Written By – PKC Desk, Edited By – Krithika Mohan, Reviewed By – Vignesh

Internal audits for real estate are a defense against fraud, regulatory fines, and financial chaos.

Stay with us as we break down exactly why real estate internal audit is essential, process & checklist they follow, best practices and how top firms like PKC help you stay compliant, secure, and audit-ready.

What is an Internal Audit in Real Estate & Why It’s Crucial?

In real estate, an internal audit is an independent and systematic review conducted by a company’s own internal auditors or outsourced specialists hired by management.

The main purpose of the internal audit is to objectively examine and evaluate the company’s:

- Internal Controls

- Risks

- Governance

- Compliance

- Efficiency & Effectiveness

- Financial Accuracy

Importance of Internal Audits for Real Estate Sector

- Protects High-Value Assets: Real estate assets are high-value and illiquid. Internal audits verify accurate records, proper maintenance, insurance coverage, and protection from misuse.

- Secures Cash Flow: They ensure rent rolls are accurate, collections are complete, expenses are correct, and vendor payments are valid—preventing revenue loss and overspending.

- Ensures Regulatory Compliance: With strict laws (fair housing, ADA, safety, environmental, tax, lease terms), audits catch non-compliance early to avoid fines, lawsuits, and reputational harm.

- Identifies Risk Exposure: They assess risks like tenant defaults, market dips, property damage, lawsuits, rate hikes, and cyber threats—ensuring mitigation plans are in place.

- Boosts Efficiency: Internal audits reveal inefficiencies in leasing, maintenance, onboarding, and reporting—streamlining operations and cutting costs.

- Prevents Fraud: With large cash flows at stake, audits test internal controls to guard against embezzlement, kickbacks, and invoice fraud.

- Supports Better Decisions: Audited financials give leadership and investors reliable data for key decisions, building confidence with lenders and stakeholders.

- Improves Controls: Audits suggest practical process and control upgrades, strengthening overall resilience and management.

Key Areas Audited During A Real Estate Internal Audit

A real estate internal audit in India covers a broad set of focus areas. Below are the key areas typically covered:

1. Regulatory & Statutory Compliance

- RERA Compliance: Verify registration, escrow (70% rule), disclosures, possession timelines, grievance redressal, and state-specific rules.

- Taxation: Ensure GST (input/output), TDS on rents/contracts, and income/capital gains tax compliance.

- Statutory Laws: Adhere to Companies Act, SEBI, FEMA, BOCW Act, and local building/fire codes.

- Land Use & Zoning: Validate land use, FSI, approvals, and sanctioned plans.

- Environmental Compliance: Check clearances, pollution norms, ISO 14001, and waste systems.

2. Financial Controls & Reporting

- Revenue Cycle: Accuracy of lease agreements, rent rolls, escalations, CAM recoveries, and security deposits.

- Expense Cycle: Scrutiny of vendor payments, project costs, payroll, and GST compliance for input tax credits.

- Bank Reconciliations: Timely and accurate reconciliation of bank accounts tied to each project or asset.

- Financial Statement Accuracy: Alignment with Indian Accounting Standards, project-wise profitability, and RERA mandates.

- Budgeting & Forecasting: Analysis of variances between budgets and actuals for operational and development activities.

3. Operational Efficiency & Property Management

- Lease & Tenant Administration: Review of lease execution, critical dates, tenant KYC, onboarding, and rent collection. Handling defaults, evictions, and grievances within legal bounds.

- Facilities & Maintenance: Evaluation of preventive maintenance schedules, contractor SLAs, energy/utility management, and work order systems.

- Vacancy & Leasing Strategy: Effectiveness of brokerage agreements, tenant retention, and occupancy rates.

4. Project Development & Construction Oversight

- Cost Control: Monitoring of material and labor costs, subcontractor bills, and adherence to approved budgets.

- Scheduling & Progress Monitoring: Tracking project timelines (critical for RERA compliance), delay analysis, and escalation tracking.

- Quality Assurance: Verification of technical specifications, quality control reports, and third-party audits.

