Internal audit documentation requirements in India are essential to understand for ensuring regulatory compliance, risk management, and transparency.

Explore with us these requirements, the laws behind it, the list and a quick internal audit documentation checklist to help you get ready.

Legal Framework for Internal Audit Documentation in India

The legal framework for internal audit documentation is based primarily on the following laws and mandates:

Companies Act, 2013:

Mandates internal audits for certain classes of companies.

Under Section 138, it clearly states that companies meeting certain criteria must appoint an internal auditor and maintain audit records to prove they’re doing their job.

These records must be made available to external auditors and regulatory bodies on request.

Securities and Exchange Board of India (SEBI) Regulations:

Impose additional documentation requirements for listed companies.

The SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, mandate that listed companies maintain comprehensive internal audit documentation to support their compliance with corporate governance norms.

Mandates:

- Proper audit trails

- Internal controls over financial reporting

- Evidence of compliance

Reserve Bank of India (RBI) Circulars (for Banks & NBFCs)

Govern internal audit documentation for banks and NBFCs (Non-Banking Financial Companies.

These require strong internal audit functions and require:

- Risk-based audit documentation

- Independent audit trails

- Records of internal control tests

RBI inspections often request these documents during on-site reviews.

Institute of Chartered Accountants of India (ICAI):

Issues the “Standards on Internal Audit” (SIAs), which set the professional and documentation standards for internal auditors across India.

Their standard SA 230: Audit Documentation outlines:

- What documents must be kept

- How to record audit evidence

- When and how to finalize documentation

- Retention period (typically 7 years)

Institute of Internal Auditors (IIA) Standards

Provide international best practices for audit documentation.

These specify requirements for documenting audit planning, fieldwork, and reporting phases.

Controller and Auditor General (CAG) and ICAI:

Both have issued manuals and guidelines for internal audit in government and public sector entities, emphasizing rigorous, documented, and reviewable audit trails.

Mandatory Documents Required in Internal Audits

Internal audits in India must follow strict documentation norms as mandated by the laws and governing authorities discussed above.

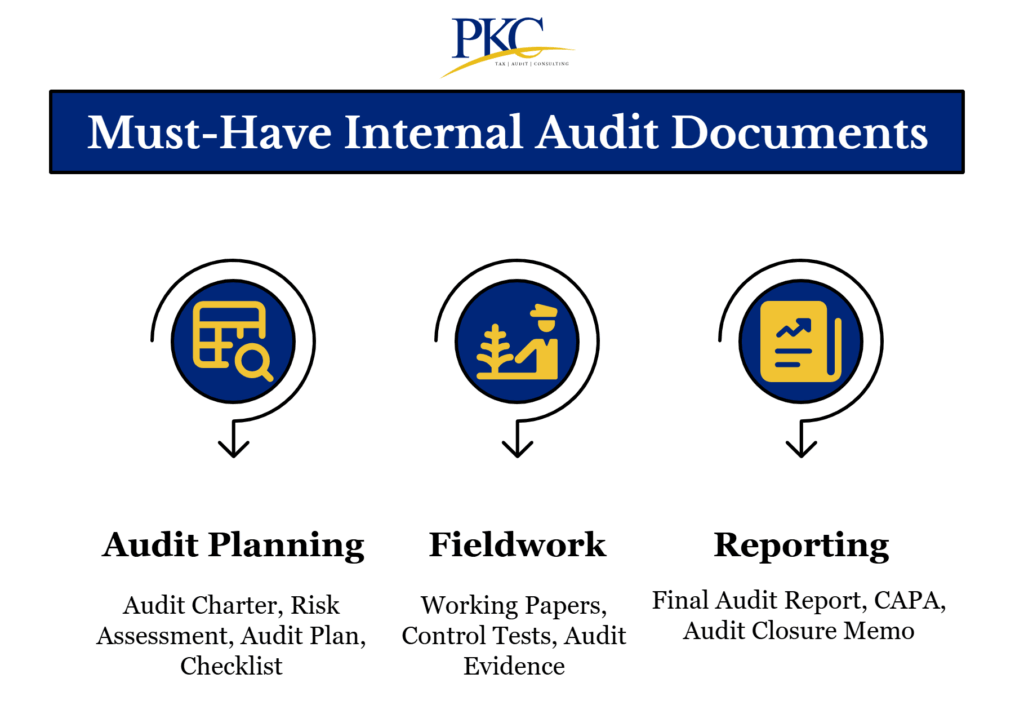

The mandatory documents are organized into three main categories based on the internal audit process.

