Knowing the income tax filing requirements for NRIs in India is essential if you’re a Non-Resident Indian with income from Indian sources.

Whether it’s from property, investments, or business, understanding when and how to file can help you stay compliant and avoid penalties.

This guide breaks down what NRIs need to know for the current financial year.

Understanding Residential Status & NRI Taxability Under Income Tax Act

Before we delve into income tax filing requirements for NRIs in India, it is important to understand who is considered an NRI.

Who Is an NRI Under the Income Tax Act?

The term NRI (Non-Resident Indian) refers to an individual who does not qualify as a “resident” under Section 6 of the Income Tax Act, 1961.

This is not based on citizenship, but purely on the number of days physically present in India during the relevant financial year and preceding years.

| Category | Criteria |

| Resident and Ordinarily Resident (ROR) | Satisfies basic residency test and: ✔ Resident in India for at least 2 out of 10 preceding years ✔ Stayed in India for 730 days or more in last 7 years |

| Resident but Not Ordinarily Resident (RNOR) | Satisfies basic residency test but does not meet the above two conditions for ROR |

| Non-Resident (NRI) | Fails both of the basic residence tests outlined below |

An individual is considered Resident in India if they meet either of the following:

- Stay in India for 182 days or more in the financial year, OR

- Stay in India for 60 days or more in the financial year and 365 days or more in the 4 preceding years

If neither condition is satisfied, the individual is considered an NRI.

Important Exceptions (Indian Citizens/PIOs)

- If you’re a high-income Indian citizen/PIO visiting India (Indian income >₹15 lakh), the 120-day rule applies.

- If you’re leaving India for employment or as a ship crew, the relaxed 182-day rule applies, protecting your NRI status more easily.

- These exceptions are aimed at preventing misuse by high-income NRIs.

