If you’re an NRI thinking about selling your property or investments, the taxation on capital gains for NRIs in India can get seriously confusing.

This guide will break down the tax implications on capital gains earned by NRIs be it on property, shares or mutual funds, so you know exactly what to expect.

Understanding Capital Gains for NRIs

Capital gains are the profits earned when a Non-Resident Indian (NRI) sells a capital asset such as property, shares, mutual funds, or gold for more than the original purchase price.

This profit is considered taxable income in India.

Why Do Capital Gains Matter for NRIs?

NRIs are taxed differently than resident Indians.

Indian income tax laws specify that NRIs are only taxed on income that arises in India, including capital gains from the sale of Indian assets.

Additionally, NRIs must also deal with:

- Tax Deducted at Source (TDS) on capital gains

- Repatriation rules for moving money abroad

- Double taxation concerns, depending on the tax treaty between India and the country of residence

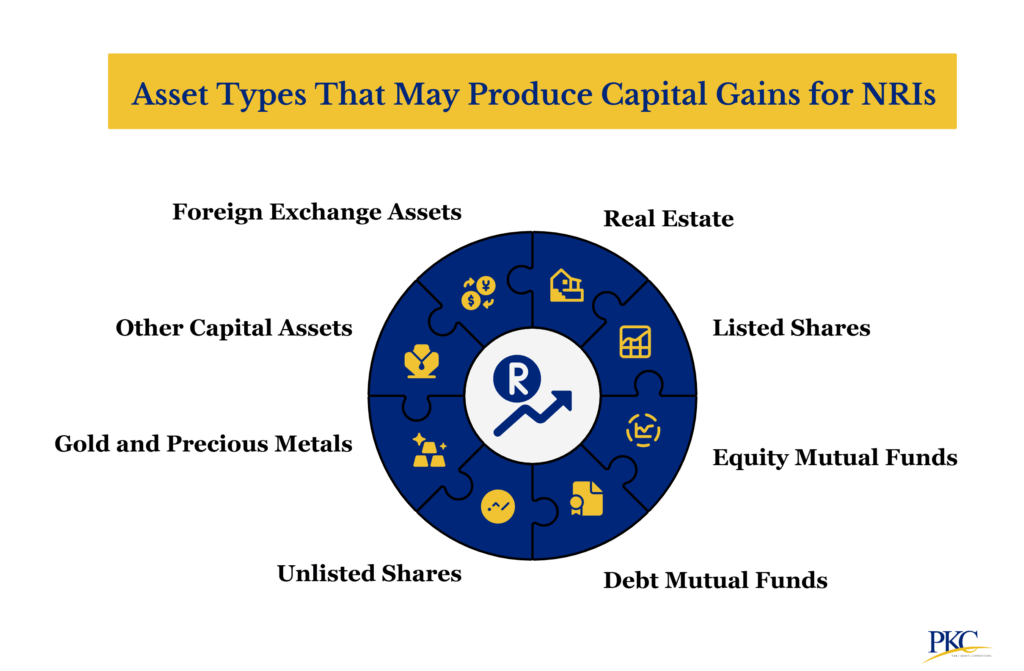

Types of Capital Assets That May Generate Capital Gains for NRIs

NRIs can earn capital gains from a variety of Indian assets, including:

- Real Estate: Residential or commercial property, plots, or land (except agricultural land)

- Listed Shares: Stocks of Indian companies traded on recognized stock exchanges

- Equity Mutual Funds: Mutual funds with at least 65% equity exposure

- Debt Mutual Funds: Mutual funds primarily invested in bonds or fixed-income instruments

- Unlisted Shares: Shares of private Indian companies

- Gold and Precious Metals: Includes physical gold, gold ETFs, and digital gold

- Other Capital Assets: Jewelry, artwork, and collectibles

- Foreign Exchange Assets: Assets acquired in India using convertible foreign exchange (important for certain tax exemptions under Section 115C to 115I)

Types & Categories of Capital Gains Tax for NRIs

Capital gains tax for NRIs can be divided and categorized on the basis of holding period and on the basis of type of asset being sold.