- Vendor & Contractor Oversight: Due diligence on vendors, adherence to contract terms, SLAs, and performance evaluations.

- Inventory Management: Accurate tracking of construction materials, spares, and consumables.

5. Risk Management & Fraud Detection

- Risk Assessment: Identification and evaluation of financial, operational, and strategic risks with appropriate mitigation measures.

- Revenue Leakage: Detection of unrecorded income, under-billed charges, and uncollected dues.

- Procurement Fraud: Scrutiny of inflated invoices, kickbacks, or fictitious vendors.

- Cash & Asset Misappropriation: Controls over cash handling, asset theft, and unauthorized usage.

- Benami Transactions: Compliance with the Benami Transactions (Prohibition) Act, especially in land and high-value property deals.

6. Internal Controls & Governance

- Policy Compliance: Examination of internal policies and approval hierarchies for accountability and control.

- Corporate Governance: Assessment of board oversight, ethical practices, audit committee function, and transparency in decision-making.

7. Procurement & Vendor Management

- Tendering & Onboarding: Review of procurement processes, including RFPs, bid evaluation, vendor due diligence (GSTIN, PAN, MSME checks).

- Contract Management: Compliance with SLAs, payment terms, scope of work, and audit trails.

- Conflict of Interest: Identification of related-party transactions or undisclosed affiliations.

8. Asset Verification & Legal Due Diligence

- Physical Verification: Matching actual properties and assets with records to ensure existence and condition.

- Title Review: Examination of title deeds, encumbrance certificates, litigation records, and RERA registration status.

- Land Records: Cross-verification with digitized land databases (e.g., Bhoomi in Karnataka, Dharani in Telangana).

- Valuation Assessment: Evaluation of asset values reflected in financials against market benchmarks.

9. Human Resources & Payroll

- Compliance Review: Verification of adherence to labor laws, minimum wage provisions, EPF, ESI, and the BOCW Act where applicable.

- Payroll Audit: Checking accuracy of payroll, reimbursement claims, leave records, and statutory deductions.

10. IT Systems & Cybersecurity

- Data Integrity & Access Controls: Ensuring restricted access to property management and financial systems.

- Cybersecurity Readiness: Protection against ransomware, phishing, and unauthorized data access.

- Backup & Recovery: Evaluation of disaster recovery capabilities and data continuity plans.

- Regulatory Compliance: Adherence to the IT Act, 2000, and CERT-In guidelines.

11. ESG (Environmental, Social & Governance) Compliance

- Sustainability: Evaluation of green building norms, energy efficiency measures, and social responsibility initiatives.

- Governance Metrics: Ensuring ESG reporting aligns with global frameworks and local regulations.

12. Anti-Money Laundering (AML) & KYC

- Regulatory Compliance: Adherence to AML regulations, especially for high-value transactions.

- Customer Due Diligence: Verification of client KYC, source of funds, and monitoring for suspicious transactions.

Sample Internal Audit Checklist for Real Estate Company

Here’s how an internal audit checklist looks like for a real estate company:

Internal Audit Process in Indian Real Estate Companies

An internal audit for a real estate company is a full investigation into how it is being run—legally, financially, and operationally.

Here’s a step-by-step breakdown of the process followed:

1. Understanding the Business and Risk Areas

- Review the company’s portfolio: residential, commercial, retail, or mixed-use assets.

- Study project life cycles: planning, construction, leasing, operations.

- Identify specific risks: RERA non-compliance, land title disputes, GST/TDS errors, project delays.

- Analyze past audit reports and management feedback.

- Consult stakeholders: legal, site teams, finance for ground-level insights.

2. Planning the Internal Audit

- Define objectives: Example: Verify RERA escrow compliance for Project A.

- Prioritize audits based on risk: Focus on high-impact areas like regulatory deadlines.

- Develop tailored audit programs: RERA checks, GST checks

- Allocate specialized auditors: GST experts for tax audits, engineers for site work.

- Set timelines aligned with regulatory cycles.

