Wondering what MIS audit in India actually involves? Let us help you break it down.

This guide takes you through the MIS audits – what it means, who needs it, and how it helps protect your business.

Breaking Down MIS Audit, Its Importance & Frequency

Management Information Systems (MIS) Audit is a systematic evaluation of an organization’s information systems, processes, and reporting mechanisms to ensure:

- Data accuracy

- Operational efficiency

- Security of sensitive information

It ensures that the system collects, processes, and reports data to support informed decision-making.

The audit focuses on data integrity, timeliness, alignment with business goals, and compliance with regulatory requirements.

Importance of MIS Audits

MIS is the backbone of decision-making in any organization. If it has errors, outdated data, or security issues, the decisions based on it could be flawed or even dangerous.

By auditing MIS regularly, organizations build trust in their internal systems and ensure their strategic decisions are based on reliable data.

Here’s where an MIS Audit helps:

- Data Integrity: Verifies accuracy of financial/operational reports (e.g., SEBI-mandated disclosures for listed firms)

- Process Validation: Ensures alignment with business objectives (e.g., TATA Group’s centralized MIS for subsidiaries)

- Compliance Assurance: Protect against penalties by aligning with Indian laws (e.g., Income Tax Act, FEMA)

- Continuous Improvement: Recommends upgrades (e.g., adopting AI-driven analytics in fintech startups)

How Often Should an MIS Audit Be Conducted?

The frequency of an MIS audit in India depends on the industry, size & level of automation and system complexity, and regulatory requirements.

At PKC we recommend the following:

- Banks and Financial Institutions: At least once a year, as per RBI norms.

- Public Sector & Government Bodies: Yearly or biannual audits.

- Private Companies: Annually, or more often if there are major system changes.

- Listed Companies (SEBI): Quarterly reviews alongside financial results.

- Risk-Based: Companies choose to audit high-risk departments more frequently.

- Trigger-Based Audits: Conducted during organizational changes like mergers, system upgrades.

Who Conducts MIS Audits in India?

MIS audits can be carried out by internal teams or external experts. Let’s take a quick look:

1. Internal Auditors: Large companies have in-house audit teams. These include IT professionals and auditors trained in management systems, financial processes, and data analysis.

2. Third-Party IT Audit Firms: These are external consulting or auditing firms like PKC Management Consulting specializing in IT and MIS audits.

3. Certified Information Systems Auditors (CISA): A CISA is a globally recognized professional who’s certified to conduct IS/IT system audits. In India, many third-party and even internal auditors hold this certification to ensure audits meet international standards.

4. Regulatory Bodies: In special cases, sectors like banking or telecom, regulators like RBI or TRAI may appoint external audit firms or require reports from certified auditors to verify compliance.

Objectives of an MIS Audit in India

An MIS audit helps Indian organizations check if their data systems are working properly, securely, and efficiently.

Let’s break down the core objectives:

1. Ensure Accuracy of Reports and Data

MIS systems generate important business reports—like sales, inventory, finance, and HR summaries.

Audits validate the reliability of data processed by the MIS to support informed decision-making.

2. Evaluate Security and Access Controls

Security is crucial, especially when handling financial or customer data. MIS audit helps prevent data theft, fraud, and privacy violations.

It also protects sensitive data in line with IT Rules and other upcoming data protection laws.

3. Assess Backup and Disaster Recovery Readiness

Disasters can happen—whether it’s a cyberattack, system crash, or natural calamity.

The audit verifies and validates backup protocols and recovery strategies to minimize downtime during crises (e.g., cyberattacks, natural disasters).

4. Check System Performance and Efficiency

An MIS audit also looks at how well the system runs.

It checks for speed and responsiveness, system downtimes, software bugs or outdated tools

Optimize resource utilization and cost-effectiveness.

5. Evaluate Compliance with Indian Regulations

Indian regulators like RBI, SEBI, and IRDAI require organizations to meet certain IT and data standards.

The MIS audit checks if your system complies with these standards, maintains proper logs and documentation.

