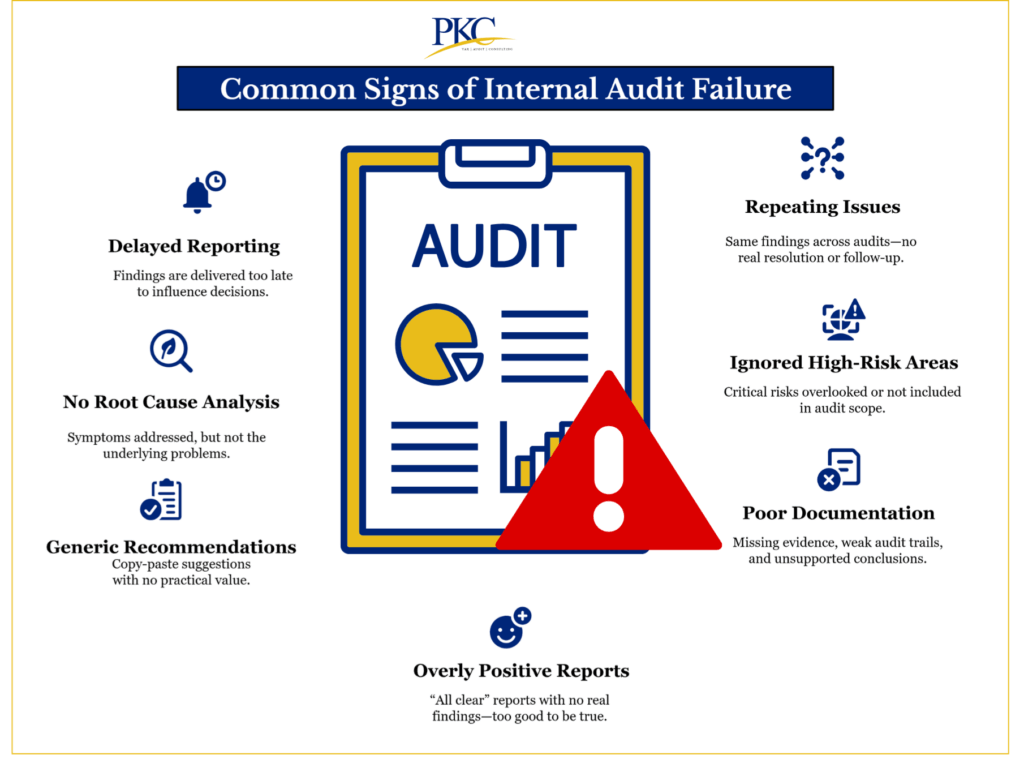

Internal audits are the backbone of risk management in any organization. But, common internal audit failures in India can lead to fraud, compliance breaches, and business collapses.

Explore with us some of the most prevalent internal audit mistakes in India along with their impact, an example and what you can do to fix them fast.

18 Most Common Internal Audit Mistakes in India

Avoiding common mistakes is key to a successful internal audit.

Here are the most frequent internal audit mistakes in India that can impact the effectiveness and usefulness of an internal audit of your organisation:

1. Scope Creep and Lack of Planning

Scope creep happens when internal audits expand beyond original objectives without proper justification, or start without clear goals/timelines.

This is often a result of reactive “checklist” approaches.

- Impact: Critical risks are missed, resources are wasted, and audits become superficial.

- Example: Internal audit team of an airline started with operational reviews but ended up examining unrelated HR functions without documenting scope changes.

- Fix: Mandatory risk-based audit charters approved by the Audit Committee.

Also Helpful: Internal Audit Planning Guide

2. Inadequate Scrutiny of High-Risk Areas

Another internal audit failure is when auditors fail to deeply examine fraud-prone zones (e.g., revenue, loans) due to time constraints or avoidance of complexity.

- Impact: Major frauds go undetected, eroding stakeholder trust.

- Example: In the PNB scam, auditors failed to examine SWIFT transactions—an area with inherent high risk.

- Fix: Risk heat maps prioritizing lending, RPTs, and cybersecurity.

3. Deficient Risk Assessment and Coverage

Risk-based audits are crucial, yet many internal audit teams rely on outdated templates or risk models instead of real-time data.

