Knowing how to respond to income tax Scrutiny notice in India is needed to ensures a smooth resolution.

Learn with us the best way to respond to scrutiny cases and the format of letter you need to respond.

What is an Income Tax Scrutiny Notice in India?

An Income Tax Scrutiny Notice is an official letter sent by the Income Tax Department asking you to provide more details or documents related to your filed Income Tax Return (ITR).

This notice is typically issued under Section 143(2) of the Income Tax Act, 1961, and serves as the starting point for a scrutiny assessment

Learn about the most common tax scrutiny notices

Types of Scrutiny Notices Under Income Tax Act

There are different types of scrutiny assessments based on the nature and extent of examination which include:

| Type of Notice | Description |

| Section 143(2) | Detailed review of filed return after ITR is processed |

| Section 142(1) | Request for additional information/documents before assessment |

| 131(1A) | Investigate possible tax evasion |

| Section 139(9) | Rectify defects in the filed return. |

| Section 148 | Reassessment when income is believed to be underreported or undisclosed. |

Should You Respond to Income Tax Scrutiny Yourself or Hire a CA?

If you have received a scrutiny notice from the Income Tax Department, you can either respond to it yourself, or seek help from experienced professionals.

Here how to make that decision:

✅ Respond to a Scrutiny Notice Yourself If

- Notice is basic (like under Section 142(1))

- Asks for common documents (e.g., salary slips, Form 16, bank statements)

- You’ve filed your ITR honestly and accurately

- You’re comfortable using the Income Tax portal

- You have all your paperwork in order

In such cases, uploading your documents and writing a simple explanation may suffice.

⚠️Hire a CA or Tax Expert If

- Notice is under Section 143(2), 148, or 131(1A) (these are serious)

- You run a business or freelance, and GST, TDS, or balance sheets are involved

- You’ve claimed huge deductions or tax refunds

- Your case involves foreign income or assets

- You don’t fully understand what the notice is asking

- The notice mentions a possible hearing or investigation

In these cases, a CA can help draft the perfect response, upload everything correctly and defend you if a hearing is scheduled.

Why Choose PKC’s Tax Experts for Responding to Tax Scrutiny Notices?

✅37 years firm legacy serving 1,500+ business clients

✅All-India Rank 12 CA leading specialized tax practice

✅Search, survey & scrutiny case resolution expertise proven

✅Zero tax additions achieved in multiple scrutiny cases

✅Minimal liability closure strategy for business scrutinies

✅Corporate tax planning integrated with scrutiny defense

✅Industry-specific knowledge across multiple business verticals

✅Proactive approach preventing scrutiny issues before occurrence

✅End-to-end handholding from notice to case closure

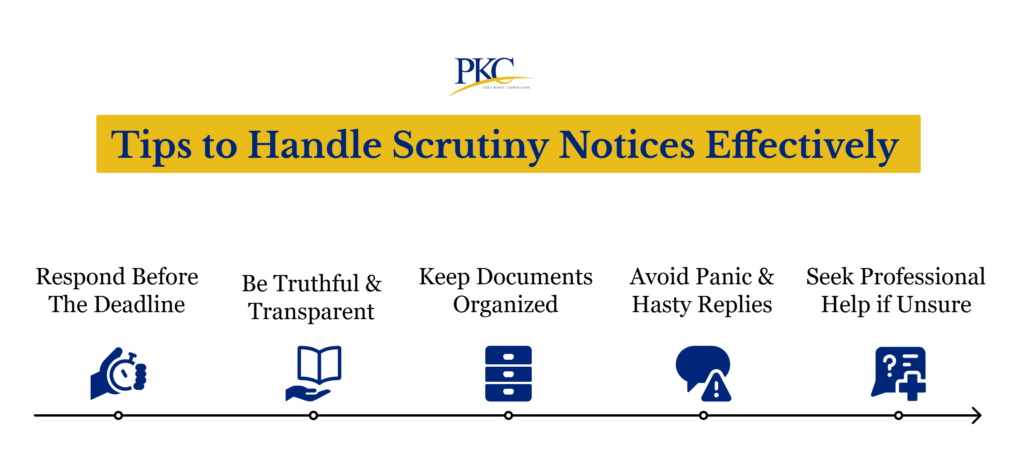

Steps to Follow When Responding to an Income Tax Scrutiny Notice

If you get an income tax scrutiny notice, here’s what you need to do:

Verify if the Scrutiny Notice Is Genuine

The first step is to verify that the scrutiny notice you received is official. Never respond to suspicious calls/emails.

The IT Department primarily communicates via:

- Official physical notice bearing your PAN, sent by post

- e-Filing Portal (incometax.gov.in)

If you receive a notice via your registered email or SMS, make sure to cross check your e-filing portal.

Log Into Income Tax E-filing Portal

Go to the Income Tax e-filing portal and log in with your account using your PAN and password.

Once logged in, you’re ready to locate and respond to the notice.

