Written By – PKC Desk, Edited By – Abhinand, Reviewed By – Aakash

Background:

This article mainly focuses on provisions of The Income Tax Act, 1961 and rules made there relating to Set Off and Carry Forward of Losses. This is a complete guide to set off and carry forward the losses including the set off of losses from business and profession from presumptive income.

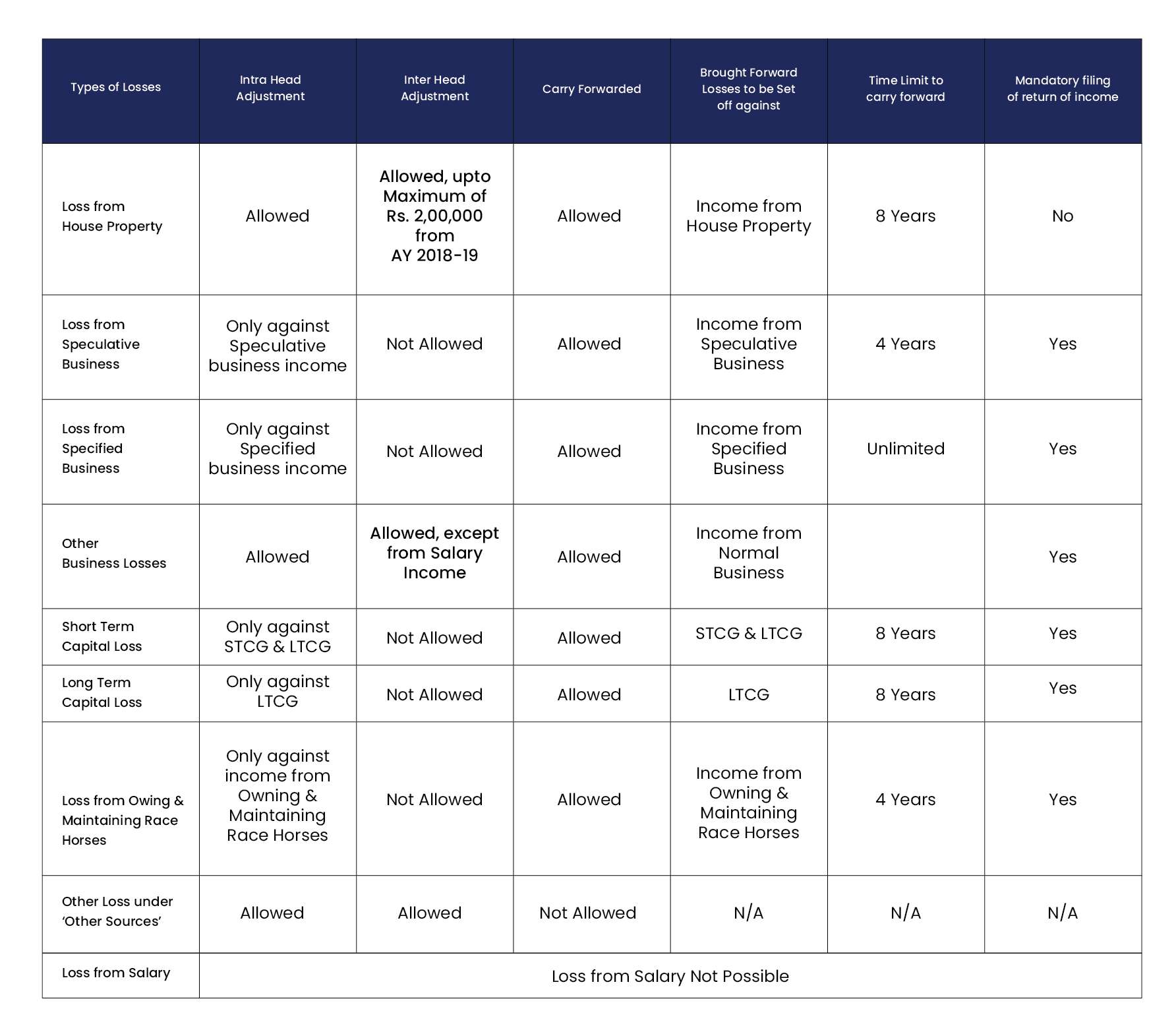

- What is Intra head adjustment?

It means loss from one source of income can be set off against income from another source but in the same head of income. For example, loss from one business, say textiles, can be set off against income from any other business, say printing, in the same year as both these sources of income fall under one head of income (Income from business). Therefore, loss in one business may be set off against the profit from another business in the same year.

- What is Inter head adjustment?

It means loss under one head of income can be set off against income from another head of income but in the same year. For example, loss from the head business can be set off against income from other sources.

- Are there any exceptions to Inter/Intra head adjustments?

Yes, there are exceptions to Inter/Intra head adjustments, i.e. the loss from the following head/sources of incomes cannot be set off against income from another head/sources of income.

i. Speculative business loss can be set off against speculative business income only.

ii. Specified business loss (u/s 35AD i.e., 100 beds hospital, cold storage facilities etc.,) can be set off against specified business income only.

iii. Long term capital loss can be set off against long term capital gain only.

iv. Loss from owing & maintaining race horses can be set off against income from owning & maintaining race horses.

v. Short term capital loss can be set off against Short term capital gain and Long term capital gain only.

vi. Loss from business cannot be set off against salary income.

- Do we need to file an Income tax return within the due date in order to gain the benefit of carryforward of losses?

Yes, In order to carry forward the losses of the current assessment year it is mandatory to file Income Tax Return within the due date. i.e. 31st July, 31st Oct, 30th Nov as the case may be.

However, the provisions apply only in case of losses of the current assessment year and not on the brought forward losses of previous assessment years which are still unutilized and required to be carried forward. Also, the losses are allowed to be set off against the income even if the return is filed after the due date.

For Example: If a person has Losses of Rs. 1,00,000 brought forwarded from AY 2017-18 and incur losses of Rs. 6,00,000 in current AY 2019-20 and he filed his return of income after the due date of return filing then he is allowed to carry forward Rs. 1,00,000 pertaining to loss of AY 2017-18 but he is not allowed to carry forward the current year loss of Rs. 6,00,000 however, he can set off this loss from the eligible income in the current AY only.

- Are there any exceptions to the above question?

Yes, House Property loss & Unabsorbed Depreciation can be carried forward even if a return is filed after the due date.

- Can the Brought forward loss be adjusted against Presumptive Income.

In case a person has brought forward losses from the business or profession and in the current assessment year the person files the return of income declaring his income under presumptive scheme specified u/s 44AD or 44ADA or 44AE then he is allowed to set off the brought forward losses from the presumptive income.

In such a case the person is required to file return of income under form ITR-3 declaring his income on presumptive basis under table 61 to 64 of “Part A P & L” of the form and declaring the brought forward losses under “Schedule-CYLA”.

- Summary of set off & carry forward of losses.

Expert verified

Expert verified