PKC Blog – Expert Insights for Business Growth

How To Do A Quick Feasibility Study For Your Business Idea

Written By - PKC Desk, Edited By - Sambavi, Reviewed By - Balaji Prasath What Is A...

Read More

10 Things For You To Do Before Starting A Business In 2021

Written By - PKC Desk, Edited By - Pranaveeka, Reviewed By - Balaji Prasath

Read More

Everything you need to know about Code on Wages 2019

Written By - PKC Desk, Edited By - Abhinand, Reviewed By - Aakash The Code on Wages...

Read More

You deserve it, you got it – a good budget!

Written By - PKC Desk, Edited By - Abhinand, Reviewed By - Aakash The Union Budget 2021...

Read More

E-Invoicing System

Written By - PKC Desk, Edited By - Abhinand, Reviewed By - Aakash E-Invoicing is now applicable...

Read More

Looking for avenues to startup? Here’s a sector with a ton of subsidies. Take a look!

Written By - PKC Desk, Edited By - Rama Narayanan, Reviewed By - Balaji Prasad For assistance...

Read More

Analysis on TCS on sale of goods

Written By - PKC Desk, Edited By - Abhinand, Reviewed By - Aakash New IT provision w.e.f....

Read More

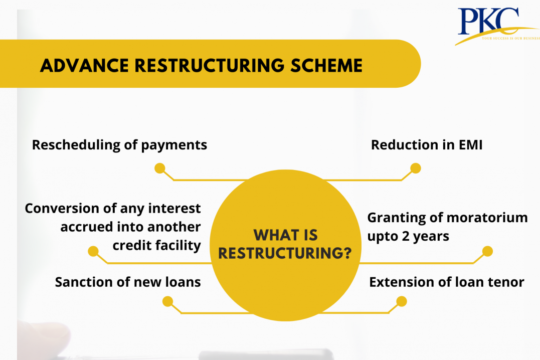

No extension of loan moratorium, but a loan restructuring scheme can help ease your debt payments. Read on to know more!

Written By - PKC Desk, Edited By - Abhinand, Reviewed By - Aakash

Read More

PKC recommends that every organization should have a separate team called COVID MARSHAL TEAM.

Written By - PKC Desk, Edited By - Pranaveeka, Reviewed By - Balaji Prasath All entrepreneurs are...

Read More

All entrepreneurs are facing challenge of ensuring Social distancing norms at work place, at the same time daunting question of how to improve sales.

Written By - PKC Desk, Edited By - Pranaveeka, Reviewed By - Balaji Prasath While both are...

Read More

“””SHIPVENTORY”” a unique solution from PKC management consulting for implementing best practices to handle inventory.

Written By - PKC Desk, Edited By - Pranaveeka, Reviewed By - Balaji Prasath Internal controls embedded...

Read More

Ways to win retail customers post lockdown

Written By - PKC Desk, Edited By - Pranaveeka, Reviewed By - Balaji Prasath

Read More