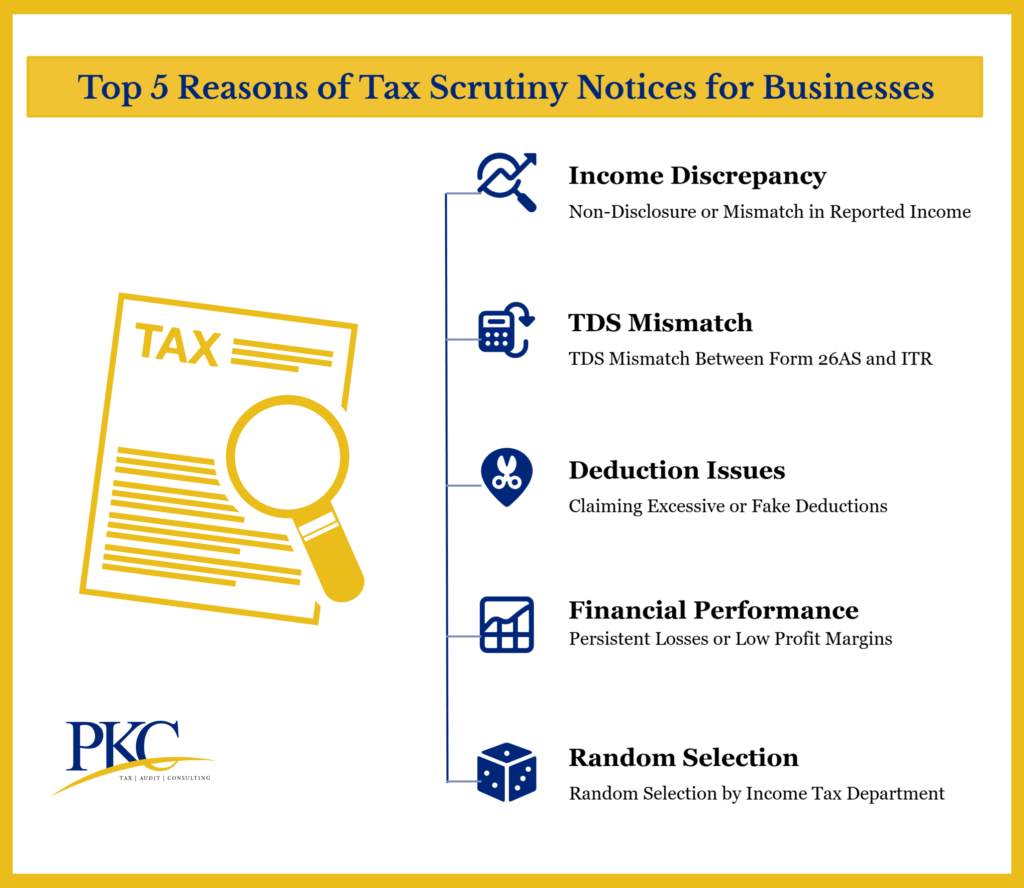

Understanding the common reasons for getting a tax scrutiny notice in India helps you stay compliant and avoid unpleasant situations.

Explore with us some of the most common reasons why the income tax department serves an income tax scrutiny notice.

Why Do Businesses & Individuals Receive Income Tax Scrutiny Notice: Reasons Explained

Here’s a list of the common reasons for tax scrutiny notices in India for companies and individuals categorized by broad sections:

Income and Reporting Discrepancies

- Underreported Income

For: Both individuals and businesses

If the income tax authorities detect that reported income is less than your than lifestyle indicators or industry benchmarks, your case may be flagged for scrutiny.

This often occurs when there’s a mismatch between reported earnings and visible spending patterns or asset acquisitions.

- Misreporting Capital Gains or Property Sales

For: Both individuals and businesses

Incorrect reporting of capital gains from property sales, stock transactions, or other asset disposals triggers scrutiny.

This includes undervaluing sale prices, overstating purchase costs, or failing to report transactions entirely.