They ignore evolving business risks like cyber fraud, market shifts, etc.

- Impact: Audits become irrelevant, while the new risks explode unchecked.

- Example: A financial services company misses critical cybersecurity threats during the annual internal audit planning, leaving the organization vulnerable to undetected breaches.

- Fix: Dynamic risk dashboards updated quarterly.

4. Lack of Auditor Independence

If auditors report to operational managers instead of the Audit Committee, they might withhold negative findings due to fear or pressure.

- Impact: Critical issues are suppressed and integrity is compromised, leading to biased reports.

- Example: A mid-sized manufacturing firm has worked with an external audit firm for over 15 years, with key audit partners developing personal relationships with the promoters. As a result, critical audit findings may be routinely softened or ignored, compromising the integrity of financial reporting.

- Fix: SEBI-mandated direct reporting to the Audit Committee.

5. Insufficient Documentation

Audit trails and working papers are often incomplete or missing. They lack signatures, evidence, or audit trails, making reviews unreliable.

- Impact: Inability to defend findings or actions during investigations or peer reviews.

- Example: RBI inspections have flagged NBFCs for missing evidence on audit procedures.

- Fix: Automated work paper tools with version control.

6. Inadequate Testing of Internal Controls

Auditors sometimes take management’s word at face value instead of testing controls themselves.

- Impact: Fake controls or broken processes remain hidden, leading to preventable losses.

- Example: In the Satyam scandal, internal controls around bank confirmations and asset valuations were ignored.

- Fix: Rigorous sample testing + surprise control checks.

7. Insufficient Expertise and Resources

Many times internal audit teams lack sufficient knowledge of the business processes especially complex areas such as IT, forensic accounting, or legal compliance.

- Impact: Superficial reviews leading to undetected errors.

- Example: A mid-sized healthcare company conducts an internal audit with insufficient expertise and resources, resulting in overlooked compliance violations and increased regulatory risk.

- Fix: Upskilling programs for internal auditors or outsourcing internal audit to experienced firms like PKC Management Consulting.

8. Failure to Identify or Report Fraud

Either due to incompetence or fear, some internal auditors avoid flagging frauds, even if suspected.

- Impact: Fraud escalates and catastrophic losses follow

- Example: In the DHFL case, internal auditors missed red flags on fake shell companies for years.

- Fix: Fraud analytics training with anonymous escalation channels.

9. Failure to Detect/Address Management Override

Internal auditors may fail to catch when top management overrides controls, such as bypassing approval systems.

- Impact: Senior-level fraud goes undetected.

- Example: A manufacturing company’s internal audit fails to detect or address management override of controls, allowing executives to manipulate financial results without timely detection.

- Fix: Data analytics to track override patterns.

10. Poor Scrutiny of Related-Party Transactions (RPTs)

Internal audits often miss complex related-party relationships and fail to assess if transactions are fairly priced.

Approval processes and disclosures are poorly reviewed, increasing the risk of fraud and non-compliance.

- Impact: Fund diversion leading to erosion of shareholder wealth erosion.

- Example: A real estate development company exercises poor scrutiny of RPTS, leading to undisclosed conflicts of interest and financial misstatements.

- Fix: AI tools mapping entity networks and mandatory RPT deep dives

11. Underinvestment in Audit Functions

Many companies treat audit as a cost center and limit budgets. Internal audit teams are often understaffed and underpaid.

- Impact: Talent drain leads to high-risk areas being ignored.

- Example: A tech startup underinvests in its internal audit functions, resulting in limited oversight of internal controls and increased exposure to fraud and compliance risks.

- Fix: Board-mandated audit budget parity or outsourcing to trusted experts like PKC.

12. Siloed Communication

Poor communication between internal auditors, management, and the board leads to misaligned expectations and reduces the impact of audit findings.

- Impact: Missed connections between risks

- Example: In cyber fraud cases, internal audit teams often fail to coordinate with IT security teams.

- Fix: Integrated risk governance platforms.

13. Underutilization of Technology

Many internal audit departments in India still rely on traditional manual methods and fail to leverage data analytics tools, resulting in less comprehensive and efficient audits.