6. Improve Decision-Making Quality

At the end of the day, the goal of MIS is to help top management make better decisions.

The audit ensures:

MIS reports are clear, timely, and actionable

There’s no delay or manipulation of critical data

Dashboards and KPIs reflect the true picture of business

Common MIS Audit Findings in India

8 Crucial Components of an MIS Audit in India

MIS audits revolve around evaluating the system’s effectiveness, security, compliance, and alignment with organizational/ regulatory requirements. Here are the main components involved:

1. System Architecture and Data Flow

This involves reviewing the design of the MIS (hardware, software, databases, integrations) and how data moves across systems (input, processing, storage, output).

The auditor checks:

- Structure of databases, software, and interfaces

- How information flows from source to final reports

- If any data bottlenecks or gaps exist

This helps catch any flaws in system design that could cause delays or errors.

2. Network Infrastructure

If the network is weak, your MIS performance and security will suffer. Therefore MIS audit checks the networks and connections that allow systems to communicate securely and quickly.

Audit reviews:

- Internet and intranet setup

- Firewalls and routers

- Network speed and downtime logs

- Vulnerability to cyberattacks

3. Access Controls and User Management

Access control is one of the most important parts of an MIS audit in India, especially for data privacy laws and cybersecurity norms.

It is needed to prevent unauthorized access to sensitive data and comply with various regulatory requirements.

Auditors examine:

- Access to sensitive data

- Verify role-based access permissions

- Multi-factor authentication use

- Regular access reviews

4. Hardware and Software Audit

Your systems are only as strong as the machines and programs running them. Therefore it is essential to inspect licenses, updates, patches, and compatibility of IT assets.

The audit checks:

- Condition and age of hardware

- Validity of software licenses

- Whether systems are patched and updated

- Redundancy in case of hardware failure

5. Data Backup and Disaster Recovery

This part checks whether your organization can recover from data loss—due to hardware failure, hacking, or natural disaster.

The main goal is to ensure your critical data is not permanently lost.

Audit tasks:

- Assess backup frequency

- Off-site storage

- Recovery plans

- Test restore functionality

- Evaluate the disaster recovery plan

6. Report Generation and Accuracy

Since MIS helps management make decisions, the audit looks at:

- Reports generation

- Data matches original entries

- Reports are timely and free from errors

- Real-time data on Dashboards

7. Security Protocols and Cyber Resilience

This section focuses on the defenses against cyber threats. It also checks compliance with Indian standards like CERT-IN guidelines or ISO 27001.

Auditors evaluate:

- Antivirus and anti-malware tools

- Intrusion detection systems (IDS)

- Firewall configurations

8. Industry-Specific Requirements

Each industry in India may follow special compliance norms, and an MIS audit must check for these. The auditor ensures your MIS is compliant with the standards that apply to your sector.

For example:

