Written By – PKC Desk, Edited By – Abhinand, Reviewed By – Aakash

The finance Act,2022 has inserted a new section 115BBH with effect from 01.04.2022 to tax the income arising on transfer of Virtual Digital assets.

What is Virtual Digital Asset?

Virtual digital asset means—

(a) any information or code or number or token (not being Indian currency or foreign currency), generated through cryptographic means,

(b) a non-fungible token and

(c) Any other digital asset

Which is the most popular Virtual Digital Asset?

Bitcoin and Ethereum are the most popular form of Virtual Digital Asset also known as crypto currency.

What is Bitcoin?

Bitcoin, a most common virtual digital asset is the first widely adopted cryptocurrency intended to provide an alternative payment system for peer-to-peer transactions. They are classified as a capital asset for the purpose of taxation in India.

What is Ethereum?

Ethereum is another cryptocurrency, the difference between Ethereum and Bitcoin is the fact that Bitcoin is nothing more than a currency, whereas Ethereum is a ledger technology that companies are using to build new programs.

Overview of taxation of crypto currencies

The key tax provisions introduced in this aspect are listed under:

- How will the Bitcoin/Ethereum be taxed?

- Computation of Income taxable under section 115BBH

- Taxation under the head PGBP

- Taxation under the head Capital gains

- Cost of acquisition of Bitcoin

- Taxation under Income from other sources

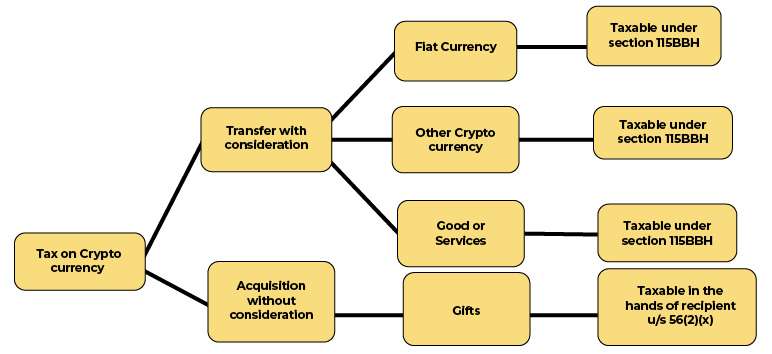

How will the Bitcoin/Ethereum be taxed?

As per section 2(47) of the Income tax Act 1961 the word transfer shall apply to any virtual digital asset, whether capital asset or not.

Section 115BBH was introduced to provide the method of computation and tax rate for the income arising from the transfer of Bitcoins.

Key points for the purpose of taxation:

- The gain on the sale of bitcoins would be taxed at 30% plus surcharge and cess.

- No benefit of maximum exemption limit.

- No deduction under Chapter VI-A shall be allowed from income computed under section 115BBH.

- Rebate under section 87A is available to resident individual.

- Rate of Surcharge are as per the normal provisions applicable to the assessee.

- Losses incurred from one bitcoin cannot be set-off against income from another bitcoin/any head of income

- Such loss cannot be carried forward to subsequent assessment years.

The income from bitcoins will be classified under the following head of income:

- Income under the head PGBP

- Income under the head Capital gains

- Income under the head Other sources

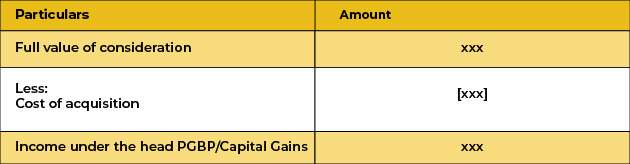

Computation of Income taxable under section 115BBH

The income arising from the transfer of Bitcoins shall be computed as follows:

Taxation under the head Profits and Gains from Business or Profession (PGBP)

When Bitcoins are held as stock in trade for sale in the ordinary course of business, the income arising out of the trading activity will be taxable under the head PGBP.

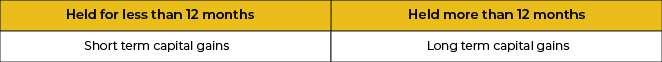

Taxation under the head Capital Gains

When the bitcoins are held as an investment, the income arising from the transfer of bitcoins will be taxable under the head Capital Gains.

