Written By – PKC Desk, Edited By Karunakaran, Reviewed By – Aakash

Tired of letting taxes steal your company’s success? Delve with us into strategies on how to save tax in private limited company in India.

We take you through some of the most proven techniques to reduce your tax bill and channel more resources into growth and expansion.

19 (Legit) Ways of Saving Taxes for Private Businesses

Here are the best tips for tax saving for private limited companies in India

1.

Utilizing Tax Holidays

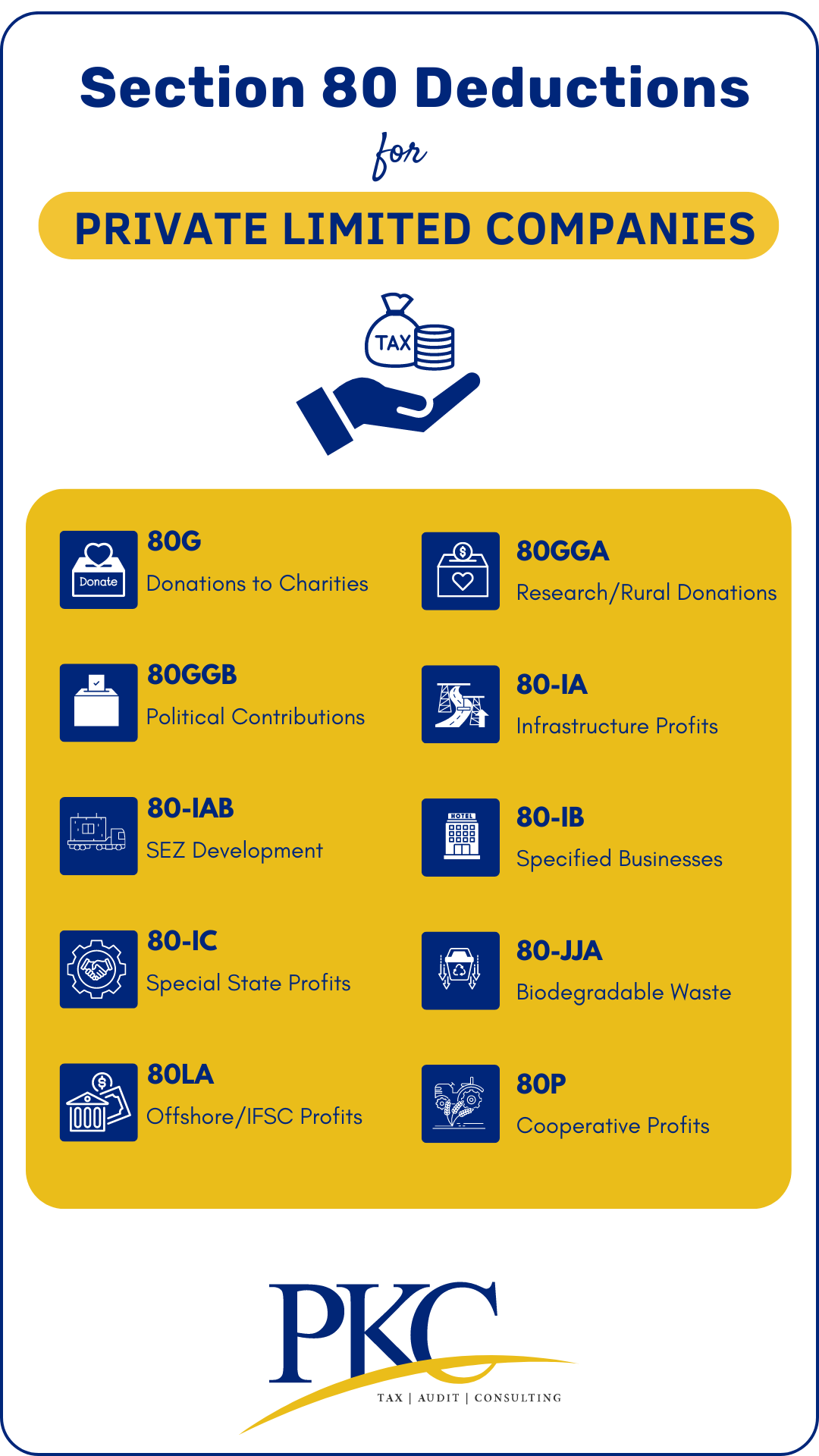

Tax holidays are periods where companies are exempt from or receive reductions in taxes. Some available tax holidays:

-

- Companies operating in Special Economic Zones (SEZs) can get tax exemptions and concessions.

-

- Start-ups can claim a 100% tax holiday for 3 out of the first 10 years under Section 80-IAC.

2.

