Written By – PKC Desk, Edited By – Rohit, Reviewed By – Balaji Prasath

Automating accounting systems in India benefits businesses across all verticals and sizes.

This guide will show you exactly how it works and why it’s essential for growth in 2025, and what the best automation options are for your business.

Benefits of Automation in Accounting Systems

Automating accounting systems can have several benefits for companies, including:

Improved Accuracy & Reduced Errors:

Automation minimizes manual data entry, reducing human mistakes in calculations, reconciliations, and GST/TDS filings.

This is essential to avoiding expensive fines and complying with intricate Indian tax rules.

Enhanced Efficiency & Time Savings:

Software automates repetitive tasks like invoicing, payments, bank reconciliation, and report generation, freeing up accountants’ time.

This frees up financial teams from laborious manual labor to concentrate on strategic analysis, cost control, and growth planning.

Real-Time Financial Visibility:

From any location, cloud-based systems offer immediate access to current financial data, including cash flow, P&L, payables, and receivables.

This enables faster, data-driven decision-making for business owners and managers in a fast-changing market.

Simplified Compliance & Reporting:

Automation tools keep updated with Indian regulations and auto-generate GST returns (GSTR-1, GSTR-3B), TDS returns (24Q, 26Q), and financial statements compliant with Accounting Standards (Ind AS) or Companies Act requirements.

It reduces the burden and risk of filing deadlines (monthly/quarterly/annual) with tax authorities and regulators like the MCA.

Better Cash Flow Management:

It allows for automated tracking of invoices, payment reminders, and reconciliation, and provides clear visibility into cash inflows and outflows.

This is particularly beneficial for Indian businesses navigating payment cycles and working capital challenges common in the market.

Cost Savings:

Automation avoids errors (avoidance of fines and penalties), lowers labor expenses for manual tasks, and saves money on paperwork, printing, and storage.

This is especially important for cost-conscious businesses like MSMEs.

Enhanced Data Security & Audit Trail:

Digital systems use access controls and encryption. Every transaction is automatically logged with a clear, tamper-proof audit trail.

This protects sensitive financial data and simplifies internal/external audits required under Indian law.

Scalability:

Automated systems easily handle increased transaction volumes as an Indian business grows, without needing proportional increases in accounting staff.

This supports the growth ambitions of Indian startups and businesses efficiently.

Top Tools for Automating Accounting Processes in India

Let’s take a quick look at the top accounting automation tools widely used and well-suited for the Indian market:

TallyPrime (Cloud) / Tally.ERP 9 (On-Premise):

India’s leading accounting software, deeply embedded with GST, TDS, e-Way Bills, and inventory management.

✅PROS:

- Unmatched depth in Indian statutory compliance (GSTR-1, GSTR-3B, e-Invoicing)

- Robust inventory & manufacturing features

- Massive local support network & user familiarity

- Reliable offline capability (Tally.ERP 9)

❌CONS:

- The user interface feels old compared to modern SaaS tools.

- Customization can be complex.

Best for: Businesses of all sizes prioritizing robust Indian compliance, especially manufacturing, trading, distribution, and CA firms.

Zoho Books:

A user-friendly, cloud-native accounting suite part of the larger Zoho ecosystem, strong on automation and integrations.

✅PROS:

- Excellent GST compliance & auto-filing.

- Seamless integration with other Zoho apps

- Affordable pricing, intuitive interface, strong mobile app.

- Good automation (recurring invoices, payment reminders).

❌CONS:

- Advanced inventory/manufacturing needs may require higher-tier Zoho apps.

- Offline functionality is limited.

Best for: Startups, SMEs, service businesses, and companies already using Zoho apps.

Marg ERP 9++:

A comprehensive Indian ERP solution with very strong inventory, supply chain, and manufacturing alongside core accounting and GST.

✅PROS:

- Exceptional inventory & supply chain management (batch/expiry, barcoding).

- Strong GST compliance, including e-Invoicing (IRN).

- Industry-specific solutions (retail, distribution, manufacturing).

- Good dealer/order management.

❌CONS

- The interface can be complex for pure accounting users.

- Primarily known for on-premise

Best for: Trading, distribution, manufacturing, and retail businesses needing deep operational control alongside accounting.

SAP Business One

An entry-level ERP solution from SAP designed for SMEs, offering integrated finance, sales, and operations.

✅PROS:

- Scalable foundation, good reporting & analytics

- Localized for key Indian compliance (GST, TDS)

- SAP brand reputation & ecosystem

- Beyond accounting, strong integrated ERP functionality

❌CONS:

- Higher implementation cost and complexity than pure accounting tools

- Requires significant training and potentially dedicated IT support

- Not for businesses needing only core accounting

Best for: Growing mid-sized businesses (especially manufacturing/distribution) needing a full ERP, willing to invest in implementation.

