Choosing between double entry vs single entry bookkeeping can feel confusing, especially for Indian entrepreneurs dealing with GST, income tax, and compliance rules.

Understand with us the difference, compare their advantages, and decide which one fits your business best.

What is Single Entry Bookkeeping

Single entry bookkeeping is a simple accounting method where each financial transaction is recorded only once, usually as income or expense in a cash book.

It tracks cash inflows and outflows but does not record assets and liabilities in detail.

What is Double Entry Bookkeeping

Double entry bookkeeping is a comprehensive accounting method where every transaction is recorded twice: once as a debit in one account and once as a credit in another.

This system ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced, provides greater accuracy, and helps identify errors.

Key Differences Between Double Entry & Single Entry Bookkeeping in India

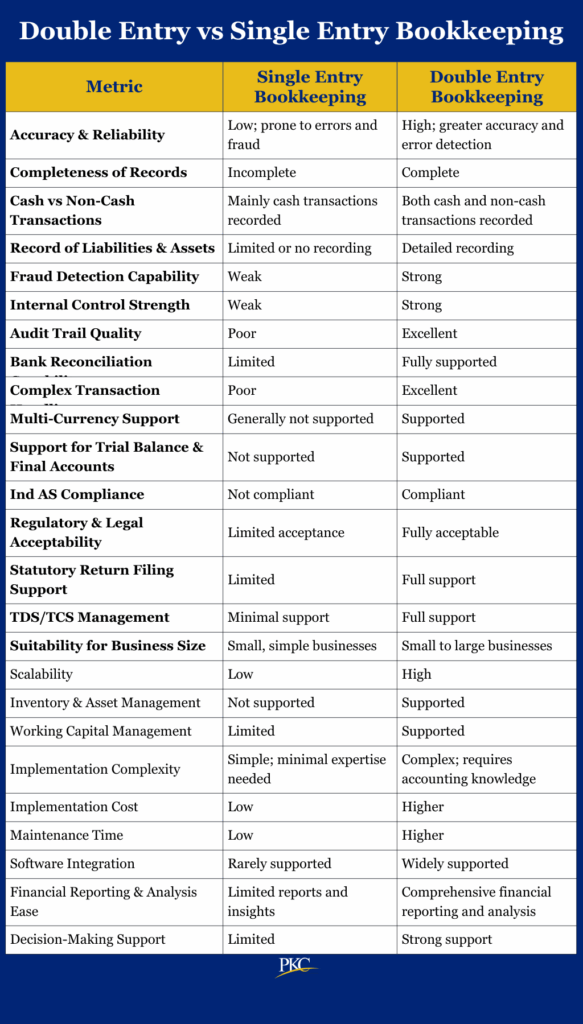

Let’s now compare Double Entry and Single Entry systems based on key performance metrics relevant for businesses, entrepreneurs, and decision-makers:

Accuracy & Reliability

Double entry records both sides of a transaction—debit and credit—so the system stays balanced and errors are easier to catch.

For example, if a company buys goods on credit, both the Inventory and Creditors accounts increase. If one side is missed, the imbalance will show up during reconciliation.

Single entry records only one side, usually cash, making it harder to detect mistakes.

Since it doesn’t track all aspects of a transaction, it’s less reliable, and different people may record the same event differently.

Conclusion: Double Entry offers a self-balancing system that ensures accuracy and data integrity.

Completeness of Records

Double entry captures complete financial information, including revenue, expenses, assets, liabilities, equity, and non-cash items like prepayments, accruals, and depreciation.

It supports a structured chart of accounts that organizes data into nominal, real, and personal accounts, ensuring nothing important is left out.

This system also aids in accurate closing processes and reflects true profit or loss.

Single entry is usually limited to tracking cash flows, such as receipts and payments.

Non-cash events like depreciation or bad debts are often ignored or recorded vaguely, and while assets and liabilities may be known, they are not always properly accounted for in the business records.

In India, the Companies Act, 2013 requires companies to maintain books of accounts that include records of assets, liabilities, and costs. If a business fails to record depreciation or unpaid bills, its financial statements will be incomplete and misleading..

