Written By – PKC Desk, Edited By – Sneha Karunakaran, Reviewed By – Balaji Prasath

Finance automation tools for Indian enterprises have become pivotal, given the increasing demand for smart solutions to manage financial processes efficiently.

Explore with us the best financial management software for Indian businesses. We also share the benefits, challenges, and selection criteria to follow when making the choice for the best financial automation tool.

What Are Finance Automation Tools?

Finance automation tools are software platforms or digital systems that automatically manage, process, and record your financial operations, without having the need to do it all manually.

The core purpose of these tools is to eliminate manual, error-prone tasks like data entry and approvals by automating them with predefined rules and workflows.

This is achieved through seamless integration with existing systems and the use of technologies like RPA, AI, ML, OCR, and APIs.

Common tasks that finance automation tools help with:

- Accounts Payable (AP): Invoice capture (via OCR), data extraction, matching invoices to POs & delivery receipts, routing for approval, scheduling payments, reconciling payments.

- Accounts Receivable (AR): Generating & sending invoices, payment reminders, applying cash receipts, reconciling customer payments, managing collections workflows.

- Expense Management: Capturing receipts (mobile scan), policy compliance checks, automated routing for approval, reimbursements, and integration with corporate cards.

- Financial Close & Reporting: Automated data aggregation from various sources, journal entry creation & posting, account reconciliations, generating standardized financial reports (P&L, Balance Sheet, Cash Flow), variance analysis.

- Budgeting & Forecasting: Consolidating inputs, performing complex calculations, generating forecast models, creating budget vs. actual reports.

- Payroll Processing: Calculating wages, taxes, and deductions; generating pay stubs; facilitating direct deposits; ensuring tax compliance.

- Reconciliation: Automatically matching bank statements, credit card transactions, and internal ledger entries.

- Audit & Compliance: Maintaining a clear audit trail of all automated actions, ensuring adherence to controls, and generating compliance reports.

Benefits of Finance Automation Tools for Indian Businesses

Finance automation tools can offer transformative benefits for your business. Here are their top benefits:

1. Simplified Compliance

Finance automation tools are made to make compliance with Indian laws easier.

They come with built-in GST, TDS, and income tax features.

2. Faster, Accurate Financial Processes

Manual tasks like making invoices, entering data, or tracking payments can take hours every week.

Automation tools do all that for you -fast and accurately. This means your team can focus on more pressing concerns, leaving this to automation.

3. Cost & Cash Flow Optimization

Automation cuts down labor costs and avoids penalties from late filings or payments.

Faster collections and early payment discounts help improve working capital and overall cash flow.

4. Smarter Decision-Making

Live dashboards provide a clear view of cash flow, P&L, and tax liabilities.

Predictive analytics help forecast cash crunches and plan for seasonal or regulatory outflows.

5. Fraud Control & Audit Readiness

System checks flag duplicate invoices and policy violations, ensuring tighter internal controls.

Digital audit trails and automated reports support compliance with GST, RBI, and SEBI regulations.

6. Higher Productivity & Talent Retention

Finance teams can concentrate on strategic activities, such as FP&A, by getting rid of repetitive duties.

Modern digital systems also attract and retain tech-savvy professionals.

7. Easily Scalable

Whether you’re a small team or a huge enterprise, finance automation tools can scale with you.

You can start small and add features like multi-user access, advanced reporting, and integrations with ERP, CRM, and HRMS tools.

