Foreign businesses earning income in India can be taxed twice. DTAA for foreign companies in India can help you avoid these.

Here’s a look at the DTAA benefits for foreign companies, exactly how it works and what challenges they face.

What is DTAA?

DTAA or Double Taxation Avoidance Agreement is a tax treaty between two countries that ensures individuals and businesses are not taxed twice on the same income.

It avoids double taxation once in the country where the income is earned (source country) and again in the country where the taxpayer resides (residence country).

DTAA also allows tax paid in one country to be credited or deducted from the tax payable in the other.

Key Objectives of DTAA:

- Prevent double taxation of the same income

- Clarify taxing rights between the countries involved

- Avoid tax evasion

- Promote cross-border trade and investment

- Encourage exchange of tax-related information

Types of Income Covered Under DTAA

DTAA applies to a wide range of income earned across borders. These include:

- Salary and wages (from employment in another country)

- Business profits (from activities across borders)

- Interest income (from fixed deposits, savings, and other debts)

- Dividends (from shares in companies overseas)

- Royalty payments

- Fees for technical or professional services

- Capital gains (from sale of shares, property, or other investments)

- Rental income (from property situated in the source country)

- Income from shipping and air transport

DTAA Benefits for Foreign Companies Operating in India With Examples

DTAA benefits foreign companies in a number of ways including:

1. Avoiding Double Taxation

This is the main benefit as foreign companies that earn income in India. They can avoid being taxed again in their home country.

It works on two levels:

- Exemption Method: Income taxed in India is completely exempt in the home country.

- Credit Method: Tax paid in India is credited against home-country tax.

Example: A U.S. company pays ₹20 lakh in Indian taxes. It can reduce its U.S. tax bill by that amount using the credit method.

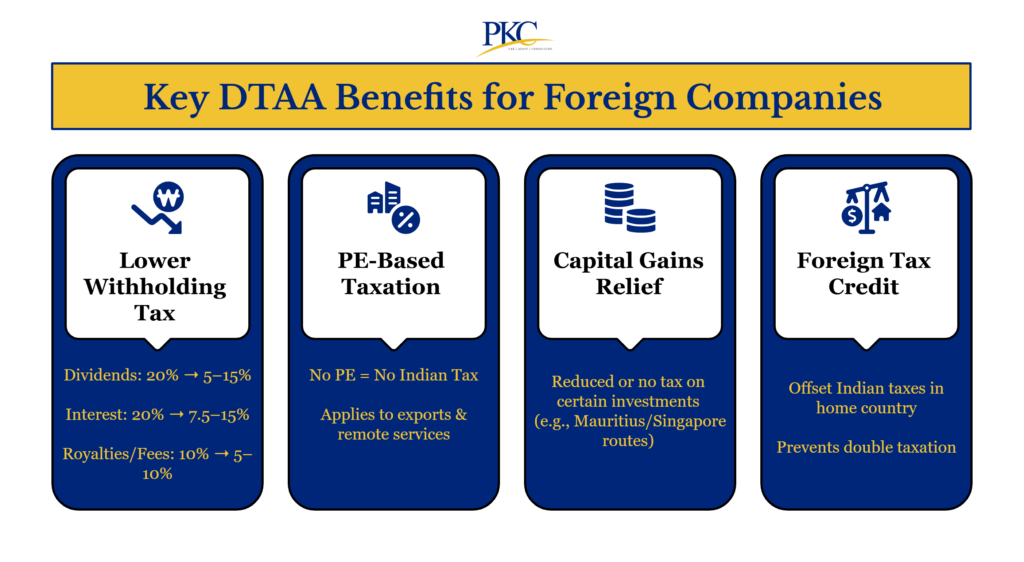

2. Reduced Withholding Tax Rates

DTAA lowers the Tax Deducted at Source (TDS) on cross-border payments such as:

| Payment Type | Domestic Rate | DTAA Rate (Example) |

| Dividends | 20% | 5–15% (e.g., 10% India–Germany) |

| Interest | 20% | 7.5–15% (e.g., 10% India–US) |

| Royalties/FTS | 10% | 5–10% (e.g., 10% India–Japan) |

3. Permanent Establishment (PE) Protection

DTAAs clearly define what qualifies as a Permanent Establishment (PE) (e.g., a fixed office, factory).

If a company has a PE in India, it may be taxed on its full business profits here.

DTAA Benefit:

- If no PE exists, India can’t tax the foreign company’s profits.

- Remote services, exports, or short-term projects (e.g., <183 days) often don’t create a PE.

Example: A German company sells software to Indian clients without any office in India. As it has no PE, India cannot tax its business profits under DTAA.

4. Capital Gains Tax Relief

Capital gains are taxed based on the asset’s location and the treaty terms.

