CSR and POSH

- Shareholding documents

- Filings made with the MCA and stock exchanges.

They also examine disclosures, resolutions, and director declarations under corporate laws.

Statutory Auditors, on the other hand, review the entire set of financial records such as:

- Books of accounts

- Invoices, contracts

- Loan agreements

- Fixed asset registers

- Trial balances.

They perform extensive verification of vouchers, bank statements, reconciliations, tax returns, and financial statements to assess the accuracy and fairness of financial reporting.

Sampling Technique

Secretarial Audit primarily relies on judgmental or purposive sampling. The auditor selects specific documents or transactions based on perceived regulatory risk or materiality.

Often, 100% checking is done for significant events such as board restructuring, mergers, or key filings.

Statutory Audit applies both statistical and non-statistical sampling methods. Random, systematic, or stratified sampling is used depending on transaction volume and risk assessment.

The use of monetary unit sampling or data analytics is common in large audits to ensure efficiency and accuracy.

Focus on Internal Controls

Secretarial Audit evaluates how effectively the organization adheres to regulatory filing deadlines, governance processes, and the roles and responsibilities of board committees.

The emphasis is on process-driven compliance culture and corporate governance.

Statutory Audit focuses on Internal Financial Controls (IFC) over financial reporting. The auditor evaluates the operational effectiveness of controls related to financial transactions.

These include authorization controls, segregation of duties, IT system controls, and fraud prevention mechanisms. The auditor must also report separately on IFC for certain companies.

Use of Technology and Tools

Secretarial Audit generally uses compliance management software, secretarial automation tools, MCA and SEBI portals, and Excel-based checklists.

The use of advanced technology such as data analytics is usually limited, and the process remains largely manual and document-driven.

Statutory Audit uses technology extensively to assist in sampling, fraud detection, and risk analysis.

Tools used include CAATs (Computer-Assisted Audit Techniques), data analytics platforms (e.g., IDEA, ACL), and ERP-integrated audit systems (e.g., SAP, Tally).

Reliance on Management

Secretarial Auditors rely heavily on management declarations, compliance certificates, and documents provided by the company’s secretarial team.

There is limited scope for independent verification unless discrepancies or red flags are detected.

Statutory Auditors rely on management representations too, but they are professionally obligated to validate those through independent testing and external confirmations.

They exercise caution and carefully test important claims and decisions to make sure they are correct.

Reliance on Other Reports

Secretarial Auditors may refer to the Statutory Auditor’s report, particularly for verifying compliance implications of financial decisions such as dividend declarations.

They might also consider internal or cost audit findings if relevant.

Statutory Auditors, especially in group audits or large organizations, coordinate with internal auditors, cost auditors, branch auditors, and subject matter experts (such as valuers or actuaries).

Nature of Assurance

Secretarial Audit provides reasonable assurance that the company has complied with applicable legal and regulatory provisions.

The assurance is limited to procedural and documentary review and does not extend to investigating financial misstatements or fraud.

Statutory Audit provides reasonable assurance that the financial statements present a true and fair view of the company’s financial position.

The auditor’s opinion is based on audit evidence gathered through various audit procedures and includes both qualitative and quantitative assessments.

Reporting Format

Secretarial Audit report is issued in Form MR-3, which is annexed to the Board’s Report and forms part of the Annual Report.

It outlines the company’s compliance status, observations, and qualifications, if any. Listed companies are also required to file it with stock exchanges.

Statutory Audit report is addressed to shareholders and attached to the financial statements.

It contains the auditor’s opinion, the basis for the opinion, and disclosures under CARO (Companies Auditor’s Report Order). For listed companies, key audit matters and internal control findings are also included.

Impact on Governance

Secretarial Audit plays a direct role in strengthening corporate governance.

It ensures transparency in board decisions, compliance with law, and adherence to ethical policies. It supports the board in maintaining investor confidence and avoiding legal exposure.

Statutory Audit strengthens financial governance by validating the integrity of financial reporting.

It enhances credibility in capital markets, assures stakeholders of financial accuracy, and contributes to informed decision-making.

Overlapping Areas

Certain areas fall under the purview of both audits. These include related party transactions (RPTs), director remuneration, board resolutions with financial implications, share capital issuance, dividend compliance, and CSR activities.

While the Secretarial Auditor checks for procedural and legal compliance, the Statutory Auditor verifies accounting treatment and financial impact.

Integration with Other Audits

Secretarial Audit may draw from internal audit and tax audit reports, especially when evaluating legal implications of financial transactions.

It can complement the findings of statutory or cost auditors but remains a standalone legal audit.

Statutory Audit is more integrated, often coordinating with internal audit, tax audit, cost audit, and branch audits.

It forms part of the broader audit and assurance framework within the company and involves multiple levels of assurance.

Alignment with International Standards

Secretarial Audit is a uniquely Indian concept mandated under Section 204 of the Companies Act, 2013.

It follows ICSI guidelines and secretarial standards. While similar practices exist in other countries (e.g., compliance audits), there is no global equivalent or standardization under international auditing frameworks.

Statutory Audit aligns with International Standards on Auditing (ISAs), which are adopted in India as Standards on Auditing (SAs) by ICAI.

This alignment supports cross-border listings, foreign investments, and international regulatory compliance.

Penalties for Non-Compliance

If a company fails to conduct a Secretarial Audit, it may face a penalty of up to ₹5 lakh.

Officers in default and the Company Secretary may also face personal penalties or disciplinary action by ICSI, including suspension or cancellation of their Certificate of Practice.

Non-compliance with statutory audit provisions is more severe.

Companies can face fines up to ₹25 lakh, while auditors may be penalized under the Companies Act, ICAI disciplinary mechanism, or by the National Financial Reporting Authority (NFRA).

For fraudulent conduct, imprisonment and disqualification may apply.

Corrective Actions and Follow-Up

In Secretarial Audit, non-compliances are highlighted in the MR-3 report, and the board must address them in the Board’s Report.

The Secretarial Auditor may follow up in subsequent years to verify rectification, though no formal mid-year tracking exists.

In Statutory Audit, findings such as internal control deficiencies or material misstatements require management’s immediate attention.

In listed companies, these are monitored quarterly, and persistent issues may lead to restatements, additional disclosures, or audit committee escalations.

Stakeholders Benefited

Secretarial Audit primarily benefits regulators (MCA, SEBI), the company’s board, compliance officers, and shareholders by enhancing governance transparency and minimizing legal risk.

It also helps prospective investors assess a company’s regulatory track record.

Statutory Audit benefits a broader financial ecosystem.

Shareholders, lenders, creditors, tax authorities, and market regulators rely on it for financial decision-making. It plays a pivotal role in maintaining trust in capital markets and ensuring financial discipline.

FAQs on Secretarial Audit vs Statutory Audit in India

Secretarial audit ensures compliance with corporate laws, while statutory audit verifies the accuracy of financial records. Both audits serve different purposes but are equally important for companies.

Statutory audit is mandatory for all companies, regardless of size. Secretarial audit is only mandatory for listed companies and certain large public companies.

No, only a qualified Company Secretary in practice can conduct a secretarial audit. Chartered Accountants are authorized only for statutory and financial audits.

Yes, but in different ways. Secretarial audit checks internal controls related to compliance and governance, while statutory audit checks financial and accounting controls.

Large listed companies in India often need both. Secretarial audit ensures compliance with SEBI and Companies Act, while statutory audit ensures financial reporting accuracy.

Expert verified

Expert verified