Often used interchangeably, bookkeeping vs accounting serve different purposes and operate at different levels of the financial process.

Let’s break down the difference between accounting and bookkeeping, so that you know what services you need and what to expect as business owners.

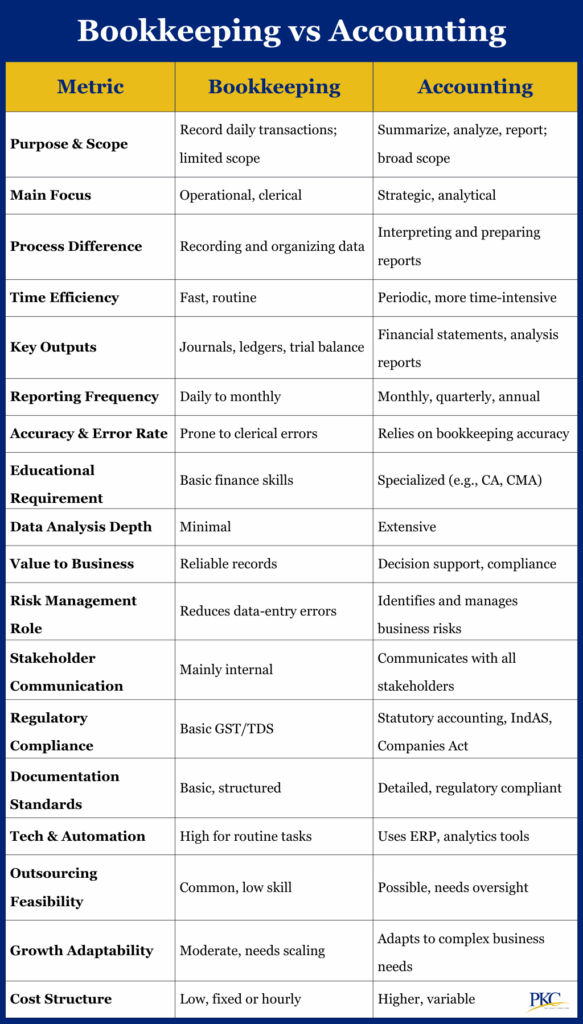

Difference Between Bookkeeping & Accounting: 21 Metrics Compared

Bookkeeping and accounting are very different from each other and cover different things.

While bookkeeping is primarily concerned with recording financial transactions, accounting focuses on interpreting and analyzing that data to guide strategic decisions.

For a better understanding, here’s a detailed comparison across multiple key areas:

Purpose & Scope

Bookkeeping aims to systematically record every financial transaction made by a business. This includes income, expenses, and cash movements accurately captured in correct accounts.

The scope of bookkeeping is relatively narrow. It focuses on daily data entry, bank reconciliations, and maintaining general ledgers.

Accounting goes beyond recording transactions. Its purpose is to analyze, interpret, and summarize data compiled through bookkeeping to assess financial health of the business.

Accounting covers a broader scope, including compliance reporting, tax planning, budgeting, forecasting, and financial performance analysis.

Main Focus

Bookkeeping is operational in nature. It deals with the day-to-day activities of tracking and recording financial events as they occur.

Example: A bookkeeper logs daily sales, vendor payments, or payroll disbursements. The focus here is on accuracy and completeness rather than insight.

Accounting is inherently strategic. They use data provided by bookkeepers and use it to develop financial reports, assess business performance, and advise on future actions.

Process Difference

Bookkeeping process involves identifying each financial transaction, categorizing it, recording it in journals or accounting software, and then posting it to appropriate ledgers.

Transactions include invoicing, bill payments, payroll management, and reconciling bank statements. It’s a structured, repetitive process that needs to be followed meticulously to ensure data integrity.

Accounting process begins where bookkeeping ends. Accountants prepare adjusting entries, review trial balances, and generate core financial statements such as the Profit and Loss Statement, Balance Sheet, and Cash Flow Statement.

They then analyze these reports to extract insights, assess profitability, track financial trends, and ensure statutory compliance.

Time Efficiency

Bookkeeping requires more frequent attention and is more time-consuming due to the need for daily transaction entries and reconciliations.

The nature of the work is repetitive, although tools like Tally, QuickBooks, and Zoho Books make the process more efficient.

Accounting is usually performed at scheduled intervals—monthly, quarterly, or annually.

Although the tasks involved are more complex, they are not as time-consuming on a per-transaction basis. Time is invested in analysis and reporting rather than data entry.

Key Outputs

The main outputs of bookkeeping are internal documents and organized records.

- General ledgers

- Journals

- Invoices

- Payroll reports

- Trial balance.

These records form the raw data that the accounting process builds upon.

Accounting produces higher-level outputs that are used by both internal and external stakeholders.

- Income Statement

- Balance Sheet

- Statement of Cash Flows

- Tax returns

- Audit reports

- Performance dashboards.

These are essential for evaluating business performance and ensuring regulatory compliance.

