The difference between NRE and NRO accounts for tax is a major deciding factor for NRIs choosing between the two.

Understand with us the tax implications of NRE and NRO accounts, which is best in what scenario and tax saving strategies.

Understanding NRE and NRO Account

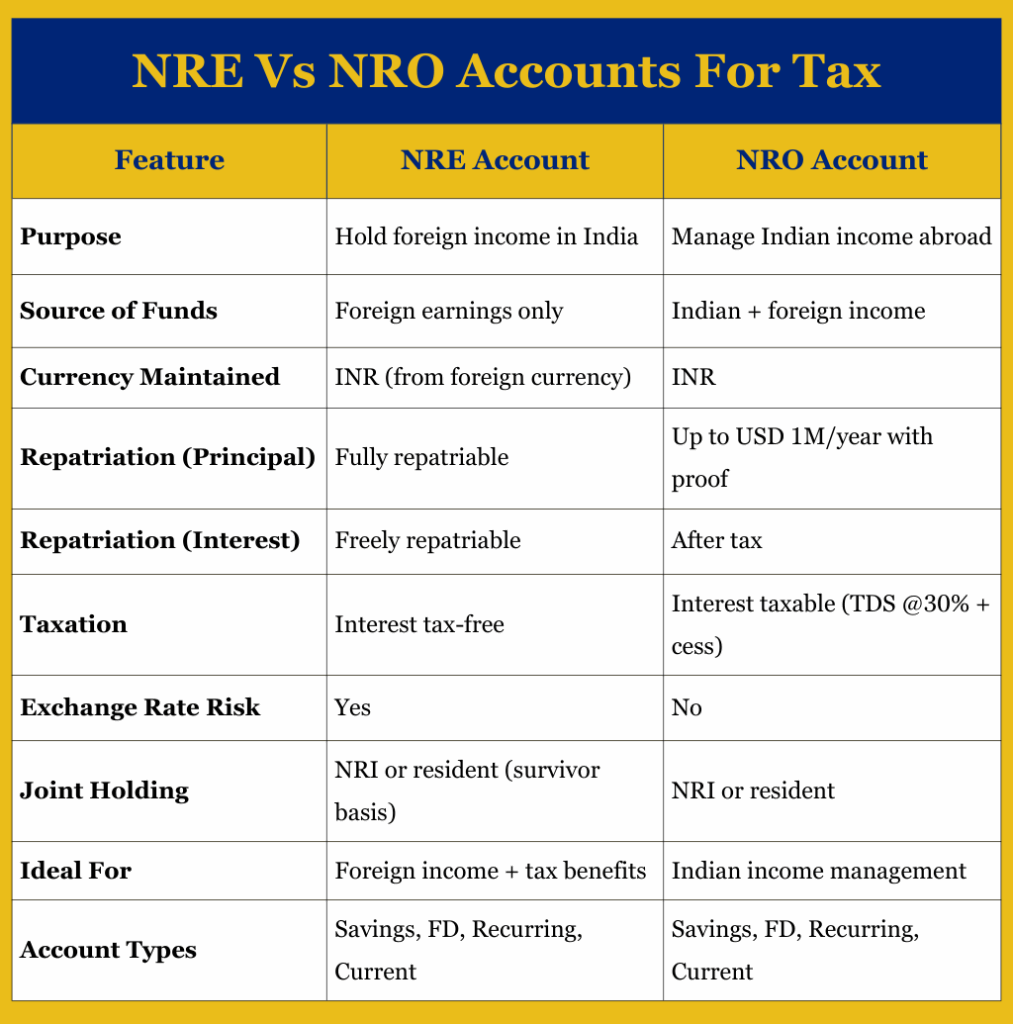

For an Non-Resident Indian (NRI) or Person of Indian Origin (PIO) wanting to manage income from both India and abroad, two specialized accounts options are available:

NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts

Each serves a distinct purpose and has different rules related to taxation, repatriation, and permissible deposits.

What is an NRE Account?

It is designed for NRIs to deposit and manage foreign income earned outside India in Indian Rupees (INR).

NRE account is best suited for NRIs who want to invest or save their overseas earnings in India while enjoying full repatriation and tax benefits.

Key Features:

- Purpose: For parking income earned abroad (salary, foreign business revenue, overseas investments).

