The faceless appeal process under income tax in India has transformed the way taxpayers handle appeals. Although introduced for simplicity, it can still be overwhelming.

Understand with us the faceless appeal procedure along with the documents needed and when to consider hiring experts to represent you.

What is the Faceless Appeal Process in India?

Faceless Appeals is a completely digital process introduced by the Income Tax Department where taxpayers can appeal against tax orders without meeting any tax officer in person.

The appeal is filed, reviewed, and decided entirely through the income tax e-filing portal – which means more transparency and less stress for taxpayers.

Under this system, all communication, submission of documents, and even hearings (via video conferencing) are conducted online.

The identity of the tax officials handling the appeal remains unknown to the taxpayer, ensuring anonymity and impartiality.

Why Was the Faceless Appeal System Introduced?

The system falls under the Income Tax Act Sections 250 and 246A, with legal support from CBDT Notification No. 76/2020.

The main reasons for its introduction were:

- Eliminate direct interaction between taxpayers and tax officials, reducing instances of bias, corruption, and harassment.

- Promote transparency, efficiency, and accountability in the assessment process by using technology and data analytics in line with Digital India initiatives.

- Make compliance easier and more convenient for taxpayers by allowing them to handle all procedures online, without visiting tax offices.

- Ensure impartiality through random allocation of cases and team-based assessment, minimizing personal discretion and potential malpractices.

- Speed up the process since face-to-face hearings were slow. The faceless system is faster and more automated.