Reporting Frequency & Timeline

Bookkeeping is an ongoing activity. Transactions are recorded in real-time or at regular short intervals, daily or weekly, to keep records updated and reliable.

Accounting reports are usually generated on a periodic basis. Financial statements and analytical reports are created at the end of each month, quarter, or financial year.

The frequency often depends on the size of the business, regulatory requirements, or internal decision-making cycles.

Accuracy & Error Rate

Bookkeeping demands high precision. Bookkeepers aim to prevent errors by accurately recording data.

Since it involves a high volume of entries, manual bookkeeping can be prone to clerical errors such as transposing numbers, duplicating transactions, or misclassifying entries.

Accounting relies on the accuracy of the bookkeeping data.

While accounting professionals often detect and correct errors through reconciliations or audits, the process is only as reliable as the data it’s based on.

However, the accounting function usually involves an additional layer of scrutiny and is less susceptible to frequent errors.

Educational / Certification Requirement

Bookkeepers usually do not require formal accounting degrees. Although not legally required, training in software like Tally, QuickBooks, or Zoho Books is helpful.

In some countries, certifications like the Certified Bookkeeper (CB) designation may add value.

Accounting is a specialized field that requires a formal degree, usually Chartered Accountancy (CA)/

In the U.S., the equivalent would be a Certified Public Accountant (CPA), and globally recognized credentials include ACCA (UK) and CMA (US).

Data Analysis Depth

Bookkeeping offers minimal to no data analysis. Its role is to organize and record the data, not to interpret it.

A bookkeeper may flag a discrepancy but does not perform in-depth financial evaluations.

Accounting is deeply analytical. Accountants use various tools and techniques such as ratio analysis, trend analysis, cash flow projections, and variance analysis, to extract insights from financial data.

These insights are then used for strategic planning, investment decisions, and risk assessments.

Value to Business

Bookkeeping provides the foundational value needed for accurate accounting and financial reporting.

Without an accurate and well-maintained record of financial transactions, a business cannot meet tax obligations, track profitability, or prepare for audits. It thus supports financial transparency and operational efficiency.

Accounting adds strategic value to a business. It transforms raw financial data into meaningful information.

This helps business owners make informed decisions, manage resources efficiently, and identify areas for growth or cost reduction. It’s a key function for long-term financial planning and sustainability.

Risk Management Role

Bookkeeping’s role in risk management is primarily preventive. It helps establish internal controls over financial data.

Accurate and timely records reduce the likelihood of fraud, ensure smooth audits, and support compliance with tax laws and financial regulations.

Accounting plays a more proactive and strategic role in managing risk.They help ensure regulatory compliance and may also lead internal audits to assess financial controls and governance.

Accountants analyze financial patterns to identify early warning signs of issues like cash flow shortages, cost overruns, or potential insolvency.

Stakeholder Communication

Bookkeeping involves mainly internal and operational communication. Its mainly transactional and focused on ensuring accuracy.

Bookkeepers work closely with internal departments such as sales, procurement, or payroll to collect and verify financial data.

Accounting requires both internal and external communication. The nature of communication is strategic, often involving analysis and explanations of the company’s financial health.

Accountants prepare reports and statements that are shared with stakeholders such as business owners, investors, creditors, auditors, and regulatory bodies.

Compliance & Regulatory Requirements

Bookkeeping is concerned with the accurate recording of transactions in accordance with basic compliance norms.

This includes organizing GST-compliant invoices, maintaining ledgers, and preparing audit-ready documents. Mistakes here can lead to downstream compliance issues.

Accounting is heavily compliance-driven. Accountants ensure businesses adhere to standards like Ind AS (India), IFRS (international), or GAAP (US).

They manage statutory filings, tax compliance under the Income Tax Act, and fulfill reporting obligations under the Companies Act and GST regime.

Documentation Standards

Bookkeepers handle source documents such as vouchers, bills, receipts, and bank statements. The key standard is accuracy and auditability.

Each transaction must be traceable to an original document.

Accountants prepare summarized and standardized reports based on this documentation.

Financial statements like Balance Sheets, P&L Statements, and Cash Flow Statements must conform to recognized accounting standards and reporting formats.

Technology Use & Automation Potential

Bookkeeping is highly automatable.

Software like Tally, QuickBooks, Zoho Books, and Xero can automate invoicing, bank reconciliations, and transaction categorization, dramatically reducing manual effort and errors.

Accounting uses technology for reporting and analysis, but core functions like interpretation, strategy, and compliance rely on human expertise.

AI and analytics tools assist accountants but CANNOT replace their judgment.

Outsourcing Feasibility

Bookkeeping is very feasible to outsource due to its repetitive, standardized processes.

The best bookkeeping service providers offer cost-effective services to businesses, especially startups and SMEs, helping them maintain compliance at lower costs.

Accounting can be outsourced for specific services like payroll, tax filing, or audit preparation.

However, strategic financial functions are often retained in-house or assigned to high-trust accounting partners like PKC.

Business Growth Adaptability

Bookkeeping scales in volume with the business.