- Funding Source: Only foreign currency (USD, EUR, GBP, etc.) deposited funds are converted to INR.

- Currency Held: INR (subject to exchange rate fluctuations).

- Repatriation: Both principal and interest are freely and fully repatriable without any restrictions.

- Taxation: Interest income is completely tax-free in India (no TDS or income tax).

- Joint Holding: Can be held jointly with another NRI. Joint holding with a resident Indian is allowed only on a “former or survivor” basis (resident can operate account only after NRI’s demise).

- Account Types: Savings, Fixed Deposit (FD), Recurring, or Current.

What is an NRO Account?

The NRO account is meant for managing income earned within India, such as rental income, dividends, pensions, or other domestic earnings.

This type of account is ideal for NRIs receiving income from Indian sources who need to pay local expenses, manage investments, or support family members.

Key Features:

- Purpose: To hold income from Indian sources (property rent, Indian salary, dividends, pensions, etc.).

- Funding Source: Can be funded from both Indian or foreign currency sources.

- Currency Held: INR.

- Repatriation:

- Interest: Freely repatriable after applicable taxes.

- Principal: Repatriable up to USD 1 million per financial year (subject to compliance with FEMA regulations and submission of Form 15CA/15CB).

- Taxation: Interest is taxable in India, with TDS at 30% + surcharge and cess.Tax relief may apply under Double Taxation Avoidance Agreements (DTAA) if eligible.

- Joint Holding: Can be held jointly with another NRI or a resident Indian.

- Account Types: Savings, FD, Recurring, or Current.

Also Read: Tax Saving Strategies for NRIs

Taxation Differences Between NRE and NRO Accounts

One of the major differences between NRE and NRO accounts is their tax implications.

| Taxation Element | NRE | NRO |

| Interest | Tax-free | Taxable |

| TDS | No | 30%+ (DTAA may reduce) |

| Principal | Not taxed | Not taxed; Must declare income |

| Wealth/Gift Tax | No | No |

| Double Taxation | Not needed | DTAA relief (TRC, Form 10F) |

| Repatriation | Free | Up to $1M/year |

| ITR Filing | Not needed (if only NRE) | Usually needed |

| Tax Abroad | Possible | Possible |

Here’s what you need to know:

Taxation on NRE Account

It is primarily used to hold income earned abroad, which is remitted to India in foreign currency.

Taxation in India

- Principal amount (deposited from foreign income) is not taxable in India

- Interest income earned on NRE savings or fixed deposits is completely exempt from tax under Section 10(4)(ii) of the Income Tax Act

- No TDS (Tax Deducted at Source) is applied by banks on interest earned

- No wealth tax or gift tax applies on funds held in NRE accounts

Global Tax Implications

Although India offers tax exemption, foreign tax liability may exist in your country of residence.

For example, NRIs in the USA or Canada must declare global income (including interest from NRE accounts) and pay applicable taxes.

Tax Residency Certificate (TRC) and disclosure are often required for foreign tax authorities.

Repatriation

Both interest and principal are freely repatriable. They can be transferred abroad without any tax or limit

NRO Account – Taxation Overview

It is used to hold income earned within India, such as rent, dividends, pensions, or Indian business revenue.

Taxation in India

- Principal amount is not taxed, but the source of funds (e.g., rent, pension) may attract taxation under other heads of income.

- Interest earned on NRO accounts is fully taxable in India under “Income from Other Sources”.

- The current TDS rate is 30% + applicable surcharge and cess

TDS Deduction and DTAA Benefits

- TDS is deducted at source by banks, even if your overall Indian income is below the basic exemption limit.

- Double Taxation Avoidance Agreement (DTAA) allows NRIs to claim a lower TDS rate by submitting:

- Tax Residency Certificate (TRC)

- Form 10F

- Self-declaration or No PE (Permanent Establishment) Declaration

Example:

- USA NRIs: TDS may be reduced to 15% under DTAA.

- UAE NRIs: TDS may be reduced to 12.5%, depending on the treaty.

Tax Return Filing (ITR)

NRIs can file an Indian Income Tax Return (ITR) to:

- Declare total Indian income

- Claim TDS refund if excess tax is deducted

- Avail DTAA benefits where not auto-applied

Repatriation and Tax Compliance

- Interest from NRO accounts is freely repatriable, post-tax.