3. Fieldwork and Evidence Collection

- Inspect physical sites: Compare actual construction work vs. reported progress

- Review critical documents: RERA registration, GST returns, land deeds, lease agreements, vendor contracts, title documents and compliance certificates

- Cross-check bank transactions

- Use data analytics to detect anomalies like duplicate payments.

4. Interviews and Data Review

- Interview key personnel: Site engineers, property managers on, accounts team on GST challenges

- Reconcile data across systems: Rent rolls vs. bank statements, Project costs vs. budgets.

- Validate digital records: Cross-check RERA filings on state portals, match books with GSTN portal data.

5. Reporting Findings

- Draft findings: High risk- needs urgent action, Medium risk – needs monitoring, Low risk – minor issue, fix later

- Incorporate management feedback for accuracy.

- Finalize report sections: Executive summary, observations with evidence, actionable recommendations

- Include management’s action plan with owners and deadlines.

6. Follow-up and Monitoring

- Track remediation via an action register: Finding, owner, deadline, status.

- Validate corrections

- Escalate unresolved issues to the Audit Committee.

- Update future audit plans using findings.

- Report progress quarterly to the Board as per Companies Act 2013.

Best Practices for Conducting Internal Audit in Real Estate India

Here are key best practices we adopt at PKC Management Consulting for conducting effective internal audits in real estate segment:

1. Project-Wise Segregated Accounting

Maintain separate books of accounts for each RERA-registered project rather than company-wide consolidation.

This ensures transparent fund utilization tracking and compliance with RERA’s project-specific financial reporting requirements.

2. Anchor Audits to India’s Regulatory Landscape

Integrate RERA, GST, Income Tax, Environmental Clearance, and local municipal compliance requirements into a unified audit framework.

Ensure every audit procedure addresses multiple regulatory obligations simultaneously rather than treating them as separate compliance exercises.

3. Real-Time Construction Progress Reconciliation

Continuously match physical construction milestones with financial expenditure and customer collections on a monthly basis.

This prevents discrepancies between actual project completion percentages and financial drawdowns that could trigger RERA violations.

4. Leverage Technology for Efficiency

Deploy digital tools including drone surveys for construction progress, geo-tagged material verification, and automated reconciliation software for multi-statutory compliance.

Use data analytics to identify patterns in vendor payments, cost escalations, and timeline deviations that require detailed investigation.

5. Adopt a Risk-Based & Project-Centric Approach

Prioritize audit focus based on project size, customer advance collections, timeline delays, and regulatory scrutiny levels.

Allocate maximum audit resources to high-risk projects with significant customer funds or potential RERA compliance issues.

6. Strengthen Documentation & Interviews

Maintain comprehensive audit trails with supporting documents for all transactions and conduct structured interviews with site engineers, project managers, and financial personnel.

Ensure all audit findings are backed by documentary evidence and stakeholder confirmations to withstand regulatory scrutiny.

7. Environmental and Safety Compliance Cost Tracking

Maintain separate audit trails for environmental clearance costs, safety compliance expenditures, and sustainability certifications.

This ensures proper cost allocation while demonstrating regulatory compliance to authorities and customers seeking green-certified properties.