- Banks must comply with RBI’s IT framework

- Stock brokers follow SEBI’s cybersecurity guidelines

- Healthcare may need HIPAA-like data protection

- Insurance companies must align with IRDAI norms

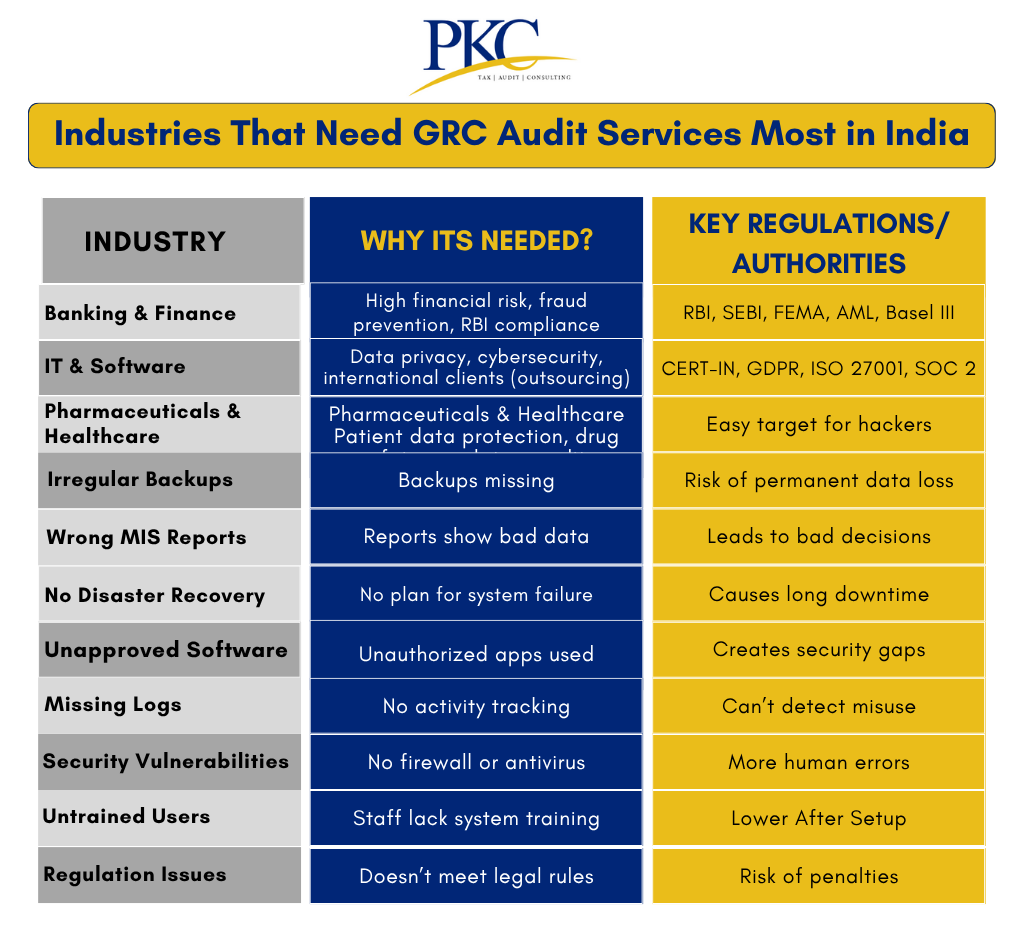

Industries That Commonly Require MIS Audit in India

MIS audits are crucial in sectors where data security, regulatory compliance, and accurate reporting are top priorities.

Here are the key industries that typically undergo MIS audits:

Banking and Financial Services

This is the most heavily audited industry when it comes to MIS due to high regulatory scrutiny, fraud risks, and reliance on real-time data.

MIS Audit is Needed for:

- Compliance with RBI guidelines (e.g., data localization, cybersecurity).

- Fraud detection in transactions (e.g., loan disbursals, NEFT/RTGS).

- Audit of systems like NPCI’s UPI, IMPS, and ATM networks.

Insurance Companies

Sensitive customer data and strict IRDAI regulations for policy management.

MIS Audit is Needed for:

- Accuracy of actuarial calculations and claim settlements.

- Compliance with Insurance Act, 1938 and data privacy norms.

Healthcare & Hospitals

They store highly sensitive patient records and run on MIS systems for scheduling, diagnostics, and billing.

MIS Audit is Needed for:

- Prevent data breaches of patient information

- Ensure compliance with medical data standards

- Keep reporting systems accurate and secure

Government and Public Sector

Public sector entities are subject to RTI, audit scrutiny, and public accountability.

MIS audit helps:

- Ensure transparency in spending and reporting

- Monitor large-scale projects and performance metrics

- Prevent data corruption or loss

E-commerce and Retail

These industries rely on MIS to track customer behavior, sales trends, and logistics.

MIS Audit is needed to:

- Handle payment gateways and personal data

- Use AI-driven dashboards for real-time insights

- Protection against cyber threats and fraud

Manufacturing and Supply Chain

MIS in these firms controls inventory, logistics, and vendor coordination. MIS audits help improve supply chain visibility and reliability.

Audits are needed for:

- Real-time data tracking

- Monitoring production KPIs

- Managing cost and time efficiency

Education

Institutions use MIS to manage students, fees, attendance, and performance.

