REVERSE CHARGE MECHANISM

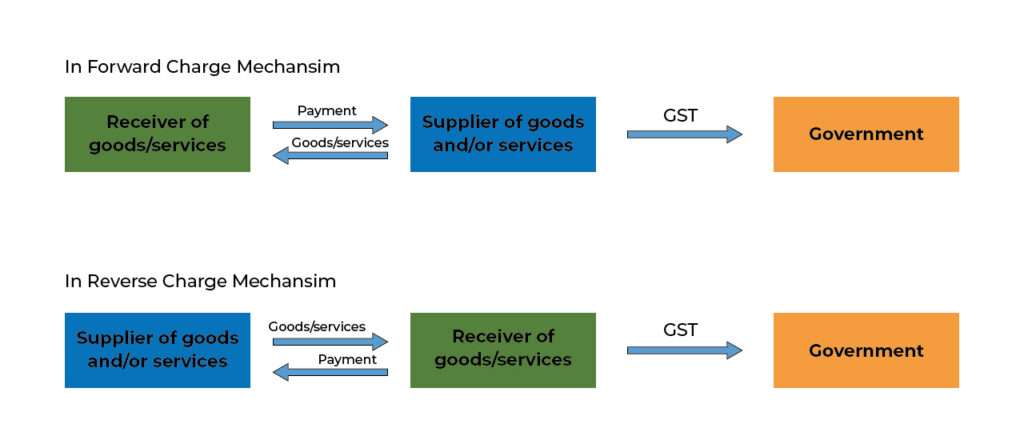

- RCM under GST is a mechanism where the supplier and the recipient change their role in paying GST to the government.

- In general, the recipient pays the GST to the supplier who then pays it to the government but under reverse charge, the recipient pays the GST to the government (not via supplier).

Payment

- All taxpayers required to pay tax under reverse charge have to register for GST and the threshold of Rs.20 Lakhs is not applicable to them.

Major services that are covered under RCM:

- Supply from unregistered person to registered

- Services through an e-commerce operator

- Supply of certain goods and services specified by CBEC

- GTA services

- Legal services by advocate

- Services supplied by an arbitral tribunal to business entity

- Services provided by way of sponsorship to anybody corporate or partnership firm

- Services provide by a director of a company or a body corporate to the said company or the body corporate

- Services supplied by an insurance agent to any person carrying on insurance business

- Services supplied by a recovery agent to banking company or a financial institution or a non-banking financial company

- Supply of services by members of Overseeing committee to Reserve Bank of India

- Services provided by the Government

- Supply of services by a music composer, photographer, artist etc.

- Supply of service by author.

- Security services

- Any service supplied by any person who is located in a non-taxable territory to any person other than non-taxable online recipient

- Services supplied by a person located in non- taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India.

Major reason for Reverse charge mechanism under GST:

Large number of service providers:

- Sometimes number of small suppliers are very large

- The recipient of goods and/or services are few

- Recovery tax from service recipients will be much simpler and will save the public at large from the burden of complying with law.

- Administrative problems in collecting the tax are heavily reduced.

- Supply from unregistered person to registered

Supply : any goods/services

Supplier : Unregistered person under GST

Receiver : Registered person under GST

- No reverse charge mechanism in case of exempted supplies

- Services by a e-commerce operator

Supply: any goods/services

Supplier: Any person

Receiver: E-commerce operator

- If an e-commerce operator supplies services than reverse charge mechanism will be applicable to the e-commerce operator

- Example: Uber, Ola, Rapido provide transportation services. Uber, ola, rapido are liable to pay GST and collect it from the customer instead of the service provider (Driver).

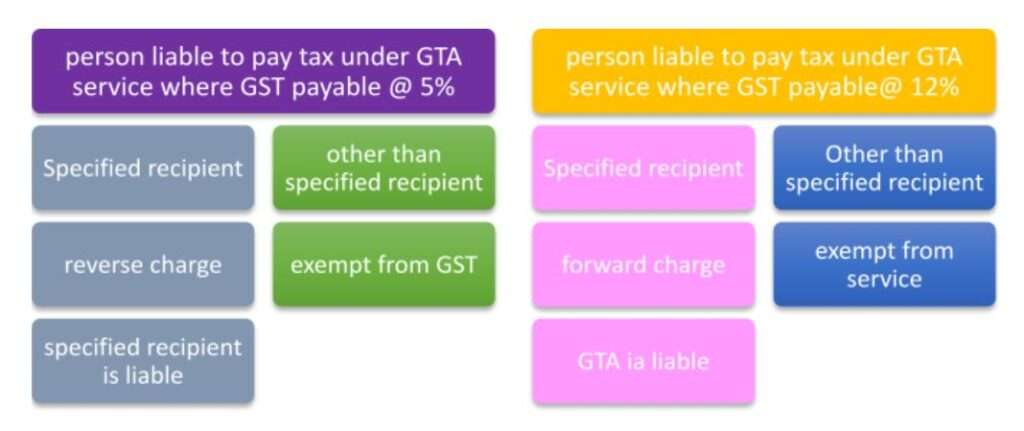

- GTA services

Supply : Transportation

Supplier : Goods transportation agency who has not paid CGST @ 5% and SGST @5%

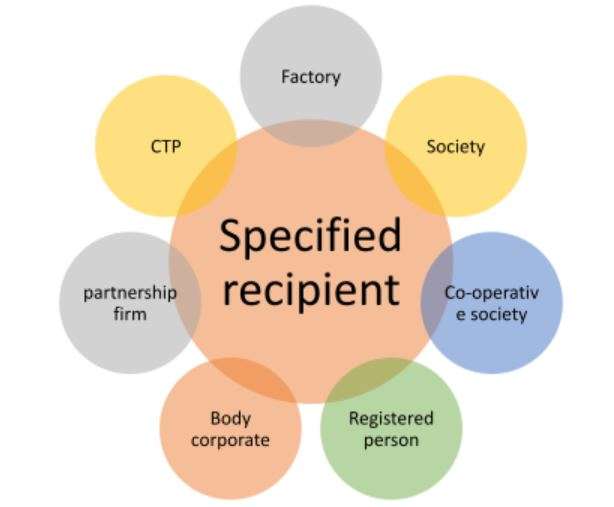

Recipient: Specified recipients

- GTA is exempted in following cases:

- Where consideration charged for the transportation of goods on a consignment transported in as single carriage does not exceed 1500

- Where consideration charged for the transportation of all such goods for a single consignee does not exceed 750

- GTA services are taxable at the following two rates

- 5% with no ITC

- 12% with ITC

- Legal services by advocate

Service: legal services*

Supplier: Advocate (includes senior advocate and firm of advocates)

Recipient: Any business entity located in the taxable territory

- *Legal services means any service provided in relation to advice, consultancy or assistance in any branch of law, in any manner and includes representational services before any court, tribunal or authority.

- Service supplied by arbitral tribunal

Supplier: Arbitral tribunal

Recipient: Any business entity located in taxable territory

- Services provided by way of sponsorship to anybody corporate or partnership firm

Service: Sponsorship service

Supplier: any person

Recipient: Any Body corporate or partnership firm.

- LLP to be considered as a partnership firm.

- The consideration is normally paid in return for naming event after the sponsor or displaying the sponsoring person logo or trade name

- But normal advertisement is not covered within ambit of Reverse charge mechanism

- Services provide by a director

Service: policy making, planning etc.

Supplier: Director of a company or body corporate

Recipient: Company or a body corporate

- The services provided by a director to the company is subject to GST at 18%

- Services supplied by an insurance agent to any person carrying on insurance business

Service: selling insurance policies to their clients (promoting, evaluating the client’s necessities, checking medical records, financial records etc.)

Supplier: Insurance agent

Recipient: person carrying on insurance business located in taxable territory

- Services supplied by a recovery agent

Service: collection of debts by all legal and possible means

Supplier: Recovery agent

Recipient: banking company or a financial institution, non –banking financial company located in taxable territory

- Supply of services by members of Overseeing committee to Reserve Bank of India

- Services provided by the Government

Services: Services other than

Supplier: Central Government, State Government, Union territory or local authority

Recipient: Any business entity located in taxable territory

- Renting of immovable property by Government

Service: renting immovable property

Supplier: Central Government, State Government, Union territory or local authority

Recipient: registered person under GST Act.

- Supply of services by a music composer, photographer, artist etc.

Service: transfer or permitting the use or enjoyment of a copyright covered under section 13(1) (a) of the copyright Act 1957.

Supplier: music composer, photographer, artist etc.

Recipient: Music Company, producer etc. located in taxable territory

- Supply of service by author

Service: transfer or permitting the use or enjoyment of a copyright covered under section 13(1) (a) of the copyright Act 1957.

Supplier: Author

Recipient: Publisher located in taxable territory

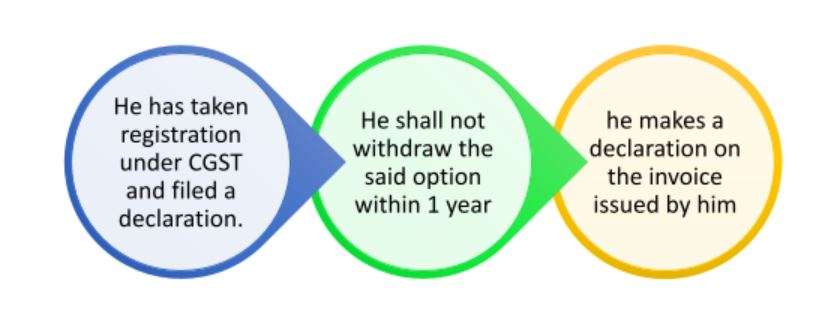

- Author can choose to pay tax under forward charge

- Security services

Service: security

Supplier: any person other than a body corporate

Recipient: a registered person located in a taxable territory

- Nothing in this section apply to :

- Others

- Any service supplied by any person who is located in a non-taxable territory to any person other than non-taxable online recipient

- Services supplied by a person located in non- taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India.

- Service provided by business facilitator to a banking company

- List of supply of goods under RCM

- Cashew nuts ,not shelled or peeled

- Bidi wrapper leaves (Tendu)

- Tobacco leaves

- Silk yarn

- Raw cotton

In all above cases

Recipient : any registered person

Supplier: Agriculturist

- Supply of lottery

Recipient: Lottery distributor or selling agent

Supplier: State government, union territory or a local authority

- Used vehicles and confiscated goods, old and used goods ,waste and scrap

Recipient: any registered person

Supplier: Central government State government, union territory or a local authority

How to show RCM sales in GSTR filing?

- We can declare the inward or outward supplies under RCM currently in GSTR-1 & GSTR-3B

- GSRT-1 :Table 4B

- GSTR-3B:Table 3.1(d)

Time of supply under reverse charge

- In case of supply of goods

The time of supply will be earlier of the following:

- The date of receipt of goods

- The date of payment

- 31st day from the date of issue of invoice by the supplier

- In case of supply of services

The time of supply will be earlier of the following:

- Date of payment

- 61st day from issue of invoice by the supplier

Manner of payment of GST under RCM

- ITC can be used for output tax liability only

- Tax under RCM can be paid through cash only without utilizing ITC