Struggling with accounting errors and compliance issues? Outsourcing accounting and bookkeeping services in India can be your window to affordability, accuracy, and expert support.

Learn with us all you need to know about onboarding the best outsourcing accounting and bookkeeping service providers and what to expect.

What is Outsourcing Accounting and Bookkeeping Services

Outsourcing accounting and bookkeeping services is the process of hiring external professionals or specialized firms like PKC Management Consulting to manage a business’s financial tasks.

Instead of maintaining an in-house accounting team, you delegate these responsibilities to third-party providers to maintain financial accuracy, reduce operational burden, and access expert support.

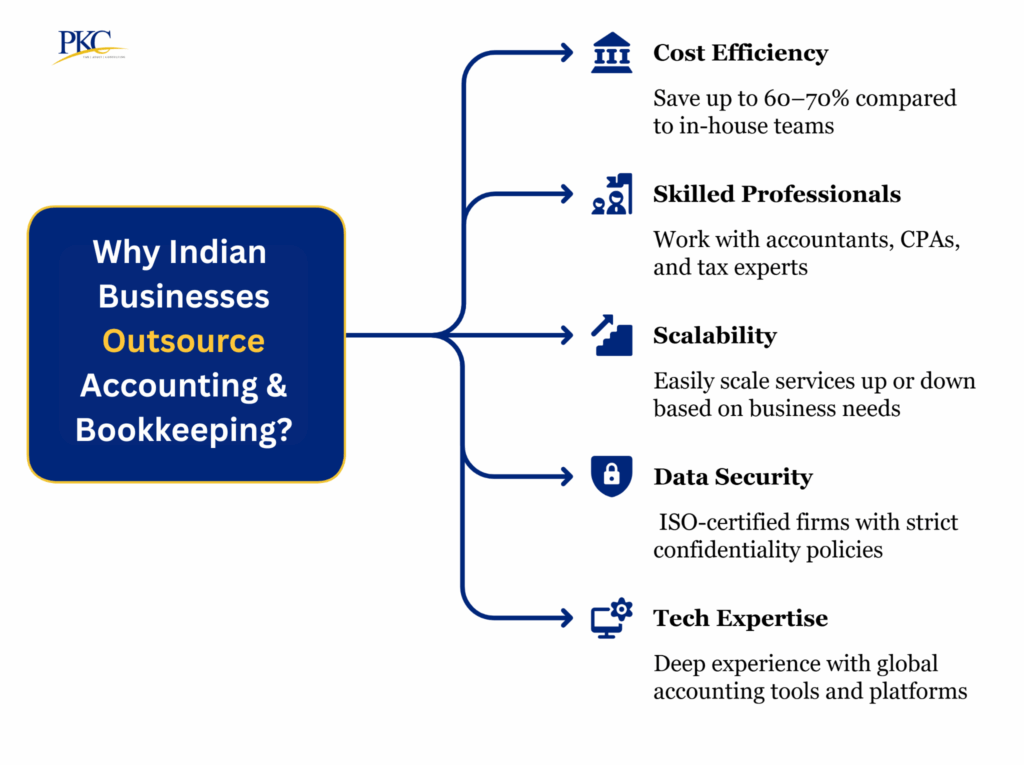

Benefits of Outsourcing Accounting and Bookkeeping Services

- Significant Cost Savings: Cut costs by eliminating overhead like office space and employee benefits. Flexible pricing models ensure you only pay for the services you need, making expert financial services accessible to businesses of all sizes.

- Access to a Vast Talent Pool: Partnering with a firm gives you access to a team of experts, including CAs and CPAs, with experience across a range of industries like e-commerce, real estate, and healthcare.

- Scalability and Operational Flexibility:Easily scale services up during busy seasons or down during slower periods without the hassle of hiring or layoffs. You get access to specialized expertise only when you need it.

- Enhanced Accuracy and Compliance: Firms prioritize precision with multiple levels of review and stay up-to-date on regulatory changes. This reduces the risk of costly errors, missed deadlines, or tax penalties.

- Advanced Technology and Automation: Providers use the latest technology to enhance data accuracy and streamline operations. This includes cloud-based platforms, AI-driven automation, and data analytics dashboards for real-time insights.