Here’s a look at the types of capital gains, applicable tax rates, and TDS rules for NRIs:

Capital Gains: Classification by Holding Period

The holding period of an asset determines whether the gain is considered short or long term:

Short-Term Capital Gain (STCG):

| Asset Type | Short-Term If Sold Within | NRI Tax Rate |

| Listed Shares / Equity Mutual Funds | 12 months | 20% |

| Property / Unlisted Shares/ Debt Mutual Funds / Gold / Other Assets | 24 months | Individual slab rates (up to 30%) + surcharge (up to 15%) + 4% health & education cess |

Long-Term Capital Gain (LTCG)

| Asset Type | Long-Term If Sold After | NRI Tax Rate |

| Listed Shares / Equity Mutual Funds | 12 months | 12.5% on gains exceeding ₹1.25 lakh (no indexation) |

| Property / Unlisted Shares/ Debt Mutual Funds / Gold / Other Assets | 24 months | 12.5% (no indexation) |

Capital Gains Tax on Property/ Real Estate for NRIs

When NRIs sell real estate in India, the tax treatment depends on how long they held the property.

Short-Term Capital Gains (STCG)

- For property held for 24 months or less

- Taxed as per the applicable income tax slab (up to 30% + surcharge + cess)

- TDS of 30% + surcharge + 4% cess is deducted on the sale value by the buyer

Long-Term Capital Gains (LTCG)

- Property held for more than 24 months

- Taxed at 12.5% flat (no indexation) for properties sold after July 23, 2024

- Taxed at 20% with indexation for properties acquired before July 23, 2024

- Buyer deducts 12.5% TDS + surcharge + 4% cess

- NRIs can apply via Form 13 for lower TDS Certificate to reduce TDS if actual tax liability is lower

- Exemptions available under Sections 54, 54EC and 54F

Capital Gains Tax on Mutual Funds and Shares

Capital gains from mutual funds and shares depend on the type of fund and holding period.

Listed Equity Shares & Equity Mutual Funds

| Holding Period | Type | NRI Tax Rate |

| ≤ 12 months | Short-Term (STCG) | 20% flat |

| > 12 months | Long-Term (LTCG) | 12.5% on gains exceeding ₹1.25 lakh |

Debt Mutual Funds

For units bought after April 1, 2023:

- Always taxed as short-term, regardless of holding period

- Taxed at slab rate (up to 30%) + surcharge + cess

- No indexation or LTCG benefit

For units bought before April 1, 2023:

- LTCG (if held > 36 months): 20% with indexation

Unlisted Shares & Hybrid Funds

- Unlisted Shares (held > 24 months): LTCG at 12.5% (or 20% with indexation)

- Hybrid Funds: Equity-oriented, follow equity rules; debt-oriented are taxed like debt mutual funds

TDS Rules for NRIs on Capital Gains

For NRIs, Tax Deducted at Source (TDS) is mandatory on capital gains unlike residents.

It’s deducted before the money is credited to your account.

| Asset | STCG TDS Rate | LTCG TDS Rate | Deducted By |

| Property | 30% + surcharge + 4% cess | 12.5% + surcharge + 4% cess | Buyer |

| Listed Equity Shares | 15% | 12.5% on gains exceeding ₹1.25 lakh | Broker / Exchange |

| Equity Mutual Funds | 15% | 12.5% on gains exceeding ₹1.25 lakh | Fund House |

| Debt Mutual Funds | Slab rate | 20% (if eligible for indexation) | Fund House |

| Unlisted Shares / Gold ETFs | Slab rate | 12.5% or 20% with indexation | Buyer / Broker |

No TDS is deducted on capital gains from listed shares in demat form, but taxes still need to be paid via your ITR.

How NRIs Can Reduce Capital Gains Tax or Associated TDS?

Capital gains tax and TDS can reduce your returns as an NRI. Here are the top strategies to lower or even avoid NRI capital gains tax:

Use Capital Gains Exemptions

- Section 54: Reinvest LTCG into another residential property in India within 2 years (or construct within 3 years). Max exemption: ₹10 crore.

- Section 54EC: LTCG exemption of up to ₹50 lakh by investing in specified bonds (NHAI, REC, PFC, IRFC) within 6 months of property sale; lock-in period is 5 years.

- Section 54F: Reinvest full net sale proceeds from any capital asset (not just residential property) into a residential property to claim proportional exemption.

- Section 115F: NRIs get LTCG exemption on foreign currency assets if gains are reinvested in specified assets; proportional exemption applies with a 3-year minimum holding period.

Claim DTAA Benefits

India has Double Taxation Avoidance Agreements (DTAA) with over 90 countries including the US, UK, UAE, Canada, and Australia.

You can benefit via:

- Avoid paying tax on the same income in two countries

- Claim credit for tax paid in India while filing in your resident country

- Lower overall tax liability

Required Documents:

- TRC (Tax Residency Certificate)

- Form 10F

- Self-declaration of NRI status

Lower/NIL TDS Certificate (Form 13)

If actual tax liability is lower than default TDS rates, NRIs can apply to the Indian tax department for a lower deduction certificate.