Top 10 Finance Automation Tools for Indian Enterprises

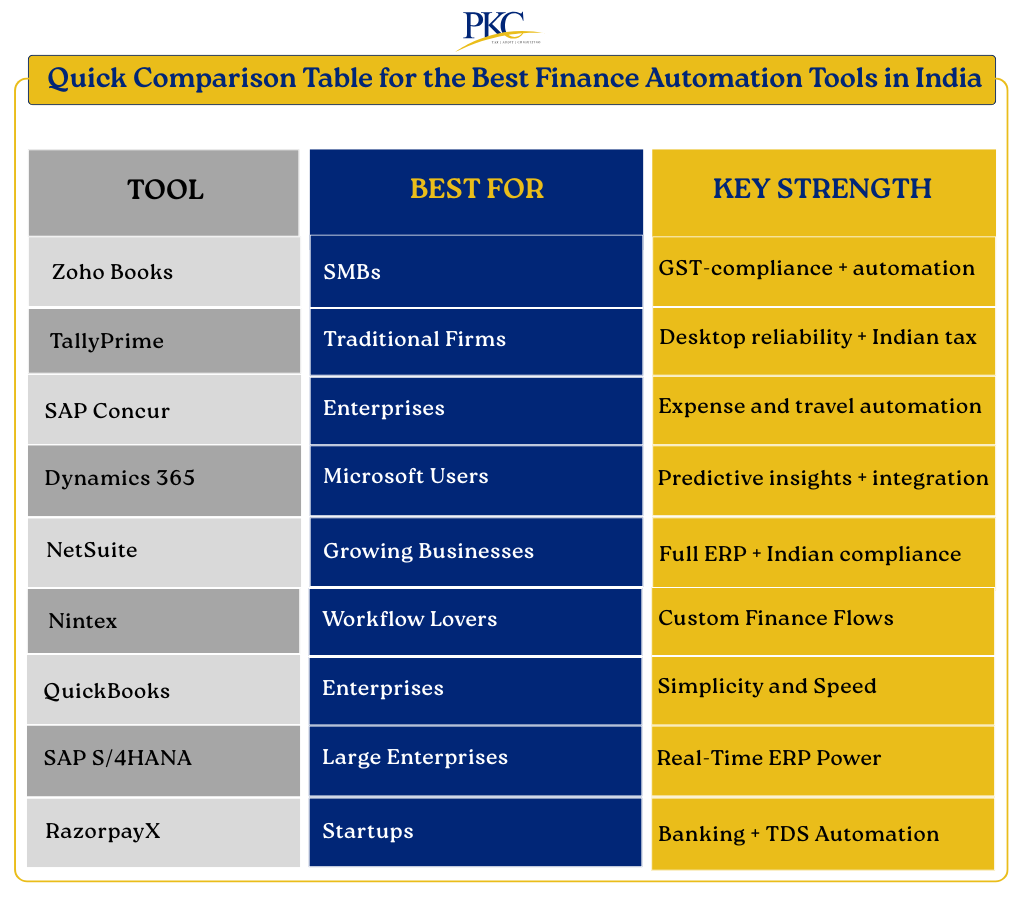

Here are some of the top finance automation tools for Indian enterprises that combine global robustness with compliance and banking integrations:

Zoho Books

Zoho Books is a GST-compliant Indian accounting tool with automation features ideal for growing businesses.

Key Features:

- 100% cloud-based

- Fully compliant with GST, e-invoicing, and TDS

- Auto-invoicing, bank feeds, expense tracking, and real-time dashboards

- Integrates with Zoho ecosystem (CRM, Inventory, Payroll)

- Affordable and easy to use, even for non-finance people

- Multi-currency support

- Mobile app for on-the-go management

Perfect for: Startups and small to mid-sized Indian businesses.

TallyPrime

The most popular accounting program in India is TallyPrime, which has a thorough awareness of Indian legal requirements and corporate procedures.

Key Features

- Powerful for inventory, tax filing, invoicing, and GST returns.

- On-premise and hybrid models are available.

- Works offline with periodic syncing

- Complete GST and statutory compliance

- Multi-company management

- Banking and payment integration

Perfect for: Traditional businesses and accountants.

SAP Concur

Focuses on automating travel and cost management, which makes it perfect for businesses with high demands for processing business travel and expenses.

Key Features:

- Automated expense capture and reporting

- Tracks spending across departments

- Mobile app for receipts and reimbursements

- Travel booking integration

- Policy compliance monitoring

- Receipt scanning and categorization

- Advanced analytics and reporting

Perfect for: Large enterprises and MNCs.

Microsoft Dynamics 365 Finance

Core financial procedures are automated by this all-inclusive financial management solution.

Key Features:

- Complete financial operations automation

- Advanced financial reporting and analytics

- Budget planning and forecasting

- Cash flow management

- Integration with the Microsoft ecosystem

- Multi-entity financial consolidation

- Indian localization supported (GST and financial year configuration)

Perfect for: Enterprises looking for deep integration with Microsoft tools.

Oracle NetSuite

Provides a complete business management suite with strong financial automation capabilities. It combines accounting, CRM, inventory management, and e-commerce in a single platform.