Conclusion: Double Entry gives a full, detailed picture of your business.

Cash vs Non‑Cash Transactions Coverage

Double entry supports accrual accounting, where revenue is recorded when earned and expenses when incurred, regardless of cash flow.

It also captures non-cash items like depreciation, bad debts, prepaid expenses, and accrued income, as required under Ind AS.

Single entry focuses mainly on cash transactions.

Credit sales or credit purchases may be missed or estimated later, and non-cash items are often excluded, leading to inaccurate profit figures and a misleading tax base.

In India, this is important because GST rules require all outward and inward supplies to be recorded, whether paid in cash or on credit.

Input Tax Credit (ITC) claims rely on proper invoice and payment records, many of which involve credit. If credit purchases are not recorded due to single entry, ITC claims may be denied.

Conclusion: Double Entry is essential for accrual accounting and legal compliance.

Record of Liabilities & Assets

Double entry provides a formal Balance Sheet that clearly shows assets, liabilities, and equity.

It also allows for detailed records of fixed assets (with depreciation), inventories, loans, and more, supporting accurate business valuation, essential for investors, lenders, or meeting Fair Value requirements under Ind AS.

Single entry includes only cash and, at best, a rough idea of receivables and payables.

Fixed assets or long-term liabilities may be missing or undervalued, making it difficult to calculate net worth reliably.

Conclusion: Double Entry is necessary for real financial visibility and external reporting.

Fraud Detection Capability

Double entry enforces consistency by requiring every transaction to have a matching debit and credit. Discrepancies, missing entries, or unusual balances can reveal errors or fraud.

For example, if cash is siphoned off, the cash account won’t match the bank or till records, and the missing credit entry will signal a problem.

Single entry offers limited ability to detect fraud.

With no cross-checking, a transaction can be hidden by simply not recording one side. It often relies on trust rather than verified records, leaving room for misuse.

Conclusion: Double Entry adds a layer of built-in protection against fraud.

Internal Control Strength

Double entry supports strong internal controls by enabling separation of duties, for example, one person approves purchases, another receives goods, a third records the transaction, and someone else processes the payment.

Access to ledgers can be restricted, and accounting software often tracks changes. Regular reconciliations, like bank matches or supplier and debtor ageing reports, serve as key control checks.

Single entry offers much weaker controls, as the same person may handle multiple steps, increasing the risk of mistakes or misuse.

Its lack of structure makes oversight difficult, especially as the business grows.

Conclusion: Double Entry strengthens governance and control, even in small firms.

Audit Trail Quality

Double entry ensures a clear audit trail, where each transaction flows from a source document to a journal entry, then to the ledger, trial balance, and final accounts.

Edits or adjustments are recorded, and accounting software maintains change logs for transparency.

Single entry often records transactions only once, with little or no supporting documentation.

This weakens the audit trail, making it difficult to trace original evidence or reconstruct missing records.

Conclusion: Double Entry is critical for GST audits, income tax scrutiny, and investor due diligence.

Bank Reconciliation Capability

Double entry records every receipt and payment in cash and bank ledgers, allowing monthly bank statements to be reconciled and helping spot unrecorded bank fees, bounced cheques, or deposits in transit.

Single entry often only reconciles the cash book, missing or delaying bank transactions.

For example, a Chennai business issuing cheques may see mismatched records without double entry, making reconciliation essential for accuracy.

Conclusion: Double Entry is needed for cash accuracy and catching bank-side errors.

Complex Transaction Handling

Double entry handles accruals, prepayments, depreciation, provisions, deferred revenue, cost centers, inter-company and foreign exchange transactions.

Single entry is limited to basic cash receipts and payments, often ignoring depreciation or complex transactions.

In India, Ind AS standards require proper accounting for leases, financial instruments, and revenue timing, which single entry cannot support.

Conclusion: Double Entry is the only system fit for businesses with anything beyond basic operations.

Multi‑Currency Support

Double entry can track foreign currency transactions, record exchange rates, and adjust for currency gains or losses.

Single entry usually records only INR values, missing foreign currency details.

Indian exporters invoicing in USD or EUR rely on double entry to manage currency impacts on profits and taxes.

