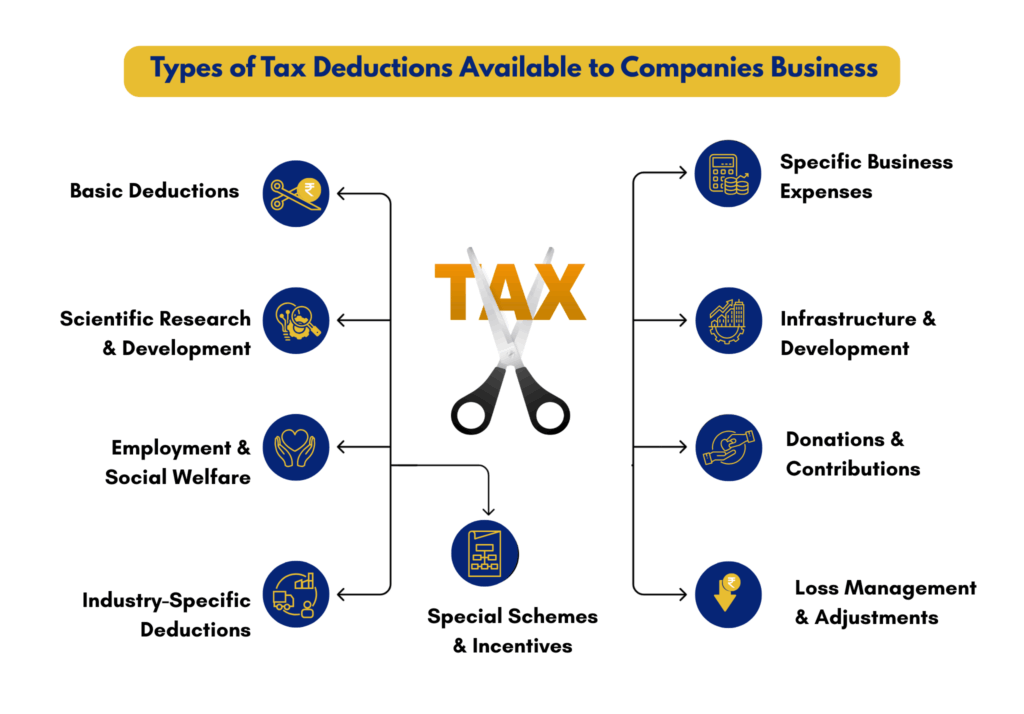

Tax deductions available under Indian Income Tax for companies can help them reduce their taxable income and improve cash flow.

Understand with us the main tax deductions for business owners. Utilising the list of tax deductions available under Indian income tax for companies can help them legally save significant amounts every year.

How Indian Companies Can Save Tax Legally: 44 Key Deductions Explained

Here’s a brief look into the tax deductions available under Indian income tax for companies:

Basic Deductions

- Depreciation (Section 32)

Companies can claim depreciation on assets used in business. These include buildings, machinery, furniture, and vehicles as they lose value over time.

The depreciation rates are prescribed by the Income Tax Act and vary by asset type. For example, computers depreciate at 40% while buildings at 10%.

- Additional Depreciation (Section 32(1)(iia))

Manufacturing and power generation companies can claim an extra 20% depreciation on new plant and machinery (not for second-hand) acquired and installed, subject to certain conditions.

This can be claimed in the same year of purchase, over and above the normal depreciation. It aims to encourage capital investment and modernization.

- Business Expenditure (Section 37)

All legitimate business expenses that are incurred wholly and exclusively for business purposes can be deducted from taxable income.

This includes day-to-day operational costs that are directly related to earning business income like electricity bills, telephone expenses, office supplies, and staff salaries.

- Preliminary Expenses (Section 35D)

Expenses incurred before starting a business – feasibility studies, incorporation fees, and market research costs, can be amortized over five years.

This provision helps new businesses recover their pre-operational costs systematically.