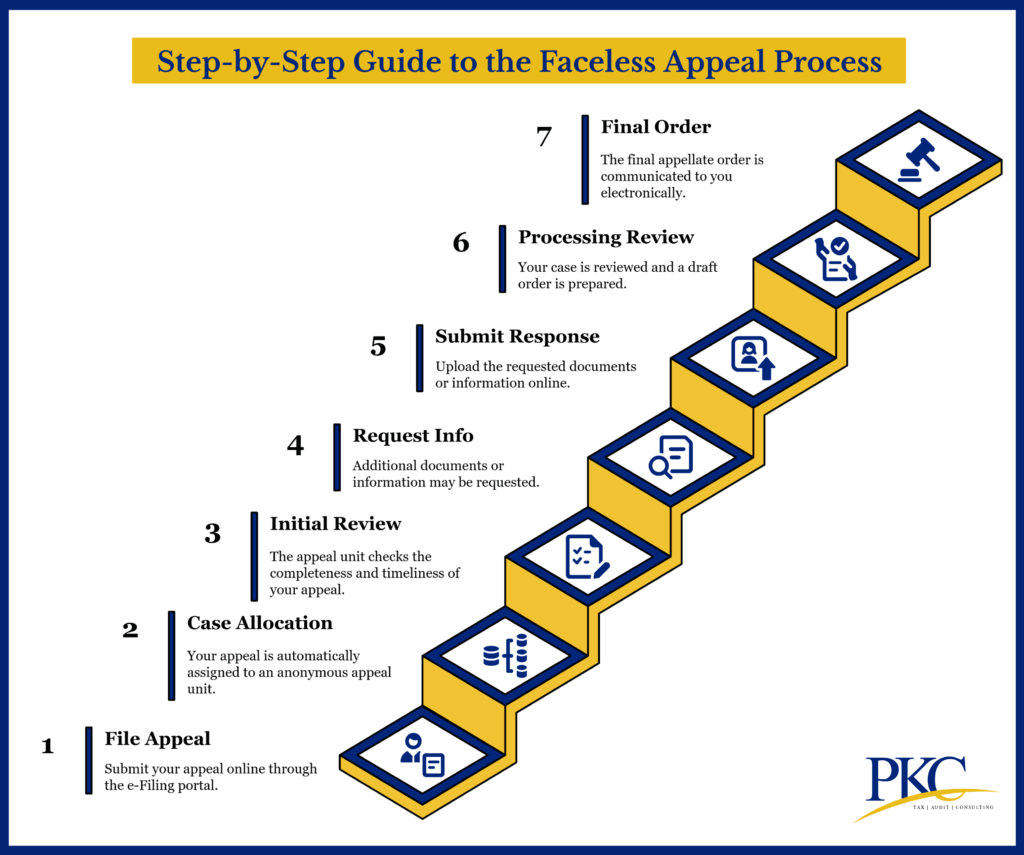

Step-by-Step Guide to the Faceless Appeal Process

Here’s a breakdown of the steps involved in the faceless appeal process:

Step 1: File the Appeal on the e-Filing Portal

- Visit the official Income Tax e-Filing portal

- Log in using your PAN as the user ID and your registered password

- Go to‘e-Proceedings’ or ‘Appeal’ section (under ‘Pending Actions’ on your dashboard)

- Select relevant assessment year and notice for which you wish to file an appeal

- Choose Form 35 for appeals

- Fill in all required details, upload supporting documents, and submit appeal online

Step 2: Automated Case Allocation

- National Faceless Appeal Centre (NFAC) receives your appeal

- It assigns the case to a specific appeal unit automatically and randomly

- You won’t know the officer’s name or location – it’s 100% anonymous

Step 3: Initial Review and Admission

- Assigned appeal unit checks if the appeal is complete and filed within the prescribed time limits

- If it’s late but accompanied by a condonation request, the unit reviews the reasons and decides whether to admit the appeal.

- NFAC notifies you about the admission or rejection of your appeal.

Step 4: Request for Additional Information

- The appeal unit may request further documents, information, or evidence through NFAC.

- You will receive electronic notices with a Document Identification Number (DIN) specifying what is required and the deadline for submission

Step 5: Submit Response Online

- Upload the requested documents or information through your e-filing account within the specified time frame

Step 6: Processing and Review

- The appeal unit reviews your case and prepares a draft appellate order

- The draft order is reviewed by another unit in a different city to ensure objectivity and fairness

Step 7: Final Order Issued

- The final appellate order is communicated to you electronically via your registered e-filing account

- All orders and communications are issued with a unique DIN for tracking and transparency

- If the decision is in your favor: you win. If not, you can go for a second appeal to the Income Tax Appellate Tribunal (ITAT).

Important: All updates are sent to your registered email and appear under the e-Proceedings tab on the portal. Make sure your email and mobile number are up to date.

Core Documentation Needed for Faceless Appeal Process

To successfully file and process a faceless appeal under the Income Tax Act, you need to prepare and submit the following core documentation:

Form 35 – The Appeal Form

This is the official form used to file an appeal before the Commissioner of Income Tax (Appeals) against an assessment or penalty order.

It includes:

- Your basic details (PAN, name, contact info)

- Details of the order being appealed

- Grounds of appeal (why you think the order is wrong)

- Statement of facts

Copy of the Assessment Order

Attach the order issued by the Assessing Officer against which the appeal is being filed. It forms the basis of the appeal.

Notice of Demand (if available)

This is the notice that says how much tax you owe as per the assessment. It’s important because it shows the monetary impact of the order.

Statement of Facts and Grounds of Appeal

Clearly state the relevant facts of your case and the grounds on which you are challenging the assessment or penalty order.

Statement of facts is to be factual and clear. It should include:

- What happened

- Why you disagree with the tax officer

- Your version of the events

Grounds of appeal is your legal reasoning. You have to clearly mention:

- Which parts of the law were not followed

- What was misinterpreted

- Why the order should be changed

- Use tax case laws or sections of the Income Tax Act if possible.

Supporting Documents & Evidence

Upload any documents that support your claims and strengthen your appeal.

