Written By – PKC Desk, Edited By – Krithika Mohan, Reviewed By – Vignesh

Most businesses today are shifting to new, more efficient accounting systems. However, all this can be futile if you aren’t taking training finance teams on new accounting systems seriously.

Explore with us the best ways of finance and accounting system training while staying fully compliant with Indian laws.

Importance of Training Finance Teams

In India, businesses use a variety of accounting systems to handle everything from billing to taxes to payroll. Some of the most popular ones:

- Tally ERP 9 / TallyPrime

- Zoho Books

- QuickBooks India

- SAP FICO

- Oracle Financials

- Marg ERP

For your finance team, getting accustomed to these accounting systems is important for the following reasons:

- Avoid Costly Errors: Without proper training, your team may make mistakes like wrong entries or tax misfiling, leading to financial and legal risks.

- Improve Accuracy & Speed: Trained staff complete tasks like invoicing and reporting faster and more accurately, reducing delays and rework.

- Build Team Confidence: New systems can be overwhelming. Training helps your team feel confident and reduces stress during the transition.

- Stay Compliant: Indian regulations like GST, TDS, and the Companies Act are complex. Training keeps your team up to date and compliant.

- Encourage Adoption: Change is hard. Training helps your team see the value in new tools and makes adoption smoother.

- Maximize Your Investment: You’ve invested in powerful software – training ensures you get the most from its features.

- Support Business Growth: A well-trained team can handle more work, more clients, and more complex reporting as your business scales.

Challenges in Training Finance Teams on New Accounting Systems in India

Training finance teams in India on new accounting systems involves unique challenges. Here’s an overview of key issues and solutions:

Resistance to Change

Junior staff may hesitate to question unclear instructions or admit confusion. Heavy reliance on manual processes (e.g., Excel) creates skepticism toward automation.

Solutions: Get leadership endorsement, use internal “change champions,” and position training as skill-building.

Skill Gaps & Digital Literacy

Teams often include both tech-savvy hires and experienced staff unfamiliar with cloud-based systems. Expertise in Indian accounting standards doesn’t guarantee software fluency.

Solutions: Pre-assess skills, offer basic digital training before system-specific modules.

Infrastructure Limitations

Unstable internet in smaller cities/towns disrupts cloud-based training. Additionally, shared devices or outdated hardware hinder access.

Solutions: Provide offline content; use low-bandwidth tools; rotate access to labs.

Training Design & Delivery

Complex concepts get lost if training is only in English. Therefore, regional language support is crucial.

Solutions: Use bilingual trainers, localized materials, and scenario-based learning instead of conceptual ones

Vendor & System Fit

Accounting system global vendors may lack understanding of Indian workflows. Some systems may not be configured for Indian accounting or reporting needs.

Solutions: Request India-specific training; phase implementation by modules.

Cost & Time Constraints

Finance teams face month-end/year-end pressures, limiting training time. Along with this, high costs for trainers, simulation tools, or downtime may impact training.g

Solution: Deliver 15-minute modules focused on single tasks. Embed quick-reference guides within the system.

Sustainment & Impact

Training often stops at go-live with no ongoing support. There is often no mechanism to capture post-training challenges.

Solutions: Conduct follow-ups at 30/60/90 days; appoint internal super-users.

Structuring a Training Program for Finance Teams For Using Accounting Systems

In order to train your finance team to adopt the new accounting systems effortlessly, here’s what approach you can adopt:

1. Skill Gap Analysis

Before you start anything, find out:

- Systems, the teams are switching (Tally, SAP, Zoho, etc.)

- Team members who need training (Accountants, auditors, managers)

- Their current skill levels

Use surveys, one-on-one interviews, or quick skill tests. This avoids wasting time on stuff they already know.

2. Clear Learning Objectives

Be very specific. Each module should have a goal and an outcome.

For example:

- Learn how to generate GSTR-3B reports in Zoho Books

- Understand SAP’s cost center accounting process

- Master monthly closing procedures in Tally

3. Module Breakdown

Break down the learning into bite-sized modules. Use real-world examples (like Indian tax returns or salary calculations).

| Module | Topic | Duration |

| Module 1 | System Navigation | 1 Hour |

| Module 2 | Basic Transactions | 2 Hours |

| Module 3 | GST Compliance | 1.5 Hours |

| Module 4 | Reports & Reconciliation | 2 Hours |

| Module 5 | Troubleshooting Errors | 1 Hour |

4. Right Training Format

Choose the right training format. Some of the options available are:

- Live sessions (in-person or Zoom)

- Pre-recorded video tutorials

- Interactive sandbox environments

- One-on-one coaching

- Documentation & PDFs

For the best results, mix them up. Example: Start with a live or recorded session, which is then checked with a quiz and ends with a follow-up session where remaining doubts are cleared, if any.

5. Hands-On Practice

Make sure your team gets hands-on experience in using the accounting system.

Provide them for practice:

- Dummy invoices

- Fake GST filing scenarios

- Trial balance exercises

- Reconciliation tasks

Use a sandbox version of the actual software if possible.

6. Role-Based Training Paths

Not every person in your finance and accounting team needs to know all the functionalities of the system.

Structure training by roles:

| Role | What to Learn |

| Junior Accountant | Basic transactions, GST filing |

| Finance Manager | Reports, compliance, audits |

| Payroll Officer | Salary, PF, TDS, Form 16 |

| CFO | Dashboard insights, decision-making tools |

7. Feedback Loops

To make sure your team is learning, include feedback loops. Ask the team what they are struggling with.