- Employee Welfare Contributions (Section 36(1)(iv), (va))

Contributions made by employers to recognized employee benefit schemes like PF, ESI, gratuity funds, and approved superannuation schemes are also deductible, provided they are paid within the prescribed time limits

These contributions have to be made to government-recognized or approved funds to qualify for deduction.

- Interest on Borrowed Capital (Section 36(1)(iii))

Interest paid on loans (taken from banks, financial institutions, or other institutions) taken for business purposes is fully deductible.

The borrowed funds must be used for business operations or acquiring business assets to qualify for this deduction

- Bad Debts (Section 36(1)(vii))

When customers fail to pay their dues and the debt becomes irrecoverable, companies can claim these bad debts as a deduction.

The debt must have been previously included in the company’s income and reasonable efforts should have been made to recover it.

- Certain Payments on Due Date Basis (Section 43B)

Statutory payments like Provident Fund, ESI, professional tax, and employee bonuses are deductible only when paid by the due date.

If these payments are made after the due date, the deduction is allowed only in the year of actual payment.

Specific Business Expenses

- Legal & Professional Fees

Fees paid to lawyers, CAs, consultants, architects, and other professionals for business-related services are fully deductible.

This includes costs for legal compliance, tax advisory, business consulting, and professional certifications. These must be directly related to business operations or income generation.

- Advertising and Marketing

Expenses incurred for promoting and marketing the company’s products or services are allowed as deductions as well.

These may include advertisements in media, digital marketing, trade shows, and promotional material. Also covers brand building activities, sponsorship costs, and customer acquisition expenses.

- Repairs and Maintenance

Regular maintenance and repair costs of business assets like machinery, vehicles, computers, and office equipment are fully deductible as revenue expenses.

However, expenses that improve or extend the life of an asset significantly may be treated as capital expenditure. This difference is important to claim deductions.

- Software and Subscriptions

Expenditure on business-related software and digital subscriptions is deductible. This highlights the growing importance and acknowledgement of technology in business operations.

You can claim deductions for accounting software, CRM systems, productivity tools, and professional subscriptions. Again they have to be revenue in nature.

- Rent, Rates, Taxes, Repairs and Insurance for Building

All property-related expenses for business premises, including rent, municipal taxes, property insurance, and building repairs, are deductible.

This applies whether the company owns or rents the property for business use.

- Repairs and Insurance of Machinery, Plant and Furniture

Maintenance costs, insurance premiums, and repair expenses for business equipment and furniture can also be deducted.

This includes preventive maintenance contracts, spare parts, and technical support costs. The key here is again that these should be for regular maintenance expenses that are counted as revenue in nature.

- Traveling and Accommodation

Business travel and accommodation expenses incurred for official purposes are deductible.

The travel must be for genuine business purposes like client meetings, conferences, or site visits. Proper documentation and business justification are essential to claim this.

Scientific Research & Development

- Expenditure on Scientific Research (Section 35(1))

Revenue expenses incurred on scientific research related to the company’s business are fully deductible in the year they are incurred.

This expense can include salaries of research staff, consumables, utilities for research facilities, and other operational costs.

- Weighted Deduction for Scientific Research (Section 35(2AA))

Payments made to approved research institutions, such as National Laboratories and IITs, qualify for a higher deduction (up to 100%).

This aims to promote collaboration between industry and academic institutions.

- Capital Expenditure on Scientific Research (Section 35(2AB))

Capital expenses on in-house scientific research facilities, including research equipment, laboratory setup, and specialized infrastructure, qualify for 100% deduction in the first year itself.

This may be more beneficial than claiming regular depreciation over several years. The research facility must be used exclusively for scientific research.

Infrastructure & Development

- Capital Expenditure on Specified Business (Section 35AD)

Companies engaged in infrastructure development can claim 100% deduction on capital expenditure in the first year.