In-House vs. Outsourcing Accounting & Bookkeeping

| Feature | In-House Department | Outsourcing |

| Cost | High (Salary + Benefits + Overheads) | Low (Cost savings) |

| Expertise | Limited to hired staff | Access to a wide pool of experts |

| Scalability | Difficult and slow (Hiring/Firing) | Easy and immediate |

| Technology | Business must invest and maintain | Provided by the service provider |

| Focus | Management handles accounting | Management focuses on core business |

| Risk & Compliance | Business bears full responsibility | Shared with the expert provider |

| Business Hours | Limited to local time zone | ~24-hour turnaround due to time zone |

When to Consider Outsourcing Accounting and Bookkeeping?

Outsourcing accounting and bookkeeping isn’t just for large enterprises. Even startups and growing small businesses can benefit from them.

Here are the most common scenarios and triggers that signal it’s time to consider outsourcing your accounting and bookkeeping functions:

| Challenge | Signs | Outsourcing Benefit |

| Too Much Time on Financial Admin | Evenings spent reconciling, tracking invoices | Frees time for sales, operations, customer engagement |

| Business Growth & Complexity | New markets expansion or higher transactions overwhelms team | Scalable support, multi-entity consolidation, and compliance |

| Lack of In House Expertise | Multi-state taxes, international transactions, or funding prep | Access to CAs, CPAs, analysts, GAAP/IFRS expertise |

| Late/ Inaccurate Accounting | Delayed reports, payroll errors, mismatched books | Accurate, timely, audit-ready financials |

| High Costs | Expensive hiring, training, employee benefits, software | Converts fixed costs into variable expenses, saving on in-house staffing |

| Weak Reporting | Only basic P&L, no cash flow/KPIs | Custom dashboards for better decisions |

| Compliance Struggles | Missed deadlines, regulatory confusion | Experts ensure timely, correct filings |

| Outdated Systems | Using spreadsheets, old software | Cloud tools offer automation, real-time data |

| Overworked Team | Burnout, errors, delays. | On-demand support, seasonal capacity |

| Major Transition | Launching, seeking funding, preparing for audit, merger, or exit | Clean, transparent numbers for due diligence, negotiations, and investor confidence |

Business Stage-by-Stage Guide on Outsourced Accounting

Startups & Small Businesses:

- Consider outsourcing from the very beginning to establish proper processes, save money, and free up the founder’s time.

- Start with basic bookkeeping and tax preparation.

Growing Businesses (SMBs):

- Most common time to outsource.

- You’ve outgrown DIY software but aren’t ready for a full-time CFO.

- Outsource to get advanced reporting, scalability, and strategic advice.

Established Companies:

- Outsource to gain efficiency, access specialized expertise for complex projects

- Supplement existing in-house teams during peak periods.

What’s Included in Outsourcing Accounting and Bookkeeping Services in India

Here’s an overview of the core, compliance, and strategic services included in accounting and finance outsourcing packages:

Core Bookkeeping & Accounting Services

- Transaction Recording: Accurately entering all sales, purchases, receipts, and payments.

- General Ledger Maintenance: Correctly categorizing and updating all financial data.

- Accounts Payable (AP): Managing vendor invoices, payment schedules, and communication.

- Accounts Receivable (AR): Creating invoices, managing collections, and following up on overdue accounts.

- Bank & Credit Card Reconciliation: Matching monthly statements with the general ledger to find discrepancies.

- Fixed Asset Accounting: Tracking and depreciating company assets in line with regulations

Ideal for small businesses and startups looking to automate and offload routine financial tasks.

Payroll Management Services

- Salary Calculation & Disbursement: Calculating and paying salaries based on hours, commissions, or a fixed rate.

- Statutory Compliance: Managing payroll taxes and adhering to all labor laws.

- Payslip Generation: Creating and securely distributing payslips.

- Employee Benefits Management: Tracking and administering benefits like health insurance and leave.

- Payroll Tax Filing: Ensuring timely and accurate tax filings with the appropriate authorities.

Scales easily as your headcount grows, reducing risk of non-compliance and errors.

Tax Preparation & Compliance

- Corporate & Individual Tax Return Preparation: For clients operating in India, US, UK, Canada, Australia, etc.

- GST/VAT Compliance: Filing indirect taxes – GST (India), VAT (UK), or Sales Tax (US).

- Withholding Tax (TDS) Management: Accurate deductions and filings.

- International Tax Compliance: Adherence to US GAAP, UK GAAP, IFRS, and other global standards.

- Tax Planning & Optimization: Identifying legitimate tax-saving strategies and improving after-tax profitability.