This can include:

- Bank statements

- Form 16 / Salary slips

- Proof of deductions (like 80C investments, 80D health insurance)

- Rent receipts

- Invoices and contracts (for freelancers/businesses)

- Any past correspondence with the AO

Proof of Payment of Appeal Fee

Attach evidence of payment of the prescribed appeal fee, as this is mandatory before filing Form 35.

Details of Taxes Paid

Provide information about the taxes already paid for the relevant assessment year to substantiate your compliance.

Attachments

Include any additional relevant documents, such as previous correspondence or notices, that may assist in your appeal.

Authorization Documents (if filed by representative)

If the appeal is filed by a representative, attach documents such as a power of attorney or authorization letter to establish their authority to act on your behalf.

Consulting A Tax Expert for Faceless Appeals – Is It Necessary?

In most cases — yes.

Although the faceless appeal process is online and designed for convenience, it’s still a formal legal procedure.

Mistakes in documentation, missed deadlines, or unclear language can weaken your case.

Here’s why expert help matters:

Tax Law Is Complex

Filing a strong appeal requires clear facts and legal grounds, accurate responses to notices and proper evidence/ documentation.

Even small errors can cause delays or rejection. A CA or tax lawyer ensures everything is done correctly.

Documentation is the Key

Since there’s no personal hearing, your paperwork must do the talking.

Poorly drafted submissions or missing evidence can harm your case. Experts know how to present a strong, complete file.

Strict Deadlines

You get just 30 days to file an appeal. Tax professionals help you stay on schedule and avoid missed steps.

Handle It Only When Simple

If it’s a small clerical issue, you might handle it yourself.

But for larger demands or complex issues, professional guidance is strongly recommended.

Why Choose PKC for Faceless Appeals Process

✅Error-free 3-tier verification mechanism for appeals

✅Timely electronic submissions within stringent deadlines

✅Expert documentation for paperless appeal proceedings

✅Comprehensive understanding of faceless system complexities

✅Advanced infrastructure for seamless online submissions

✅Dynamic adaptation to evolving faceless tax laws

✅Professional appeal drafting with to-the-point explanations

✅Minimal risk closure for faceless appeal cases

Exceptions to the Faceless Appeal Scheme

The Faceless Appeal system was introduced to make income tax appeals faster, transparent, and free from personal interaction. But not all cases qualify.

Here are the main exceptions:

- Serious Fraud or Tax Evasion: Cases flagged for serious fraud, tax evasion, or willful misreporting are excluded. These require in-depth investigation and may need in-person hearings.

- International Tax & Transfer Pricing” Appeals involving international taxation, transfer pricing, or non-residents are kept out due to their complexity and cross-border nature.

- Personal Hearing Required: A physical hearing (via video conference) may be allowed if the taxpayer requests it or the case involves mixed questions of fact and law

- Ongoing Traditional Appeals: If your appeal was already assigned to a local CIT(A) before the faceless system began, it may continue in the traditional format.

- CBDT-Notified Exclusions: The CBDT can exclude certain cases through official notifications – such as those requiring field verification or court-directed hearings.

Frequently Asked Questions

- How to file a faceless appeal?

You can file a faceless appeal by submitting Form 35 on the official Income Tax e-Filing Portal. Make sure you upload all supporting documents and submit within 30 days of receiving the order.

- Can I represent myself in a faceless appeal?

Yes, you can represent yourself if the case is simple. But for complex cases, it’s highly recommended to consult a Chartered Accountant or tax expert.

- What documents are required for the faceless appeal process?

You need Form 35, the assessment order, statement of facts, grounds of appeal, and supporting evidence. Additional documents may be requested during the process.

- Can I request a personal hearing in a faceless appeal?

Only in exceptional cases, and even then, it will be through video conferencing. You must request it in writing, and it has to be approved by a senior tax authority.

- Can I file a second appeal if I lose the first one?

Yes, if your appeal is rejected or unfavorable, you can go to the Income Tax Appellate Tribunal (ITAT). This is the next level of appeal under Indian tax law.

Expert verified

Expert verified