Claiming Section 80C Deductions:

Private limited companies can claim deductions under Section 80C by investing in approved instruments like Employee Provident Fund (EPF) and life insurance premiums.

These investments can reduce the taxable income of the company, offering savings up to Rs.1.5 lakh.

3.

Restructure Business Operations

Restructuring your business, such as forming holding and subsidiary companies or consolidating group companies, can optimize your tax position.

It helps in reducing the overall tax liability by streamlining operations and reducing inter-company taxes.

4.

Professional Tax Planning

Engaging in professional tax planning helps ensure that your company is taking full advantage of available deductions, exemptions, and credits.

A seasoned tax professional or a trusted firm like PKC Management Consulting can help structure transactions and investments to minimize tax liabilities legally and effectively.

5.

Claim Preliminary Expenses

Preliminary expenses, such as incorporation costs, legal fees, and professional charges, can be claimed as deductions under Section 35D.

This reduces the taxable income during the initial years of operation of a private limited company.

6.

Tax-Efficient Salary Structure

Structuring salaries with components like allowances, perquisites, and benefits that are tax-efficient can reduce the company’s overall tax burden.

It also benefits employees by maximizing their take-home pay.

7.

Claim Deductions on Everyday Business Expenditures

Ordinary business expenses like rent, utilities, salaries, and administrative costs are deductible from the company’s income, reducing its taxable profits.

You can even deduct for things like travel and meeting expenses incurred for business purposes, expenses related to vehicles used for business purposes, etc.

8.

Invest in Specified Bonds

Investing in government-specified bonds, such as those under Section 54EC, can help defer or reduce capital gains tax.

This is particularly beneficial when the company sells assets and wishes to reinvest the proceeds.

Also Read:

How to save capital gain tax by investing in bonds?

See how we helped other businesses

9.

Utilize Employee Welfare Deductions:

Expenditures made towards employee welfare, such as health insurance premiums, education expenses, and other benefits, are deductible under Section 36(1)(iv).

This not only reduces taxable income but also enhances employee satisfaction.

10.

Tax Planning for Dividends

Dividends are taxed in the hands of shareholders.

Companies can implement tax planning strategies to distribute profits in a way that minimizes tax liabilities for shareholders.

11.

Save on GST

By claiming input tax credits and ensuring correct GST classifications, private limited companies can reduce their GST liabilities.

You will need to track all GST paid on purchases and offset it against GST collected on sales.

12.

Optimize TDS Payments

Properly managing TDS (Tax Deducted at Source) payments ensures compliance and prevents interest, penalties, and the disallowance of expenses.

Timely and accurate TDS payments can help in reducing the company’s overall tax burden.

13.

Capital Gains Management

Companies can manage capital gains tax by reinvesting the proceeds from the sale of assets into specified bonds or assets.

Setting off capital losses against gains also reduces the tax liability.

14.

Utilize Employee Stock Option Plans (ESOPs)

ESOPs allow companies to defer tax liabilities and align employee interests with the company’s growth.

By granting stock options, companies can offer tax-efficient remuneration to employees.

15.

Avoid Double Taxation

Companies involved in international operations can avoid double taxation by utilizing Double Taxation Avoidance Agreements (DTAA).

This prevents income from being taxed twice, once in the source country and again in India.

16.

Use Sector Specific Tax Incentives & Subsidies

Many private limited companies can avail of various government tax incentives and subsidies aimed at promoting specific industries or activities.

These incentives for sectors such as manufacturing, renewable resources, etc. can significantly reduce their tax burden.

17.

Salary and Sitting Fees to Directors

Paying salary and sitting fees to directors is a deductible expense, reducing the company’s taxable income.

This allows for an efficient method of compensating directors while also saving on taxes.

18.

Depreciation on Assets

Claiming depreciation on company assets like machinery, vehicles, and office equipment reduces taxable income.

Depreciation deductions allow companies to spread the cost of assets over their useful life, thereby lowering the tax liability each year.

19.

R&D and Innovation Incentives

Take advantage of the deductions and incentives available for research and development activities.

Explore opportunities to invest in innovative projects that may qualify for tax benefits

Also Check: Tax on YouTube Income in India

Frequently Asked Questions

Common strategies include investing in tax-exempt instruments, claiming deductions for eligible expenses, and optimizing dividend distribution.

Yes, a company can claim deductions for the salaries and allowances paid to its employees, provided they are incurred for business purposes.

Yes, companies can provide certain tax-free employee benefits, such as health insurance, retirement plans, and commuting allowances, within specified limits.

If transfer pricing is not at arm’s length, it can lead to adjustments in taxable income and possible penalties.

Yes, there are specific tax rules governing foreign exchange earnings and remittances. Companies need to comply with these rules to avoid penalties.

Expert verified

Expert verified