Add:

- Quizzes after each module

- Quick surveys

- Live Q&A sessions

Based on the feedback, include the changes in the training program.

8. Measure Training Success

After the training, track KPIs. These may include error rates before vs after, time taken for key tasks, etc.

9. Continuous Learning

Finance laws in India change often. Therefore, your training has to be continuous.

Set up:

- Monthly refreshers

- Email tips

- Short video updates

- WhatsApp groups for doubt-solving

How Can PKC Help?

✅30+ years proven expertise in accounting system implementations

✅Structured user training programs for seamless transitions

✅Staff trained in record-keeping best practices

✅Expert migration across Tally, Busy, ZohoBooks, QuickBooks

✅Real-time business performance visibility through proper setup

✅Employee productivity improvement through systematic process consulting

✅Integration expertise connecting processes with existing systems

✅Structured requirement gathering ensures proper system alignment

✅Organized financial record maintenance training for teams

✅Post-implementation support with checks and balances framework

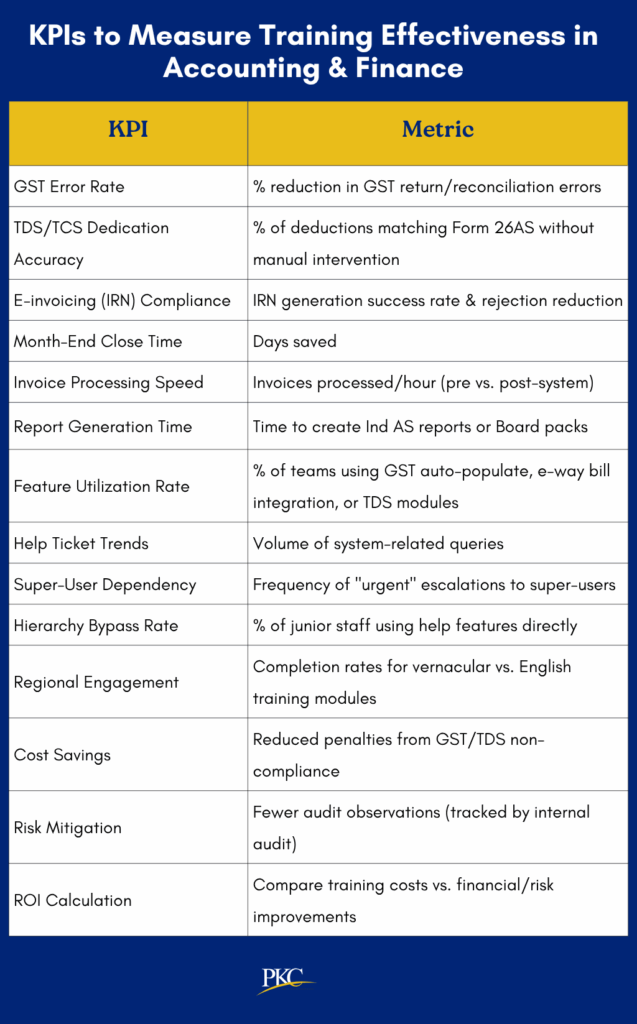

Measuring Training Effectiveness: What KPIs to Track

Here are some of the KPIs you can track to measure the success of your training programs.

1. Compliance & Accuracy KPIs

Track reduction in regulatory errors like

- GST Error Rate: % reduction in GST return/reconciliation errors

- TDS/TCS Deduction Accuracy: % of deductions matching Form 26AS without manual intervention

- E-invoicing (IRN) Compliance: IRN generation success rate & rejection reduction.

2. Process Efficiency KPIs

Measure time/money saved by replacing manual work:

- Month-End Close Time: Days saved

- Invoice Processing Speed: Pre vs. post-system

- Report Generation Time

3. System Adoption & Proficiency KPIs

Gauge real-world usage (beyond training attendance):

- Feature Utilization Rate: % of teams using GST auto-populate, e-way bill integration, or TDS modules.

- Help Ticket Trends: Reduction in volume of system-related queries

- Super-User Dependency: Frequency of “urgent” escalations to super-users.

4. Behavioral KPIs

- Hierarchy Bypass Rate: % of junior staff directly using system help features without escalating to managers

5. Business Impact KPIs

Link training to financial/risk outcomes:

- Cost Savings: Reduced penalties from GST/TDS non-compliance.

- Risk Mitigation: Fewer audit observations (tracked by internal audit).

- ROI Calculation

Frequently Asked Questions

1. What is the best way to train finance teams on new accounting software in India?

The best approach is hands-on, role-based training with live demos, followed by regular assessments. Use specific examples like GST, TDS, and invoice matching to ensure they are relevant for your team.

2. How long does it take to fully train a finance team on new systems?

Depending on the software, it usually takes 2–4 weeks for full adoption. More complex finance and accounting tools like SAP may take up to 3 months.

3. Should we train finance staff in-house or hire external trainers?

For basic tools like Tally or Zoho, internal training may be enough. For complex ERP systems like SAP or Oracle, external experts are recommended.

4. What are the most common accounting systems used in India?

Popular systems include Tally, Zoho Books, SAP FICO, Oracle Financials, and QuickBooks India. Each offers features tailored for Indian tax compliance and business needs.

5. Should training be a one-time event or ongoing?

It should be ongoing, with monthly updates and refresher modules. Finance regulations in India change frequently, so training must evolve too.

Expert verified

Expert verified