- Unexplained Income/Liabilities

For: Both individuals and businesses

When taxpayers cannot adequately explain sources of income or sudden increases in wealth, it raises red flags.

Such amounts may be taxed at a higher rate if not properly explained

Cash Transactions and High-Value Activities

- High-Value Cash Deposit

For: Both individuals and businesses

Cash deposits exceeding ₹10 lakh (for individuals) in a financial year in savings accounts, or large cash transactions in current accounts, are automatically reported to the Income Tax Department.

The department may issue a notice seeking clarification on the source of these funds, especially if the deposits do not match your declared income

- High-Value Purchases

For: Both individuals and businesses

Purchases of high-value assets (such as property, vehicles, or jewelry) that seem disproportionate to declared income attract attention.

If these purchases are inconsistent with your declared income or financial profile, you may receive a notice to explain the source of funds.

- Excessive Use of Cash in Business Transactions

For: Primarily businesses

Excessive cash transactions in business operations, especially above the legal thresholds, may face scrutiny.

The department may issue a notice if cash transactions are high and not supported by proper documentation or justification

Banking and Financial Irregularities

- Inconsistent or Unexplained Bank Deposits/Withdrawals

For: Both individuals and businesses

Unusual banking patterns, including frequent large transactions, multiple account operations, sudden changes in account balances, or inconsistent deposit patterns trigger alerts.

Banks share transaction data with tax authorities through various reporting mechanisms. The Income Tax department monitors these patterns for potential tax evasion

- Digital Payment Irregularities

For: Both individuals and businesses

Mismatches between digital payment receipts and reported income, or excessive use of digital payments without corresponding income disclosure.

This includes UPI transactions, credit card payments, and other electronic payment irregularities.

Investment Discrepancies

- Share Market and Investment Activities

For: Both individuals and businesses

Large investments, substantial trading activities, frequent high-value transactions, or profits that seem inconsistent with declared income trigger scrutiny.

This includes both direct stock trading and indirect investment activities.

- Non-disclosure of Crypto or Digital Assets

For: Both individuals and businesses

With the rise of crypto and digital assets, the Income Tax Department expects disclosure of such holdings and related transactions.

Failure to report cryptocurrency holdings, trading profits, or digital asset transactions increasingly triggers scrutiny.

Business-Specific Issues

- Business and Professional Income Issues

Discrepancies in business income reporting, including underreporting of receipts or overstatement of expenses.

This particularly affects professionals like doctors, lawyers, and consultants who might have significant cash receipts.

- Persistent Losses

Businesses showing continuous losses over multiple years without reasonable explanation face scrutiny.

Tax authorities examine whether losses are genuine or used to avoid tax obligations.

- Low Profit Margins

When businesses consistently report profit margins significantly below industry standards, it triggers investigation.

This is especially relevant for businesses in sectors with known profit benchmarks. The department may scrutinize your books to ensure that income is not being underreported or expenses overstated

- Business Structure Red Flags

Complex business structures, multiple shell companies, or unusual ownership patterns may attract the eyes of the income tax officials.

This includes situations where business structures don’t align with actual operations.The department investigates such structures for potential tax avoidance

- Tax Audit Lapses

This is one of the most common reasons for getting tax scrutiny notice for companies.

Failure to conduct mandatory tax audits when required, or significant discrepancies found during audits can attract scrutiny.

- Misreporting of Expenses

Inflating business expenses, claiming personal expenses as business costs, or reporting expenses that don’t align with business activities.

This particularly affects small businesses and professionals.

How Can PKC Help Businesses Avoid Scrutiny Notices? ▫️Below 75% Industry Average Scrutiny Rate Record ▫️Proactive Tax Planning Strategies Minimize Scrutiny Risks ▫️Expert AIS/TIS Reconciliation Prevents Automated Red Flags ▫️Comprehensive Documentation Review Before ITR Filing ▫️Strategic Capital Gains Reporting Avoids Valuation Issues ▫️Professional Business Expense Categorization Reduces Audit Triggers ▫️Industry-Specific Tax Optimization Within Legal Boundaries ▫️Advanced Cash Flow Analysis Prevents Deposit Mismatches ▫️Specialized High-Value Transaction Documentation and Reporting ▫️Regular Tax Health Checks Identify Potential Issues ▫️Zero to Minimal Tax Liability Achievement Record |

- Sector-Specific Red Flags

Certain industries like real estate, construction, or cash-intensive businesses face enhanced scrutiny due to their nature.