Key Features:

- Complete ERP + finance automation suite.

- Cloud-based and global, but supports Indian tax laws

- Real-time dashboards and role-based access

- Custom dashboards and reporting

- Multi-subsidiary management

- Industry-specific functionality

Perfect for: Mid to large-sized companies with complex needs.

BlackLine

BlackLine specializes in automating complex financial operations that require strict controls, audit trails, and faster month-end closing.

Key Features:

- Automated account reconciliation

- Financial close management

- Journal entry automation

- Variance analysis

- Comprehensive audit trails

- Helps CFOs track internal controls and reporting metrics.

- Cloud-based with strong audit features.

Perfect for: Enterprises needing advanced accounting controls.

Nintex

While not exclusively a finance tool, Nintex is great at automating procedural aspects of financial operations, making it valuable for Indian enterprises.

Key Features:

- Automates approvals, purchase orders, and invoice routing

- Integrates with SharePoint, Office 365, and SAP

- Mobile workflow access

- Analytics and reporting

Perfect for: Businesses looking to automate finance workflows.

QuickBooks (India)

It is a user-friendly software with strong accounting automation features. Its integration capabilities and comprehensive features make it popular among growing businesses.

Key Features:

- Automated invoicing and payments

- Expense categorization and tracking

- Payroll automation

- Tax preparation assistance

- Bank reconciliation and custom financial reports

- Multi-user collaboration

- Super simple and affordable.

Perfect for: Freelancers, consultants, and small businesses.

SAP S/4HANA

SAP S/4HANA represents the best when it comes to enterprise financial automation. It’s designed for large enterprises that require sophisticated financial operations management.

Key Features:

- High-performance ERP + finance management system

- Real-time financial processing

- Advanced predictive analytics

- Comprehensive financial management

- Multi-currency and multi-company support

- Integrated business planning

- Machine learning capabilities

Perfect for: Very large enterprises with global operations.

RazorpayX

Its strength lies in its deep integration with local banking systems and understanding of Indian payment ecosystems.

Key Features:

- Automated vendor payments

- Payroll automation

- Business banking integration

- Expense management

- Tax payment automation

- Real-time payment tracking

- UPI and API-first for developers

Perfect for: Indian startups, fintechs, and ecommerce brands.

Need Help With These Tools, Reach Out to Our Experts Today!