Go to “Pending Actions” → “E-Proceedings”

On the dashboard, select “Pending Actions” and then “E-Proceedings” to view and manage your notice.

Choose the relevant assessment year and click on the scrutiny notice to view the full details.

You’ll see a detailed breakdown of the queries raised and documents required.

Check the Details in the Notice

Next, read the notice carefully. Ensure that the notice pertains to your PAN and the correct assessment year.

Note down:

- Section number (e.g., 143(2), 142(1), 148, etc.)

- Assessment Year

- Deadline to reply

- Documents or information are being asked for

This will tell you exactly what kind of scrutiny is happening and what they expect from you.

Understand the specific issues, documents, or clarifications required by the Assessing Officer.

Gather Documents Systematically

Assemble all documents requested in the notice and documents supporting that.

Prioritize documents directly related to the queries raised. Gather proofs to support your ITR entries for those points.

Organize them chronologically & categorically.

Prepare physical originals (for potential verification) and scanned digital copies (PDF) for upload.

Here are common documents you may need:

- PAN, Aadhaar, and ITR copy

- Filed ITR-V

- Form 16/16A,

- Bank Statements

- Proofs for deductions (e.g., ELSS, PPF, Insurance)

- Rental agreements and HRA proofs

- TDS certificates and Form 26AS

- Capital Gains Statements

- Audit Reports (if applicable).

- Foreign asset declarations (if any)

- Business books, invoices, or balance sheets

Draft & Submit Comprehensive Response

Now it’s time to write a clear, professional, and honest reply.

- Draft a formal response letter explaining your position, addressing each point raised in the notice.

- Use precise information. Admit genuine errors upfront and offer to pay due tax.

- Explicitly link each response point to supporting evidence (e.g., “Refer Bank Acc XXXX Statement, pg Y, dt DD/MM/YY”).

- Clearly mention your PAN, assessment year, and other details as specified in the notice.

- Upload your response and supporting documents through the e-proceedings section in the prescribed format.

- If the notice requires a physical response, send it to the local Income Tax office with proper acknowledgment

Consult a CA or a CA firm like PKC Management Consulting to draft a robust, legally sound response. Authorize them via Form 26 on the portal if they will represent you.

Upload your drafted response letter and ALL referenced supporting documents in the “e-Proceedings” section for this specific notice.

Use your DSC (Digital Signature Certificate) or EVC (Electronic Verification Code) to submit.

Acknowledgement

Once your response is submitted, you’ll get an acknowledgement number on the screen.

Save and download system-generated acknowledgment receipt or note the submission confirmation number as proof of timely response.

If submitting in person, ensure you receive an acknowledgment receipt for your response.

Attend Hearings (If Scheduled):

Sometimes, the assessing officer may schedule a hearing (often virtual via the portal’s VC facility).

Have your response & document references ready and make sure to join the video conference on time.

Bring original documents if physical verification is requested. Answer questions concisely and factually.

Let your authorized representative (CA) handle complex arguments.

If the officer requests more details/documents post-hearing or post-response, upload them via e-Proceeding within the new deadline.

Follow Up and Await Assessment Order

After review, the assessing officer uploads a Draft Assessment Order (DAO) on the portal. Review it thoroughly. Check calculations, additions, and reasons.

If you disagree with the DAO, file objections within the short specified timeframe, citing factual/legal errors.

The officer issues the Final Assessment Order (FAO)after considering your DAO objections (if any).

The outcome can be:

- No Change: Your original return accepted.

- Refund Due: To be processed.

- Tax Demand: Additional tax + interest (+ potential penalties) payable.

Pay any tax demand + interest promptly via the e-filing portal to avoid further penalties.

If the FAO is incorrect, file an appeal with CIT(A) within 30 days, usually requiring 20% pre-deposit of disputed tax.

Consult your CA immediately.

Sample Format of Income Tax Scrutiny Response Letter

The format of the scrutiny response letter can vary with the kind of letter or objections raised.

Here’s a Sample Response Letter to Income Tax Scrutiny Notice

Frequently Asked Questions

1. Is it mandatory to respond to a scrutiny notice?

Yes, you must respond within the specified deadline. Ignoring it can lead to penalties and in serious cases, the tax department may initiate prosecution.

2. Can I respond to a scrutiny notice online?

Yes, responses can be submitted through the official Income Tax e-filing portal under the “e-Proceedings” section.

3. How much time do I get to respond to a scrutiny notice?

Typically, you get 15 to 30 days from the date of the notice. The exact deadline will be clearly mentioned in the notice.

4. Can I get help from a Chartered Accountant (CA)?

Yes, hiring a CA is recommended for complicated notices. Experts ensure proper documentation, response drafting, and representation.

5. Can I request an extension to respond?

Yes, you can request more time via the e-filing portal by submitting a valid reason. The assessing officer has discretion to approve or deny your request.

Expert verified

Expert verified