Tax authorities maintain sector-specific risk profiles and benchmarks.

Learn More about Our Tax Services Here

Compliance and Documentation Issues

- TDS and AIS/TIS Mismatches

For: Both individuals and businesses

Discrepancies between the TDS reported by employers or deductors and the information in your Annual Information Statement (AIS) or Taxpayer Information Summary (TIS) can trigger scrutiny.

The department expects the information across all documents to match; mismatches may result in a notice for clarification

- Multiple ITR Revisions Without Reason

For: Both individuals and businesses

Frequent revisions to income tax returns without valid reasons raise suspicion about the accuracy of original filings.

This suggests potential attempts to hide income or manipulate reported figures.

- Incorrect or Incomplete Documentation

For: Both individuals and businesses

Poor record-keeping, missing supporting documents, or inconsistent documentation across different filings trigger scrutiny.

This includes situations where claimed deductions lack proper supporting evidence.

Claims and Deductions

- High or Repetitive Refunds Claimed Repeatedly

For: Both individuals and businesses

Consistently claiming large refunds or showing patterns of refund claims that seem disproportionate to business activities.

This includes situations where refund amounts don’t match with business scale or income levels.

- Deduction and Exemption Claims

For: Both individuals and businesses

Excessive or suspicious deduction claims under various sections of the Income Tax Act.

This includes situations where claimed deductions are disproportionate to income or lack proper supporting documentation.

Profession and Relationship-Specific Issues

- Professional Service Irregularities

For: Primarily professionals/businesses

Professionals like doctors, lawyers, chartered accountants, or consultants showing income inconsistent with their practice scale or client base.

This includes situations where professional fees don’t match declared income.

- Family and Relationship Transactions

For: Both individuals and businesses

Transactions between family members, related parties, or connected entities that might be used to shift income or avoid taxes.

This includes gift transactions, family business arrangements, or inter-family asset transfers.

External Data and Random Factors

- Third-Party Information Sources

For: Both individuals and businesses

Information received from banks, financial institutions, or other third parties that doesn’t match filed returns attract scrutiny.

This includes data from credit card companies, investment platforms, whistleblowers or business partners.

- Random Selection By Tax Authorities

For: Both individuals and businesses

Computer-assisted random selection processes that pick returns for detailed examination without specific red flags. This is part of the broader compliance monitoring strategy.

- Compliance History Issues

For: Both individuals and businesses

Previous non-compliance issues, pending assessments, or history of tax disputes increase the likelihood of scrutiny.

Tax authorities maintain compliance profiles for taxpayers.

- Foreign Transaction Red Flags

For: Both individuals and businesses

International transactions, foreign investments, or cross-border business activities that aren’t properly disclosed or reported.

This includes foreign bank accounts, overseas investments, or international business operations.

Frequently Asked Questions

1. What triggers a tax scrutiny notice in India?

Tax scrutiny is usually triggered by discrepancies in your ITR, such as mismatches with Form 26AS or unusually high deductions. Large cash deposits or unreported income are also common reasons.

2. Can I ignore a tax scrutiny notice?

No, ignoring it can lead to penalties, legal action, or assessment without your input. Always respond within the specified time frame.

3. Do cryptocurrency transactions cause tax scrutiny?

Yes, if you trade crypto and don’t report it, the IT Department may flag your return.

Since 2022, crypto gains are taxable and tracked via exchanges.

4. Is filing a revised return risky for scrutiny?

Frequent or late revisions may raise suspicion, especially if you change income or deduction amounts. Use revisions only to fix genuine mistakes.

Expert verified

Expert verified