Cost of acquisition

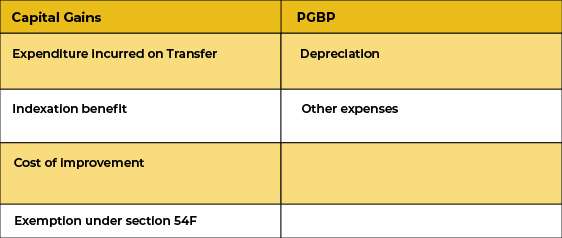

While computing capital gains or business income on transfer of Bitcoins, no deduction for any expenditure or any allowance shall be allowed except the cost of acquisition.

Hence, only deduction from sale consideration can be the ‘cost of acquisition of bitcoin’.

The following items shall be excluded:

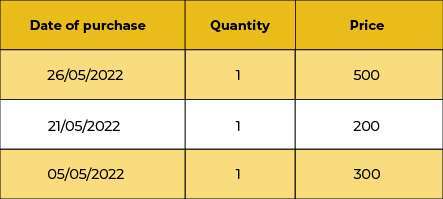

1.Following are the methods for computing cost of acquisition FIFO (First in first):

In FIFO method, the VDA acquired first will be treated as sold.

For example: Mr. A has purchased bitcoins on the following dates:

He sells 1 bitcoin for INR 2,000 on 01/11/2022

Capital gains = Selling price – purchasing price (first bought bitcoin)

(1 x 2,000) – (1 x 500) = INR 1,500

2. Weighted average: The capital gains under this method shall be calculated as follows based on the above example:

Weighted average price is calculated as follows:

- Total quantity = 3

- Total value of bitcoins = 1000

- Average price = 1000/3 = 333.33

- He sells 1 bitcoin for INR 2,000 on 01/11/2022

Capital gains = Selling price – purchasing price (weighted average price)

(1 x 2,000) – (1 x 333.33) = INR 1666.67

Taxation under the head Income from other sources

Gifting of bitcoins

The provision of Section 56(2)(x) applies when any person receives any benefit whose value exceeds Rs. 50,000.

Explanation to section 56(2)(x) of the Act, provide that for the purpose of the said clause, the expression “property” shall have the meaning assigned to it in Explanation to clause (vii) and shall include Bitcoins and Ethereum.

Bitcoin received as gift shall be taxed in the hands of the receiver if the asset is received without any consideration (gift) or for a consideration which is less than its fair market value.

The fair market value of the asset in excess of the consideration shall be taxed under the head income from other sources.

Summary

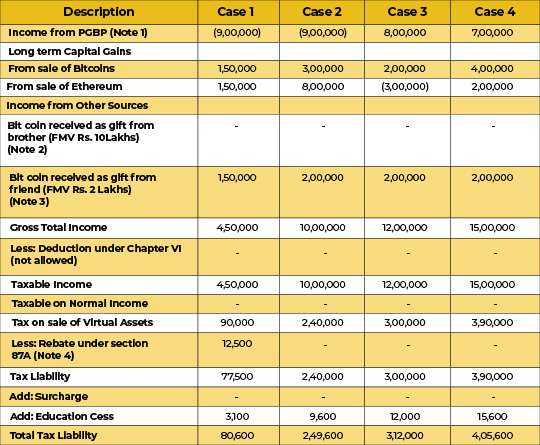

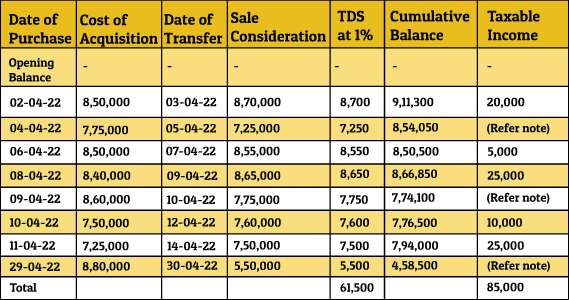

Few illustrations on computation of Capital gains and business income is as under:

Mr. A has earned the following income from bitcoins. The tax liability shall be computed as follows:

Note:

- Loss from PGBP cannot be set off against income from bitcoins.

- Any gift received from relatives is exempt from tax. Hence gift received from brother is not liable to taxation.

- Since the gift is received from a friend it shall be taxed under section 56(2)(x) “income from other sources” at rate applicable to the assessee. Such income shall not be taxed under section 115BBH.

- Rebate u/s 87A shall be applicable for taxable income up to Rs.5,00,000.