DTAA Impact:

- Shares: Some treaties (like India–Mauritius or India–Singapore, pre-2017) exempt capital gains on Indian shares.

- Property: Taxed in India if the property is located here.

Example: A Singapore company sells shares in an Indian company. If covered under the old treaty terms, no capital gains tax applies in India.

5. Legal Clarity & Reduced Disputes

DTAAs provide clear rules, helping foreign companies:

- Reduce tax uncertainty

- Avoid unexpected audits or demands

- Resolve disputes through the Mutual Agreement Procedure (MAP)

Example: If a US firm faces double taxation due to a mismatch, the U.S. and Indian tax authorities can resolve it under MAP.

Must Know: Internal Audit for Foreign Companies in India

6. Promotes Investment & Fair Treatment

DTAAs make India more attractive for investment by:

- Providing tax transparency and predictability

- Ensuring foreign companies are not taxed more heavily than Indian firms (non-discrimination)

- Including safeguards against treaty abuse

How Can Foreign Companies Claim DTAA Benefits in India: Step-By-Step Process

Let’s take a look a step-by-step guide for foreign companies to claim DTAA benefits in India:

Step 1: Confirm Eligibility & Treaty Applicability

- Check if your country has a DTAA with India: India has DTAAs with more than 90 countries, including the US, UK, Germany, Singapore, and UAE.

- Determine the type of income: Identify the nature of income from India such as royalties, interest, dividends, or technical service fees. Verify if the DTAA provides lower tax rates or exemptions for that category.

- Ensure your company qualifies: Your company must be a tax resident of the DTAA partner country and not have a Permanent Establishment (PE) in India if you’re claiming exemption on business income.

Step 2: Obtain a Tax Residency Certificate (TRC)

TRC is an official certificate issued by your company’s home-country tax authority confirming that your company is a tax resident there.

It’s mandatory to claim reduced tax rates under India’s DTAA. Without it, Indian tax authorities will not allow DTAA benefits.

You can get it from your country’s tax authority. E.g., IRS (USA), HMRC (UK), IRAS (Singapore), etc.

It must include:

- Company name

- Registered address

- Country of residence

- Taxpayer Identification Number (TIN)

- Status (e.g., company, LLP)

- Residency period covering the relevant financial year

Step 3: Prepare and File Form 10F Electronically

Form 10F is an online declaration submitted to India’s Income Tax Department, used alongside the TRC to confirm your DTAA eligibility.

Even if your TRC has all necessary details, Form 10F is a mandatory supporting document under Indian tax law for DTAA claims.

To file this:

- Log in to the Indian Income Tax e-filing portal

- Navigate to “e-File” > “Income Tax Forms” > Select “Form 10F”

- Fill in details like:

- Nationality

- Tax identification number

- Status (e.g., company)

- Address

- Period for which the TRC is applicable

- Digitally sign or verify using an OTP or DSC (Digital Signature Certificate)

Keep a copy of the submitted Form 10F and acknowledgment for your records.

Step 4: Submit Documents to Indian Payer or Deductor

Before your Indian client or business partner makes a payment, provide them with:

- TRC

- Form 10F

- PAN (if applicable)

- No PE Declaration

- Any relevant contracts or invoices

This allows the Indian entity to apply the lower DTAA withholding tax rate, rather than the standard 20–30% domestic TDS rate.

Example: If a US company receives royalties from India, the normal TDS is 30%, but under DTAA it can be reduced to 10%.

Step 5: Ensure Form 15CA/15CB Are Filed by the Indian Payer

If funds are being remitted outside India:

- The Indian payer must file:

- Form 15CA (remittance declaration)

- Form 15CB (CA certificate confirming tax compliance), if applicable

- Your TRC and Form 10F help justify lower TDS during this process.

Step 6: File Indian Income Tax Return (ITR)

Even if TDS was already deducted:

- File an Indian tax return (if required) to:

- Report Indian-sourced income

- Claim refund for excess TDS, if applicable

- Confirm you’re applying DTAA rates correctly

- Disclose:

- Foreign income in Schedule FSI

- Tax relief claimed in Schedule TR

- Foreign assets, if relevant, in Schedule FA

- If you’ve paid tax in India and wish to claim credit in your home country, you may also need to submit India’s tax documents (e.g., TRC, TDS certificate) to your home country tax authorities.

Step 7: Reconcile Tax Credits (Form 26AS)

After payment check Form 26AS on the Indian tax portal to confirm that TDS has been deducted correctly under the DTAA rate.

If errors exist (e.g., full 30% deducted), you may need to:

- File for a refund through your Indian tax return

- Reach out to the Indian payer for correction

How Can PKC Help Foreign Companies with DTAA?

