Written By – PKC Desk, Edited By – Abhinand, Reviewed By – Aakash

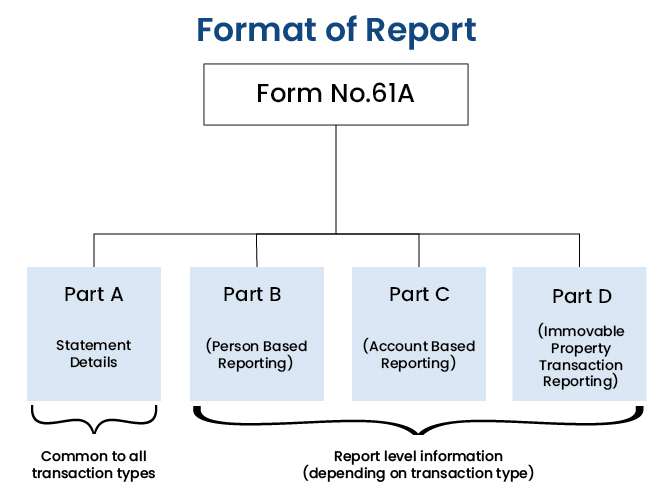

Reporting Format:

Statement of Financial Transactions (SFT) Relevant Format:

Identification of Reportable Transactions

Aggregation Rule

- Aggregation of amounts for determining the threshold amount for reporting

- All accounts of the same nature in respect of a person during the financial year

- All transactions of the same nature in respect of a person during the financial year

- Attribute the entire value of the transaction or the aggregated value of all the transactions to all the persons (if in name of more than one person)

* Aggregation is applicable for all transaction types except

- SFT- 012 (Purchase or sale of immovable property)

- SFT- 013 (Cash payment for goods and services)

Statement Type

- NB: New Statement containing New Information

- CB: Correction Statement containing corrections for previously submitted information

- ND: No data to report

One Statement can contain only one type of Statement

Multiple New Statements can be filed for a reporting period

Statement Number, Statement ID & Report Serial Number

Statement Number

- Statement Number is a free text field capturing the unique identification number for any statement sent by reporting entity

- The identifier allows both the entity and ITD to identify the specific Statement later if questions or corrections arise.

Statement ID

- Upon successful validation checks on uploaded statements, a new unique Statement ID is generated for future reference.

Report Serial Number

- Uniquely represents a report within a Statement.

- Report serial number along with Statement ID, uniquely identify any report received by ITD

Report Generation and Validation Utilities

Resources’ section on Reporting Portal (https://report.insight.gov.in)

- Prerequisites for the Utility

- Operating System : Windows 7.1 and Above

- Java Runtime Environment (JRE) version 1.8 Update 101 or later available at https://java.com/en/download/

- Running the Utility

- Extract the downloaded file to the folder using tools like WinZip or WinRAR

- Go to the folder where the contents of the Utility have been extracted and click on jar file. It displays the General Instructions window

Preparation of Report

Select SFT Code

- Select the relevant SFT Code

- Based on selected SFT Code relevant part will be displayed (Part B, Part C, Part D)

Enter Statement Details – Part A

Part A contains the details of Reporting Entity, Statement and Principal Officer.

Enter Report Details

- There are two ways to enter the data:

- Enter the data in the utility itself

- Import data CSV

Import Report Details (1/3) – Export CSV Template

- Export CSV to be filled with reportable data

- Select CSV type as ‘Report Details”

- For multiple transactions or addresses against a particular PAN or account, use CSV type “Address” and “Financial transaction”.

Import Report Details (2/3) – Populate CSV with Data to be Reported

Import Report Details (3/3) – Import Populated CSV file

Bulk reports can be captured by importing CSV

Validation of Report

Validate the Statement

- Validation errors will be displayed in right panel

Defects & Exceptions

- Defects

- Defects are those which render the record(s)/ statement invalid

- The reporting entity would be required to file the correction statement to rectify the defect

- Exceptions

- Exceptions are those which would not result in the statement/report being rejected

- These only affect the quality of the data.

- However reporting entity should endeavour to rectify the exceptions

Rectify Validation Errors

- It is mandatory to rectify the errors to generate the XML

- Revalidate the statement once error are rectified

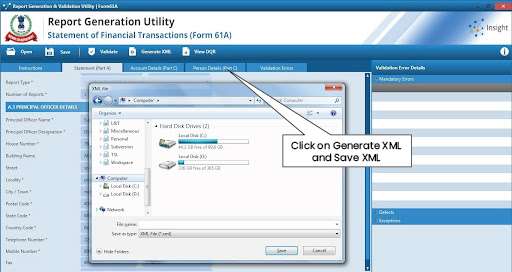

Generation of XML

- In case of no error, successful validation message will be displayed

- Generated XML file should have ‘.xml’ extension.

Generic Submission Utility

- Generic Submission Utility enables users to digitally sign the statements and generate the secure statement package.

- Key features

- Sign the XML

- Generate Secure Statement Package

- Upload Secure Statement Package

- View Uploaded Statements

- Download DQR

The Submission Utility is available under the “Resources” section of the Reporting Portal.

Preparation of Secure Statement Package

Select XML

- Select statement XML prepared through report generation utility

- XML file should be with “.xml” extension

Select Digital Certificate

- Select relevant digital certificate to sign the statement

- DSC should be connected to the system through USB while generating package

Sign the Statement

- DSC of Class II or III, issued by CCA approved certifying agencies in India, should be used

Enter Password

Save Statement Package

- Digitally signed Statement shall be saved with “.tar.gz” extension

Statement Upload Methods

- Two Methods for Uploading Statement Package

- Reporting Portal

- through Submission Utility

- Designated director of reporting entity can upload the statement

- Ensure that valid digital signature is registered with Income Tax Department on reporting portal

Statement Upload on Reporting Portal

Upload on Reporting Portal

- Fill the upload form on reporting portal

- In case of correction statement, additional field “Original Statement Id” will also appear

Manifest Validation

- Form details should match with statement details (Part A)

- Errors appearing in manifest check have to be rectified

Acknowledgement of Successful Upload

- On successful upload, acknowledgement message will be displayed

- Email will be sent to registered id along with transaction number

- Upon successful validation (schema & file level checks) unique statement id will be generated

Submission status

Status of Submitted Statement

Uploaded Statements View

Statements pending for correction should be rectified and resubmitted.

Uploaded Statement Details View

Uploaded statement details with statement status and rejection reason (If rejected)

Expert verified

Expert verified