- Principal can be repatriated up to USD 1 million per financial year, subject to:

- Form 15CA (self-declaration)

- Form 15CB (issued by a Chartered Accountant)

- You must prove that all Indian taxes on the income were paid before remittance.

Taxation on Other Income in NRO

- Rental Income: Taxable under “Income from House Property” (standard 30% deduction + municipal taxes allowed).

- Dividends: Taxable as per slab (TDS generally 10% or higher for NRIs).

Which One to Choose NRE or NRO Account – Under Different Scenarios?

Choosing between an NRE and NRO account depends on your source of income, tax obligations, repatriation needs, and investment goals.

Here’s a scenario-wise comparison to help NRIs make informed choice:

1. Earn Income Abroad & Want to Save/Invest in India

Best Choice: NRE Account

- Ideal for parking foreign income in India

- Interest is tax-free in India

- Fully and freely repatriable (you can transfer funds abroad anytime)

- Suitable for investing in Indian mutual funds, stocks, fixed deposits, and real estate.

2. Receive Pension, Rent, or Dividends from India

Best Choice: NRO Account

- Required for Indian-sourced income (per RBI rules).

- TDS @ 30% applies (can be reduced via DTAA).

- Allows repatriation of interest + principal up to USD 1 million/year after tax compliance.

3. Send Money to India & Bring It Back Later

Best Choice: NRE Account

- No restriction on repatriation of principal or interest.

- Interest earned is tax-free in India.

- Offers liquidity and flexibility for NRIs who want to move funds between countries.

4. Open a Demat or Trading Account in India

Best Choice: Both NRE and NRO Accounts

- NRE-linked Demat: For buying Indian stocks using foreign income. Fully repatriable

- NRO-linked Demat: Required when investing Indian income (e.g., dividends or rent)

- Both accounts support stock and mutual fund trading, but tax treatment and repatriation differ

Example: An NRI uses an NRE account to buy Indian stocks (can repatriate later) and an NRO account to receive dividends.

5. Have an Indian Savings Account & Recently Became an NRI

Best Choice: Convert to NRO Account

- RBI rules require resident savings accounts to be converted to NRO upon change in residency

- You cannot legally operate a resident savings account after becoming an NRI

6. Plan to Buy Property in India & Need a Loan

Best Choice: Use Both NRE and NRO Accounts

- NRE Account: Use foreign income for down payment; proceeds from property sale can be repatriated.

- NRO Account: Useful for EMIs paid through local income (like rent) and other Indian earnings.

Example: An NRI buys a flat in Mumbai using NRE funds for 50% of the payment and uses NRO income to service the home loan.

7. Want to Save on Taxes in India

Best Strategy:

- Use NRE for foreign earnings – completely tax-free in India.

- Use NRO for Indian income – claim DTAA benefits to reduce TDS from 30% to 10-15%.

- Transfer eligible funds from NRO to NRE after paying applicable taxes.

Example: A US NRI reduces TDS on NRO interest from 30% to 15% via DTAA, then transfers remaining funds to their NRE account for easier future repatriation.

How to Minimize Tax on NRO Account?

NRO accounts are taxable in India. Here’s a look at how you can minimize this tax burden:

1. Claim DTAA Benefits (Lower TDS Rate)

India has Double Taxation Avoidance Agreements (DTAA) with many countries including USA, UK, Singapore, Canada, etc.

These treaties allow lower TDS rates on NRO interest (typically 10–15% instead of 30%).

To claim this-

- Get a Tax Residency Certificate (TRC) from your current country of residence.

- Submit Form 10F via the Income Tax Portal.

- Provide a self-declaration letter to your bank stating DTAA claim

- Ensure your bank applies the reduced rate.

2. File ITR in India & Claim Refund

Even if TDS is deducted, you may be eligible for a refund if your total Indian income is below taxable threshold, or DTAA was not applied properly by your bank.

NRIs with small NRO interest and rental income benefit most from this. It is also helpful for retired NRIs with pension income below the threshold.

Filing ITR also gives you official tax proof for global compliance (especially useful in the US, Canada, UK).

3. Shift Funds from NRO to NRE (If Eligible)

If your NRO balance is from foreign earnings (not Indian income), you can move it to your NRE account.

