Understanding GST applicability on professional services is essential to stay within the purview of the law.

Explore with us all you need to know about GST for professionals in India, its applicability, services included, exceptions, claiming refunds and more.

What is Professional GST?

Professional GST refers to the Goods and Services Tax (GST) applicable to professional services offered by individuals or entities such as

These can include consultants, lawyers, architects, CAs, IT professionals, designers, digital marketers, and other knowledge-based service providers.

Although the term “Professional GST” is not formally defined under GST law, it is widely used to describe GST compliance obligations for service providers across professional domains.

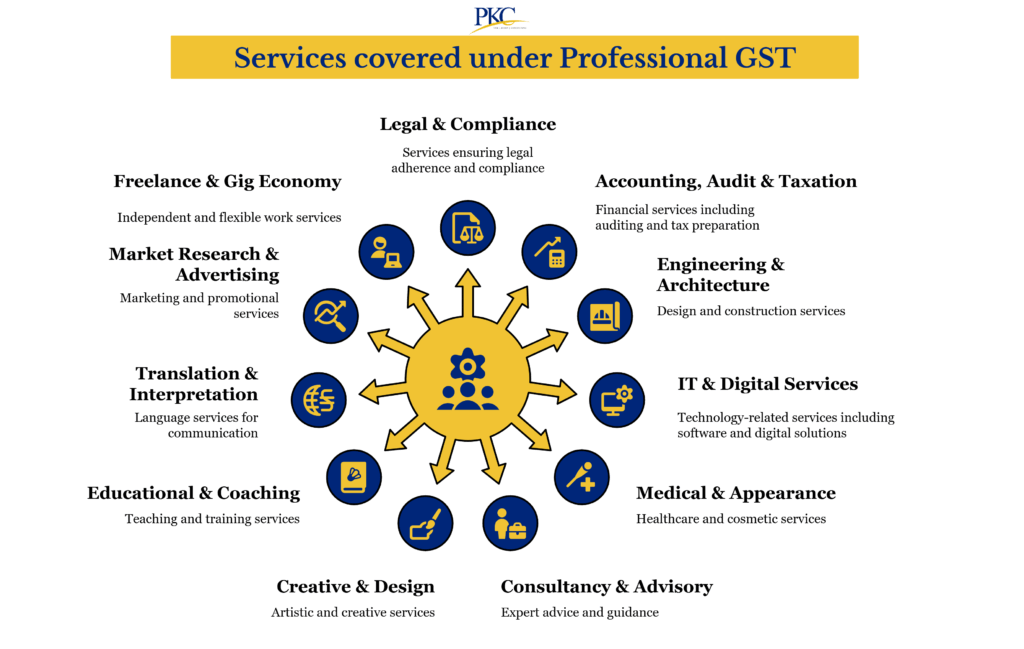

What Services Are Covered Under Professional GST?

Professional GST applies to a wide range of fee-based, intellectual, or specialized services, including:

1. Legal and Compliance Services

- Legal consultation and advisory

- Drafting of legal documents

- Representation in courts, tribunals, and arbitration

- Company secretary services

2. Accounting, Audit, and Taxation Services

- Chartered accountants (CAs)

- Cost accountants

- Bookkeeping and payroll services

- Tax filing and GST compliance support

- Financial consultancy and auditing

3. Engineering and Architectural Services

- Civil, mechanical, and electrical engineering consultancy

- Architecture and interior design

- Urban planning, land surveying, and landscape architecture

- Construction project supervision and design validation

4. Information Technology (IT) and Digital Services

- Software development and system integration

- Web and app design

- IT consultancy and technical support

- Cybersecurity and data management

- Digital marketing and SEO services

5. Medical and Appearance-Related Services

- Cosmetic surgery, hair transplant, and dermatological aesthetic treatments

- Dental cosmetic procedures

Exemptions: General healthcare services provided by hospitals, clinics, or individual practitioners (e.g., diagnosis, preventive care, surgery for medical conditions) are exempt from GST.

