Introduction

The Legal Entity Identifier (LEI) code is a unique identifier assigned to entities engaging in financial transactions. It was introduced in response to the global financial crisis to enhance transparency and regulatory oversight in financial markets. LEI codes are standardized 20-character alphanumeric codes used to identify legally distinct entities that engage in financial transactions.

Report on the Applicability of LEI Code:

1. Purpose and Applicability: The LEI code is primarily used for identifying parties to financial transactions. It helps regulatory authorities and market participants in assessing and managing risks, particularly in the context of systemic risk monitoring and financial stability. LEIs are applicable to various entities, including but not limited to:

- Corporations

- Banks and financial institutions

- Investment funds

- Government entities

- Charities and non-profits

2. Monetary Limits

The Reserve Bank of India (RBI) has mandated the use of Legal Entity Identifier (LEI) for transactions in various financial markets, including interest rate, forex, and credit derivatives. Additionally, companies and organizations with aggregate fund-based and non-fund-based credit exposure exceeding Rs 50 crore are required to obtain an LEI.

The RBI has set a schedule for the implementation of LEI for large corporate borrowers, which is as follows:

- For entities with a total exposure to Scheduled Commercial Banks (SCBs) above Rs 25 crore, the LEI implementation deadline was April 30, 2023.

- Entities with exposure between Rs 10 crore and Rs 25 crore are required to obtain LEI by April 30, 2024.

- For entities with exposure ranging from Rs 5 crore to Rs 10 crore, the deadline for LEI implementation is April 30, 2025.