This significant tax benefit is designed to promote infrastructure development in the country. It covers sectors like – roads, bridges, airports, cold chains, warehousing, hospitals, and telecommunication networks

- Expenditure on Acquisition of Patent Rights & Copyrights (Section 35A)

Costs incurred for acquiring patent rights, copyrights, trademarks, or other intellectual property for business use can be amortized.

This supports intellectual property investments for businesses in India.

- Expenditure on Know-how (Section 35AB)

Payments made for acquiring technical know-how, engineering designs, drawings, or specialized technical knowledge are eligible for deduction.

This encourages technology transfer and skill development in Indian businesses.

- Deduction for Prospecting Minerals (Section 35E)

Expenses incurred on prospecting for minerals or oil, including geological surveys, drilling, and exploration activities, are deductible over a specified number of years.

This provision supports the exploration and development of natural resources.

- Expenditure on Agricultural Extension Project (Section 35CCA)

Deductions are also available to companies under the Income Tax Act for expenses on approved agricultural extension projects to support rural and agricultural development.

The project must be approved by the prescribed authority and should benefit agricultural communities.

- Expenditure on Skill Development (Section 35CCD)

Costs incurred on government-approved skill development projects, including training programs, vocational education, and capacity building initiatives, are deductible.

To claim this, the projects must be approved by the National Skill Development Agency or other prescribed authorities.

- Amortization of Telecom License & Spectrum Fees (Section 35ABB & 35ABA)

Telecommunication companies can amortize the cost of licenses and spectrum fees over the validity period of the license.

This helps telecom operators manage the substantial upfront costs of spectrum acquisition.

Employment & Social Welfare

- Employment of New Employees (Section 80JJAA)

Companies that employ new workers can claim an additional deduction equal to 30% of the salary paid to new employees for three consecutive years.

This deduction is subject to certain conditions and incentivises job creation and formal employment by companies

- Contribution to Pension Schemes (Section 80CCD(2))

Employer contributions to recognized pension schemes like National Pension System (NPS) for employees are fully deductible.

The contribution must be made to government-approved pension schemes and should be part of the employee’s compensation structure.

Donations & Contributions

- Donations to Charitable Institutions (Section 80G)

Donations made to approved charitable organizations, relief funds, and social causes are eligible for deduction ranging from 50% to 100% of the donated amount.

Some donations have monetary limits while others are unrestricted.

- Contributions to Political Parties or Electoral Trusts (Section 80GGA)

Companies can claim deductions for contributions made to registered political parties or electoral trusts, subject to certain conditions and limits.

The contributions must be made through banking channels and proper documentation is required.

- Deduction for Donations for Scientific Research or Rural Development (Section 80GGA)

Contributions to approved institutions engaged in scientific research or rural development programs are eligible for enhanced deductions.

This promotes private sector participation in research and rural development.

All Section 80 Tax Deductions for Companies in India

Industry-Specific Deductions

- Tea, Coffee and Rubber Development Account (Section 33AB)

Companies in these plantation sectors can claim deductions for deposits made in designated development accounts, supporting industry modernization.

The amount set aside is deductible and must be utilized for specified development activities within prescribed time limits.

- Site Restoration Fund for Mining Companies (Section 33ABA)

Mining companies can create a fund for environmental restoration and mine closure activities, with contributions to this fund being deductible.

The fund must be used for environmental protection, land restoration, and rehabilitation of mining areas.

- Weighted Deductions for Specified Businesses

Certain businesses in backward areas or specific industries may be eligible for enhanced deductions on their expenditure.

These weighted deductions provide additional tax benefits to promote industrial development in underdeveloped regions.

- Other Industry-Specific Deductions

Various industries have specialized deductions based on their unique characteristics and government policy objectives.

These may include deductions for specific types of expenditure, investments, or activities that are relevant to particular sectors.

Special Schemes & Incentives

- SEZ Units (Section 10AA)

Companies operating in Special Economic Zones can claim deductions on export profits for a specified period.