Tax Implications Based on Residential Status

| Resident Type | Indian Income | Foreign Income |

| ROR | Taxed | Taxed |

| RNOR | Taxed | Not taxed (with few exceptions) |

| NRI | Taxed | Not taxed |

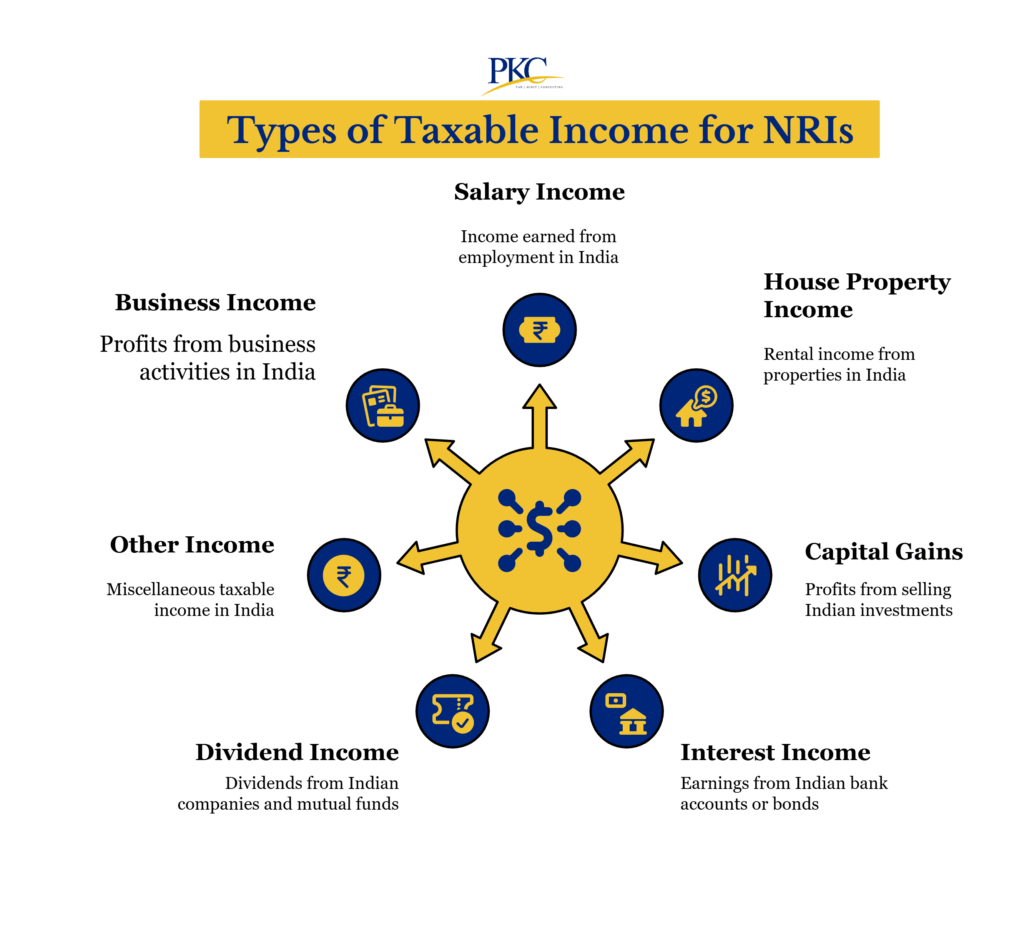

What Type of Income is Taxable for NRIs in India?

If you’re a n NRI, you are liable to pay income tax in India only on income earned, accrued, or received in India.

Here’s a complete breakdown of taxable income for NRIs:

1. Salary Income

- Taxable if: Salary is earned for work or services provided in India, or if the salary is received in an Indian bank account.

- Not Taxable if: Earned for services performed outside India and received outside India

Example: Working remotely from Dubai for an Indian employer will be Taxable in India

2. Income from House Property in India

- Rental income from property in India is fully taxable

- Capital gains from selling property in India are also taxable.

- NRIs can claim deductions including standard deduction of 30% on rental income, municipal taxes paid and interest on home loan under Section 24

3. Capital Gains on Indian Investments

- NRIs must pay tax on gains from sale of assets (real estate, shares, mutual funds, etc.) situated in India

- TDS is applied on sale proceeds by the buyer

- Exemptions under certain sections (like 54, 54EC, 54F) may be available for long-term capital gains if reinvested properly.

4. Interest Income

| Account Type | Taxability |

| NRE (Non-Resident External) | Tax-free |

| FCNR (Foreign Currency Non-Resident) | Tax-free |

| NRO (Non-Resident Ordinary) | Taxable at 30% (TDS applicable) |

5. Dividends from Indian Companies & Mutual Funds

- Dividends received from Indian-listed companies or mutual funds are taxable

- Generally taxed at a flat 20% TDS, unless a lower rate applies under a Double Taxation Avoidance Agreement (DTAA).

- Dividend income must be reported even if TDS has already been deducted

6. Other Taxable Indian Income for NRIs

- Freelance or business income earned in India

- Royalty or technical/professional fees from Indian sources

- Pension received from Indian employers

- Income from business operations partially or wholly carried out in India

7. Business Income

Business income is taxable if the control or setup is in India, even if you operate remotely.

Income Tax Filing Requirements for NRIs in India

If as an NRI you earn income from Indian sources, you may have to file an Income Tax Return (ITR).

When Should NRIs File Income Tax Returns in India?

You must file an ITR in India if:

1. Your Total Indian Income Exceeds Basic Exemption Limit

- ₹2.5 lakh under the old tax regime.

- Under the new tax regime (default from AY 2025–26), the limit is ₹4 lakh.

- Income includes salary earned in India, rent from Indian property, interest on NRO accounts, capital gains from Indian assets, etc.

Note: Senior citizens who are NRIs do not get a higher exemption limit.

2. You Have Any Taxable Capital Gains

Even if your total income is below the basic exemption limit, you still must file if:

- You had any short-term or long-term capital gains

- You sold property or other capital assets in India.

3. You Want to Claim a TDS Refund

- TDS is commonly deducted on NRO interest, rent, dividends, or property sale proceeds, even if your income is below the exemption limit.

- To claim a refund, you must file an ITR.

4. You Want to Carry Forward Losses

- If you incurred capital losses or business losses in India, filing allows you to carry them forward to offset against future profits.

5. Specific Transactions

Filing is compulsory if there are high-value transactions.

These include deposits exceeding ₹50 lakh in savings accounts or ₹1 crore in current accounts, or large travel expenses from Indian accounts.

Documents Needed for NRI ITR Filing

- PAN Card and Passport

- Visa or proof of foreign residency

- Bank statements (NRO/NRE/FCNR)

- Form 16/16A (TDS certificates)

- Form 26AS (tax credit statement)

- Proof of investments or deductions (if claiming any)

- Property documents, if applicable

- Tax Residency Certificate (for DTAA benefits)

Tip: Even when not required, filing income tax in India voluntarily can be a smart move. It helps build tax records, supports visa/loan applications, and ensures compliance.