- Support During Tax Audits: End-to-end documentation and auditor liaison services.

Must-have for international businesses navigating cross-border tax rules.

Financial Reporting & Analysis

- Financial Statements: Timely generation of Balance Sheets, Income Statements (P&L), and Cash Flow Statements.

- Month-End & Year-End Closings: Accurate period-end processes, including journal entries and reconciliations.

- Management Reports (MIS): Customized dashboards and KPIs.

- Variance Analysis: Spot trends, anomalies, and performance deviations quickly.

- Investor & Board Reporting: Clear and professional reports to present financials to stakeholders.

Enables strategic planning and real-time business decision-making.

Virtual CFO Services

- Financial Strategy & Planning: Long-term financial roadmaps aligned with business goals.

- Cash Flow Forecasting: Proactive cash management and scenario analysis.

- Profitability Consulting: Cost analysis, margin improvement, and pricing strategies.

- Fundraising Support: Preparing financial models, investor decks, and due diligence documentation.

- Board & Investor Reporting: High-level reporting for external stakeholders.

- Business Risk Assessment: Identifying and mitigating financial and operational risks.

Perfect for high-growth startups and mid-sized businesses lacking in-house financial leadership.

Audit Support & Internal Controls

- Audit Preparation: Organizing financial records, schedules, and working papers.

- Internal Control Reviews: Assessing and recommending improvements for processes, fraud prevention, and compliance.

- Coordination with Auditors: Liaising with external/internal auditors to answer queries and provide documentation.

Saves time, reduces stress, and ensures smoother audits.

Technology-Driven Services

- Cloud Accounting Setup & Migration: Xero, Zoho Books, Tally, NetSuite, and more.

- Software Integration: Integrate with CRMs, ERPs, e-commerce platforms, and payment gateways.

- Real-Time Dashboards: Live financial dashboards accessible from anywhere.

- Cybersecurity & Data Protection: Enterprise-grade data encryption and role-based access control.

Maximizes efficiency, accuracy, and scalability, essential for remote and global teams.

How Accounting Services Are Usually Bundled:

| Package Tier | Ideal For | Typical Services Included |

| Basic Bookkeeping | Startups, very small businesses | Transaction entry, bank reconciliations, AP/AR, basic financial reports |

| Advanced Accounting | Growing SMEs (Small & Medium Enterprises) | All bookkeeping + month-end closing, full financial statements, payroll, tax support, management reports |

| Enterprise / Virtual CFO | Established, scaling businesses | Full accounting & compliance + financial analysis, budgeting, forecasting, cash flow management, strategic advisory |

How Outsourcing Accounting and Bookkeeping Services Work?

When you work with experienced firms, outsourcing becomes a streamlined and collaborative process.

Here’s how it works from start to finish:

1. Initial Consultation & Needs Assessment

- Discovery Call: Your business and the provider discuss your specific needs (e.g., bookkeeping, payroll, tax filing).

- Customized Proposal: The firm reviews your requirements and proposes a tailored service plan, including the scope, pricing, and timeline.

- Agreement: Once you agree, a contract or service-level agreement (SLA) is signed, ensuring everyone is aligned before the work begins.

2. Onboarding & System Setup

The outsourcing team sets up the tools and access for a smooth transition.

- Secure Access: You provide the team with limited, role-based access to your cloud accounting software and bank feeds.

- Data Transfer: You share financial records, invoices, and other important documents through secure cloud folders or dedicated tools.

- Software Integration: If you’re not already using a cloud platform, the firm will set one up and configure it for you.

- Communication: You’ll establish communication channels (email, Slack, Zoom, etc.), and decide on the frequency and format of updates.

All data transfers and software access are protected using encryption, MFA, and other security best practices.

3. Day-to-Day Operations Begin

Once setup is complete, partner begins handling your daily, weekly, or monthly accounting tasks.

- Bookkeeping & Transactions: All sales, purchases, and payments are entered, categorized, and coded to maintain an up-to-date general ledger.

- Accounts Payable & Receivable: Vendor invoices and payments while also generating customer invoices and following up on collections.

- Reconciliation: Your bank and credit card statements are reconciled to your ledger, identifying any errors and ensuring your books are always current.

- Payroll: Salary calculations, employee deductions, payslip generation, and tax filings.

