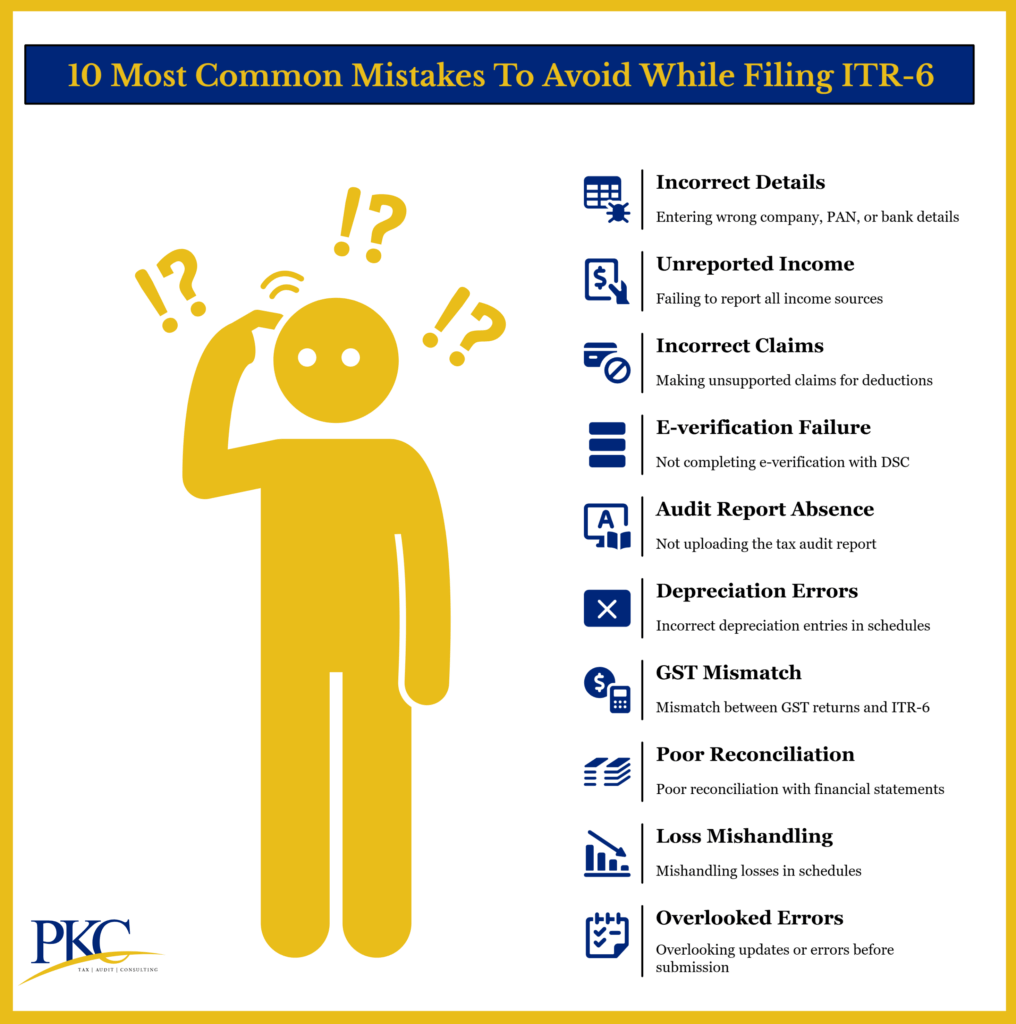

Filing ITR-6 for Indian businesses is mandatory for most companies. However, the process can be confusing if you’re not familiar with tax laws.

Our guide breaks everything down in simple steps, explaining the essentials – from who needs to file, to documents, penalties, and mistakes to avoid.

What is ITR-6?

ITR-6 is an Income Tax Return form used by companies in India to file their income tax returns with the Income Tax Department.

The ITR-6 form requires comprehensive disclosure of a company’s income from various sources, financial statements, tax computation, and other relevant details for the financial year.

Key Features of ITR-6:

- Must be filed online only on the Income Tax Department’s e-filing portal.

- If the company is liable for audit under Section 44AB or any other law, details of the audit report and auditor must be provided with the return.

- Filing requires a Digital Signature Certificate (DSC)

- Has detailed schedules for balance sheet, profit and loss, tax computation, etc.

Who Needs to File ITR-6?