✅20+ years expertise in international taxation and DTAA compliance solutions

✅Expert Form 67 filing ensures maximum foreign tax credit claims before deadlines

✅Multi-country DTAA knowledge covering India’s 90+ tax treaties for optimal benefits

✅Seamless exemption vs credit method analysis to choose most beneficial tax structure

✅Real-time compliance tracking prevents penalties through automated DTAA documentation systems

✅End-to-end handholding from treaty interpretation to final tax liability optimization

✅Specialized NRI subsidiary advisory for foreign companies establishing Indian operations

✅Integrated tax planning approach combining DTAA benefits with overall business strategy

DTAA Challenges for Foreign Companies & How To Resolve Them

For foreign companies seeking to utilise DTAA, several practical and legal challenges can block or delay these benefits. Here are some key challenges and recommended solutions:

1. Misreading DTAA Provisions

Misunderstanding treaty clauses leads to incorrect tax treatment and missed benefits.

Solution:

- Carefully study Articles 5, 7, 12, and 23 of the relevant DTAA.

- Use the official Income Tax India DTAA site.

- Consult a cross-border tax advisor like PKC familiar with India’s tax treaties.

- Match income types correctly with treaty definitions.

2. Incomplete Documents Given to Indian Payer

If required documents aren’t provided before payment, the Indian payer will deduct full tax.

Solution:

- Share PAN, TRC, Form 10F, and No PE Declaration before the payment.

- Confirm that the payer is aware of DTAA provisions.

- Send supporting contracts or invoices if requested.

- Follow up to ensure the reduced TDS rate is actually applied.

2. Refund Delays and Tax Disputes

Over-deducted TDS refunds take months or years, impacting cash flow and requiring legal effort.

Solution:

- Claim DTAA benefits upfront to prevent excess tax deduction.

- File Indian income tax returns with all supporting documents

- Track refund status regularly via the income tax portal

- In case of disputes, file for rectification (Section 154) or appeal (Section 246A).

3. GAAR, PPT & Transfer Pricing Risks

Tax benefits may be denied if the arrangement is seen as abusive or artificial under GAAR or PPT rules.

Solution:

- Ensure all transactions are commercially justified and at arm’s length.

- Maintain proper transfer pricing documentation.

- Avoid round-tripping or tax-motivated structures

- Review all structures with a GAAR/PPT lens before execution.

4. GST and Local Regulatory Complexities

Even after DTAA compliance, businesses can face GST, FDI, and sectoral regulation issues.

Solution:

- Register for GST, PAN, TAN, and other local tax numbers.

- Understand FDI limits and licensing requirements in your sector

- File GST and other returns on time to avoid penalties

- Work with a local advisor for end-to-end compliance

5. Underestimating India’s Compliance Environment

Assuming Indian tax and legal processes are simple can lead to missed deadlines and penalties.

Solution:

- Build a compliance calendar to track all deadlines.

- Partner with experienced Indian tax and legal firms like PKC Management Consulting

- Set up internal systems for document management and tracking.

- Factor in regulatory costs while planning your India operations.

6. Most Favoured Nation (MFN) Clause Complications

Recent developments, including Switzerland suspending the MFN clause from January 2025, create uncertainty about tax rates and benefits previously available.

Solution:

- Regular monitoring of treaty amendments and notifications

- Restructure operations or holding structures to optimize treaty benefits

- Evaluate alternative treaty networks for better tax positions

- Consider the impact of changing MFN provisions on existing structures

7. Currency Conversion and Rate Determination

Confusion over applicable exchange rates for foreign tax credit calculations and income computation, particularly regarding telegraphic transfer buying rates.

Solution:

- Establish clear policies for currency conversion using SBI telegraphic rates

- Maintain records of applicable rates for different types of income

- Implement systems for accurate rate determination based on specified dates

- Regular reconciliation of foreign currency positions

FAQs About DTAA Benefits for Foreign Companies

1. Is DTAA applicable to foreign companies operating in India?

Yes, DTAA applies to foreign companies that earn income in India and are tax residents of a country with which India has a DTAA. They can claim reduced tax rates and avoid double taxation by submitting required documentation.

2 How can a foreign company claim DTAA benefits in India?

They must obtain a Tax Residency Certificate (TRC), a PAN, submit Form 10F, and a No PE Declaration to the Indian payer. This ensures they are taxed at DTAA rates rather than the default rate.

3. What documents are required to claim DTAA benefits in India?

The key documents are PAN, TRC, Form 10F, and a declaration of no Permanent Establishment in India. These must be submitted before payment to apply DTAA benefits.

4. Can foreign companies get a refund for excess TDS deducted?

Yes, but the refund process can be slow and requires filing an income tax return in India.That’s why claiming DTAA benefits before payment is better than requesting a refund later.

5. What if India doesn’t have a DTAA with the foreign company’s country?

If no DTAA exists, the foreign company will be taxed under regular Indian tax laws. This usually results in higher TDS and no tax relief in the home country.

Expert verified

Expert verified