Ramco ERP

An India-born global ERP suite known for innovation (AI, voice), strong compliance, and industry solutions.

✅PROS:

- Deep Indian statutory coverage (GST, Tax, Excise) + global needs

- AI/ML features (anomaly detection, predictive insights)

- Strong mobile/voice capabilities

- Proven in complex industries (aviation, logistics)

❌CONS:

- Pricing can be competitive for the very high end

- Implementation can take time

- Less common

Best for: Mid-to-large enterprises in complex sectors (aviation, logistics, manufacturing) valuing innovation and deep compliance.

Sage Business Cloud Accounting

A straightforward cloud accounting solution focused on core financials, suitable for smaller businesses.

✅PROS:

- Simple, clean, and easy-to-use interface

- Handles basic GST invoicing and filing

- Affordable entry point

- Good for basic accounting needs

❌CONS:

- Limited depth in advanced Indian compliance

- Limited inventory and operational features

- Smaller local ecosystem & support

Best for: Micro-businesses, freelancers, consultants, and small service firms needing simple accounting with basic GST.

Xero

A popular global cloud accounting platform known for its user experience and app ecosystem.

✅PROS:

- Excellent user interface and bank reconciliation

- Strong third-party app marketplace (global)

- Good collaboration features

❌CONS:

- Limited built-in Indian compliance (GST, TDS)

- Core features are less tailored to specific Indian business practices

- Less local support network in India

Best For: Small businesses or freelancers in India primarily dealing internationally.

Get in Touch With Our Business Automation Experts Now!

Common Challenges in Automating Accounting Processes in India + Solutions

Automating accounting systems in India can be challenging. Here are common challenges along with practical solutions:

1. Complex & Evolving Regulatory Compliance

Keeping up with frequent GST rate changes, e-invoicing (IRN) mandates, TDS rules, and state-specific requirements is daunting.

Solution:

- Use compliance-focused Indian software with auto-updates

- Integrate with GST Suvidha Providers (GSPs) for seamless filing

- Subscribe to government alerts (GSTN portal) and industry newsletters

2. Resistance to Change & Lack of Digital Skills

Accountants/owners used to manual processes may resist automation due to fear or a lack of tech familiarity.

Solution:

- Conduct phased training in local languages using vendor-provided resources.

- Start with low-risk modules (e.g., invoicing) to showcase quick wins

- Appoint a tech-savvy team/ team member to drive adoption

3. High Initial Costs & ROI Uncertainty

SMEs fear subscription fees, hardware upgrades, and implementation costs without clear payback timelines.

Solution:

- Opt for scalable cloud tools with tiered pricing.

- Calculate ROI using benchmarks.

- Leverage government subsidies (MSME schemes) for digital adoption.

4. Data Migration & Legacy System Integration

Moving decades of ledger data from old systems (Excel/Tally 7.2) to new platforms risks errors and downtime.

Solution:

- Use automated data migration tools and validate with sample checks.

- Prioritize API-first platforms that integrate with Indian banking/payroll apps.

- Migrate in phases

5. Infrastructure & Connectivity Issues

Power outages, slow internet in Tier 2/3 cities disrupt cloud access.

Solution:

- Choose offline-capable tools with cloud sync.

- Use hybrid models (local server + cloud backup)

6. Data Security & Privacy Concerns

Fear about cloud-based financial data breaches, particularly in light of India’s growing cybercrime rate.

Solution:

- Select certified platforms with Indian data centers

- Enforce role-based access controls and audit logs

- Train teams on Cyber Swachhta Kendra guidelines (MeitY).

7. Customization for Indian Business Practices

Global software may not support khata systems, regional language invoices, or kirana store workflows.

Solution:

- Prioritize India-built tools with local business logic.

- Use platforms offering vernacular interfaces

- Leverage custom field options in Zoho/Tally for unique needs.

How Can PKC Help With Automating Accounting Processes?

