The foreign tax credit under Indian tax laws helps you avoid this double taxation and keep more of your hard-earned money.

Learn with us foreign tax credits available under Indian tax laws, eligibility conditions and process of calculating and claiming FTC with clear and simple examples.

What is Foreign Tax Credit?

Foreign Tax Credit (FTC) is an important tax relief mechanism that helps prevent double taxation.

For individuals and businesses earning foreign income, the FTC provides a way to reduce domestic tax liability by claiming a credit for income taxes paid to foreign governments.

This ensures that cross-border income isn’t taxed twice- once in the country where it is earned and again in the taxpayer’s country of residence.

Key Features of the Foreign Tax Credit

- Prevents Double Taxation: Allows you to offset foreign tax paid against your domestic tax liability on the same income.

- Credit vs. Deduction: The FTC is a dollar-for-dollar credit, not a deduction. It directly reduces your tax liability as opposed to deduction which only reduces your taxable income.

- Applicable Taxes Only: It applies to foreign income taxes or taxes in lieu of income taxes. It does not apply to sales tax, VAT, property tax, penalties or fines

Example:

Ms. K an Indian resident earning foreign income:

- She earns ₹10 lakhs from a U.S. client

- The U.S. withholds ₹1 lakh in tax

- India taxes that same income at ₹1.5 lakhs

Using the Foreign Tax Credit, she can claim a credit of ₹1 lakh (the tax already paid in the U.S.).

Net tax payable in India = ₹1.5 lakhs – ₹1 lakh = ₹50,000

Foreign Tax Credits Under Indian Tax Laws

The Income Tax Act, 1961, and Income Tax Rules, 1962, lay the foundation for FTC in India:

- Section 90: Provides bilateral relief where India has a Double Taxation Avoidance Agreement (DTAA) with the foreign country

- Section 90A: Similar to Section 90, for agreements with specified associations.

- Section 91: Offers unilateral relief where no DTAA exists.

- Rule 128 of the Income Tax Rules, 1962: Defines the methodology, documentation, and conditions for availing FTC

Types of Foreign Tax Credit

1. Bilateral Relief (DTAA-Based: Sections 90 & 90A)

- Applicable when India has a DTAA with the foreign country.

- Relief can be provided via:

- Exemption method: Income is taxed in only one country.

- Credit method: Income is taxed in both countries, but India allows credit for foreign taxes paid.

2. Unilateral Relief (Section 91)

- Applies when no DTAA exists.

- FTC is allowed for foreign tax paid, limited to Indian tax liability on that income.

Who Can Claim Foreign Tax Credit in India?

If you’re paying taxes on the same income both in India and abroad, understanding who can claim FTC and under what conditions is essential:

Eligibility to Claim Foreign Tax Credit in India

1. Resident Taxpayers Only: FTC benefit is exclusively available to Indian residents that include:

- Individuals (e.g., salaried employees, freelancers, investors)

- Companies registered in India

- Firms / LLPs controlled and managed from India

- HUFs where the Karta is a resident

- Trusts and other resident entities

To qualify as a resident, an individual must generally be present in India:

- For ≥182 days during the financial year, or

- For ≥60 days in that year and ≥365 days over the past 4 years.

2. Ineligible Persons: The following taxpayers cannot claim FTC:

- Non-Resident Indians (NRIs) since they are only taxed in India on Indian-sourced income, not global income.

- Resident but Not Ordinarily Residents (RNORs): FTC can be claimed only if foreign income is derived from a business/profession controlled from India.

- Foreign entities or individuals, unless eligible under a Double Taxation Avoidance Agreement (DTAA).

Conditions to Claim Foreign Tax Credit in India

To validly claim FTC, taxpayers must meet all of the following criteria:

1. Foreign Income Must Be Taxable in India

The foreign income must be included in the Indian Income Tax Return (ITR). It should be taxable under Indian law, unless exempt under DTAA

2. Actual Payment of Foreign Tax

FTC is allowed only if:

- Tax has been paid or deducted in the foreign country

- Proof of actual payment is available

- The tax is of the nature of income tax or tax in lieu of income tas

Payments like VAT/GST, social security contributions and interest or penalties on foreign tax are ineligible

3. Claim Must Be in the Same Year

FTC must be claimed in the same assessment year in which the foreign income is taxed in India.

If income is spread over multiple years, FTC can be proportionately claimed for each year.

In cases where the foreign tax amount is under dispute, credit can only be claimed after the dispute has been resolved. This can be done by submitting evidence within 6 months of settlement.