Entities Required to File ITR-6:

- All companies registered under the Companies Act, 2013 or 1956, including:

- Private limited companies

- Public limited companies

- One Person Companies (OPCs)

- Foreign companies with income sourced from India

- Companies earning income from business or profession, capital gains, house property, or other sources.

- Companies that are not claiming exemption under Section 11 (i.e., their income is not from property held for charitable or religious purposes)

- Companies cannot declare income under the presumptive taxation schemes and must maintain proper books of accounts.

- Companies meeting certain turnover/profit thresholds must upload their audit report electronically before or along with filing ITR-6.

- The usual due date for companies to file ITR-6 is October 31st of the assessment year. This date can sometimes be extended by the government.

Entities that Cannot Use ITR-6:

- Section 8 Companies (charitable or non-profit companies – they use ITR-7

- LLPs (Limited Liability Partnerships) – they file ITR-5

- Partnership firms – also use ITR-5

- Sole Proprietors, Individuals, HUFs – they file ITR-1 to ITR-4

Documents Required for Filing ITR-6

While filing ITR-6, companies are not required to attach any physical documents, annexures, or TDS certificates with the return itself.

However, you’ll need to collect several financial and legal documents for accurate data entry and for compliance.

Here’s a checklist:

Financial Statements

- Audited Balance Sheet as on 31st March

- Profit and Loss Account for the financial year (P&L statement)

- Schedules for depreciation and fixed assets

- Cash Flow Statement (if applicable)

- Manufacturing Account (if applicable)

- Trading Account (if applicable)

- Receipts and Payments Account (for companies under liquidation)

- Quantitative details of inventory/stock (if applicable)

Tax Related Documents

- PAN Card of the company

- TDS certificates

- Advance Tax challans

- Self-assessment tax payments

- GST Return Filings (if applicable)

- TAx Audit Report (Form 3CA/3CD) and auditor details (if liable for audit under Section 44AB) – needs to be uploaded

- Details of deductions claimed under Chapter VI-A (e.g., Section 80G, 80IA, etc.)

- Details of Minimum Alternate Tax (MAT) computation and credits

- Details of Dividend Distribution Tax, buy-back tax, and special rate incomes

- Details of foreign taxes paid, if any

Details of Directors and Shareholders

- Names, PAN, shareholding percentage

- Residential status of directors

- Changes in shareholding (if any)

Bank Account Details

- Bank statements of the company

- Account numbers, IFSC codes, etc.

- Make sure all transactions are reconciled

Previous Year’s ITR & Assessment Orders

- Copy of previous year’s ITR filed

- Details of assessment orders, if any, for reference and reconciliation

Other Supporting Documents

- Loan statements, EMI details

- Details of assets and liabilities

- Details of foreign assets or income (if applicable)

- Details of transactions with related parties

- Details of capital gains, if any

- Foreign transactions or foreign assets (if applicable)

- Certificate of Incorporation and Corporate Identity Number (CIN)

- Aadhaar Card of the authorized signatory (if applicable)

- Details of carried forward losses or unabsorbed depreciation

How’s How Can PKC Help With Your ITR 6 Filing ▫️ITR-6 specialists for private limited companies specifically ▫️Proactive penalty avoidance through meticulous error checking ▫️Seamless electronic filing with secure data protection ▫️End-to-end ITR 6 support from preparation to submission ▫️Enhanced accuracy and compliance guaranteed approach ▫️Custom tax calendar and reminders system ▫️Advanced tax audit compliance and scrutiny handling |

Step-by-Step Guide to Filing ITR-6 Online

Filing ITR-6 online is mandatory for all companies.

It must be done online and you need to use a Digital Signature Certificate (DSC) to verify the return.

Follow these steps carefully:

Step 1: Register or Log In to the Income Tax e-Filing Portal

- Visit: https://www.incometax.gov.in

- Log in using your company’s PAN, password, and password/DSC

- If you are a new user, register your company using the company’s PAN, email ID, and mobile number

Step 2: Choose “File Income Tax Return”

- After logging in, go to the “e-File” section

- Select “Income Tax Return” from the menu

- Select the assessment year (e.g., 2025–26 for FY 2024–25)

- Select the status as “Company.”

- Select “ITR-6” from the list of available forms

Step 3: Select Filing Mode

- Indicate whether this is an “Original Return” or a “Revised Return”

- The portal may pre-fill certain details based on previous filings or linked data (e.g., TDS).

- Review and edit any incorrect or incomplete information

Step 4: Fill in the Details of the ITR-6 Form

- General & Company Information: Name, PAN, incorporation date, CIN, address, type of company, shareholder details, and business nature.