6. Consultancy and Advisory Services

- Management consulting (strategy, HR, operations)

- Financial and investment advisory

- Business process consulting

- Scientific and technical consulting

- Environmental and sustainability consulting

7. Creative and Design Services

- Graphic design, UI/UX, and industrial design

- Fashion design and textile consulting

- Film direction, acting, editing (non-exempt categories)

- Photography and videography (non-personal)

8. Educational and Coaching Services

- Private tutoring and exam coaching

- Corporate training, skill development, and executive education

- Online educational platforms and test prep services

Exemptions: Services provided by recognized educational institutions that lead to a qualification recognized by law (e.g., schools, colleges, universities) are exempt.

9. Translation, Interpretation, and Language Services

- Professional translation and language interpretation

- Content localization and transcription

- Language consulting for corporate or media use

10. Market Research and Advertising Services

- Market surveys and data analysis

- Consumer research and insights

- Branding and ad campaign management

- Sponsorship and brand placement consulting

11. Freelance and Gig Economy Services

- Content writing, blogging, copywriting

- Social media management and influencer marketing (taxable if for commercial gain)

- Voice-over artists and podcast editors

- Online freelance services on platforms like Upwork, Fiverr, Freelancer

Important: GST applies when freelancer’s turnover exceeds the threshold or if services are provided inter-state or through online platforms/e-commerce operators.

GST Exemptions & Special Considerations

| Service Type | GST Applicability |

| General healthcare by doctors/hospitals | Exempt |

| Education by recognized institutions | Exempt |

| Cosmetic medical services | Taxable |

| Legal services to business entities | Taxable under Reverse Charge Mechanism |

| Coaching centers & private tuition | Taxable if not part of recognized curriculum |

| Freelance creative work (non-commercial) | May be exempt (case-specific) |

GST on Professional Services: Applicability, Threshold & Rates

Here’s a look at its applicability, threshold and rates of GST for professionals in India:

Applicability of GST on Professional Services

GST applies to individuals and entities providing taxable professional services for a fee. The comprehensive list of services included is given above.

GST applies when the professional:

- Is registered under GST, OR

- Is mandatorily required to register (e.g., interstate supply), OR

- Falls under Reverse Charge Mechanism (RCM) cases.

GST Registration Threshold for Professionals

Professionals must register under GST if their annual turnover exceeds:

- ₹20 lakh for most states in India.

- ₹10 lakh for special category states (North-East, hill states).

Mandatory registration also applies if:

- They supply services interstate (even if turnover is below the threshold).

- They fall under specific notified categories.

- Voluntary registration is allowed, which lets professionals claim Input Tax Credit (ITC).

Example:

- A freelance software developer in Bangalore earning ₹22 lakh/year must register for GST.

- An advocate providing legal services only within Maharashtra earning ₹12 lakh/year is exempt unless the client falls under RCM.

| Category | Annual Turnover Threshold | GST Registration? |

| Normal states | ₹20 lakh | Mandatory if exceeded |

| Special category states (NE, hilly) | ₹10 lakh | Mandatory if exceeded |

| Inter-state service supply | No threshold | Mandatory |

| Through e-commerce platform | No threshold | Mandatory |

| Reverse charge liability | Any amount | Mandatory |

| Below threshold | Voluntary option | Optional (enables ITC) |

GST Rates Applicable on Professional Services

Standard GST rate for most professional services: 18% (9% CGST + 9% SGST for intra-state, or 18% IGST for inter-state supply).

In RCM cases, the GST rate still applies (usually 18%), but the recipient pays it.

| Service Type | GST Rate | Tax Payment Mode |

| Accounting, auditing, tax services (CA) | 18% | Forward charge |

| Legal services (individual or firm) | 18% | RCM applies if recipient is a business |

| IT consulting, software development | 18% | Forward charge |

| Architectural/engineering design services | 18% | Forward charge |

| Freelancing (e.g., writing, design) | 18% | If registered |

| Cosmetic medical services | 18% | Appearance-related services are taxable |

Who Pays GST on Professional Services?