Conclusion: Double Entry is a must-have for any business with global dealings or exposure.

Support for Trial Balance and Final Accounts

Double entry produces a trial balance to check arithmetic accuracy.

This forms the basis for preparing Profit & Loss accounts, Balance Sheets, and Cash Flow statements as required under Indian law.

Single entry cannot generate trial balances automatically, often leading to rough estimates in final accounts.

Conclusion: Double Entry is a must for proper compliance and reporting.

Indian Accounting Standards (Ind AS) Compliance

Ind AS demand structured double entry accounting for accruals, fair value, and detailed disclosures like leases and financial instruments.

Single entry cannot meet these requirements. For entities above certain thresholds, Ind AS adoption is mandatory

Conclusion: Double Entry, is the only system that enables proper statutory compliance.

Regulatory & Legal Acceptability (IT, GST, etc.)

Double entry meets Income Tax, GST, and Companies Act requirements by maintaining proper audit evidence and supporting tax filings like GSTR-1 and GSTR-3B, ensuring accurate Input Tax Credit claims.

Single entry is only acceptable for very small businesses under presumptive schemes. It risks penalties if turnover grows or audits occur.

Conclusion: Double Entry is required by most regulators and tax authorities.

Statutory Return Filing Support

Double entry forms the backbone for filing statutory returns in India. It accurately captures all transactions – cash, credit, assets, and liabilities – enabling proper GST, Income Tax, and MCA filings.

It also supports e-invoicing and GSTN integration.

Single entry lacks the detail needed for compliance, often requiring rework by accountants.

Conclusion: Double entry is essential for statutory filings; single entry is not suitable beyond basic returns.

TDS/TCS Management

Double Entry facilitates accurate TDS/TCS computation and reporting as per the Income Tax Act. It allows businesses to:

- Record TDS deducted at the time of payment or expense booking

- Maintain liability ledgers

- Track due dates for TDS deposit

- Reconcile with Form 26AS and AIS

This supports filing of Forms 24Q, 26Q, and 27EQ for TDS/TCS returns.

In Single Entry, TDS or TCS amounts are often not recorded separately.

The focus remains on net cash paid or received, overlooking the statutory obligation to deduct or collect tax. This results in missed deductions, inaccurate records, and potential penalties.

Conclusion: Only double entry supports proper TDS/TCS compliance.

Suitability for Business Size

Double Entry is suited for all types and sizes of businesses including MSMEs, startups, partnerships, LLPs, and corporations.

It becomes mandatory when:

- Business is registered under GST

- Turnover exceeds limits set for presumptive taxation

- Tax Audit is applicable

- Business seeks institutional funding or government tenders

Single Entry is appropriate only for very small, unregistered entities that do not deal in credit or maintain inventory.

Typical users include local shops, service professionals, and traders operating on a cash basis within the limits of presumptive taxation.

Example: A tea vendor in Bhopal records daily cash sales and expenses in a notebook, which suffices for their minimal compliance needs.

Scalability

Double Entry is built to scale with business growth.

Whether the enterprise expands by volume, product range, geographic reach, or entity structure, double entry can accommodate changes.

Single Entry is not scalable.

As complexity increases (e.g., credit purchases, inventory management, multiple bank accounts), the single entry format becomes chaotic and error-prone.

Conclusion: Double entry is the only sustainable option for scaling businesses.

Inventory & Asset Management

Double Entry provides structured inventory control and fixed asset tracking. Supports:

- FIFO/LIFO/Weighted Average inventory valuation

- Depreciation calculation as per Companies Act and Income Tax Act

- Integration with billing, warehouse, and procurement modules

- Real-time stock movement reports

Example: A wholesale distributor in Chennai uses ERPNext with double entry integration to monitor stock levels, damaged goods, and returns across multiple warehouses.

Single Entry cannot manage inventory or fixed assets.

Most businesses relying on this system maintain a separate physical register or spreadsheet, leading to mismatched or outdated values.

Conclusion: Only double entry enables accurate inventory and asset tracking.

Working Capital Management

Double Entry enables businesses to track key components of working capital:

- Receivables (debtors)

- Payables (creditors)

- Inventory holding

- Cash and bank balances

This facilitates effective cash flow planning, collection follow-ups, and supplier negotiations.