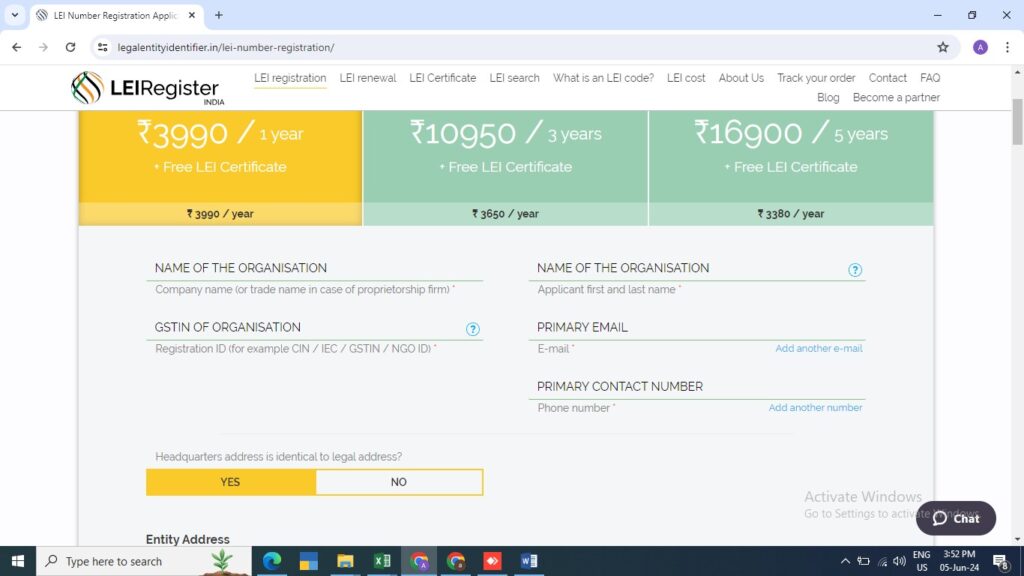

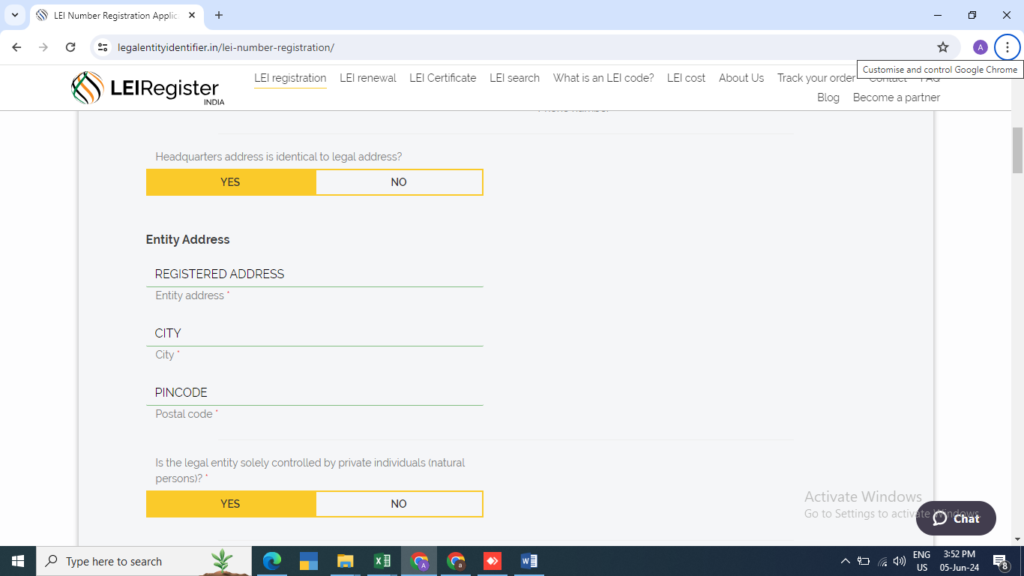

2. Where to Register: LEI can be registered on the LEI Registration India website by paying applicable fees. Once processed, the required certificate will be issued.

3. Details Required for Registration: Entities applying for an LEI code need to provide certain information during the registration process. The required details typically include:

- Legal name of the entity

- Registered address

- Legal form and status of the entity

- Entity’s relationship to the parent company (if applicable)

- Registration authority and registration number – GST registration & PAN copy

- Entity’s ownership structure

- Details of the entity’s management

4. Registration Process: The registration process for obtaining an LEI code involves the following steps:

- Go to this https://www.legalentityidentifier.in

- Providing required information: The entity submits the necessary information through the LOU’s online portal or application form.

- Verification: The LOU verifies the submitted information, which may involve validation of legal documents and other supporting evidence.

- Issuance of LEI: Upon successful verification, the LOU assigns a unique LEI code to the entity.

- Renewal: LEI codes need to be renewed annually to ensure their accuracy and relevance.

Conclusion: The Legal Entity Identifier (LEI) code serves as a vital tool for enhancing transparency and regulatory oversight in financial markets. Its applicability extends to a wide range of entities involved in financial transactions, and obtaining an LEI code is a necessary step for compliance with various regulatory requirements. Entities can register for LEIs through accredited Local Operating Units (LOUs) by providing essential details about their legal identity and structure. Compliance with LEI requirements is crucial for fostering transparency and stability in global financial markets.

FAQS ON LEI REGISTERATION

- Why is LEI registration necessary?

LEI registration is necessary to comply with regulatory requirements, facilitate transparent financial transactions, and mitigate risks in the global financial system.

- How long does it take to obtain an LEI?

In general, it can take anywhere from a one day to a few weeks to receive an LEI after submitting the application

- What is the cost of obtaining an LEI?

The cost of obtaining an LEI depends on the chosen tenure of the certificate. As of 03-06-2024, the pricing structure typically includes:

- Rs. 3,990 for a 1-year certificate

- Rs. 10,950 for a 3-year certificate

- Rs. 16,900 for a 5-year certificate

These fees cover the initial registration and annual renewal costs. Additionally, pricing may vary depending on the LEI issuer and the specific services offered. It’s advisable to check with the chosen LEI issuer for the most accurate and up-to-date pricing information.

- Is an LEI valid indefinitely?

No, LEIs are not valid indefinitely. They require annual renewal to ensure that the information associated with the LEI remains accurate and up to date.

- Can an LEI be transferred or reused?

No, LEIs are unique to the legal entity for which they are issued and cannot be transferred or reused. If there are changes in ownership or legal structure, a new LEI may need to be obtained.

PORTAL SCREENSHOTS ARE IMMEDIATE REFERANCE.

Expert verified

Expert verified