4. Mandatory Filing of Form 67

If Form 67 is not submitted on time, FTC will be denied. It must be:

- Filed electronically via the Income Tax e-Filing portal

- Submitted before filing the ITR for that assessment year

5. Documentary Evidence Required

The following documents must be maintained and submitted:

- Proof of foreign tax payment (e.g., TDS certificates, tax receipts)

- Details of foreign income earned

- Foreign tax return copy (if applicable)

- Tax Residency Certificate (TRC) from the foreign country (especially if claiming DTAA benefit)

- Certified translation if documents are not in English

6. Currency Conversion

Foreign taxes must be converted to INR using the Telegraphic Transfer Buying Rate (TTBR) of the last day of the month prior to tax payment

7. Credit Limit, Lower of Two

FTC allowed is restricted to the lower of:

- The actual foreign tax paid, or

- The Indian tax payable on the same foreign income

This must be computed source-wise and country-wise.

8. No Double Benefits Allowed

You cannot claim FTC if:

- You’ve already claimed a deduction under Section 80 (e.g., 80C, 80G)

- The income is exempt under a DTAA (like Article 13 for capital gains)

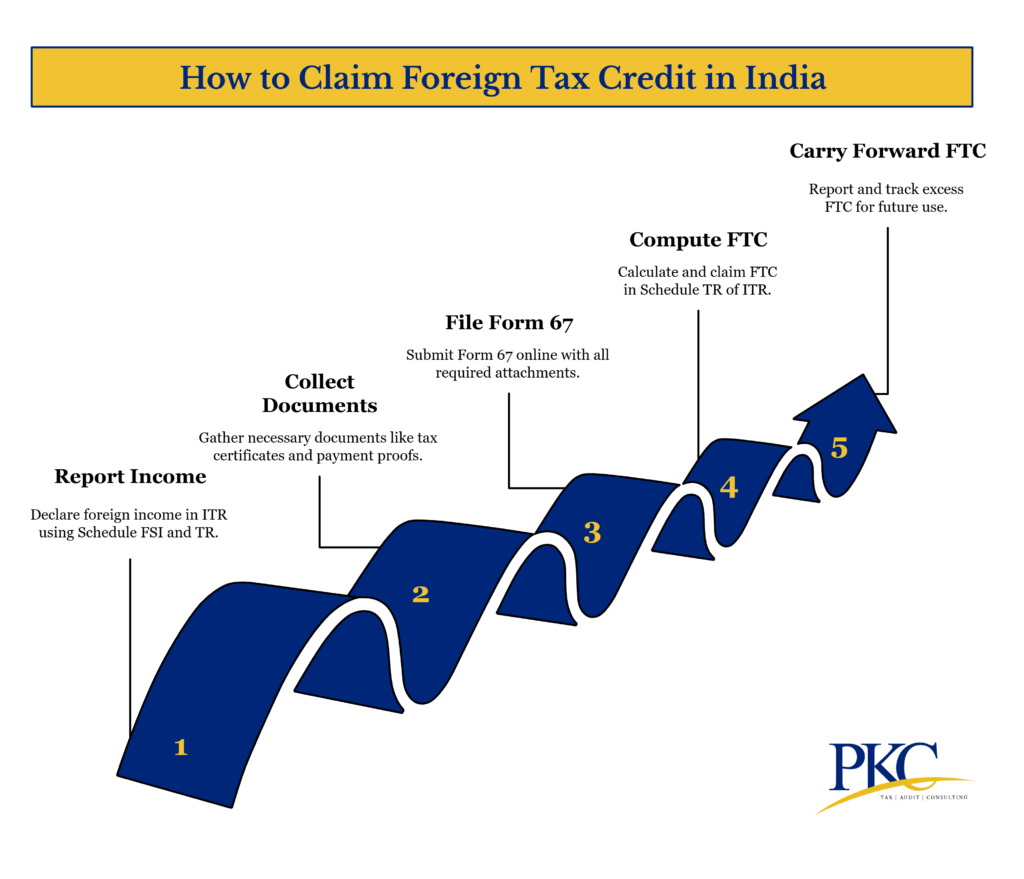

How to Claim Foreign Tax Credit in India: Step By Step Process

Resident taxpayers in India who have paid taxes on foreign income can claim FTC to avoid double taxation.

Here’s how to do so:

Step 1: Report Foreign Income in Your ITR

To claim FTC, you must include the foreign income in your Indian Income Tax Return (ITR):

- Use Schedule FSI (Foreign Source Income) to declare foreign income source-wise and country-wise.