ITR Filing Deadlines for NRIs (AY 2025–26)

| Situation | Due Date |

| Regular cases | 15 Sept 2025 (extended from 31 July) |

| If accounts are audited (e.g., business partner in a firm) | 30 Sept 2025 |

Which ITR Form Should NRIs Use?

| Form | When to Use |

| ITR-2 | Most common for NRIs. Used if you have capital gains, rental income, or other sources of income Not for business income |

| ITR-3 | For business or professional income in India |

| ITR-1 (Sahaj) | Not applicable for NRIs |

Special Considerations

- If your tax liability exceeds ₹10,000 in a year, you must pay advance tax in installments.

- Missing payments can lead to interest under Sections 234B and 234C.

- If your only income is from certain investments where TDS has been deducted, and no other filing condition applies, you may not need to file.

- But you must file if you want a refund or to carry forward losses.

Consequences of Not Filing When Required

- Late fee of ₹1,000 to ₹5,000 under Section 234F

- Interest on tax due

- Legal consequences for continued non-compliance

- Affects your financial reputation (for visa, loan, investment purposes)

How to File Income Tax Return for NRIs

Filing income tax in India as a NRI can be simple if you know the correct process. Here’s a look at it”

Step 1: Check If You Need to File an ITR

As discussed above, check if you are required to file ITR.

Even if income is lower, filing can help maintain a clean tax record and claim treaty benefits under DTAA.

Step 2: Determine Your Residential Status

Your tax status depends on how many days you stayed in India.

Check if you qualify as a NRI as per Income Tax Act

Step 3: Collect Required Documents

| Document | Purpose |

| PAN Card | Mandatory for filing |

| Passport & Visa | Proof of NRI status |

| Bank statements (NRO/NRE) | For interest income reporting |

| Form 16/16A | Salary/TDS details |

| Form 26AS & AIS | Track TDS and income |

| Property/investment papers | Rental or capital gain calculations |

| Tax Residency Certificate (TRC) | Needed for DTAA benefits |

| Form 10F | Used with TRC for DTAA |

| Form 67 | For claiming foreign tax credit |

Step 4: Choose the Correct ITR Form

Most NRIs need to file ITR-2, which covers income from salary, house property, capital gains, and other sources.

If you earn business or professional income from India, use ITR-3.

Step 5: Login to the Income Tax Portal

- Visit https://www.incometax.gov.in

- Log in using your PAN

- Select “File Income Tax Return”

- Choose:

- Assessment Year: 2025–26

- Mode: Online

- Form: ITR-2 or ITR-3

Step 6: Fill In the Return

Within the form:

- Declare residential status as NRI

- Report only Indian income: salary, rent, interest, capital gains, etc.

- Enter TDS details from Form 26AS

- Claim deductions (like 80C, 80D)

- Attach Form 67 and TRC/Form 10F for DTAA claims

- Provide your bank account details for refund

Step 7: Submit and E-Verify

Once done:

- Validate and submit the return

- E-Verify using:

- Aadhaar OTP

- Net banking

- Demat account

- EVC from bank

- Or post signed ITR-V to CPC Bengaluru within 30 days

Important Filing Deadline

- Due Date: 15 September 2025 (extended for FY 2024–25)

- Penalty for late filing: ₹1,000 to ₹5,000 under Section 234F

FAQs on Income Tax Filing Requirements for NRIs

1. Do NRIs have to file income tax returns in India?

Yes, if your total taxable income in India exceeds the basic exemption limit, you must file a return. Even if it’s below that, you may still need to file for capital gains or refunds.

2. Which ITR form should NRIs use?

Most NRIs should use ITR-2 to report income like rent, capital gains, and interest.

3. Is foreign income taxable for NRIs in India?

No, foreign income is not taxable in India as long as it is not received or transferred into India. Only income earned or received in India is taxed.

4. Is interest earned on NRE and NRO accounts taxable?

NRE account interest is tax-free, while NRO account interest is fully taxable at 30% TDS. Choose accounts wisely to minimize taxes.

5. Is rental income from Indian property taxable for NRIs?

Yes, rental income is fully taxable for NRIs under normal slab rates. You can also claim a standard 30% deduction for maintenance.

Expert verified

Expert verified