- Audit & Financial Information: Audit report details (Form 3CA/3CD), auditor information, balance sheet, manufacturing/trading account, profit and loss statement.

- Income Details: Income from business/profession, house property, capital gains, other sources, exempt income, foreign income (if any).

- Depreciation & Adjustments: Depreciation on assets, deemed capital gains, unabsorbed depreciation, ICDS adjustments.

- Deductions & Reliefs: Deductions under Chapter VI-A, donations, SEZ/startup/IFSC deductions, DTAA relief.

- Tax Computation: MAT, tax credits, taxes on distributed profits/dividends, income at special rates.

- Other Disclosures: Shareholding, assets and liabilities, GST turnover, foreign currency transactions, pass-through income.

- Tax Payments: Advance tax, self-assessment tax, TDS/TCS details.

- Verification: Complete the verification and declaration section.

Step 5: Validate Information & Submit Form

- Use the “Validate” button to check for errors or missing information in the form before submission.

- After uploading, complete the e-verification process using the company’s DSC

- Once successfully filed, download the acknowledgment (ITR-V) for your records

Due Dates and Penalties for ITR-6

| Category | Details |

| ITR-6 Filing Due Date | 31st October of the Assessment Year |

| Tax Audit Due Date | 30th September (if audit applicable under Section 44AB) |

| Late Filing Fee (Before Dec) | ₹5,000 under Section 234F |

| Late Filing Fee (After Dec) | ₹10,000 under Section 234F |

| No Late Fee (If Income < ₹5L) | Maximum penalty capped at ₹1,000 |

| Interest on Tax Due | About 1% per month |

| Revision of ITR-6 | Allowed until 31st December of the assessment year |

| Filing Mode | Mandatory online filing with Digital Signature Certificate (DSC) |

Tax Audit Requirement for ITR-6

If a company’s turnover, sales, or gross receipts exceed the limits specified under Section 44AB of the Income Tax Act, a tax audit under this section is mandatory.

Companies engaged in international or specified domestic transactions may have additional audit requirements (Form 3CEB).

Audit Report Submission

- The audit report must be submitted electronically by the auditor through the Income Tax Department’s e-filing portal.

- It is to be submitted using Form 3CA along with Form 3CD.

- Requires name and details of the auditor, date of furnishing the audit report and acknowledgement number of the electronically filed audit report

- Filing ITR-6 without uploading the audit report will mean an invalid return

Digital Signature Certificate (DSC) Requirement

A DSC is an electronic version of your signature, used to sign digital documents securely. It proves your identity and ensures that the ITR is authentic and tamper-proof.

The use of Digital Signature Certificate (DSC) is mandatory for all companies filing ITR-6.

The return cannot be submitted or verified without a valid DSC. This applies to both domestic and foreign companies.

Key Features of DSC:

- DSC must belong to the authorized signatory of the company – usually a director, managing director, or CEO

- DSC should be registered on the e-filing portal against the PAN of the authorized signatory before uploading the ITR-6.

- The DSC must not be expired or revoked at the time of filing.

- Only Class II or Class III DSCs, issued by a Certifying Authority authorized by the Controller of Certifying Authorities (CCA),are accepted for ITR filing.

Registration and Usage Process

- Get your Class III DSC from a licensed provider

- Install the DSC driver on your system

- Register the DSC on the Income Tax e-Filing portal:

- Log in to https://www.incometax.gov.in

- Go to My Profile > Register DSC

- Follow on-screen instructions

- Attach the DSC while submitting ITR-6

When filing ITR-6, select the option to digitally sign the return, choose the registered DSC, and complete the authentication process.

The system will verify the DSC’s validity and its registration against the PAN of the authorized signatory.

ITR-6 Structure & Schedules Explained in Simple Terms

ITR-6 is one of the most detailed income tax return forms with multiple parts and schedules to capture financial and tax information.

ITR-6 is divided into:

- Part A: General and financial information

- Part B: Computation of total income and tax liability

- Schedules: Detailed supporting sections for specific disclosures and calculations

Part A – General and Financial Information

Part A: General Information

Basic company data: Name, PAN, address, CIN, incorporation date, business type/nature, and shareholder details.

Part A-BS (Balance Sheet)

Snapshot of financial position as of 31st March – assets, liabilities, share capital, reserves, loans, and investments.