- Impact: Slower, less comprehensive and efficient audits with more room for error.

- Example: Companies that fail to use GRC tools like SAP or ACL miss pattern-based frauds.

- Fix: Invest in tech-driven and audit automation tools.

14. Incomplete or Poor Quality Internal Audits

Some internal audits are rushed to meet deadlines or done just for compliance.

They often lack clear scope, risk-based planning, and proper documentation.

- Impact: Provides false assurance, while the hidden risks explode.

- Example: An energy company conducts incomplete and poor-quality internal audits, failing to identify critical safety compliance issues that later result in regulatory penalties

- Fix: Quality reviews by Audit Committee

15. Poor Quality of Audit Reports

Audit reports often lack actionable recommendations, are poorly written, or fail to clearly communicate risks and their business impact to management and stakeholders.

- Impact: Senior management ignores the findings.

- Example: An internal audit report of a manufacturing company report states “controls weak” but omits risk quantification for example – INR 100 cr exposure

- Fix: Standardized templates with risk ratings.

16. Overemphasis on Compliance Over Value Addition

Internal audit functions often focus primarily on regulatory compliance rather than identifying operational improvements and strategic risks that could add value to the organization.

- Impact: No support for business growth or innovation.

- Example: An FMCG company’s audit focused only on tax compliance, missing inefficiencies in the supply chain costing them millions.

- Fix: Audit plans aligned with business objectives.

17. Weak Follow-Up on Audit Recommendations

Many organizations fail to establish proper mechanisms to track and ensure implementation of audit recommendations, rendering the entire audit exercise ineffective.

- Impact: Recurring failures and internal audit becomes “toothless.”

- Example: A logistics company has weak follow-up on internal audit recommendations, resulting in persistent gaps in vendor management and increased operational risk.

- Fix: Digital trackers with deadlines owned by department heads.

18. Lack of Continuous Monitoring

Organizations often conduct audits as periodic exercises rather than implementing continuous monitoring systems, which limits their ability to detect issues in real-time.

- Impact: Issues arise and stay hidden for months.

- Example: Fraudulent expense claims in an MNC often go undetected due to lack of real-time transaction monitoring.

- Fix: Automated transaction monitoring systems.

Next Read: Best Practices for Internal Auditing

Why Choose PKC Management Consulting for Your Internal Audits?

Serving over 1500 clients, PKC Management Consulting is a leading and technologically enabled firm that can take care of all your internal audit functions.

Here’s what makes us a great choice in comparison to our peers:

| Criteria | PKC Management Consulting | Other Internal Audit Firms |

| Experience & Scale | 37+ years, 200+ employees, 1500+ satisfied clients | Smaller teams, limited experience or reach |

| Technology | Strong automation, ERP integration, custom reporting | Limited technology use, mostly manual processes |

| Service Approach | Integrated audit + business consulting, value-driven | Primarily compliance-focused, less strategic |

| Cost | Competitive pricing with ROI focus | Pricing varies, often less transparent |

| Industry Focus | Deep expertise in hospitality, retail, manufacturing and more | Broad but shallow sector knowledge |

| Client Experience | Personalized service, fast decisions, long-term partnerships | Less personalized, slower response times |

Frequently Asked Questions

1. What are internal audit failures?

Internal audit failures occur when audits fail to detect risks, fraud, or control weaknesses. In India, they often stem from poor planning, limited scope, or lack of independence.

2. What are the consequences of internal audit failures in India?

Audit failures can lead to financial fraud, regulatory penalties, and reputational damage. They also impact investor trust and long-term business sustainability.

3. How can internal audit failures be prevented?

By ensuring independent reporting, better planning, continuous monitoring, and use of technology. Companies should also upskill auditors and follow global best practices.

4. Are internal audit failures common in Indian startups and SMEs?

Yes, because startups often lack formal audit structures and prioritize growth over controls. Audit oversight in SMEs is also weak due to budget constraints.

5. Can internal auditors be held liable in India?

Yes, especially if they intentionally ignore fraud or are complicit. Under Companies Act and SEBI rules, auditors can face penalties or prosecution.

Expert verified

Expert verified