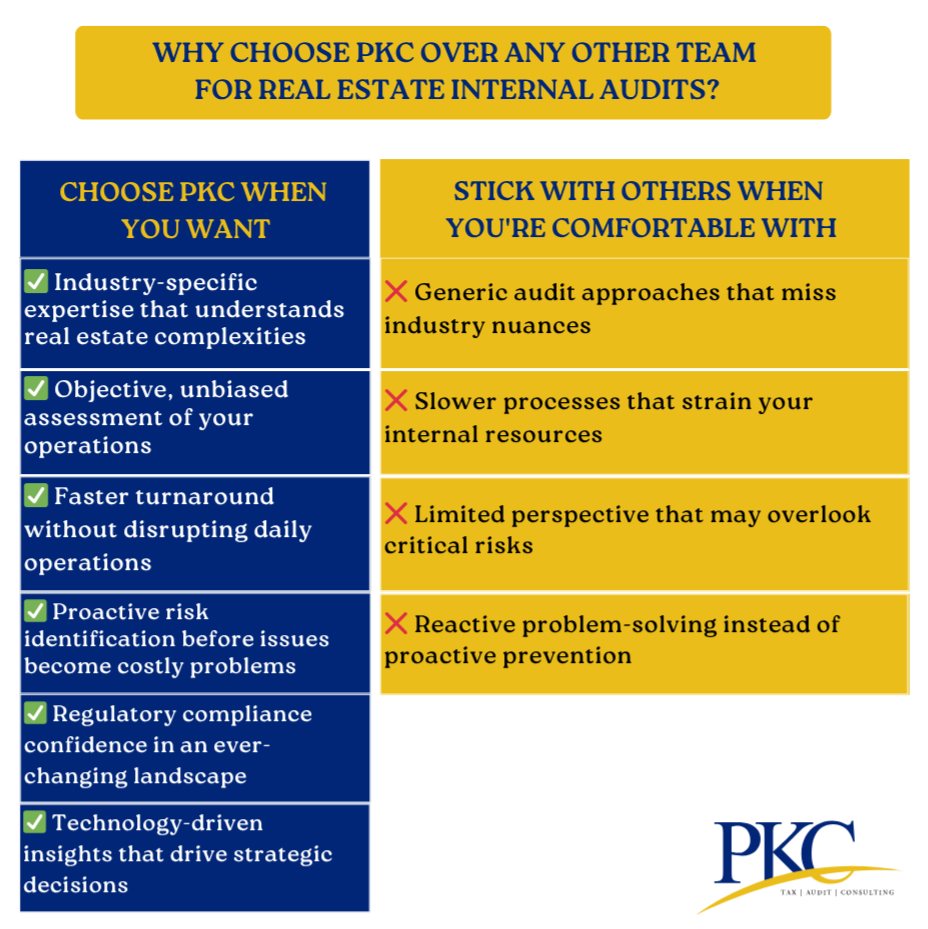

Why Choose PKC Over Any Other/ Internal Team for Real Estate Internal Audits?

The real estate industry is a complex ecosystem of regulations, transactions, and risks. Here’s why you need a partner like PKC to handle your internal audits:

Deep Real Estate Expertise

Unlike general audit firms, at PKC, we have dedicated real estate expertise spanning site management, construction processes, finance, and taxes—all integrated under one roof.

Fresh Eyes, Objective Insights

Your internal team knows your processes, but they’re too close to see the blind spots. We bring a fresh and objective perspective that uncovers what internal teams miss, delivering insights that drive real improvements.

Speed & Efficiency That Saves You Money

While your internal team juggles audit responsibilities with daily operations, PKC’s dedicated professionals focus solely on delivering results.

Comprehensive Risk Coverage

PKC doesn’t just check compliance boxes. We identify operational risks, financial irregularities, and process gaps that could cost you millions. Our risk assessment methodology is specifically designed for real estate’s unique risk profile.

Technology-Driven Insights

While others rely on traditional audit methods, PKC leverages advanced analytics and technology to provide deeper insights into your financial health, operational efficiency, and compliance status.

Partnership Approach

We measure our success based on our client’s success. We’re invested in enabling clients to realise their business aspirations.

Frequently Asked Questions

- What is an internal audit in real estate?

An internal audit is a detailed review of a real estate company’s finances, compliance, and operations to identify risks, fraud, and gaps. It ensures the business follows laws such as RERA, GST, and the Companies Act.

- 2. Is internal audit mandatory for real estate companies in India?

Yes, under the Companies Act 2013, certain real estate companies must conduct internal audits based on turnover and borrowing limits.

- How often should internal audits be done in real estate?

For real estate companies, the best practice is to conduct quarterly audits, especially for ongoing projects, to ensure real-time risk control.

- Who conducts internal audits in Indian real estate companies?

Internal audits for the real estate sector can be conducted by Qualified CAs, independent audit firms like PKC Management Consulting, or in-house audit teams typically conduct them.

- What are the penalties for internal audit failures in the real estate sector?

Non-compliance may lead to RERA fines, GST penalties, disqualification of directors, and loss of investor trust for real estate companies.

Expert verified

Expert verified