- Use Schedule TR (Tax Relief) to claim FTC under:

- Section 90/90A: If the foreign country has a DTAA with India

- Section 91: For unilateral relief (no DTAA)

Step 2: Collect Required Documents

Ensure you have the following supporting documents:

| Document | Purpose |

| Certificate from foreign tax authority | Proof of tax paid/deducted abroad |

| Foreign tax return (if applicable) | Verifies tax filing abroad |

| Payment proof (challan, bank receipt) | Shows actual payment made |

| Statement of income | Clarifies income nature and amount |

| Tax Residency Certificate (TRC) | Required for claiming DTAA relief |

| DTAA copy (optional) | Supports treaty-based claims |

| Currency conversion sheet (TTBR-based) | Mandatory for INR conversion |

Step 3: File Form 67

Form 67 is the official declaration of your foreign income and taxes paid. It must be:

- Filed online through the Income Tax e-Filing portal

- Submitted before or along with the ITR

- Accompanied by all supporting documents

- Return to be filed within due date

Contents of Form 67:

- Part A: Taxpayer details (Name, PAN, AY), foreign income, tax paid, country

- Part B: Any refund of foreign tax or disputes

- Verification: Self-declaration of truth and correctness

- Attachments: PDFs of all documents (certificates, TRC, tax receipts, income proofs)

How to File Form 67 Online:

- Login to https://www.incometax.gov.in

- Go to e-File > Income Tax Forms > File Income Tax Forms

- Select Form 67

- Fill in income and tax details along with Section 90/90A/91 applicable

- Upload documents

- E-verify via Aadhaar OTP / EVC / DSC

- Submit and save acknowledgment

Remember: Form 67 filed after the ITR due date = FTC claim denied (CBDT Circular No. 9/2022)

Step 4: Compute and Claim FTC in Your ITR

Claim FTC in Schedule TR of your ITR, based on:

You can claim credit for the lower of:

- Foreign tax paid (converted to INR), or

- Indian tax on that income.

Example: Foreign income is ₹10,00,000 and foreign tax paid is ₹1,50,000. Assuming that the Indian tax on that income is, ₹1,20,000, the FTC allowed will be ₹1,20,000

If foreign tax > Indian tax, the excess cannot be claimed or refunded in India.

Step 5: Carry Forward Excess FTC (If Applicable)

From AY 2022–23 onwards, excess FTC (if any) can be carried forward up to 4 years.

This is only applicable if allowed under applicable DTAA provisions and CBDT notifications. Taxpayer must:

- Report carry-forward in Schedule CYLA of ITR

- Maintain a track of set-off in subsequent years

DTAA & Its Impact on Foreign Tax Credit

This treaty has a direct and crucial impact on how Indian residents claim the Foreign Tax Credit (FTC) under Indian tax laws.

Methods of Relief Under DTAA

- Credit Method: Income is taxed in both countries. India gives credit for tax paid abroad.

- Exemption Method: Income is taxed only in one country; the other exempts it completely.

Most Indian DTAAs use the Credit Method. The Exemption Method is rare but applies in specific income types (e.g., pensions, property income in some treaties).

DTAA vs No-DTAA FTC Relief

| Feature | DTAA Country (Sec 90/90A) | No DTAA Country (Sec 91) |

| Relief Type | Bilateral | Unilateral |

| Method | Credit/Exemption (as per DTAA) | Credit only |

| TRC Required | Yes | No |

| DTAA Article Applies | Yes | No |

| Withholding Relief Possible | Yes (reduced rates) | No |

| More Beneficial to Taxpayer | Yes | Limited |

FTC Calculation & DTAA Benefits

FTC calculation and filing (Form 67, documents, currency conversion by RBI TTBR) method remains the same whether the income is from a country with a DTAA or without a DTAA.

The differences arise in terms of treaty benefits

For countries with a DTAA there are added advantages and conditions:

- Lower Withholding Tax abroad

- Clear rules on taxing income types (salary, dividends, interest, etc.)

- Exemption or Credit based on DTAA articles

- TRC required for claiming DTAA benefits

For countries without a DTAA, taxpayers are still eligible for FTC as a unilateral relief. No concessional rates or treaty benefits apply, so the foreign tax credit may be less favorable.

Computation of Foreign Tax Credit (FTC) with Example

In order to claim FTC, you must first understand how to do it. Here’s how to calculate FTC in India:

Identify Foreign Income:

- Report foreign income (salary, interest, dividends, etc.) in your Income Tax Return (ITR) under the appropriate head of income.

- Exclude income exempt in India under DTAA provisions. Only taxable foreign income qualifies for FTC.

Convert Foreign Income and Tax to INR:

Use the Telegraphic Transfer Buying Rate (TTBR) on the last day of the month preceding payment to convert foreign income and tax paid to INR.

Calculate Indian Tax on Foreign Income:

Include foreign income in Indian gross total income. Compute your total Indian tax liability including foreign income.