This prevents over-deduction and avoids refund delays.

File Income Tax Returns in India

If higher TDS was deducted, but you qualify for exemptions, you can claim a refund by filing your Indian Income Tax Return (ITR).

Steps:

- File ITR and declare capital gains

- Apply exemptions (Section 54, 54F, etc.)

- Claim excess TDS refund

Refunds are typically credited to your NRO account within 2–3 months.

Consult a Tax Advisor

For NRIs with large-value transactions, its best to consult a trusted and experienced advisor like PKC Management Consulting.

They help optimize use of multiple exemptions and avoid double taxation

How Can PKC Help NRIs With Capital Gains Tax?

✅100+ consultants specializing in international tax

✅End-to-end repatriation support to multiple nations

✅24-hour query resolution for urgent tax issues

✅DTAA advisory minimizing international double taxation

✅Land sale tax planning with repatriation assistance

✅Succession planning for inherited property capital gains

✅Prompt notice responses preventing costly penalties

✅Sound tax planning reducing capital gains liability

Also Read: Top Taxing Saving Strategies for NRIs

Repatriation of Capital Gains By NRIs & Impact on Taxation

When NRIs sell assets in India and wish to transfer the money to their overseas bank accounts, they must follow rules under Indian tax law and Foreign Exchange Management Act (FEMA)/

Here’s what you must know:

Repatriation Limits & Accounts

- NRIs can repatriate up to $1 million per financial year from their NRO account, including capital gains, rent, or dividends.

- Repatriation above $1M requires RBI approval.

- NRE/FCNR Accounts are fully repatriable. There is no limit on transferring proceeds from investments made through these accounts.

- Property or assets sold must have been legally acquired under FEMA (e.g., purchased via foreign remittance or inherited with proper records).

Tax Must Be Paid Before Repatriation

- Capital gains tax must be paid (short- or long-term) before repatriating.

- TDS should be deducted by the buyer or fund house.

- Tax paid documents are needed before the bank will process repatriation.

Use of DTAA (Double Taxation Avoidance Agreement)

- If you live in a country with a DTAA with India, you may claim a tax credit abroad for Indian taxes paid, helping reduce overall tax burden.

Documentation Required

- Form 15CA: Declaration of tax payment (filed online)

- Form 15CB: Certificate from a Chartered Accountant

- Form A2: FEMA declaration

- Bank Repatriation Form: Submitted to your NRO bank

- Supporting Docs: PAN, sale deed, bank proof, TDS certificate, etc.

Repatriation Process Summary

- Sell asset and deposit proceeds in your NRO account

- Pay applicable capital gains tax

- Get Form 15CB from CA, file Form 15CA online

- Submit forms to your bank

- Bank processes repatriation (up to $1 million/year)

Important for Property Sales

- Max 2 residential properties per year can be repatriated

- You cannot repatriate more than the original amount invested (from foreign funds)

- Inherited property may have separate rules

GST and Other Minor Charges

- No tax on remittance itself after capital gains tax is paid

- GST/service charges may apply on currency conversion or processing

FAQs on Taxation on Capital Gains for NRIs in India

1. What is capital gains tax for NRIs in India?

Capital gains tax for NRIs is the tax paid on profits from selling property, shares, or mutual funds in India. The rate depends on whether the gain is short-term or long-term.

2. Do NRIs have to pay TDS when selling property in India?

Yes, NRIs face TDS at 12.5% for long-term and 30% for short-term capital gains on property sales. This is deducted by the buyer before payment is made to the NRI.

3. Can NRIs avoid paying capital gains tax in India?

Yes, by reinvesting the capital gains under Section 54, 54F, or 54EC, NRIs can reduce or eliminate the tax. The exemption applies only if all eligibility conditions are met.

4. Can NRIs repatriate capital gains to their foreign account?

Yes, NRIs can repatriate up to $1 million per year from their NRO account after paying taxes. They must file Form 15CA and 15CB to do so.

5. Do NRIs need to file income tax returns in India after TDS?

Yes, NRIs should file ITR in India to claim exemptions or refunds even if TDS has already been deducted. Filing helps ensure correct tax treatment.

6. Are capital gains earned by NRIs also taxed in their resident country?

Yes, depending on the country, you may also be taxed abroad—but you can claim relief through the Double Taxation Avoidance Agreement (DTAA) between India and your country of residence.

7. How can NRIs reduce TDS on capital gains?

NRIs can apply for a Lower TDS Certificate (Form 13) from the Income Tax Department. This lets the buyer deduct a reduced or zero TDS based on actual tax liability.

Expert verified

Expert verified