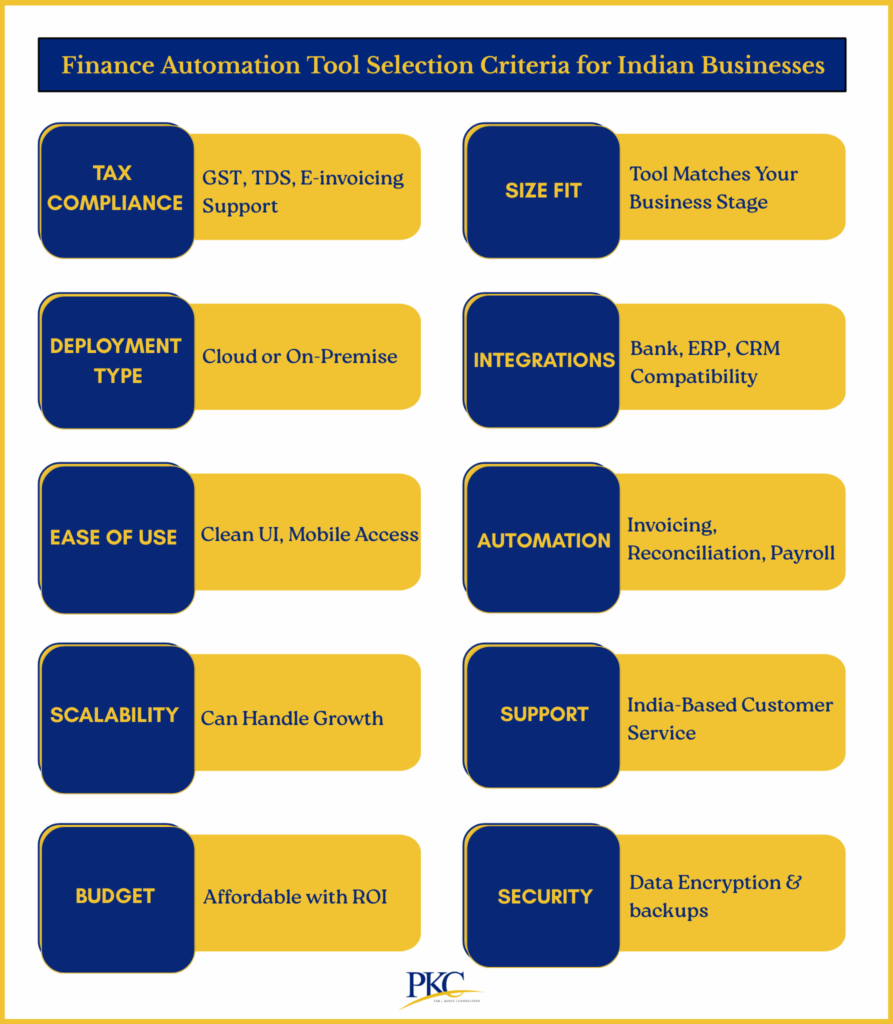

Finance Automation Tool Selection Criteria for Indian Businesses

In order to pick the right finance automation tool for your enterprise, here are points to :

- Regulatory Compliance: Ensure the tool supports GST, TDS, and other Indian tax requirements

- Integration Capabilities: Look for tools that integrate with existing systems and popular Indian platforms

- Scalability: Select solutions that will expand with your company.

- Local Support: Prioritize vendors with a strong Indian presence and support

- Cost-Effectiveness: Balance features with budget constraints

- User Adoption: Consider the learning curve and user-friendliness for your team

- Business Size and Complexity: Choose according to your size, for example: Small Business – Zoho Books, QuickBooks, Mid-Sized – RazorpayX, TallyPrime, and Large – SAP S/4HANA, Microsoft Dynamics 365.

Challenges in Implementing Finance Automation Tools in India

- Many businesses use outdated systems that don’t integrate well with modern automation tools.

- Employees often resist change, and upskilling can be difficult in traditional work environments.

- Automation raises concerns around data protection and navigating complex regulations like GST and TDS.

- The initial investment in automation tools is a major barrier, especially for MSMEs with limited funding.

- Poor internet connectivity and frequent power outages in smaller cities hinder automation efforts.

- Many businesses lack the internal knowledge necessary to properly install and operate automation solutions.

- Inconsistent, incomplete, or unstandardized data complicates automation.

- Selecting the appropriate instrument is difficult, and the problem is made worse by a lack of local assistance.

- Complying with RBI, SEBI, GST, and state laws requires automation tools to handle diverse rules.

- Hierarchical structures and a preference for manual processes slow down tech adoption.

- Without automation, businesses risk falling behind in efficiency, insights, and talent retention.

- Lack of data and poor risk assessment methods limit access to financing for automation.

How Can PKC Help With Finance Automation?

✅37 years expertise with 200+ employees serving 1500+ clients

✅Expert implementation across Tally, Busy, Zoho, and QuickBooks platforms

✅Real-time business performance monitoring and reporting systems

✅Complete statutory compliance automation, preventing revenue leakage

✅Custom ERP implementation with automated financial reporting

✅Automated accounts cleanup and financial restructuring services

✅Seamless integration with existing business software systems

✅Outsourced CFO services with automated financial operations

Frequently Asked Questions

1. What are finance automation tools?

Software programs that manage financial duties, including payroll, tax filing, and invoicing automatically, are known as finance automation tools. They enhance accuracy, save time, and lessen errors in corporate operations.

2. Which is the best finance automation tool for small Indian businesses?

Zoho Books and TallyPrime are top choices due to their local compliance features and ease of use. They also support GST, e-invoicing, and integrate with Indian banks.

3. Are finance automation tools safe for Indian enterprises?

Yes, these tools are built with data encryption and follow Indian compliance standards like MCA and GSTN. The majority also have role-based access and backups on the cloud.

4. Do finance automation tools support multi-user access?

Absolutely. Most enterprise tools offer multiple user roles, permissions, and team collaboration features.

5. How long does it take to set up a finance automation tool?

Most tools can be set up in under a week, especially cloud-based ones like QuickBooks or Zoho. Enterprise tools like SAP or Dynamics 365 may take longer due to customization.

Expert verified

Expert verified