Then compute the Indian tax attributable to the foreign income based on the proportion:

Determine FTC Allowed:

- Compare the foreign tax paid (converted to INR) and the Indian tax calculated on the foreign income.

- The FTC allowed is the lower of the two amounts.

Carry Forward Excess FTC (Applicable From AY 2022-23):

If foreign tax paid exceeds Indian tax payable on the foreign income, the excess FTC can be carried forward for up to 4 assessment years.

FTC Examples with Calculations

Example 1: Foreign Salary in a DTAA Country: An Indian resident works abroad in a country that has a DTAA with India and earns a foreign salary.

The foreign country deducts tax from the salary. Since the same income is also taxable in India , the individual is eligible to claim FTC under Indian tax laws to avoid being taxed twice

| Component | Amount (₹) |

| Foreign Salary (converted to INR) | ₹20,00,000 |

| Foreign Tax Paid | ₹4,00,000 |

| Total Indian Income (incl. foreign salary) | ₹30,00,000 |

| Total Indian Tax Liability | ₹7,50,000 |

FTC Calculation:

Indian tax on foreign salary = (₹20,00,000 / ₹30,00,000) × ₹7,50,000 = ₹5,00,000

FTC allowed = Lower of:

- Foreign tax paid (₹4,00,000) or

- Indian tax on the income (₹5,00,000)

So, the taxpayer can claim FTC of ₹4,00,000 without any carry-forward.

Example 2: Dividends from a Non-DTAA Country

In this case, the foreign country deducts withholding tax at 20%, and the dividend income is also taxable in India.

Since no DTAA applies, the Indian taxpayer can still claim FTC under Indian tax rules (Rule 128), but only up to the Indian tax payable on that income. Any excess FTC can be carried forward for up to 4 assessment years

| Component | Amount (₹) |

| Foreign Dividends | ₹5,00,000 |

| Foreign Tax Withheld (20%) | ₹1,00,000 |

| Total Indian Income | ₹15,00,000 |

| Total Indian Tax Liability | ₹2,70,000 |

FTC Calculation

Indian Tax on Dividends = (₹5,00,000/ ₹15,00,000) × ₹2,70,000 = ₹90,000

FTC Allowed, lower of

- Foreign Tax Paid = ₹1,00,000

- Indian Tax on the Dividend = ₹90,000

So, the FTC Allowed = ₹90,000

Excess FTC = ₹1,00,000 − ₹90,000 = ₹10,000, can be carried forward for up to 4 years

Common Errors While Claiming FTC

Here are some of the most common errors taxpayers commit while claiming FTC:

| Mistake | Consequence |

| Not filing Form 67 before ITR | FTC claim disallowed |

| Mismatch in income between Form 67 and ITR | FTC may be partially or fully denied |

| Claiming FTC on VAT, social security, etc. | FTC denied (only income tax allowed) |

| Not reporting foreign income | No FTC allowed, possible penalty |

| Using wrong currency conversion rate | Inaccurate FTC computation |

| Claiming FTC on disputed/refunded tax | Must revise FTC claim |

How Can PKC Help With Your FTC Claims?

✅ 3 decades of expertise in international tax matters

✅ Specialized Form 67 filing for FTC claims

✅ Expert bilateral DTAA relief computation services

✅ Professional double taxation avoidance strategy planning

✅ Comprehensive foreign income documentation support

✅ Strategic tax credit optimization across multiple years

✅ Expert handling of complex global income scenarios

✅ Seamless coordination with foreign tax authorities

✅ End-to-end FTC claim processing and filing

FAQs About Foreign Tax Credit in India

1. Who can claim foreign tax credits in India?

Only Indian tax residents who have earned income abroad and paid foreign taxes on that income can claim foreign tax credits. They must also include the foreign income in their Indian tax return and file Form 67.

2. How to claim foreign tax credit in India?

You must file Form 67 on the Income Tax portal before submitting your return and include the foreign income in your ITR using Schedule FSI and TR. You also need to provide proof of tax paid abroad to get the credit.

3. How to calculate foreign tax credit in India?

The foreign tax credit allowed is the lower of the foreign tax paid or the Indian tax payable on that foreign income. You must convert the foreign tax into INR using the RBI TTBR rate of the preceding month.

4. Do I need to file Form 1116 to claim the foreign tax credit?

No, Form 1116 is a U.S. tax form and not applicable in India. In India, you must file Form 67 to claim foreign tax credit.

5. What is the deadline for claiming foreign tax credit in India?

Form 67 must be filed before or on the same day you file your income tax return. If not filed on time, FTC will be disallowed, even if you’re eligible.

Expert verified

Expert verified