Receiving a notice of income tax scrutiny under Section 143(2) can lead to anxiety, but more often than not, it can be resolved quickly.

In this guide, we’ll explain what Section 143(2) of Income Tax Act means, what it contains, how to respond and your rights as a taxpayer.

Section 143(2) of the Income Tax Act Explained

Section 143(2) is a provision in the Indian Income Tax Act that allows the Income Tax Department to scrutinize your Income Tax Return (ITR).

This notice is sent after you file your ITR if the tax department finds something unusual or wants to verify details.

Getting this notice doesn’t mean you’ve done something wrong. It’s just the department doing a deeper check on your return.

Also Read:

Common Reasons for Income Tax Scrutiny Notice in India

Key Considerations of Scrutiny Notice Under Section 143(2)

- Notice Timing: A notice under Section 143(2) can only be issued within 3 months after the end of the financial year in which the return was filed. For example, if you file your return for FY 2024-25 by July 31, 2025, the notice must be issued by June 30, 2026.

- Scrutiny Process: The notice signals that your return has been selected for detailed assessment or scrutiny. You (or your representative) are required to appear before the assessing officer, present your arguments, and submit supporting documents.

- Outcome: After considering your submissions, the assessing officer will pass an order under Section 143(3), confirming the final tax payable or refundable.

- Non-Compliance: Ignoring the notice can lead to penalties, prosecution, and assessment based on best judgment, which may increase your tax liability

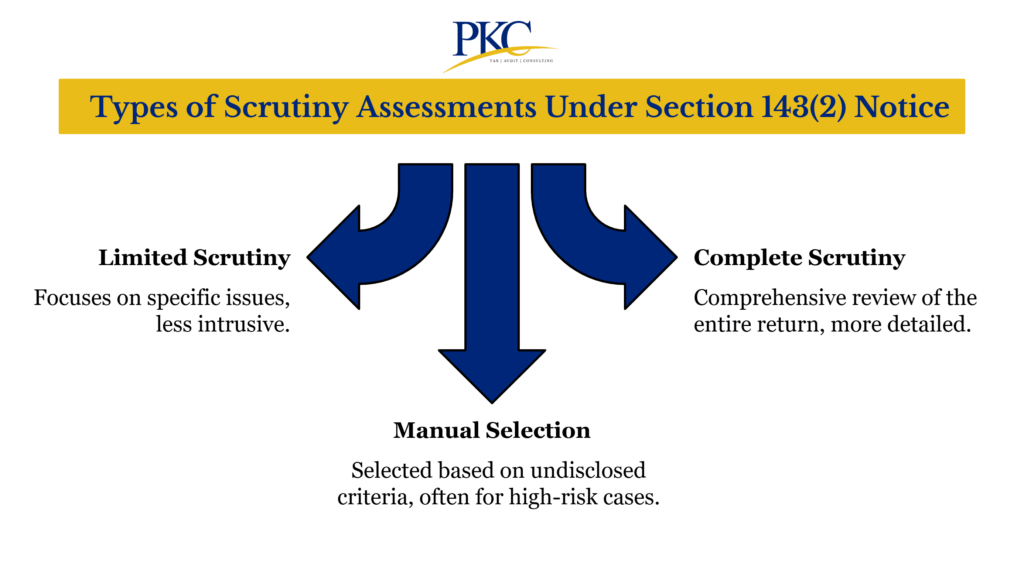

Types of Scrutiny Assessments Under Section 143(2) Notice

There are generally three main types of scrutiny assessments that can be triggered, as outlined below:

Limited Scrutiny

A limited scrutiny is the lighter version of scrutiny. It is a computer-assisted scrutiny selection (CASS) where only specific issues or areas in your return are examined.

The scope is restricted to the particular issue mentioned in the notice. The assessing officer cannot go beyond the listed issues without approval from higher authorities.

Examples:

- A mismatch between Form 26AS and ITR

- High refund claim that looks suspicious

- Salary income declared doesn’t match TDS data

Complete Scrutiny

This is the full and detailed examination of your return – usually longer and more complex. Here, the entire return is thoroughly reviewed.

It is usually triggered through CASS, but the examination is comprehensive rather than limited to a specific area. All claims, deductions, exemptions, and income sources are verified.