I. Audit Planning

These documents lay the foundation of the audit. They help establish the scope and direction of the internal audit assignment:

📋 Annual Internal Audit Plan:

Outlines the planned audits for the year, including the business units, processes, and locations to be covered.

It must be approved by the Audit Committee and should align with the needs of the organization, regulatory expectations (e.g., Companies Act, 2013, SEBI), and assessed risks.

📋 Risk Assessment & Audit Universe

Identifies and ranks auditable areas based on risk factors such as materiality, complexity, and strategic importance.

It includes a risk assessment matrix with scoring methodologies, helping prioritize audits and ensure adequate risk coverage.

📋 Audit Committee Charter & Terms of Reference

Define the scope, authority, and independence of the internal audit function.

They also clarify the Audit Committee’s responsibilities in approving audit plans, reviewing results, and ensuring follow-up actions.

📋 Engagement Letter / Internal Audit Charter

Outlines the formal agreement for an audit engagement, specifying scope, objectives, roles, and responsibilities.

It ensures clarity between the auditor and auditee and reinforces independence and access rights.

📋 Audit Programs

Detailed procedures and checklists for each audit area, specifying tasks, responsible team members, and timelines.

They guide execution and ensure consistent, structured audits across different functions.

📋 Internal Audit Manual

A reference document that defines internal audit methodologies, sampling approaches, documentation standards, and reporting formats.

It ensures consistency in audit practices and compliance with professional standards (ICAI, IIA).

📋 Budget and Resource Allocation Documents

Demonstrate the internal audit function’s capacity to execute its mandate, showing allocation of staff, technology, and external experts.

They must reflect adequacy in relation to audit scope and comply with resource-related regulatory requirements.

📋 Understanding of the Entity

Documentation such as organizational charts, process flows, and industry background that shows the auditor’s familiarity with the entity’s environment.

This understanding supports risk identification and tailored audit planning.

📋 Planning Memos / Checklists

Supporting documents such as notes, templates, and questionnaires used during the planning phase of audits.

They provide evidence of thoughtful planning and alignment with audit objectives.

II. Fieldwork Documentation

These documents are related to executing the internal audit and gathering evidence. The mandatory documents usually include:

📜Working Papers and Audit Evidence

Records of procedures performed and evidence gathered, these documents support audit conclusions.

They should include contracts, ledgers, reconciliations, vouchers, confirmations, and analytical reviews, and meet ICAI standards for completeness and clarity.

📜Internal Control Evaluation Documentation

Captures the assessment of internal financial controls as required under Section 143(3)(i) of the Companies Act, 2013.

It must include testing results for both design and operational effectiveness, especially over financial reporting for listed entities.

📜Management Representation Letters

Formal letters from management that confirm their responsibilities and representations made during the audit.

Must cover disclosures of known frauds, internal control responsibilities, and acceptance of audit findings.

📜Exception and Findings Documentation

Detail all control weaknesses, deviations, or non-compliance issues identified during fieldwork.

Each exception should include its root cause, impact assessment, and the immediate response or corrective action by management.

📜Compliance Testing Records

Documentation proving that operations adhere to legal, regulatory, and internal policy requirements.

For regulated sectors like banking, this includes testing of KYC norms, AML practices, and other regulatory standards.

📜Evaluation Tools (Questionnaires, Flowcharts, and Checklists)

These tools support the assessment of business processes and internal controls.

They provide a structured approach for capturing control design, execution, and risk exposures.

