Written By – PKC Desk, Edited By – Farith, Reviewed By – Sanjana

Confused about tax planning vs tax preparation, which one’s better suited to your needs? As a service provider for 35+ years, let us help.

We break down the difference between tax planning and preparation, helping you understand what all it covers, so that you can make the right choice.

Tax Planning vs Tax Preparation: Making the Right Choice

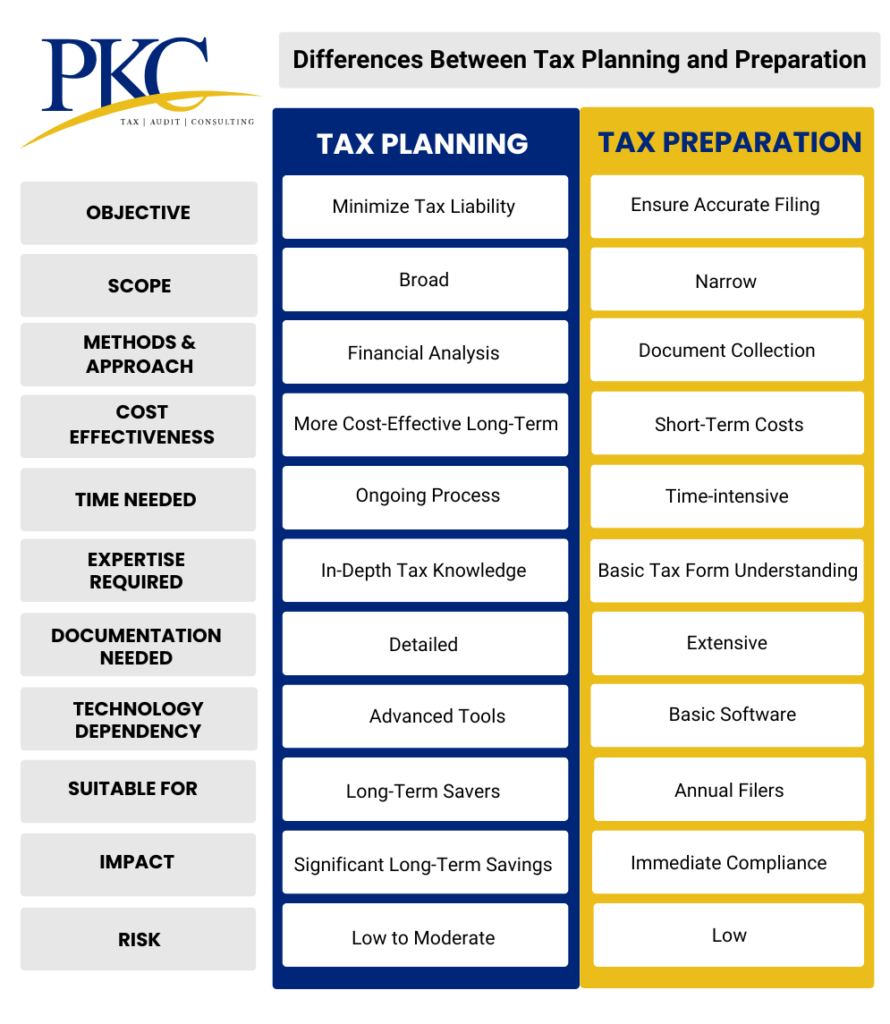

Before we go into the detailed comparison, let’s take a quick look at how tax planning and Tax Preparation fare against each other:

Main Intent & Objective

The main objective of tax planning is to optimize a taxpayer’s finances and tax position by using the available deductions, exemptions and credits allowed under the Income Tax Act.

It can include taking financial decisions throughout the year to optimize savings and investments for tax benefits, thereby contributing towards attaining long-term financial goals.

The intent of tax preparation is to accurately report income and expenses for a given financial year and file tax returns on time.

It ensures compliance with tax regulations and avoids penalties for late or incorrect filings.

Scope of Work

Tax planning has a wide scope. It includes evaluating income, investment planning, retirement planning, estate planning and identifying tax-saving opportunities.

It requires continuous monitoring of tax-related legislative changes and financial recalibration as per tax laws.

Tax preparation, however, is more limited in scope. It focuses on collecting financial documents, calculating income, deductions, credits, and accurately filling out tax returns.