It can happen if:

- You have multiple red flags

- High-value transactions across accounts

- Random selection under CASS (Computer Assisted Scrutiny Selection)

- Business owners or professionals with inconsistent income patterns

Manual Selection

In this type, cases are selected manually by the tax authorities based on pre-defined criteria set by the Central Board of Direct Taxes (CBDT).

The reasons and parameters for selection may vary each year and are not necessarily disclosed to the taxpayer

It is less common and happens in high-risk or complex cases, like:

- Foreign transactions

- Undisclosed assets

- Large unexplained income

What Does a Section 143(2) Notice Contain?

A notice under Section 143(2) typically is usually issued in PDF format and sent via email or the income tax portal.

It is specific to the assessment year for which the return was filed and contains the following elements:

Reference to Your ITR:

The notice will mention the Assessment Year and the Acknowledgment Number of your Income Tax Return.

This is how they match the notice to your filed return.

Reason for Scrutiny:

It might mention why your return is under scrutiny. This is usually due to discrepancies or mismatches found in your filed return or supporting documents.

They may include high deductions, mismatch in income, or large transactions. Sometimes, it’s random selection (called CASS).

Request for Documents:

It asks you to produce documents, records, or evidence in support of deductions, exemptions, allowances, reliefs, or any loss claimed in your return

They may be income receipts, Form 16 or Form 26AS, investment proofs or property transaction details.

Deadline to Respond:

The notice will also give you 15 to 30 days to respond.

Ignoring this deadline can lead to a penalty or legal action.

Mode of Response:

It outlines the procedure for responding.

This may include submitting documents in person or uploading them electronically, depending on the mode of the notice

Date and Place of Hearing:

The notice specifies the date, time, and venue (often the AO’s office) where you or your representative are required to appear and present your case.

Legal Consequences:

The notice may mention the consequences of non-compliance.

These may be penalties, prosecution, or a best judgment assessment under Section 144 if you fail to respond

Details of Assessing Officer

Includes the name, designation, and contact info of the officer handling your case.

How Can PKC Help With A Section 143(2) Scrutiny Notice?

✅Strategic response framework minimizes business tax liability

✅Experts dedicated to comprehensive scrutiny defense

✅Round-the-clock support throughout entire assessment process

✅Appeal preparation included with minimal additional liability

✅Complete handholding from notice to assessment closure

✅Specialized faceless assessment procedure management for businesses

✅Advanced documentation strategies prevent assessment additions

✅Expert representation reduces scrutiny duration by 40%

Documents Commonly Requested in a 143(2) Scrutiny

When you receive a notice under Section 143(2), the Assessing Officer requests specific documents to verify the details and claims .

Commonly requested documents include:

1. Financial Records

- Books of Accounts: Ledgers, cash/bank books, journal entries, trial balance

- Financial Statements: P&L, Balance Sheet (as of 31st March), Cash Flow (if applicable)

- Audit Reports: Tax Audit (3CA/3CB), Statutory Audit, Cost/Internal Audit (if applicable)

2. Income-Related Documents

- Revenue Records: Sales/purchase registers, invoices, delivery challans, GST returns, export/import docs

- Investment Income: Bank statements, interest/dividend certificates, capital gains, mutual fund/Demat statements

- Other Income: Rent agreements, professional/consultancy income, commissions, other support docs

3. Deductions & Exemptions

- Salary Proofs: Form 16, salary slips, PF, gratuity, perquisite details

- Investment Proofs (80C/80D etc.): LIC, ELSS, PPF, NSC, FDs, home loan/health insurance, medical bills

- House Property: Ownership papers, tax receipts, loan interest, rent/renovation records

4. Business-Specific Documents

- Manufacturing/Trading: Stock/inventory records, production logs, raw material consumption, GST/excise returns

- Services: Contracts, completion certificates, qualification proofs, GST compliance

- Expenses: Rent, utilities, vehicle/travel logs, staff salary, professional fees, ads, maintenance

5. Statutory & Compliance

- Tax Compliance: ITRs (last 3–4 years), assessment orders, advance tax, TDS/TCS certificates

- Regulatory: ROC filings, GST returns, professional tax, PF/ESI, trade license

- Banking/Financial: Account KYC, loan docs, credit card (if business use), FDRs, forex transactions

6. Supporting & Digital Records

- Legal/Contracts: Partnership deed, MOA/AOA, POA, legal opinions, court orders, insurance claims

- Miscellaneous: Asset valuations, survey/search docs, tax correspondence, CA workings, computations

- Digital: Business emails, e-payment records, online bank/e-comm statements, DSCs

Responding to a 143(2) Income Tax Scrutiny Notice

Responding to an income tax scrutiny notice requires a step by step approach.