Single Entry is limited to observing bank balances and cash inflows. Cannot offer insights into outstanding dues or stock investment, leading to poor liquidity planning.

Conclusion: Double entry supports healthy liquidity management.

Implementation Complexity & Professional Assistance Needs

Double Entry requires accounting knowledge to configure:

- Chart of accounts

- Opening balances

- Tax codes

- Control accounts (e.g., GST Payable, TDS Receivable)

This setup is done by professionals or with the help of accounting software consultants.

Single Entry is easy to start and no technical setup required. It is ideal for those without formal training in accounting.

Conclusion: While single entry is easier to implement, the complexity of double entry provides structure and long-term benefits.

Implementation Cost

Double Entry involves:

- Subscription or license for accounting software

- Possible CA or consultant fees

- Staff training

This cost is justified by accuracy, audit-readiness, and time savings over time.

Single Entry is practically free. It is often maintained using notebooks or Excel.

Conclusion: Double entry has higher costs but delivers far greater value.

Maintenance Time Requirements

Double Entry needs regular updates and reconciliations, especially for:

- Bank transactions

- GST reconciliations

- Payroll processing

- Vendor/customer ledger matching

Single Entry is quicker to update daily. However, cumulative time spent at year-end for compliance or funding purposes is often much higher.

Conclusion: Double entry saves time in the long run.

Software Integration

Double Entry supports integrations with:

- GST portal for e-invoicing and return filing

- Bank accounts for auto reconciliation

- Payroll, CRM, POS, and ERP systems

Tools like TallyPrime, Zoho Books, and QuickBooks India offer end-to-end business integration.

Single Entry is not designed for integration. Any software used is standalone and disconnected, requiring manual data re-entry.

Conclusion: Software ecosystem compatibility is only offered by double entry systems.

Financial Reporting & Analysis Ease

Double Entry helps stakeholders (owners, investors, banks) assess business health as it generates:

- Trial balance

- Profit and Loss statement

- Balance Sheet

- Cash flow statement

- Budget vs Actual reports

Single Entry cannot produce structured reports. Key performance indicators like gross profit margin, return on capital employed, or current ratio are unavailable.

Conclusion: Double entry turns data into decision-grade financial reports.

Decision-Making Support

Double entry provides accurate data for informed decisions on profitability, investments, and loans.

Data-backed decisions reduce risk and improve long-term performance.

Single entry forces decisions based on cash in hand or guesswork.

Conclusion: Double entry turns financial data into actionable insights.

Which is Better for Your Businesses: Double Entry vs Single Entry?

Double Entry bookkeeping is the preferred and, in many cases, the legally mandated system for Indian businesses.

It offers accuracy, transparency, scalability, and full compliance with GST, TDS, and Income Tax laws.

Single Entry bookkeeping is only suitable for very small, informal businesses with minimal transactions and no regulatory obligations.

Choose Double Entry Bookkeeping If You:

- Are registered under GST

- Deal in credit sales or purchases

- Own any assets or inventory

- Have employees and pay TDS, PF, or ESI

- Want to track profits, reduce taxes, or apply for a loan

- Plan to grow beyond a single location or product line

Only Consider Single Entry If You

- Are operating below all regulatory thresholds

- Deal only in cash

- Have no employees, no assets, no credit, no inventory

- Don’t need financial statements and are running a side business

FAQs About Double Entry vs Single Entry Bookkeeping

Single entry records only one side of each transaction, usually cash, while double entry records both debit and credit. Double entry gives a complete and accurate picture of finances.

Single entry is not recognized for companies or GST-registered businesses. Only very small traders or unregistered proprietors can use it informally.

Double entry ensures that every transaction has two entries — debit and credit — making it easier to detect errors and fraud. It also allows preparation of financial statements.

Yes, but it requires careful conversion of existing records into a double entry format. Many Indian SMEs upgrade when they grow or need loans/investors.

Yes, since it often requires accounting software or professional help. However, the accuracy and compliance benefits outweigh the extra cost.

Expert verified

Expert verified