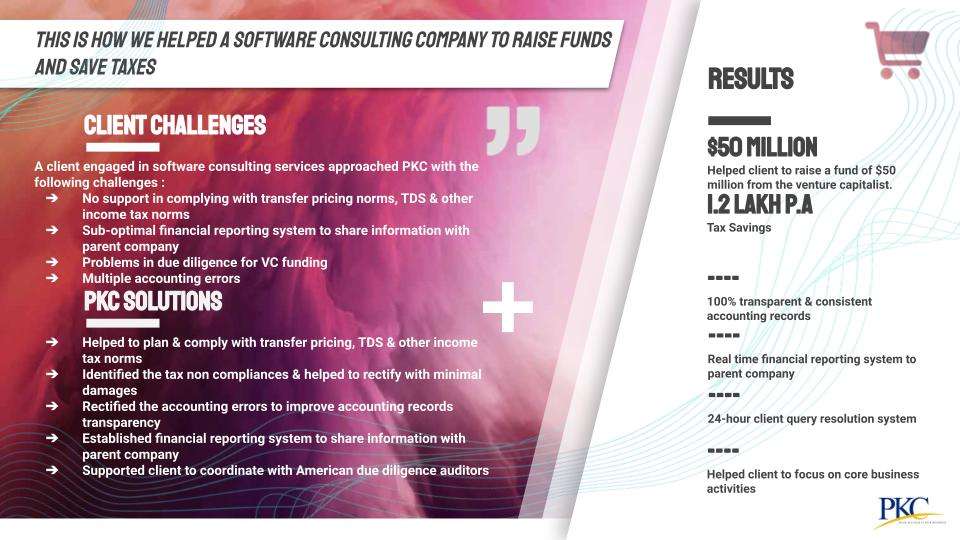

Client Challenges

A client engaged in software consulting services approached PKC with the following challenges:

- No support in complying with transfer pricing norms, TDS & other income tax norms

- Sub-optimal financial reporting system to share information with parent company

- Problems in due diligence for VC funding

- Multiple accounting errors

PKC Solutions

- Helped to plan & comply with transfer pricing, TDS & other income tax norms

- Identified the tax non compliances & helped to rectify with minimal damages

- Rectified the accounting errors to improve accounting records transparency

- Established financial reporting system to share information with parent company

- Supported client to coordinate with American due diligence auditors

Results

- Helped client to raise a fund of $50 million from the venture capitalist.

- 1.2 LAKH P.A Tax savings.

- 100% transparent & consistent accounting records.

- Real time financial reporting system to parent company.

- 24-hour client query resolution system.

- Helped client to focus on core business activities