Written By – PKC Desk, Edited By Karunakaran, Reviewed By – Aakash

Wondering how to save tax on sale of ancestral property? This guide answers your questions and offers effective strategies.

Maximize your financial returns from selling ancestral property by understanding the tax implications and implementing our suggested smart strategies.

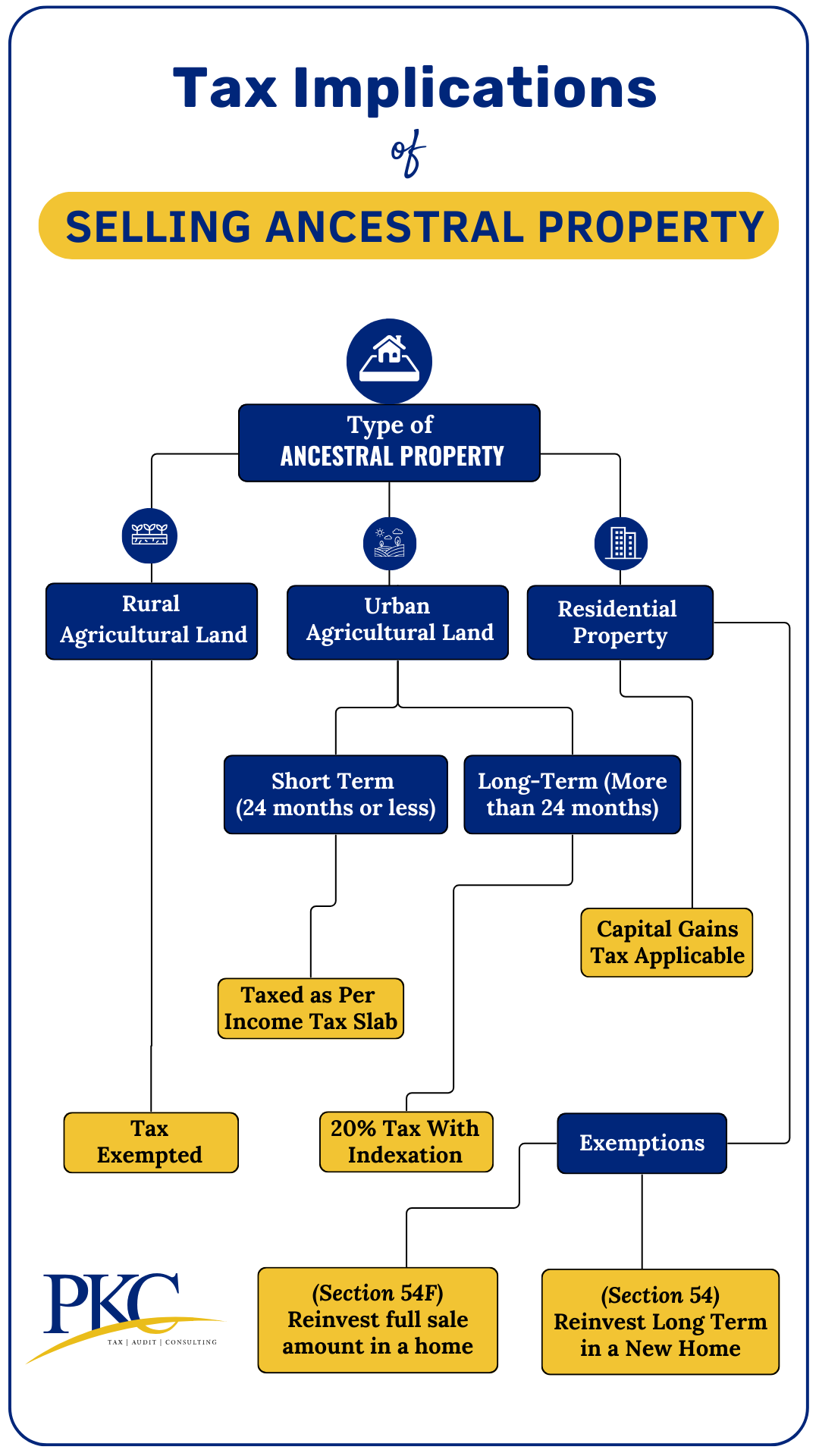

Overview of Tax Implications of Ancestral Property Sale

Before we answer the question – how to save tax on sale of ancestral property, let’s take a quick look at the tax implications of sale of ancestral property:

Capital Gains Tax

When you sell an ancestral property in India, you have to pay Capital Gains Tax. It is levied on the profit made or the capital gains made from the sale.

Capital gains are calculated by subtracting the asset’s purchase price (adjusted for inflation) from its selling price.

The nature of the capital gains depends on the holding period:

- Long-Term Capital Gains (LTCG): If the property is held for more than 24 months, the gains are classified as LTCG.

- Short-Term Capital Gains (STCG): If the property is held for less than 24 months, the gains are taxed at the individual’s applicable income tax slab rates.

