Determining the optimal frequency of internal audit is essential for proactive risk management.

Explore the variables that dictate audit frequency, from industry regulations to business complexity. Discover how to strike the right balance.

Factors Influencing the Frequency of Internal Audits in India

The frequency of internal audits in India is influenced by several factors, including:

Regulatory and Statutory Requirements

The frequency of internal audits for businesses is hugely impacted by regulatory requirements.

- Companies Act, 2013: Mandates internal audits for certain classes of companies (e.g., listed companies, large unlisted public/private companies).

- SEBI Regulations: Listed companies must comply with stricter audit requirements, including quarterly reviews.

- RBI Guidelines: Banks, NBFCs, and financial institutions must conduct frequent internal audits due to high regulatory scrutiny.

- Tax Laws (GST, Income Tax): Businesses may require periodic audits to ensure compliance.

- Sector-Specific Regulations (e.g., Insurance, Pharma, Telecom): Some industries have stricter audit frequency norms.

Size & Complexity of the Organization

The size of business operations and processes directly impact the number of audits needed.

- Larger companies with more complex operations: More frequent internal audits to ensure effective risk management, compliance, and governance.

- Small and Medium Enterprises (SMEs): Fewer audit requirements due to a simpler organizational structure and lower risk exposure.

Business Risks & Control Mechanisms:

Companies in high-risk industries or those with higher exposure to financial, operational, or reputational risks are likely to conduct internal audits more frequently to manage these risks.

- High-Risk Industries (Banking, Finance, Healthcare): Require more frequent audits (e.g., monthly/quarterly).

- Fraud & Compliance Risks: Companies with past fraud incidents may increase audit frequency.

- Cybersecurity Threats: IT companies may conduct frequent IT audits.

- Robust internal controls: Require less frequent audits, as compared to those with companies with weaker control environments

Internal Audit Resources & Budget

The availability of resources (time, budget, and personnel) plays a crucial role in determining how often internal audits can be conducted.

- Limited resources can lead to fewer audits or a focus on high-priority areas.

- For smaller firms outsourcing auditing functions: Depend on the outsourcing contract and costs involved.

Audit Committee and Board Oversight:

The frequency of internal audits is often influenced by decisions made by the board of directors or the audit committee.

- Board & Audit Committee: May demand more frequent audits for better governance.

- Investor Expectations: Shareholders may push for regular audits for transparency.

- Internal Policies: Some companies voluntarily adopt frequent audits for operational efficiency.

Changes in Business Environment:

The changing nature of business operations, including global expansion, necessitates regular audits to ensure internal controls are effective.

- Mergers & Acquisitions: Post-M&A integration may necessitate additional audits.

- New Business Lines: Expansion into new markets/products may trigger more audits.

- Economic & Market Volatility: Companies may increase audits during uncertain times.

Technology & Automation:

The use of AI and Analytics can enhance audit effectiveness by providing more detailed insights, which can influence the frequency of internal audits.

- ERP & AI-Driven Audits: Companies using real-time monitoring tools may reduce manual audits.

- Data Analytics: Enables continuous auditing, reducing the need for periodic checks.

Recommended Internal Audit Frequency Guidelines for Indian Businesses

The general internal audit frequency recommendations for different types of businesses in India are:

Listed Companies & Large Corporates:

Recommended Frequency: Quarterly or Half-Yearly

Quarterly Audits: Due to regulatory scrutiny, listed companies often conduct quarterly internal audits to monitor financial and operational controls.

Annual Comprehensive Audit: A thorough audit covering all aspects of operations, financial controls, and compliance.

High-Risk Area Audits: Audits for areas like cash handling, procurement, and compliance may occur more frequently based on risk.

Note: The recommendation frequency should can vary with industry and not all large companies are recommended to have quarterly audit.

Mid-Sized and Small Companies:

Frequency: Annual or Bi-Annual Audits

Annual Audit: A comprehensive audit covering key financial and operational areas.

Bi-Annual Audits: For businesses with growing complexity, semi-annual audits help identify risks early.

Risk-Based Audits: With focus on specific high-risk areas like procurement or sales.

