Written By – PKC Desk, Edited By – Abhinand, Reviewed By – Aakash

1) How to register for GST?

- Visit the GST portal – https://www.gst.gov.in

- Under the ‘Taxpayers’ tab, Click on the ‘Register Now’

- Select ‘Taxpayer’ in the ‘I am a’ drop-down menu,

- Choose the respective state and district.

- Enter the name and PAN of the business.

- Enter the email ID and mobile number in the respective boxes

- Enter the image that is shown on the screen and click on ‘Proceed’.

- Type the OTP that was sent to the email ID and mobile number in the respective boxes.

- After entering the OTP, click on ‘Proceed’.

- Note down the Temporary Reference Number (TRN) on the screen.

- Visit the GST portal again and click on ‘Register’ under the ‘Taxpayers’ menu.

- Enter the ‘Temporary Reference Number (TRN) and the captcha details.

- Click on ‘Proceed’.

- You will receive an OTP on your email ID and registered mobile number.

- Enter the OTP on the next page and click on ‘Proceed’.

- The status of your application will be available on the next page. On the right side, there will be an Edit icon, click on it.

- All the relevant details must be filled, and the necessary documents must be submitted. The list of documents that must be uploaded are mentioned below: Photographs, Business address proof , Bank details , Authorisation form

- Visit the ‘Verification’ page and check the declaration, Then submit the application by using one of the below mentioned methods:

- By Electronic Verification Code (EVC). The code will be sent to the registered mobile number.

- By e-Sign method. An OTP will be sent to the mobile number linked to the Aadhaar card.

- In case companies are registering, the application must be submitted by using the Digital Signature Certificate (DSC).

- Once completed, a success message will be shown on the screen. The Application Reference Number (ARN) will be sent to the registered mobile number and email ID.

- You can check the status of the ARN on the GST portal.

2) How do I check my GST Registration status?

Visit the Page https://www.gst.gov.in/

Click on Services —> Registration—-> Track Application status on the home page

Enter your ARN and give search

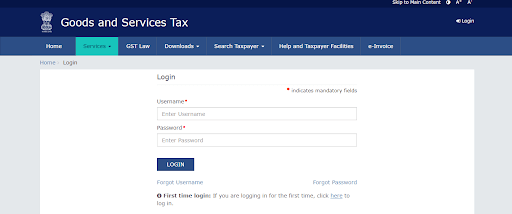

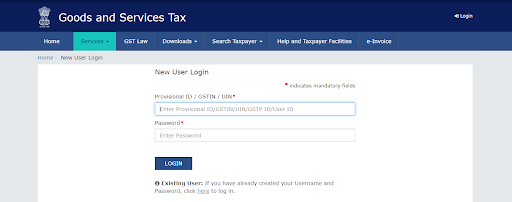

3) How do I create GST Username and password?

For New user:

Visit the Page https://www.gst.gov.in/

Click on the Login Button in the right hand top corner

Click on the here link in the instruction that says “First time login: If you are logging in for the first time, click here to login”.

Type the Provisional ID/ GSTIN/ UIN and password received in the registered E- Mail ID and enter the captcha.

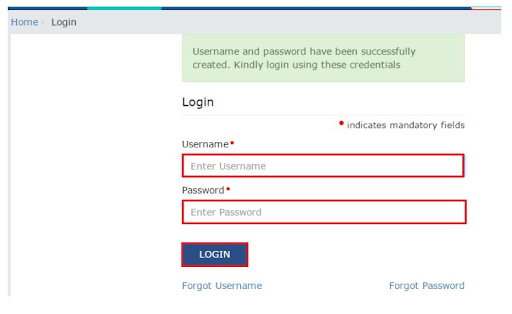

Enter the username and password what we require. Re-confirm the password and click on submit.

Your GST Username and password has been created successfully now

4) How to find a GST number of a registered person

Visit the Page https://www.gst.gov.in/

Click on the Search Tax Payer Tab

Give the PAN number of the tax payer

On giving the PAN number, the GST registration details of the tax payer will appear.

Expert verified

Expert verified