Tax Deducted at Source (TDS)

It is applicable on the sale of property if the transaction value exceeds Rs 50 lakh. The buyer is required to deduct TDS (a higher rate for non-residents and lower for residents)

Wealth Tax

Although there is no wealth tax, if the property’s value exceeds Rs. 30 lakhs, the owner must report it.

How to Save Tax on Sale of Ancestral Property: 16 Strategies to Adopt

Some of the most efficient save taxes on sale of inherited property are:

Choose the Right Holding Period

If possible, hold the property for more than 24 months to qualify for long-term capital gains (LTCG) treatment.

Here, you may get taxed at a lower rate (20% with indexation) compared to short-term capital gains (STCG), which are taxed at the individual’s applicable slab rate.

Weigh Indexation With Non Indexation Option

The new rules regarding Long-Term Capital Gains (LTCG) (effective from July 23, 2024) allow taxpayers to choose between two options

- 12.5% tax rate without indexation benefits, or

- 20% tax rate with indexation benefits.

You should evaluate both options to determine which regime offers the most tax savings.

Utilizing the Fair Market Value (FMV)

When calculating capital gains, you can use the Fair Market Value (FMV) as of April 1, 2001, if the property was purchased before this date.

This can substantially increase the indexed cost, thereby reducing the taxable capital gains when the property is sold.

Government Acquisition Relief

If your property is compulsorily acquired by the government, you may be eligible for relief under provisions under the Income Tax Act.

This may provide you additional exemptions or deductions from tax.

Purchase of New Residential Property

Under Section 54 of the Income Tax Act, if the proceeds from the sale of ancestral property are reinvested in a new residential property, the seller can claim an exemption from LTCG tax.

This must be done within one year before or two years after the sale, or construction must be completed within three years.

Reinvestment of Full Sale Proceeds in Residential Property

Under Section 54F, if you reinvest the entire sale proceeds (not just capital gains) in a residential property, you can save on capital gains tax.

This is especially beneficial if the capital gains form only part of the total sale proceeds.

Seek Professional Help

Engaging a tax consultant or financial advisor like PKC Management Consulting can provide personalized solutions that cater to your unique circumstances.

Professionals can help navigate complex tax laws and identify the best tax-saving opportunities.

Why let taxes take more than necessary?

Capital Gains Account Scheme (CGAS)

If you plan to buy or build a new property but are not ready by the time tax filing is due, you can deposit the gains in a Capital Gains Account Scheme.

This defers the tax until the reinvestment is made.

Selling in Tranches

Instead of selling the entire property at once, selling it in smaller portions over different financial years can help spread the capital gains across multiple years.

This can help in reducing your overall tax liability.

Joint Ownership & Splitting Property Sales

If the property is jointly owned, each owner is only taxed on their portion of the capital gains.

This can be beneficial if the co-owners fall into lower tax brackets. This strategy can be particularly effective in family-owned properties.

Consider Intergenerational Transfers

Transferring the property to your children or grandchildren through a gift deed can result in lower tax liabilities.

This works specially if they are in lower income brackets or entitled to specific exemptions.

DTAA Benefits for NRIs

Non-Resident Indians (NRIs) selling ancestral property can benefit from Double Tax Avoidance Agreements (DTAA) between India and their country of residence.

This may provide reduced tax rates on capital gains, depending on the agreement.

Investment in Specified Bonds

Under Section 54EC, if the capital gains are invested in specified bonds ((issued by NHAI, REC, etc.) within six months of the sale, taxpayers can claim exemption up to Rs 50 lakh.

Set Off Against Losses

If you have incurred capital losses from other investments, these can be set off against the capital gains from the sale of ancestral property.

This helps in effectively reducing the overall tax liability.

Deductions on Improvement Costs and Transfer Expenses

Taxpayers can deduct expenses incurred for improvements made to the property before the sale, as well as transfer expenses (such as brokerage fees, legal fees, and stamp duty).

This can aid in calculating net capital gains and reducing taxable income.

Avoid Capital Gains Tax through Will Inheritance

There is no tax on property received through inheritance.

By planning the transfer of property through a will, individuals can avoid immediate capital gains tax liabilities, as tax is only applicable upon the sale of the property.

Also Check: Section 194BA TDS on Winning Form Online Games

Frequently Asked Questions

Unfortunately, you cannot completely avoid capital gains tax, but you can minimize it by adopting tax saving strategies like long term capital gains. Investment, etc.

Short-term capital gains tax applies if you sell the property within two years of acquisition, while long-term capital gains tax is applicable if you sell it after two years. Long-term capital gains are generally taxed at a lower rate or may be exempt under certain conditions.

Yes, you can defer long-term capital gains tax under Section 54B by reinvesting the sale proceeds in another residential property within two years.

The tax implications will depend on the mode of ownership and the share of each individual. We recommend consulting with a tax professional to determine the tax liability for each owner.

While gifting ancestral property to a family member may not result in immediate capital gains tax, there could be implications in the future if the property is sold by the recipient.

Expert verified

Expert verified