Generally the deduction is 100% for the first five years, 50% for the next five years or the amount transferred to the Reinvestment Allowance Reserve.

- Expenses on Eligible Startups (Section 80-IAC)

Eligible startups can claim deductions for three consecutive years out of their first ten years of operation.

The deduction is available on profits and gains derived from eligible business activities. Startups must obtain certification from the Department for Promotion of Industry and Internal Trade to avail this benefit.

- Undertakings in Backward States

Businesses established in industrially backward states or areas may be eligible for additional deductions or tax concessions.

These incentives are designed to promote balanced regional development and encourage investment in less developed areas.

- Investment Linked Tax Incentive

Certain investments in specified assets or activities may qualify for additional deductions or accelerated depreciation.

These incentives are typically time-bound and aimed at promoting particular types of economic activities or investments. Companies should verify current applicability as these schemes are often modified or discontinued.

Loss Management & Adjustments

- Unabsorbed Depreciation

When a company’s depreciation allowance exceeds its profits in a year, the unabsorbed depreciation can be carried forward indefinitely until fully absorbed.

This ensures that companies eventually get the full benefit of depreciation even in loss-making years..

- Amortization of Expenditure in Case of Demerger or Amalgamation

During corporate restructuring like mergers or demergers, certain expenses and tax attributes are transferred to successor companies.

Expenses incurred during corporate restructuring can be amortized and deducted as per prescribed rules

Other Considerations

- Investment in New Plant & Machinery

For a company filing under the new tax regime, investing in new plant and machinery may be eligible for specific tax treatments or lower rates, subject to conditions

However, they need to carefully choose between the tax regimes to make sure they are choosing the best option.

- Reduced Tax Rates

Certain companies may qualify for concessional tax rates under various provisions like Section 115BAA (for domestic companies) or Section 115BAB (for new manufacturing companies).

These reduced rates come with restrictions on claiming various deductions and incentives. Companies must choose between the old regime with deductions or the new regime with lower rates.

- Inter-corporate Dividends (Section 80LA)

Certain inter-corporate dividends received by companies may be eligible for deduction under specific conditions.

This provision aims to avoid double taxation of the same income as it passes through different corporate entities.

- Insolvency Resolution

Deductions may be available for expenses or losses arising from insolvency proceedings, helping companies manage financial distress

How Can PKC Help You Optimize Taxes?

✅Expert CA team identifies overlooked deduction opportunities

✅Customized deduction strategies for your industry sector

✅Specialized knowledge uncovers sector-specific tax saving schemes

✅Industry expertise reveals manufacturing and export incentives

✅Strategic timing maximizes capital expenditure deduction benefits

✅Expert guidance on depreciation policies saves thousands

✅Specialized teams handle IT, pharma, textile deductions

✅Relationship-based approach ensures long-term tax optimization

Find Out More About Our Tax Advisory Services Here

Frequently Asked Questions

- What are the most common tax deductions available to companies in India?

The most common deductions include depreciation, R&D expenditure, employee-related deductions, and donations. Each falls under specific sections of the Income Tax Act.

- Can companies claim tax deductions for R&D activities?

Yes, companies can claim deductions under Section 35 for both in-house and outsourced scientific research. Eligible expenses may qualify for a 100% deduction.

- Can a company claim depreciation as a deduction?

Yes, companies can claim depreciation on tangible and intangible assets under Section 32. Different rates apply based on asset type and usage.

- Are capital expenditures eligible for full deduction?

Only specific capital expenses like those under Section 35AD (infrastructure or specified businesses) are allowed as a 100% deduction. Other capital assets are subject to depreciation instead.

- Can bad debts be claimed as a deduction?

Yes, bad debts written off in the books are allowed as a deduction under Section 36(1)(vii). However, they must be actual bad debts and not just provisions.

Expert verified

Expert verified