✅Custom implementation strategies for seamless tool integration

✅Chartered Accountants assess automation needs and recommend

✅Complete implementation support from selection to execution

✅End-to-end automation tool configuration and customization

✅Training teams on chosen automation software platforms

✅Post-implementation optimization and automation tool fine-tuning

✅Integration consulting for multiple accounting automation systems

✅Customized automation roadmaps based on business requirements

✅Vendor-neutral advice ensuring the best automation tool selection

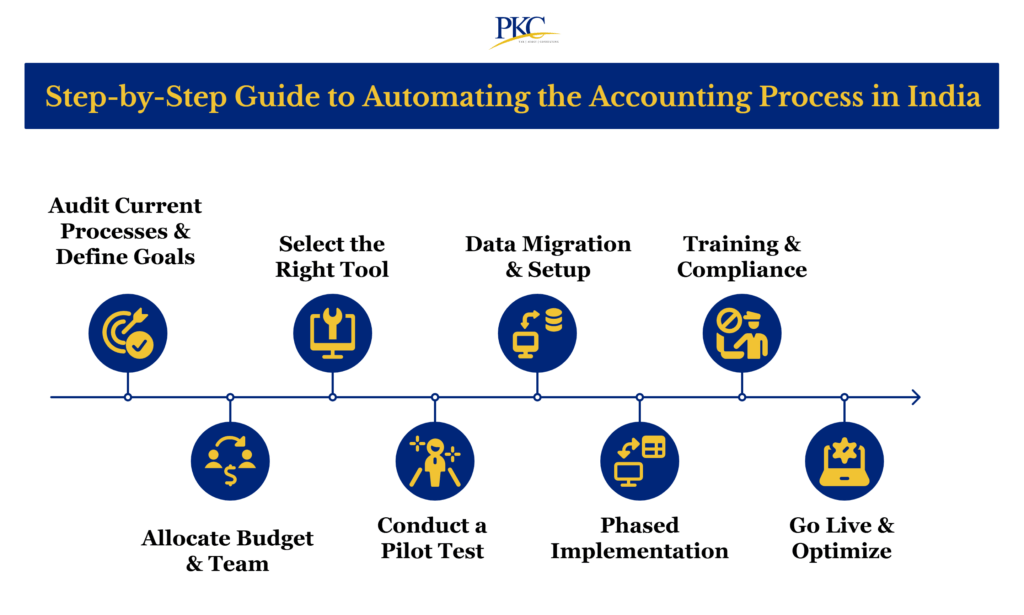

Step-by-Step Guide to Automating the Accounting Process in India

Automating your accounting systems can be done seamlessly if you take the right approach. Here’s a step-by-step method:

Audit Current Processes & Define Goals

- Map all workflows: Manual data entry → GST filing → Payroll → Reporting.

- Identify pain points: High error rates, delayed bank reconciliations, etc.

- Prioritize and define the most important needs

Allocate Budget & Team

- Set budget costs that include: Software cost + training + IT support.

- Assign: Project lead (CA/CFO) + IT head + key accountants

Select the Right Tool

- Shortlist compliant platforms

- Make sure they have the features you need, like Auto-GST. TDS/TCS management, integration with Indian banks, payment gateways, and e-Way Bill portals.

Conduct a Pilot Test

- Test: GST invoice generation → E-Way Bill creation → Reconciliation with Form 26AS.

- Verify: Tool updates automatically for the latest GST rule changes

Data Migration & Setup

- Export all your existing data (invoices, expenses, taxes, etc.)

- Clean it up: remove duplicates or errors

- Import it into the new system

- Set up state-wise GST rates and TDS slabs.

- Connect bank feeds (via APIs like ICICI iPal or HDFC SmartHub).

Phased Implementation

- Start Basic (Weeks 1-4): Start by automating invoicing, GST Filing

- Expand to Core Processes (Weeks 5-8): Accounts Payable, Bank Reconciliation, TDS Management

- Advanced Automation (Month 3+): Payroll Integration, Cost Center Tracking.

Training & Compliance

- Teach your staff or accountant how to use the new software

- Use built-in tutorials, YouTube videos, or help guides

- Assign roles to users so no one makes accidental changes

Go Live & Optimize

- Parallel Run: For one month, run old + new systems simultaneously

- Track KPIs: “Time saved per GST return,” “Error reduction in TDS.”

- Check reports weekly or monthly

- Fix errors quickly and optimize settings as your business grows

Frequently Asked Questions

1. What is accounting automation, and how does it work?

Accounting automation uses software to handle tasks like invoicing, GST filing, and bank reconciliation. It replaces manual work with digital processes, saving time and reducing errors.

2. Which software is best for small businesses in India? Softwares such as Zoho Books and Vyapar App are great for small businesses because they’re easy to use and affordable. They also support GST, inventory tracking, and mobile access.

3. How does automation help with GST compliance?

Most tools auto-generate GSTR-1, GSTR-3B, and other forms based on your entries. This helps you file faster and reduces the chance of errors or missed deadlines.

4. Can accounting automation work without the internet?

Some tools, like Tally, work offline, but most modern platforms are cloud-based and need the internet. Cloud tools are better for real-time access and automatic backups.

5. Will I still need an accountant after automation?

Yes, but their role will change—they’ll spend less time entering data and more time giving insights. Automation helps them focus on smarter work, not boring tasks.

Expert verified

Expert verified