4. Reporting & Compliance

At regular intervals, your outsourcing partner provides the financial visibility you need:

- Regular Reports: Monthly or quarterly reports like Income Statements, Balance Sheets, and Cash Flow Statements, along with any custom reports you need.

- Compliance & Tax Support: All tax filings and annual documentation to ensure you stay compliant.

- Audit-Ready Books: Organized and audit-ready books, with the firm providing assistance in preparing for and responding to auditor queries.

These reports are usually reviewed during a scheduled video call or sent directly to you via email.

5. Strategic Advisory (Optional Add-On)

For businesses seeking more than just compliance, many firms offer Virtual CFO services:

- Financial planning and forecasting

- Cash flow projections and risk analysis

- Investor and board reporting

- Budgeting and business modeling

This is ideal for startups, growing SMEs, or companies without in-house financial leadership.

6. Ongoing Support, Optimization & Scalability

Outsourcing can grow with your needs:

- Scale services up or down based on your business activity or budget

- Receive suggestions for process improvements and automation opportunities

- Add services like tax planning, internal controls, or audit support as needed

- KPIs and SLAs are reviewed regularly to ensure continued satisfaction

How to Choose the Best Outsourcing Accounting & Bookkeeping Services in India

It is critical to choose the right partner for outsourcing your accounting and bookkeeping functions.

Apart from the usual experience and expertise, here are some pointers to help you make the right choice.

Key Factors to Consider

- Use of Cloud Technology: Go beyond a simple “yes” to cloud software. Ask if their workflow is deeply integrated with the technology for real-time efficiency and collaboration.

- Standardized Processes: Ask about their SOPs to verify the depth of their documented processes for key tasks like monthly reporting. This way you can assess their operational excellence and ensure you get reliable, predictable results.

- Dedicated Team: Ensure, you are provided with a dedicated team. When you work with the same people every month, they become deeply familiar with your business.

- Advisory Capability: Ask if routine reporting includes forward-looking commentary and “what-if” scenarios, not just historical data. This separates basic processors from strategic partners who add value.

- Client Exit Protocol: A professional firm will have a clear, cooperative process for data repatriation. Understanding this ensures you maintain full control and access to your information, avoiding vendor lock-in.

- Communication & Escalation Protocols: Clarify response times, primary points of contact, and clear escalation paths for urgent issues. Structured communication prevents frustrations and ensures accountability.

- Security Protocols: Partner should have VPNs, encrypted data transmission, multi-factor authentication, and strict confidentiality agreements to keep your data safe.

Red Flags to Watch Out For

| Red Flag | Why It’s a Problem |

| Unrealistically Low Pricing | May indicate poor quality, hidden fees, or inexperienced staff. |

| Vague Scope or Services | Leads to disputes, missed expectations, and hidden costs. |

| Poor Response Times | If they’re slow during the sales process, expect worse after signing. |

| No Clarity on Security Measures | A serious risk if they can’t explain how your data is protected. |

| No References Provided | Suggests limited experience or unhappy clients. |

| High Employee Turnover | You may be dealing with a team that is constantly changing |

| Pressure to Sign Long-Term Contracts | A good partner earns your trust month by month. Avoid lock-ins. |

Your 6-Step Evaluation Checklist

- Shortlist 3–5 firms based on online reviews and referrals.

- Schedule intro calls to discuss your business, needs, and expectations.

- Request proposals with scope, pricing, and sample reports.

- Ask detailed questions about data security, software tools, and escalation paths.

- Call client references and ask about reliability, communication, and results

- Start with a pilot project or a short-term contract to test the waters

Risks of Outsourcing Accounting & Bookkeeping Services & How PKC Handles Them

When outsourcing financial tasks, clients often have valid concern like:

- Fear of sensitive financial information being breached

- Feeling disconnected from your own financial processes

- Potential for errors if work is done by inexperienced staff

- Communication challenges between the partner and you

How PKC Management Consulting Handles These Risks

At PKC, we resolve these concerns with a professional approach:

- Robust Security: We use enterprise-grade data encryption, secure cloud platforms , and strict access controls. All employees sign strict NDAs, ensuring your data remains confidential and secure.

- Transparency & Control: You retain 24/7 access to your books through the cloud. A dedicated account manager provides consistent communication and regular reporting, ensuring you never lose visibility or control.

- Quality Assurance: Work is performed by qualified experts, including CAs. A multi-layer review process ensures accuracy and compliance with international accounting standards, minimizing errors.