MIS Audits check:

- Proper access control

- Data privacy of students and staff

- Accuracy in academic and financial records

Why Choose PKC for Your MIS Audits?? ▫️35+ years proven track record in consulting excellence ▫️Deep expertise across diverse industry sectors and technologies ▫️Comprehensive audit methodologies ensuring thorough risk assessment ▫️Senior consultants with extensive MIS audit experience ▫️Rapid turnaround times without compromising audit quality ▫️Strong client relationships built on trust and reliability ▫️Up-to-date knowledge of latest compliance and regulations ▫️Detailed reporting with actionable recommendations for improvement ▫️Post-audit support to help implement recommended changes ▫️Advanced audit tools and technologies for accuracy ▫️Flexible engagement models to fit your budget |

How to Prepare for an MIS Audit in India?

Preparing for a MIS Audit in India needs to be done in a structured manner. Here’s a step-by-step guide to get audit-ready”

1. Understand the Audit Scope and Objectives

- Identify laws that apply to your business (e.g., GST, Income Tax, Companies Act, DPDP Act 2023 for data privacy).

- Clarify the audit focus – data integrity, system security, compliance, or operational effectiveness.

2. Organize All Documentation

- Prepare diagrams of your MIS structure and how it connects to other tools like ERP accounting software

- Document data security rules, user access controls, backup plans, and disaster recovery steps

- Keep GST returns (GSTR), TDS filings, tax audit reports, and past audit findings handy.

3. Check Data Accuracy

- Use system checks (e.g., mandatory fields, date formats) to prevent errors.

- Match MIS reports with source documents (invoices, bank statements) to fix mismatches.

- Enable logs to record who enters or edits data (audit trails).

4. Secure Your System

- Assign user roles (e.g., admin, viewer) and use multi-factor authentication (MFA).

- Use firewalls, encryption, and regular security checks (e.g., vulnerability scans).

- Ensure sensitive data is stored in India if required (e.g., RBI rules for financial firms).

5. Review Internal Controls

- Avoid overlap in roles (e.g., Same person shouldn’t approve and make payments. One person should approve the payment and a different person should execute or process the payment).

- Set up system warnings for suspicious activity (e.g., duplicate invoices).

- Verify report accuracy and test how the MIS performs during high workloads.

6. Train Teams & Run Mock Audits

- Train staff on data entry rules, security practices, and error reporting.

- Do a trial run to find gaps (e.g., unreconciled GST entries, outdated user access). Fix issues beforehand.

7. Collaborate with MIS Auditors

- Provide system details, policies, and compliance records upfront.

- Involve IT, finance, and compliance teams to answer auditor’s queries quickly.

- Use dashboards to track data quality and security after the audit.

8. Act on Audit Results

- Understand non-compliance issues (e.g., TDS errors, weak passwords).

- Update policies, improve controls, and retrain staff as needed.

- Keep records of improvements for future audits.

MIS Audit Checklist for Indian Organizations

Here’s a sample MIS Audit checklist in PDF you can download:

Frequently Asked Questions

1. Is MIS audit mandatory in India?

Yes, in many industries it is mandatory. Sectors like banking, insurance, Stock markets are required by regulators like RBI, SEBI, and IRDAI to conduct MIS or IT audits regularly.

2. What is checked during an MIS audit?

Auditors check data accuracy, user access control, backup systems, cybersecurity measures, report generation, compliance with laws. The goal is to ensure the MIS is safe, accurate, and reliable.

3. How often should MIS audits be done?

MIS Audits should usually be done once a year, but it depends on Industry regulations, system complexity, and risk level. High-risk sectors may need audits twice a year or more.

4. Who uses the results of an MIS audit?

Mostly senior management, compliance teams, IT departments, and regulators. They use the MIS audit results to improve systems, fix weaknesses, and plan better.

5. How long does an MIS audit take?

It usually takes 2 to 4 weeks, depending on the size of the organization, complexity of systems and number of locations involved.

Expert verified

Expert verified