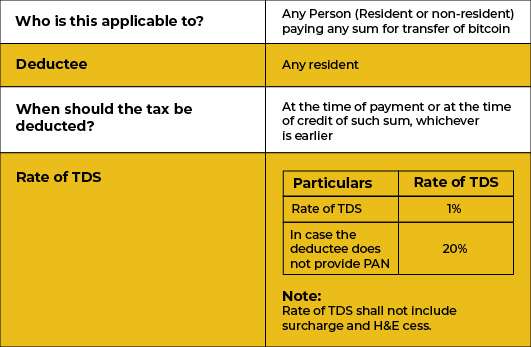

Applicability of TDS provisions [Section 194S]

Section 194S, which deals with TDS on virtual digital assets, comes into effect on 01.07.2022

Other points

- No TDS on gift of VDA

- If the recipient of the consideration is a non-resident, then tax may be deductible under section 195.

- If a transaction is subject to TDS under section 194S, the deduction or collection of tax in respect of such transaction can also be made under any other provision of the Act except section 194-O.

- Any transaction on which both TDS under section 194O and 194S is applicable, then TDS under section 194S shall prevail.

- TDS deducted under this section can be claimed by the deductee against tax liability arising under other head of income while filing the income tax return.

Illustrations to understand the time of deduction.

For example: Mr.A has deposited Rs.9 lakhs in his account in an exchange platform. He has done multiple transactions in bitcoin over a month as follows:

Note: loss cannot be adjusted against Taxable income. Hence ignored.

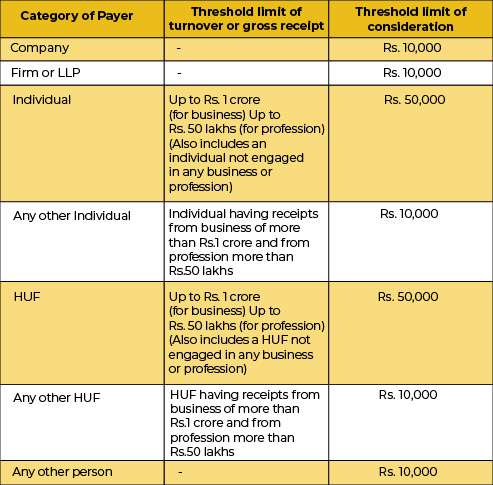

What is the threshold limit for TDS?

- If the payer is “Specified Person”

The aggregate value of consideration does not exceed Rs.50,000/- during the financial year.

- If the payer is other than “Specified Person” (Eg. Company, LLP, Partnership firm etc.) The aggregate value of consideration does not exceed Rs.10,000/- during the financial year.

Who is a specified person for the purpose of this provisions?

‘Specified person’ means

- being an individual or HUF whose total sales, gross receipts or turnover from the business carried on by him or profession exercised by him does not exceed one crore rupees in case of business or fifty lakh rupees in case of profession, during the financial year immediately preceding the financial year in which such bitcoin is transferred;

- being an individual or HUF having income under any head other than the head ‘Profits and gains of business or profession’

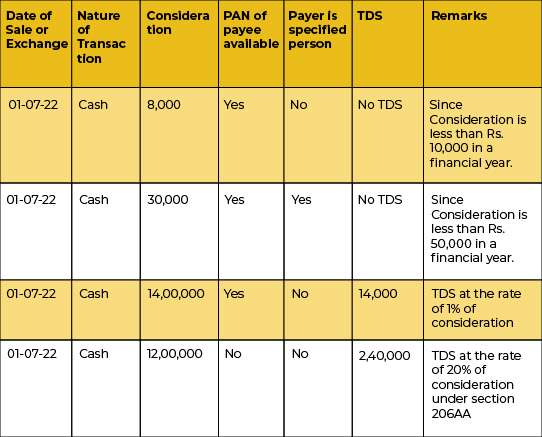

Amount on which tax is to be deducted

It is the obligation of the payer to ensure the tax is deducted before releasing the consideration.

(a) Where consideration is wholly in kind;

(b) Where a transaction is in exchange for another virtual digital asset, and there is no part in cash;

(c) Where consideration is partly in cash and partly in kind, but the part in cash is not sufficient to meet the liability of deduction of tax in respect of the whole of such transfer

(d) Wholly in cash

The TDS computation in the different scenarios has been enumerated in the below table:

Author

Sanjana C

Expert verified

Expert verified