More transactions require more entries, but the process remains structurally the same. It’s relatively easy to scale through automation or outsourcing.

Accounting becomes significantly more complex as the business grows.

Accountants must handle multiple entities, regulatory jurisdictions, funding rounds, acquisitions, or IPO preparations. They provide critical insight for strategic growth decisions.

Cost Structure

Bookkeeping is a lower-cost function. It may be charged on an hourly basis, per-transaction basis, or as a monthly flat fee.

The cost is closely tied to volume and routine effort.

Accounting commands higher costs due to the need for certified professionals, advanced analysis, and compliance expertise.

It may involve fixed salaries for in-house finance staff or higher consulting fees for external experts.

Customization Needs

Bookkeeping is mostly standardized.

Beyond customizing the chart of accounts to reflect a company’s structure, the processes of recording debits and credits are universal.

Accounting is highly customizable.

Financial reports, forecasts, tax strategies, and KPIs are all tailored to the company’s sector, goals, and regulatory environment.

Seasonal Variations Impact

Bookkeeping workload spikes during high-sales seasons (e.g., Diwali, year-end sales) due to increased transactions, invoice processing, and reconciliations.

Accounting experiences peak demand during statutory deadlines: quarterly and annual tax filings, audit season, and financial year-end closings. These peaks are driven by regulatory calendars.

Key Performance Indicators (KPIs)

Bookkeeping KPIs include:

- Number of transactions processed

- Data entry accuracy rate

- Reconciliation completion time

- Timeliness of invoice generation

- Ledger update frequency

Accounting KPIs focus on strategic metrics:

- Net profit margin

- Return on investment (ROI)

- Budget vs actual variance

- Tax compliance rate

- Forecasting accuracy

Accounting Vs Bookkeeping Services: Which One You Need For Your Business?

As a business owner, keeping your finances in check is critical, but should you hire a bookkeeper, an accountant, or both?

Here’s a service comparison:

| Criteria | Bookkeeping Services | Accounting Services |

| Transaction Recording | ✅ | ❌ |

| Financial Reports | Basic reports (trial balance, ledgers) | Detailed P&L, Balance Sheet, Cash Flow |

| Tax Filing & Compliance | Prepares records | Prepares and files taxes |

| Budgeting & Forecasting | ❌ | ✅ |

| Strategic Advice | ❌ | ✅ |

| Cost | Lower | Higher |

| Outsourcing Feasibility | Easy and cost-effective | Possible, but needs specialized expertise |

When To Consider Bookkeeping Services?

- Starting out and need to keep your records organized

- Spending too much time managing receipts, invoices, and payments

- Want to prepare for tax filing but have no clear financial documentation

- Need monthly or weekly transaction tracking

- Business handles a high volume of daily transactions

When To Consider Accounting Services?

- Need help with tax strategy and filing

- Applying for a loan or seeking investment

- Want to analyze profitability by product/service/department

- Need budgeting, forecasting, or financial advisory

- Preparing for an audit

- Business is growing and becoming financially complex

Why Your Businesses May Need BOTH

Bookkeeping and accounting work hand in hand.

- Bookkeeping ensures your records are clean, complete, and up-to-date.

- Accounting turns those records into insights, ensures legal compliance, and helps you make better decisions.

Bookkeeping Vs Accounting Services: Quick Decision Guide

| Business Stage | Recommended Setup |

| Pre-revenue / Very Early Startup | DIY bookkeeping + occasional CA support for setup/tax filing |

| Small, Growing Business | Outsourced Bookkeeper + CA firm for taxes & strategic advice |

| Established SME | In-house Bookkeeper + External Accountant (monthly review) |

| Large Company | In-house Accounting Dept + External CA for audits/compliance |

Why Pick PKC’s Accounting & Bookkeeping Services?

✅ 200+ skilled professionals handling complex accounting tasks

✅ Real-time financial reporting with advanced MIS dashboards

✅ Multi-software expertise: Tally, QuickBooks, Zoho, Busy

✅ Complete outsourced CFO solutions for strategic guidance

✅ Quick turnaround times without compromising accuracy standards

✅ End-to-end services from invoice generation to reporting

✅ Dedicated account managers for personalized service delivery

✅ Cloud-based platforms with robust data security measures

✅ Flexible engagement models adaptable to seasonal fluctuations

FAQs About Bookkeeping vs Accounting

No, bookkeeping and accounting are not the same. Bookkeeping records daily transactions, while accounting analyzes those records to prepare reports and make financial decisions.

Yes, most small businesses need both. Bookkeeping ensures accurate financial records, while accounting helps with compliance, tax filing, and planning for growth.

Yes, many small business owners manage basic bookkeeping with software like Tally or Zoho Books. But as the business grows, hiring a professional ensures accuracy and saves time.

Yes, a Chartered Accountant or experienced finance professional can handle both. However, in larger businesses, these roles are usually separated for efficiency and accuracy.

Both are important, but accounting has a greater impact on long-term growth. It helps you plan, analyze, and make better financial decisions using bookkeeping data.

Expert verified

Expert verified