The liability to pay GST can either lie with the service provider or shift to the service recipient, depending on:

- nature of the service

- parties involved

- registration status under GST

Before delving into the details, here’s a quick look at who is liable to pay GST:

| Provider Status | Recipient Status | Who Pays GST? |

| Registered | Any client | Provider |

| Unregistered | GST-registered business | Recipient (RCM) |

| Unregistered | Consumer/unregistered | No GST |

| Advocate/Law firm | Business entity | Recipient (RCM) |

| Doctor/Hospital | Patient | No GST |

General Rule: Service Provider Pays GST (Forward Charge Mechanism)

The professional or business providing the service, if registered under GST, is responsible for charging and remitting GST to the government.

Applies When:

- The service provider is registered under GST.

- Their annual aggregate turnover exceeds the threshold discussed above

- The service is not subject to Reverse Charge Mechanism (RCM).

How It Works:

- The professional adds 18% GST to the invoice (usually 9% CGST + 9% SGST or 18% IGST for inter-state supply)

- The client pays both the service fee and the GST

- The service provider files GST returns and remits the collected tax

Examples:

- An IT consultant charging a domestic client for software implementation

- An architect invoicing a private individual for house design.

Special Case: GST on Professional Services under RCM – Client Pays GST

Under the Reverse Charge Mechanism (RCM), the responsibility to pay GST shifts from the service provider (professional) to the recipient (client).

So, instead of the professional charging GST on the invoice, the client calculates and pays the tax directly to the government.

Applies to:

RCM mechanism is not applicable to all professional services, but only to specific situations notified by the government:

- Legal Services: When a lawyer or law firm provides services to a GST-registered business, the business, and not the lawyer, is required to pay GST under RCM.

- Professional services by unregistered persons to registered businesses: When services are received from an unregistered professional by a GST-registered entity, the recipient pays GST if such services fall under a category where RCM is mandated.

- Services provided by company directors or partners: When they provide services to their own company or firm, the company is liable to pay GST under RCM

How It Works:

- The professional issues an invoice without GST, stating that RCM applies

- The client calculates and pays GST directly to the government

- The client can claim Input Tax Credit (ITC) on the GST paid under RCM

Example: A law firm provides legal consultation to a GST-registered company. The company pays the applicable GST directly to the government under RCM.

Input Tax Credit (ITC) for Professional Service Providers

The Input Tax Credit (ITC) mechanism under GST enables professionals to reduce their net GST liability.

This can be done by claiming credit for the GST paid on inputs and eligible business expenses used to deliver taxable services.

This mechanism ensures there is no tax on tax (cascading), and it keeps your services more competitively priced.

Which Professionals Can Claim ITC: Eligibility and Conditions

To claim ITC, the professional must:

- Be registered under GST

- Use the goods or services exclusively for business purposes

- Possess a valid tax invoice or debit note from a GST-compliant supplier

- Ensure the supplier has filed their GST returns and paid tax to the government

- Claim the credit through their own GST returns (usually GSTR-3B)

- Pay the supplier within 180 days of the invoice date (else ITC must be reversed temporarily).

Common Business Expenses Eligible for ITC

Professional service providers can claim ITC on the GST paid for a variety of business-related expenses, including:

- Office Rent & Utilities: GST paid on rented office space, electricity, and internet bills.

- Technology & Equipment: Computers, laptops, printers, and other hardware used in professional work.

- Software Subscriptions: Cloud-based tools, accounting platforms, project management software, etc.

- Professional Services: Legal, accounting, marketing, or consultancy services used in business.

- Marketing & Advertising: Digital ads, website design, SEO services.

- Travel & Accommodation: GST paid on hotels, airfare, and taxis used for business travel.

- Office Supplies: Stationery, printer ink, packaging, and consumables.

- Repairs & Maintenance: For office equipment or leased properties.

Blocked Credits (Ineligible ITC Under Section 17(5))

Not all business expenses are eligible for ITC. Common restrictions include:

- Personal Use: Items used for both personal and business purposes are not eligible (e.g., smartphones, cars).

- Food, Beverages & Entertainment: Unless used in the same line of business (e.g., catering services).

- Club/Gym Memberships: Except when mandated under employment law.

- Motor Vehicles: ITC disallowed for vehicles used to transport people (capacity ≤13), unless used for training or transportation services.

- Health Insurance, Gifts & Free Samples: Unless required under statutory obligations.