Part A-Manufacturing Account / Trading Account / Profit & Loss Account

Annual figures on inventory, production costs, sales, expenses, and net profit/loss.

Part A-OI (Other Information)

Miscellaneous company-specific details not covered in other sections.

Part A-QD (Quantitative Details)

Quantitative details of stocks, production, and sales.

Part A-OL (Receipts and Payments Account)

Applicable to companies under liquidation – cash inflows and outflows during the year.

Part B – Total Income & Tax Computation

Part B-TI (Total Income)

Calculation of income from various heads: business/profession, house property, capital gains, other sources, and deductions.

Part B-TTI (Tax Liability on Total Income)

Calculation of tax payable, interest, fee, reliefs, refunds, and final tax liability

Schedules

There are around 42 schedules in ITR 6. These include:

| Schedule | Meaning |

| Schedule BP | Income from business or profession |

| Schedule VDA | Income from Transfer of Virtual Digital Assets |

| Schedule OS | Computation of Income from Other Sources |

| Schedule EI | Income Not Included in Total Income (Exempt Incomes) |

| Schedule SI | Income Chargeable to Tax at Special Rates |

| Schedule 115TD | Accredited Income under Section 115TD |

| Schedule DPM/DOA/DG/DEP | Depreciation on various assets |

| Schedule 112A | Sale of Equity Shares/Units on which STT is Paid |

| Schedule 115AD(1)(b)(iiii) | Sale of Equity Shares/Units (STT Paid) under Section 112A |

| Schedule ESR | Deduction under Expenditure on Scientific Research |

| Schedule RA | Donations to Research Associations |

| Schedule PTI | Pass-through income from investment funds/business trusts |

| Schedule DCG | Gains from selling depreciable assets (treated as short-term gains) |

| Schedule SI | Income taxed at special rates |

| Schedule GST | GST turnover/revenue details |

| Schedule CG | Capital Gains |

| Schedule CYLA | Set-off for current year losses – shows which income is reduced by losses |

| Schedule CFL | Statement of Losses to be Carried Forward |

| Schedule BFLA | Losses from earlier years that are carried forward and used to reduce current income |

| Schedule AL-1/ AL-2 | Assets and liabilities at the end of the year |

| Schedule UD | Unabsorbed Depreciation and Allowance under Section 35(4) |

| Schedule MAT/MATC | Minimum Alternate Tax and MAT credit |

| Schedule 10AA | Deduction under Section 10AA – profit coming from export |

| Schedule 80IAC | Deduction in Respect of Eligible Start-up |

| Schedule 80LA | Deduction of Offshore Banking Unit or IFSC |

| Schedule VIA | Deductions under Chapter VIA – certain investments and expenditures |

| Schedule BBS | Tax on Distributed Income of Domestic Company on Buyback of Shares |

| Schedule TPSA | Secondary Adjustment to Transfer Price as per Section 92CE(2A) |

| Schedule IF | Investment in Unincorporated Entities |

| Schedule 80IA/ 8IB/ 80IC/80IE | Deduction under sections 80IA/ 8IB/ 80IC/80IE |

| Schedule 80G/ 80GGC/ 80GGA | Details of Donations & Contributions |

| Schedule ICDS | Effect of Income Computation Disclosure Standards on Profit |

| Schedule 40A(2) | Transactions with related parties (directors, family members, etc.) and disclosures |

| Schedule IT/TDS/TCS | Details of advance tax, self-assessment tax, TDS, and TCS |

| Schedule FSI/TR/ESI | Foreign income and tax relief details |

| Schedule FA | Details of Foreign Assets and Income from Any Source Outside India |

| Schedule FD | Break-up of Payments/Receipts in Foreign Currency |

Frequently Asked Questions

- What is ITR-6 and who should file it?

ITR-6 is an income tax return form for companies not claiming exemption under Section 11. It must be filed by companies like Pvt Ltd, Public Ltd, and OPCs.

- Is ITR-6 filing mandatory for all companies?

Yes, all companies (except those registered as charitable institutions) must file ITR-6 annually.

- Is DSC mandatory for filing ITR-6?

Yes, a Class III Digital Signature Certificate (DSC) is compulsory for submitting ITR-6.

- What documents are required to file ITR-6?

You’ll need financial statements, audit reports, tax payment proofs, and director/shareholder details.

- Can I revise my ITR-6 after submitting it?

Yes, you can revise ITR-6 if needed before 31st December of the assessment year.

Expert verified

Expert verified