- Proactive Communication: PKC’s team proactively schedules updates to bridge any communication gap, providing a near-24-hour workflow.

How to Measure Efficiency of Outsourced Accounting and Bookkeeping Services

Once you have onboarded an outsourcing partner, here’s how to measure efficiency of their services using KPIs:

Key Efficiency KPIs

| KPI | What It Measures | Target Benchmark |

| Accuracy Rate | % of error-free entries in financial reports | 98–100% |

| Turnaround Time | Speed of completing tasks (e.g., reconciliations, invoices) | < 48 hours for daily tasks |

| Cost Savings | % reduction vs. in-house staffing cost | 20–50% |

| Compliance Rate | Timeliness and accuracy of filings (taxes, payroll) | 100% |

| Scalability | Capacity to handle increased workload without delays | Seamless during peak periods |

| Tech Adoption | Use of modern, cloud-based accounting tools | ZohoBooks, Xero, NetSuite, etc. |

| Client Satisfaction | Your own rating of communication and quality | 8+/10 |

| Cash Flow Efficiency | Speed of receivables collection | 15–30% DSO improvement |

| Audit Readiness | Records are accurate, current, and well-organized | Always audit-ready |

Operational & Financial Metrics

- Invoice Cycle Time: Time from receiving an invoice to paying it. Faster processing improves vendor relations and can earn you early payment discounts.

- Days Sales Outstanding (DSO): Time taken to collect payments from sales. A lower DSO means better cash flow.

- Days Payable Outstanding (DPO): Time taken to pay vendors. This helps manage cash flow and builds supplier trust.

- Cost per Invoice: Total cost of processing a single invoice, which helps measure the cost-efficiency of your accounts payable.

- Payment Error Rate: Percentage of payments with errors. A low rate indicates strong quality control.

Quality & Reliability Metrics

- Accuracy of Financial Statements: Conduct regular audits or spot checks for discrepancies or errors to ensure accuracy.

- Timely Book Closings: Completing month-end or quarter-end closes on schedule ensures you have timely data for better decision-making.

- Issue Resolution Time: Measure how quickly the firm resolves errors or responds to questions. Aim for a quick response time, like under 24 hours.

Strategic Value Metrics

- Return on Investment (ROI): Calculate ROI using cost savings, efficiency gains, and strategic improvements like tax optimization.

- Time Saved for Internal Staff: Estimate number of hours your team saves by outsourcing.

- Access to Expertise: Assess whether the partner provides valuable insights, such as tax-saving advice, forecasting, and help with budgeting.

How to Track These KPIs

- Define Clear Expectations: Set baseline targets for each KPI and include them in your Service Level Agreement (SLA).

- Use Scorecards: Create a monthly or quarterly vendor scorecard that tracks KPIs like turnaround time, error rate, and client satisfaction.

- Conduct Regular Reviews: Hold monthly or quarterly reviews with your partner to objectively evaluate their performance using data, reports, and issue logs.

- Collect Internal Feedback: Ask your internal team for feedback on the partnership’s effectiveness, perhaps with a simple survey or meeting.

Example KPI Snapshot for Accounting & Bookkeeping (Monthly)

| Metric | Target | Actual | Status |

| Accuracy Rate | 99% | 98.7% | ✅ On Track |

| Bank Reconciliation Time | < 48 hrs | 36 hrs | ✅ Excellent |

| Cost per Invoice | INR 250 | INR 320 | ⚠️ Review Needed |

| Client Satisfaction | 8/10 | 9/10 | ✅ Above Expectations |

| DSO | 30 days | 27 days | ✅ Improved |

| Audit Readiness | 100% | 100% | ✅ Ready |

FAQ on Outsourcing Accounting and Bookkeeping Services

Outsourcing helps businesses cut costs, access skilled accountants, and use modern software. Experienced firms also offer scalability and faster turnaround.

Services usually include bookkeeping, payroll, tax preparation, financial reporting, audit support, and even virtual CFO services. Many firms allow you to customize packages.

Yes, outsourcing is especially useful for small businesses and startups. It saves money and provides expert financial support without hiring a full-time accountant.

Almost all industries can benefit, including e-commerce, IT, healthcare, real estate, retail, and startups. Indian firms adapt their services to different business models.

Look for experience, certifications, data security policies, and good client reviews. Avoid firms with poor communication, hidden fees, or unrealistic promises.

Expert verified

Expert verified