📜Analytical Reviews and Summaries

Evaluations of account balances, trends, and variances used to identify unusual patterns or potential risk areas.

They form a key part of audit fieldwork and help corroborate or challenge other findings.

📜Meeting Notes and Interview Records

Document discussions with management and staff during the audit.

They serve as evidence of inquiries made and help support conclusions drawn from fieldwork.

📜Review Notes

Comments and observations by audit supervisors or partners on completed audit work.

These ensure quality control and compliance with professional audit standards.

📜Reconciliation Statements and Schedules

Supporting documents that explain mismatches or discrepancies identified during the audit.

They help validate the accuracy and completeness of financial and operational data.

📜MIS Reports and Progress Notes

Periodic reports prepared during the audit to update on status, highlight key issues, and track progress.

They are shared internally and with management to ensure timely attention to emerging concerns.

III. Reporting Documentation

These documents include all supporting papers that serve as the basis for the audit report, along with the reporting documents themselves:

📝Draft Audit Reports

Preliminary audit reports that summarize findings, management responses, and recommended corrective actions.

Shared with auditees for review and feedback before finalization, ensuring accuracy and completeness of audit communication.

📝Management Response Documentation

Formal written responses from management addressing each audit finding.

This includes agreement or disagreement, corrective action plans, responsible personnel, and implementation timelines, demonstrating accountability and commitment to remediation.

📝Final Audit Reports

The official audit report was shared with the Audit Committee and Board of Directors. It incorporates management responses and finalized recommendations.

These reports must adhere to prescribed regulatory formats and professional standards (e.g., SEBI, ICAI).

📝Audit Committee Presentation Materials

Detailed presentations used to communicate key findings, risk issues, and recommendations during Audit Committee meetings.

They ensure clarity and enable effective oversight, as required under Section 177 of the Companies Act, 2013.

📝Follow-up and Tracking Documentation

Records used to monitor the status of corrective actions taken in response to audit findings.

Include implementation tracking, verification checks, and closure confirmations to ensure timely and effective resolution.

📝Annual Internal Audit Summary Report

A comprehensive report that summarizes all internal audit activities for the financial year.

It highlights audit coverage, recurring issues, improvements in control environment, and recommendations for strengthening internal audit effectiveness.

📝Regulatory Filing Documentation

Includes records of audit-related communications submitted to regulatory authorities such as SEBI, RBI, or other oversight bodies.

Support external compliance and facilitate regulatory audits or inspections.

📝Report Distribution List

A log that tracks the recipients of draft and final audit reports, including names, titles, and dates of issuance.

It ensures proper communication and accountability in the reporting process.

📝Supporting Schedules and Annexures

Additional documents and evidence referenced in the audit report to support material findings.

These may include test results, control walkthroughs, and analysis used in forming conclusions.

📝Summary of Recommendations and Follow-up Documentation

A consolidated summary of key audit recommendations and their implementation status.

It also captures board or audit committee discussions on prior audit issues and ongoing resolution efforts.

📝Reporting Checklists

Checklists used by auditors to confirm that the audit report meets required quality standards.

These ensure the report is clear, fact-based, timely, and aligned with applicable professional guidelines.

How to Structure Internal Audit Documentation?

A standardized internal audit documentation system ensures that auditors, management, and regulators can easily locate information without ambiguity or wasted time.

Here are some pointers to help you stay on top of the documentation:

1. Establish a Clear Folder Hierarchy

Organize files by Year → Department → Audit Type for logical navigation.

Add timestamps (e.g.,Jan2025) to filenames for chronological sorting.

2. Organize by Audit Phases

Divide folders into three primary phases:

| Folder Name | Includes |

| 01_Planning | Audit plan, risk assessment, checklists |

| 02_Fieldwork | Working papers, control tests, observations |

| 03_Reporting | Draft/final reports, CAPA, closure documentation |

This aligns with expectations from regulators and reviewers.