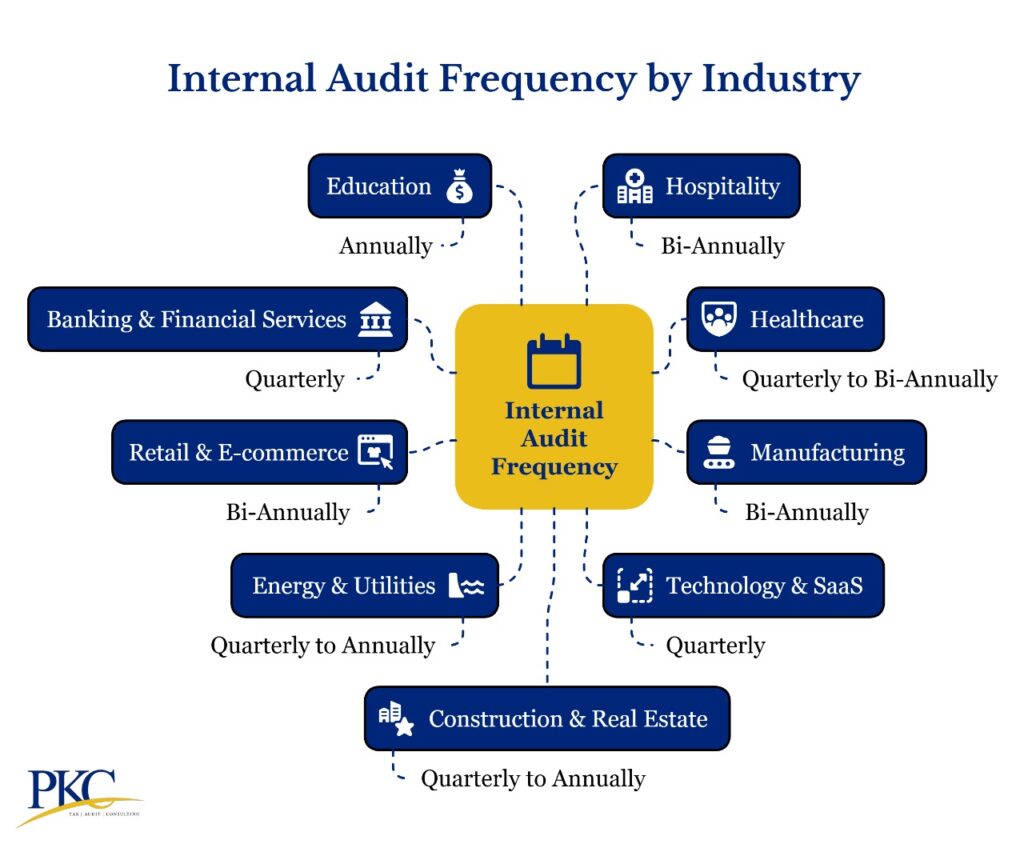

Industry-Specific Practices:

Financial Services & Banking:

Frequency: Quarterly Audits

Quarterly Audits: Due to regulatory requirements, audits are conducted regularly for compliance and risk management.

Annual Compliance Audits: Reviews to ensure regulatory adherence and effective internal controls.

Manufacturing & Infrastructure:

Frequency: Annual Audits with Specific Focus Areas

Annual Audit: Reviews financial and operational controls.

Special Audits: Additional audits for inventory, procurement, and safety compliance as needed.

IT & Technology:

Frequency: Annual or Semi-Annual Audits

Annual Audit: Reviews financial and security systems, data protection, and compliance.

Semi-Annual Audits: For rapid technology changes, to ensure security and regulatory compliance.

Retail and Consumer Goods:

Frequency: Quarterly or Bi-Annual Audits

Quarterly Audits: Focus on inventory control, sales processes, and financial reporting.

Bi-Annual Audits: For smaller companies, to ensure effective controls are in place.

Healthcare:

Frequency: Annual Audits with Focus on Compliance

Annual Audits: Focus on financial operations, patient safety, and compliance with regulations.

Compliance Audits: Ensures adherence to healthcare regulations and safety standards.

Assessing Internal Audit Frequency For Your Business Needs

Determining the right frequency for internal audit can be tricky. Here’s our guide with examples to help you find the right number:

Understand the Business Structure & Risk Profile

Business size and complexity impact audit frequency. Larger, complex businesses need more audits.

Along with this, business risks impact the frequency too. High-risk businesses may need more audits.

Example: A MNC with several subsidiaries and departments might need quarterly audits, while a small local retail business might be able to perform annual audits.

Identify Regulatory & Compliance Requirements

Certain industries have specific regulatory requirements dictating audit frequency.

Understanding these will help set a baseline for how often audits need to occur.

Example: In healthcare, HIPAA compliance audits may need to be conducted annually, while an NBFC regulated by RBI must audit critical functions monthly.

Review Historical Audit Findings

Review past audits for issue frequency and resolution progress. Frequent audits are needed if past audits showed many weaknesses.

Example: If past audits reveal consistent discrepancies, audit frequency may be increased until the discrepancies are resolved.

Assess Effectiveness of Internal Controls

Mature internal controls may allow less frequent audits, while weak controls require more frequent audits for monitoring.

Example: A company with a well-established internal audit function might conduct bi-annual audits, while a company that has recently experienced fraud or financial misstatements may need audits quarterly.

Assess Business Growth and Change

Business changes (such as launching new products, entering new markets, or acquiring new businesses) may require temporary audit frequency increases.

Example: A startup that has rapidly expanded into new markets might need more frequent audits during its first few years of growth (e.g., quarterly), compared to a mature business with stable operations (annual audits).

Consider Stakeholder Expectations

Discuss audit frequency with management and the audit committee. Align audits with organizational priorities.

Example: A board of directors may request bi-annual internal audits to ensure that the company is meeting its goals and mitigating risks associated with expansion into new territories.

Assess Resource Availability

Balance audit frequency with resources. Over-auditing strains resources and reduces quality.

Example: A small nonprofit organization might not have the resources to perform monthly audits, so it may opt for quarterly or annual audits, depending on their available budget and staff.

Monitor External Factors & Industry Trends

Market conditions affect audit frequency. Economic or cyber threats may require more frequent internal audits.

Example: During a cybersecurity breach, a tech company might increase its audit frequency to monthly or quarterly to assess vulnerabilities and compliance with new regulations.

Frequently Asked Questions

1. How often should internal audits be conducted?

There’s no one-size-fits-all answer. The frequency depends on factors like size, industry, risk profile, and regulatory requirements. However, a common practice is to conduct internal audits at least annually.

2. Do ISO standards specify a frequency for internal audits?

ISO standards, such as ISO 9001, require that internal audits be conducted at planned intervals, but they do not dictate a specific frequency. The organization must determine a suitable schedule.

3. What factors influence the frequency of internal audits?

Key factors include the complexity of processes, the level of risk involved, changes in regulations, and the results of previous audits. Higher-risk or complex processes may require more frequent audits.

4. Can internal audits be conducted more frequently than annually?

Yes, absolutely. Organizations can conduct audits quarterly, monthly, or even more frequently, especially for high-risk areas or newly implemented processes.

5. How do past audit results affect audit frequency?

If previous audits revealed significant issues or non-conformities, it’s advisable to increase the frequency of audits in those areas to ensure corrective actions are effective.

Expert verified

Expert verified