- Exempt Services: If a professional provides GST-exempt services (e.g., patient care by doctors), no ITC is allowed on inputs used for those services.

ITC Reversal: When Do You Need to Reverse Claimed Credit?

You must reverse ITC if:

- Payment is not made to the supplier within 180 days.

- Inputs are used for personal consumption or for exempt supplies.

- You switch from regular GST to the Composition Scheme.

- There’s a change in the usage of goods or services (from business to personal/exempt use).

Partial Reversal Formula applies when goods/services are used for both taxable and exempt supplies.

How and When to Claim ITC: Step By Step Process for Professionals

- Ensure valid invoice: Must include GSTIN, tax amount, and description

- Verify supplier filing: Check GSTR-2B (auto-generated ITC statement) to confirm that your supplier has uploaded the invoice

- Claim in GSTR-3B: Input eligible ITC under the appropriate section

- Maintain documentation: Keep all tax invoices and proof of business use for at least 6 years

- Deadline: Claim ITC before:

- Due date of the September return following the end of the financial year, or

- Date of filing the annual return, whichever is earlier.

Profession-Specific ITC Examples

| Professional | Claimable ITC | Blocked ITC |

| Lawyer | Legal databases, research tools | Vehicle expenses, gifts |

| Architect | CAD software, design tools | Client hospitality costs |

| CA | Audit tools, compliance software | Staff welfare gifts |

| Consultant | CRM tools, office rent | Personal travel costs |

| Doctor (for taxable services) | Equipment used in OPD (corporate clients) | Patient-care inputs (for exempt services) |

ITC and the Composition Scheme

If a professional opts for the Composition Scheme (available for turnover up to ₹50 lakh), they cannot claim ITC on any purchases.

Also, they are not allowed to charge GST on invoices and must pay tax at a lower flat rate from their own margin.

Key Compliance Obligations for GST Registered Professionals

As a professional, registering under GST comes with several legal and procedural responsibilities.

Here’s an overview of the key GST compliance duties:

1. Mandatory GST Registration

- Exceed the turnover limit

- Provide interstate services, sell online, or offer services to foreign clients.

- Fall under mandatory GST registration criteria, such as being liable under RCM

You can also voluntarily register even below the threshold, to avail ITC and enhance your professional image.

2. Issue GST-Compliant Invoices

Must issue a tax invoice for taxable services. The invoice must include:

- GSTIN of service provider and recipient (if registered)

- Unique invoice number and date

- Description of service provided

- SAC code (Service Accounting Code)

- Value of service and applicable GST rate (usually 18%)

- Tax breakup (CGST + SGST or IGST)

- Total invoice value

If under Composition Scheme or providing exempt services, you must issue a Bill of Supply instead of a tax invoice (no GST charged).

For RCM scenarios, clearly mention: “Tax payable under reverse charge.”

3. Charge the Correct GST Rate

- Most professional services = 18% GST.

- Intra-state services = 9% CGST + 9% SGST.

- Inter-state services = 18% IGST

4. File GST Returns Timely

Common returns for professionals:

- GSTR-1: Monthly or quarterly statement of outward supplies (sales/invoices)

- GSTR-3B: Monthly summary return for tax liability and ITC claim

- GSTR-9: Annual return (mandatory if turnover exceeds ₹2 crore)

Small professionals (turnover ≤ ₹5 crore) may opt for the QRMP scheme: Quarterly Return filing with Monthly Payment of taxes.

5. Pay GST to the Government

- Deposit collected GST after adjusting ITC

- Payment is generally due by the 20th of the following month (for GSTR-3B).

Late payment leads to:

- Interest at 18% p.a.

- Late fees (₹50/day or ₹20/day for nil returns)

6. Maintain Proper Books and Records

Must keep comprehensive records for at least 6 years from the due date of the annual return.

Records to maintain:

- GST invoices (issued and received)

- Bills of supply, credit/debit notes

- Tax payment records

- ITC register

- RCM transactions

- Any stock register (if applicable)

These records are essential during audits, assessments, or notices from GST authorities.