3. Use Consistent File Naming Conventions

Apply a standardized naming format that includes Audit Area, Document Type, Date. Auditor and extension (pdf, png, etc.

Avoid generic or unclear names like Document(1).pdf or FINAL-final-v2.docx.

Examples:

- Finance_RiskAssessment_Jan2025_RMehta.xlsx

- HR_WorkingPaper_LeavePolicy_Auditor1.docx

4. Maintain a Document Index or Control Sheet

Create a centralized index of the internal audits documents. This speeds up reviews and improves audit traceability.

It should capture:

- Document Name

- Version Number

- Author

- Status (Draft/Final)

- Last Updated

- File Path or Link

5. Set Appropriate Access Permissions

Use secure platforms to control access:

- Google Drive

- SharePoint

- Zoho WorkDrive

- OneDrive

- AuditBoard

For security restrict editing rights, maintain view-only backups and store read-only versions for final reports

6. Consolidate Reviews and Approvals

Keep all review history within documents. Avoid relying on email chains. This will result in a clear, audit-ready approval trail.

Options:

- Add comments directly within the document

- Use digital signatures (DSC or Aadhaar eSign)

- Include a sign-off sheet in each audit phase folder

7. Archive Older Files Securely

ICAI recommends maintaining records for 7 years.

Organize archives year wise and use locked cloud folders or zip files for read-only access.

Checklist for Internal Audit Documentation in India

Here’s a simple yet comprehensive internal audit documentation checklist.

This can be customized based on organization size, industry, and specific regulatory requirements.

Common Mistakes in Internal Audit Documentation

These errors can cost you time, credibility, and even lead to legal trouble.

Inadequate Planning Documentation

- Risk assessments lack depth, scoring, and audit linkages, making them non-compliant.

- Generic audit programs are reused without tailoring to specific risks or regulations.

- Resource planning ignores audit complexity and skill needs, causing staffing gaps.

Poor Fieldwork Documentation Standards

- Working papers miss clear procedures, references, and reviewer sign-offs.

- Evidence sources, sampling, and results are not properly documented.

- Exceptions lack root cause, impact analysis, and management response.

- Control tests are missing or poorly documented, with no proof of effectiveness.

Reporting and Communication Deficiencies

- Reports are vague, lacking clear impact or actionable recommendations.

- Management responses lack corrective actions, timelines, and ownership.

- Issue tracking is incomplete, with missing resolution or delay reasons.

- Key audit committee meetings and approvals go undocumented.

Systemic Documentation Problems

- No standard templates or procedures, reducing audit consistency and quality.

- Missing reviewer comments, sign-offs, and oversight documentation

- Disorganized files lack structure, cross-referencing, and searchability.

- Required compliance records are missing or incomplete.

Technology and Data Management Issues

- No access controls, versioning, or audit trails in place.

- Audit data isn’t validated, sourced, or checked for accuracy.

- No backup or disaster recovery plans for audit files.

Frequently Asked Questions

1. What is internal audit documentation?

Internal audit documentation is a set of records that shows the planning, execution, findings, and reporting of an audit. It’s required under Indian laws like the Companies Act, 2013 and ICAI standards.

2. What are the key documents needed for an internal audit?

Documents include the audit plan, risk assessments, checklists, working papers, findings reports, and management’s corrective action plans. These form the audit trail and are legally required.

3. Who can access internal audit documentation?

Only authorized personnel like internal auditors, audit committee members, and regulators (SEBI, RBI, MCA) can access audit files. Proper access controls must be in place to protect confidentiality.

4. Are digital audit documents legally valid in India?

Yes, digital audit files are accepted if they are secured, backed up, and signed using valid digital signatures or eSign methods as per Indian IT laws.

5. What happens if audit documentation is incomplete or missing?

Incomplete documentation can result in failed audits, penalties, or regulatory action. It may also weaken a company’s defense in case of fraud or legal investigation.

6. Can audit documentation be outsourced or managed by a consultant?

Yes, many companies outsource audits to CA firms or consultants like PKC Management Consulting.

Expert verified

Expert verified