Methods & Approach Used

Tax planning is more proactive. It employs various methods like financial analysis to assess one’s situation and identify opportunities for savings.

It often uses forward-looking strategies like income deferral, wealth restructuring, and family income distribution.

Conversely, tax preparation has a more reactive approach. It involves gathering all financial documents ensuring data accuracy, and submitting tax returns.

It is essentially a procedural task of compiling already completed transactions.

Cost effectiveness of Tax Planning Vs Preparation

Tax planning is cost-effective in the long run as it focuses on strategies that can significantly reduce future tax liabilities.

Although you might have to pay the costs associated with hiring professionals for planning services, the potential savings from efficient tax planning often outweigh this.

While, Tax preparation is generally cheaper than tax planning, it offers no long-term cost benefits beyond avoiding penalties and errors.

The cost of tax preparation services depends on the complexity of your finances.

Frequency & Time Needed to Execute

Tax Planning is a continuous process that requires year-round attention. Regular reviews and adjustments must be made as tax laws change or financial goals shift.

In contrast, tax preparation is often time-sensitive. It requires concentrated effort during the weeks leading up to the filing deadline.

Expertise Required for Tax Planning & Preparation

Tax planning requires high-level expertise.

Professionals such as financial planners, tax consultants, or chartered accountants, well-versed in tax law, investment strategies, and financial planning, are good fit for such tasks.

Tax preparation requires less specialized knowledge. A basic understanding of tax forms and regulations suffices for most individuals or preparers.

Although for more complex returns, a tax preparer or chartered accountant may be required. Expertise is less about strategy and more about accuracy in form filling.

Documentation Needed

In tax planning, documentation is required to aid in future tax strategy formulation.

Salary slips, investment proofs, insurance policies, real estate documents, and detailed records of financial transactions may be analyzed by the tax planner, throughout the year

Tax preparation demands extensive documentation needed for filing ITR form.

It includes income statements, receipts for deductions, and various forms that report financial activities.

Software/Tool Dependency

Tax planning often utilizes advanced financial planning software, tax calculators, and tools for forecasting and scenario analysis.

Some professionals and service providers may also use customized software to track investments and evaluate tax-saving strategies.

Tax preparation generally relies on basic tax-filing software that helps in computing tax liability, identifying applicable deductions, and ensuring that tax returns are filed correctly and on time.

Suitable For

Tax planning is suitable for individuals with complex financial portfolios, high-income earners, businesses, and anyone looking to optimize tax efficiency over the long term.

Tax preparation is essential for all taxpayers who need to file annual returns accurately and on time. For those with straightforward finances, it may not require specialized assistance beyond simple software tools.

Impact of Tax Planning Vs Preparation

Tax Planning can have a significant impact on an individual’s or organization’s long-term financial health.

Effective tax planning can result in significant tax savings and contribute to wealth maximization.

In contrast, tax preparation has a more immediate impact and less transformative compared to strategic planning.

Risk Associated

The risks of poor tax planning can include misinterpreting tax laws, over-reliance on aggressive tax-saving strategies, or future tax law changes that could nullify the benefits of prior planning.

Poor tax preparation risks are mainly related to mistakes in filing or omitting crucial information, which could lead to penalties, audits, or interest on unpaid taxes.

However, these risks are generally lower than in tax planning.

So, overall, tax planning is a long-term strategy for minimizing taxes and optimizing finances. while tax preparation is a short-term process to ensure accurate and compliant tax filings.

Frequently Asked Questions

Tax planning involves strategizing to minimize tax liabilities through financial decisions and investments, while tax preparation focuses on gathering documents and accurately filing tax returns for compliance.

Tax planning is a continuous, year-round process, while tax preparation is typically a seasonal activity focused on filing returns during the tax season.

Tax planning is proactive, involving making informed decisions made throughout the year to minimize future tax liabilities, whereas tax preparation is reactive, addressing past financial activities to ensure compliance.

Yes, effective tax planning can simplify tax preparation by ensuring that all necessary documentation and strategies are in place well before filing deadlines, leading to a smoother process.

Engaging in tax planning can boost long-term savings and improve financial health through proper investments, while focusing only on preparation may only ensure compliance without optimizing financial outcomes.

Expert verified

Expert verified