You benefit from NRE accounts and earn tax-free interest, No TDS and its funds are fully repatriable

However, Indian-sourced income (like rent/dividends) cannot be moved this way. Banks and the RBI monitor such transfers closely and may allow them infrequently.

4. Invest in Tax-Free Instruments

Instead of leaving funds idle in NRO accounts, invest in low- or zero-tax options.

However, before making investments, make sure to check the eligibility for NRIs as some instruments are restricted for NRIs.

You can always talk to experts like PKC Management Consulting to help you with the right tax saving strategies.

5. Use NRO Joint Account with Resident Indian

If you have family in India (spouse, parents), consider:

- Opening a joint NRO account

- Letting the resident holder include interest in their ITR (if they fall in a lower tax slab)

However, only ₹10,000/year is tax-free under Section 80TTA for the resident.

6. Time Your Repatriation Smartly

NRIs can repatriate up to $1 million/year from their NRO account (including interest and principal) without RBI approval.

Tax Saving Strategy:

- Withdraw principal first (not taxable)

- Split interest payouts across years or into smaller tranches

- Avoid breaching higher tax slabs in one year

Make sure to maintain documentation and use Form 15CA & 15CB during repatriation.

Step-by-Step: Converting NRO Income to NRE

Transferring funds from your NRO to NRE account can be a powerful tax-saving strategy.

It allows you to move money from a taxable account (30% TDS) into a tax-free, fully repatriable NRE account, subject to RBI and tax compliance.

Under RBI’s Liberalized Remittance Scheme, NRIs can transfer up to USD 1 million per financial year from NRO to NRE, provided taxes are paid.

Step 1: Confirm Eligibility

- Source of funds: Indian income (e.g., rent, pension, interest, property sale)

- Taxes must be fully paid on this income

- You must have PAN and be filing tax returns in India

Step 2: Gather Required Documents

| Document | Purpose |

| Form 15CA | Self-declaration of tax payment |

| Form 15CB | Chartered Accountant (CA) certificate |

| Bank Statements | To trace source of funds |

| Sale/Rent Agreements | If applicable |

| Passport, PAN, Visa | KYC compliance |

| FEMA Declaration | Required by bank for forex compliance |

Step 3: Submit Request to Bank

- Fill out the bank’s NRO-to-NRE transfer form

- Submit the CA certificate, 15CA/15CB, and KYC documents

- Choose source: e.g., rent, sale proceeds, interest

Once verified, the bank will transfer the amount to your NRE account (in INR). It usually takes 2–5 business days

Step 4: Maintain Records

Keep digital/physical copies of:

- 15CA & 15CB acknowledgments

- Bank transfer confirmations

- Proof of source (in case of future audits or inquiries)

How Can PKC Help with NRE/NRO Tax Planning

✅ 35+ years expertise in NRI taxation matters

✅ Dedicated online tax expert for each client

✅ Double taxation avoidance through DTAA advisory services

✅ Specialized repatriation advisory for NRE/NRO accounts

✅ Capital gains planning for property sale proceeds

✅ End-to-end support for fund transfer abroad

✅ Succession and inheritance planning for NRI assets

✅ Systematic approach to minimize overall tax liability

Frequently Asked Questions

1. How DTAA affects NRE and NRO taxes?

The agreement helps NRIs avoid being taxed twice on the same income. It allows you to pay reduced tax on NRO interest or claim a tax credit in your country of residence.

2. What is the difference in repatriation rules for NRE and NRO accounts?

NRE accounts allow unlimited repatriation of both principal and interest. NRO accounts limit repatriation to $1 million per financial year and require certification from a CA.

3. Is it better to have an NRE or NRO account?

If you earn income outside India, an NRE account is better because it’s tax-free and fully repatriable. Use an NRO account only if you have indian income like rent, dividends, or pension.

4. Can I transfer money from NRE to NRO?

Yes, you can transfer funds freely from NRE to NRO without any restrictions. But moving money from NRO to NRE has repatriation limits and documentation requirements.

5. Is interest on NRO account taxable?

Yes, interest on NRO accounts is taxed at 30% + surcharge + cess, deducted automatically by the bank. However, you can reduce this using DTAA or file an ITR for a refund.

Expert verified

Expert verified