You can read here the complete step by step approach on how to respond to income tax scrutiny notice in India.

Here’s a quick overview:

- Read the Notice Carefully: Confirm your details – PAN, Assessment Year, and Assessing Officer. Understand the reason for the notice and note the deadline for response.

- Log in to the Income Tax Portal: Log in using your PAN, password, and any required OTP. Ensure you access the correct taxpayer dashboard.

- Go to ‘Pending Actions’ or ‘e-Proceedings’: Locate the specific scrutiny notice under the relevant assessment category.

- Prepare Your Documents: Gather all documents that support your case. Organize them according to the issues raised in the notice.

- Upload and Submit Response: Upload scanned copies (PDFs) of all required documents via the portal in the specified format. If an in-person visit is requested, carry original documents for verification.

- Use Help from a Tax Professional: If you’re unsure how to proceed or the case is complex, consult a Chartered Accountant. They can help draft your response or represent you before the tax authorities.

- Wait for Further Instructions: After submission, the Assessing Officer will review your documents. You may receive an acceptance, a request for more info, or a notice for further scrutiny under Section 143(3).

Rights of the Taxpayer During Scrutiny

Taxpayers undergoing scrutiny under Section 143(2) have specific rights to ensure fairness and transparency in the assessment process.

Here’s a look at them:

Right to Representation

Taxpayers can appoint a qualified representative (like a CA) to handle scrutiny proceedings. They also have the right to explain and justify their return through evidence and arguments.

Right to Fair Treatment

Tax authorities must follow due process, treating taxpayers respectfully and without harassment, as per the Taxpayers’ Charter.

Right to Due Process

Scrutiny notices must be issued within 3 months after the end of the financial year, or they can be challenged. Notices must clearly state the reason for scrutiny and list the required documents.

Right to Challenge Flaws

Taxpayers can contest defective or jurisdictionally incorrect scrutiny notices, provided they continue cooperating with the process.

Right to Appeal

If unhappy with the assessment outcome, taxpayers can appeal to the Commissioner (Appeals) or escalate to higher tribunals for resolution.

Right to Confidentiality

All your tax data and personal financial information must be kept confidential by the tax department. They can’t share your details with anyone unless legally required.

Consequences of Ignoring a Section 143(2) Notice

Ignoring a notice under Section 143(2) of the Income Tax Act can lead to several serious consequences:

- Penalties: You may be subject to a penalty of ₹10,000 for each failure to respond under Section 272A.

- Best Judgment Assessment(Section 144): The Assessing Officer can complete the assessment using available information, which often results in higher tax liability.

- Interest on Tax Dues: If the final assessment increases your tax liability, you’ll be charged interest under Section 234A/B/C.

- Future Scrutiny Risk: Your likelihood of being selected for future scrutiny or audit increases, as non-compliance is noted in your tax record.

- Legal Action: Prolonged non-compliance may lead to prosecution or further legal proceedings.

Frequently Asked Questions

- What is a Section 143(2) notice?

It’s a notice from the Income Tax Department to scrutinize your return after it has been processed. They want to verify certain details, documents, or claims you’ve made.

- Does getting a Section 143(2) notice mean I’m in trouble?

No, it doesn’t mean you’re guilty of anything. It just means your return has been selected for further review.

- What’s the difference between limited and complete scrutiny?

Limited scrutiny focuses on specific issues mentioned in the notice. Complete scrutiny covers your entire income tax return and all financial details.

- Can I challenge the assessment order later?

Yes, if you disagree with the assessment, you can appeal to the Commissioner (Appeals) or go to the Income Tax Appellate Tribunal. You have a right to challenge incorrect or unfair decisions.

Expert verified

Expert verified