1. What is a Composition Scheme?

The Composition levy is an alternative method of levy of Tax designed for Small Taxpayers whose Turnover is upto Rs. 1.5Crore (75 Lakhs for notified states).

2. Who can opt for the Composition scheme?

The Person whose Aggregate Turnover of Preceding Financial year was Upto 1.5Crore(75laks for notified States) and not providing services more than 10% of there Turnover (or) 5 lak rupees whichever is higher.

3. Who Cannot Opt for a Composition Scheme?

- C – Casual Taxable Person

- O – Outside the state (Interstate) and outside the country (Import) purchased in stock on the date of opting for the Composition scheme.

- N – Non-resident taxable person

- S – Service providers (Whether taxable or exempted) other than (a)Restaurant service provider, (b)Service upto a limit allowed.

- U – Purchased from Unregistered supplier held in stock on the date of opting for composition scheme on which GST paid under RCM u/s 9(4).

- M – Manufacturer of certain notified goods – Ice cream, edible ice, Pan Masala, Tobacco & Tobacco products.

- E – Supplier of goods through E-commerce operator

- I – Interstate supplier of goods (whether taxable or exempted)

- N – Non-taxable supplies.

- . How to Opt for a Composition scheme?

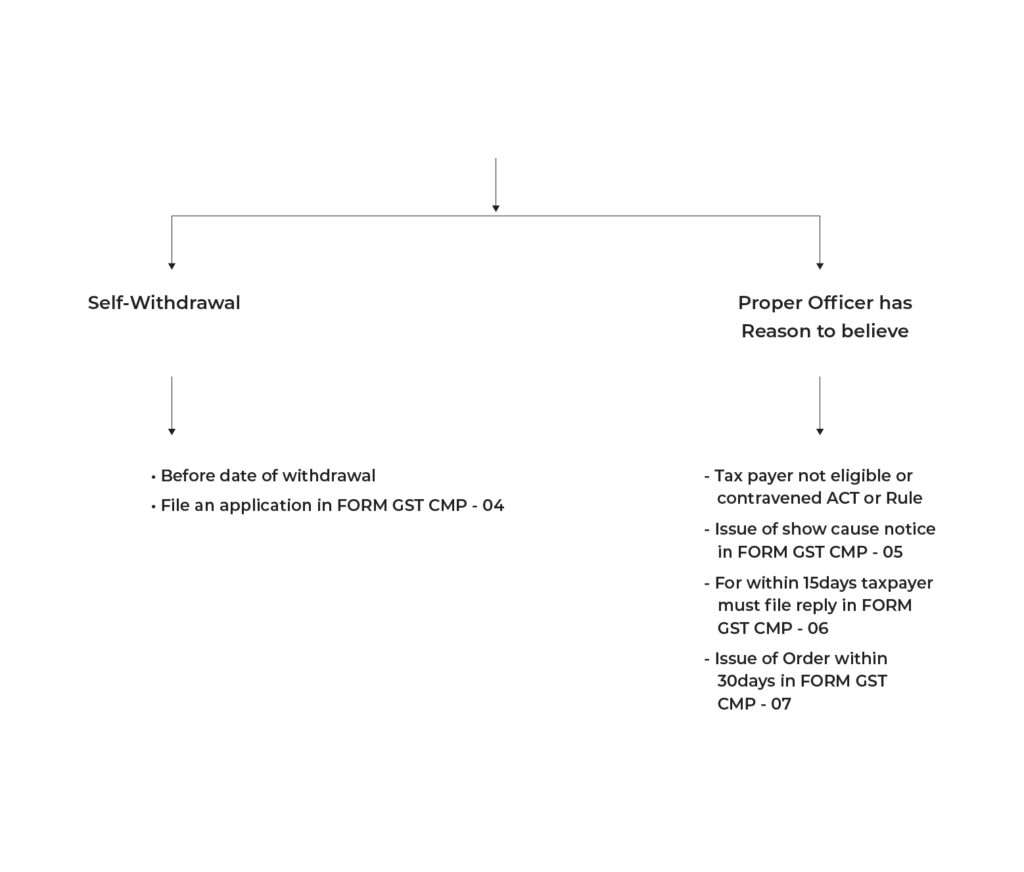

6. How to withdraw from the Composition Scheme?

7. What is the Composition Rate?

- For Manufacturers – 1% on Total Turnover(i.e. 0.5% of CGST &

0.5% of SGST)

- For Traders – 1% on Taxable Turnover(i.e. 0.5% of

CGST & 0.5% of SGST)

- For Restaurant – 5% on Total Turnover(i.e. 2.5% of CGST & 2.5% of SGST)

8 .What is the meaning of Aggregate Turnover for determining the

Eligibility for Composition scheme?

Aggregate Turnover = Includes

1. Value of all Taxable supply

2. Exempted supplies

3. Exports made by all persons with same PAN.

4. Interstate supplies.

Excludes

- Inward supplies under RCM

NOTE: Even though consideration represented by way of interest or discount on deposits, loan and advance is exempted service, it will not be considered for calculating aggregate turnover. (Order no. 1/2017 – CT dated 13/10/17)

9. What are the forms filed by a Composition Dealer?

GSTR CMP 08 – 18TH of succeeding month of every Quarter

GSTR 4 – Annual Return- 30th April of succeeding FY.

10. Can a Composition dealer issue a Tax invoice?

No, they have to issue a Bill of supply, and the word “Composition Taxable person “should be mentioned in the bill of supply.

11. Can a Composition dealer take ITC?

No, they are not allowed to take ITC and also not allowed to charge GST from their outward supplies.

Note:

- If he is converting to a normal tax payer from the Composition scheme, then GST needs to pay.

12. Whether Aggregate turnover is based on Branch wise or Pan based?

Aggregate Turnover is seen on a PAN based.

13. If a taxable person has different segments of businesses (such as textile, electronic accessories, groceries, etc.) under the same PAN , whether Composition scheme can opt for one business and pay tax as normal tax payer for Other business ?

No, they must register all such businesses under the scheme collectively or opt out of the scheme.

14. Whether a Normal tax payer can convert to a Composition scheme during the relevant financial year?

No, Normal tax payers can convert to a Composition scheme only at the beginning of the relevant financial year.

15. What are all the notified states under the composition scheme for which turnover limit is 75laks?

- Manipur

- Mizoram

- Nagaland

- Tripura

- Meghalaya

- Sikkim

- Arunachal Pradesh

- Uttarakhand

15. How will ITC be claimed by composition dealers when they convert to a Regular scheme?

ITC can be claimed for the goods held in stock /semi-finished goods when he convert as a normal tax payer (for the goods -within 1 yr. from the Invoice date given by the supplier & incase of Capital Goods – [exclusive of such exempt supply] reduce by 5% per quarter or part thereof from the date of invoice)

16. How will ITC be reversed by Regular tax payers when they convert to composition scheme?

1. Input held in stock /inputs contained in semi-finished goods held in stock.

2 .Capital goods

On the day immediately preceding the date of switch over/ date of exemption /date of cancellation of registration.

Notification No. 2/2019 w.e.f 1/4/2019

1. When Applicable?

Annual Turnover during PY <=50 Lakhs

2. To whom it’s applicable?

Manufacturer, Trader, and any service provider.

3. What is the reduced rate?

6% (3% CGST & 3% SGST) on Total Turnover.

4. What are the Notified goods for which this notification was not applicable?

Same as the Notified goods mentioned in the Composition scheme.

5. Whether service providers can opt to this notification?

Yes.

Note:

Remaining points are the same as the Composition scheme.

Expert verified

Expert verified