7. RCM Compliance

You (the recipient) must pay GST directly if RCM is applicable. In such cases, you must:

- Self-assess and pay GST

- Report it in your returns

- Claim ITC (if eligible) after payment

8. Avail ITC Appropriately

You can claim ITC on GST paid on business-related expenses (office rent, software, marketing, etc.), but only if you meet the conditions

9. Stay Compliant to Avoid Penalties

Regular compliance protects your business from unnecessary legal trouble and ensures smooth operations.

Common non-compliance consequences include:

- Late filing penalty

- Interest on late payment

- Show-cause notices for incorrect returns, ITC mismatches, or underreporting

10. Other Legal Duties

- E-Invoicing: Mandatory for professionals with turnover over ₹5 crore.

- GSTIN Display: Must be displayed prominently at your office and on official documents.

- Amendments: Any change in business details (address, email, partners, bank) must be updated on the GST portal within 15 days.

How to Calculate GST on Your Professional Invoices With Examples

Here are three examples that’ll help you understand GST for professional services:

Example 1: Intra-state Supply (CGST + SGST)

A freelance consultant (registered under GST) based in Mumbai, provides services to a client also based in Mumbai.

- Fee: ₹50,000

- GST Rate: 18% (split into 9% CGST and 9% SGST)

Since both the service provider and the client are in the same state, Central and State GST are applied.

Calculation:

- CGST = 9% of ₹50,000 = ₹4,500

- SGST = 9% of ₹50,000 = ₹4,500

- Total GST = ₹9,000

- Total Invoice Amount = ₹59,000

Example 2: Interstate Supply (IGST)

A graphic designer registered in Karnataka provides design services to a client located in Chennai.

- Fee: ₹80,000

- GST Rate: 18% IGST

Since the service is provided from one state to another, Integrated GST (IGST) is applicable.

Calculation:

- IGST = 18% of ₹80,000 = ₹14,400

- Total Invoice Amount = ₹94,400

Example 3: RCM – Legal Services to a Business

A corporate firm in Hyderabad hires a lawyer (registered under GST) for legal consultation. Legal services provided to businesses are notified under RCM.

- Fee: ₹1,00,000

- GST Rate: 18% (applicable under RCM)

Under RCM, responsibility to pay GST shifts from the service provider (lawyer) to the recipient (business client).

The lawyer issues an invoice without charging GST, and the recipient pays the tax directly to the government.

Calculation:

- GST to be paid by recipient = 18% of ₹1,00,000 = ₹18,000

- Lawyer’s invoice remains ₹1,00,000 (no GST shown)

- Business accounts for ₹18,000 as both input tax and output tax in their GST return

Export of Professional Services and GST Exemption

Export of professional services under GST is treated as a zero-rated supply. This allows professionals to claim ITC on business expenses.

To qualify, services must meet conditions including foreign payment and distinct client entity. Exporters can either:

- Export without IGST under LUT/bond and claim ITC refund, or

- Export with IGST, pay tax, then claim refund

- GST registration mandatory, regardless of turnover.

Also Read: GST on Goods & Services Explained

FAQs about GST Applicability on Professional Services

1. Is GST registration mandatory for professionals?

Yes, GST registration is mandatory if your annual turnover crosses ₹20 lakh (₹10 lakh in special category states). It is also compulsory if you provide interstate services or fall under specific notified categories.

2. What is the GST limit for professional services?

The GST registration threshold is ₹20 lakh for most states in India. For North-Eastern and special category states, the limit is ₹10 lakh.

3. Is consultancy fees GST free?

No, consultancy fees are generally taxable under GST at 18%. Only certain government-notified exemptions, like specific education or healthcare consultancy, are GST-free.

4. Do freelancers have to pay GST?

Yes, freelancers must pay GST if their turnover exceeds the threshold or they provide interstate services. Voluntary registration is also possible to claim Input Tax Credit (ITC).

5. Are accountant fees GST free?

No, accountant and audit fees attract 18% GST. They are taxable unless specifically exempted by the GST law.

6. What is the limit for 194J professional services?

TDS under Section 194J applies if total payments to a professional exceed ₹30,000 in a financial year. The standard TDS rate is 10%, separate from GST obligations.

Expert verified

Expert verified